Table of Contents

Introduction

The first full investing week of the year is in the books — and the market has already made its vote clear: SMID caps are taking the baton from large caps.

Why?

It’s the Fed, duh!

The economy is softening, labor trends remain increasingly worrisome, and yet the Fed has effectively decided to hand the market back the proverbial punchbowl. In other words: when growth starts to wobble, the Fed’s tolerance for pain drops — and markets know it. Nowhere is that message louder than in SMID cap stocks, which are the most sensitive to shifts in interest rates and credit conditions, and historically the biggest beneficiaries when policy pivots from restraint back toward stimulus.

This is a dramatic contrast to 2022, when the mission was straightforward: kill inflation. And to be fair — they largely did. While the inflation victory hasn’t been permanently cemented, the market is acting as if the battle has been won… and it’s not doing so blindly. Inflation has rolled over meaningfully from the June 2022 peak — falling from roughly 9% to 2.7% YoY — enough for investors to believe inflation is now a secondary concern relative to growth, employment, and financial conditions.

And when that narrative takes hold, small packages tend to produce big moves.

The next CPI report hits this week (January 13th), and any continued degradation in the inflation trend should only extend SMID cap leadership. Since the June ’22 inflation peak, market returns have been substantial — further reinforcing one of the most reliable truths in investing: the best opportunities usually appear when the data looks the ugliest and sentiment feels the darkest.

And yet, despite the reflation tailwind and the Fed pivot, SMID caps have still lagged meaningfully.

The Russell 2000 (RTY) — our SMID cap proxy — remains the underperformer in what has otherwise been a powerful market recovery. Consider the contrast: since that ~9% CPI print, the “Mag 7” index has returned more than 5x what small caps have delivered. That dispersion isn’t just notable — it’s unsustainable if the cycle continues moving in the direction we believe it is: softer growth, easier policy, and broader participation.

So it’s only natural that the Mag 7 eventually spreads the love — and the market is beginning to price in exactly that rotation.

In fact, RTY is now outpacing the Mag 7 Index by nearly 10x, and the S&P 500 by roughly 3x. Do we expect that pace of outperformance to persist? Of course not. But early-year trends matter. January is often when institutional investors place their highest-conviction bets — deploying capital early to express their annual view, rebalance exposures, and reposition leadership.

And when leadership shifts, it rarely does so quietly.

If you’ve been paying attention to our reports, you already know this rotation didn’t come out of nowhere. We began laying the groundwork for a SMID-cap regime shift more than a month ago.

In our 12/7 report, we wrote:

“Small caps have been left for dead while mega-cap tech monopolized flows, creating one of the widest performance gaps in modern market history. The setup for mean reversion is massive.”

“What makes the small-cap setup even more intriguing is the backdrop. Consensus forecasts are calling for nearly 50% EPS growth next year for the Russell 2000—an extraordinary inflection following two consecutive years of negative earnings growth in 2023 and 2024. That’s not a marginal improvement; it’s a regime shift. Layer on top the new fiscal initiatives being rolled out, and you have a structural catalyst that disproportionately benefits smaller companies. The fundamentals are finally aligning with the technicals—never a coincidence at major turning points.”

That gave any serious investor plenty of time to reposition through year-end, rather than chase strength after the fact. And so far, that patience has been rewarded: SMID caps have come out of the gate blistering hot.

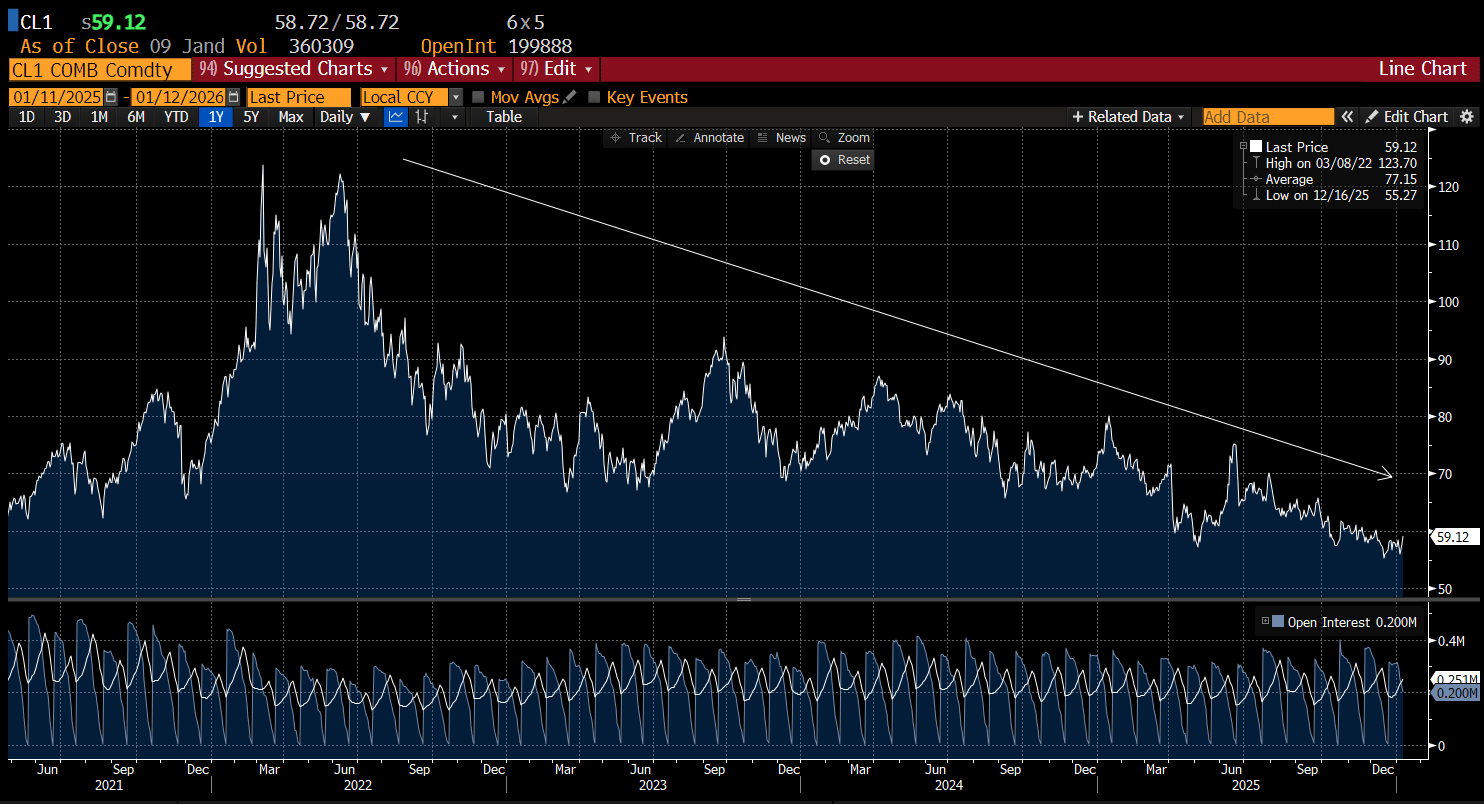

Of course, this week’s CPI print (January 13th) has the potential to sour the trade. A hotter-than-expected number could interrupt the rotation, at least temporarily. But our bias remains that inflation continues to cool. We don’t pretend to “forecast” economic releases — but we do understand cause and effect. Lower oil prices tend to lead disinflation.

Don’t believe us?

Oil conveniently peaked in June 2022… which is also when CPI conveniently peaked. Coincidence? Maybe.

Don’t overthink it.

Oil has been stuck on the mat since March, and has been steadily rolling over since June. That’s a disinflationary — if not outright deflationary — impulse in our book. And frankly, whether CPI beats or misses this week is less important than the broader message: as long as inflation remains subdued, the Fed can stay the course on its rate-cut trajectory.

And don’t forget the political overlay: the closer we get to May, the more the market begins discounting the next phase of Fed leadership — and the growing probability that Trump installs his new FOMC “puppet”… I mean Chair. Markets move on anticipation, not ceremony.

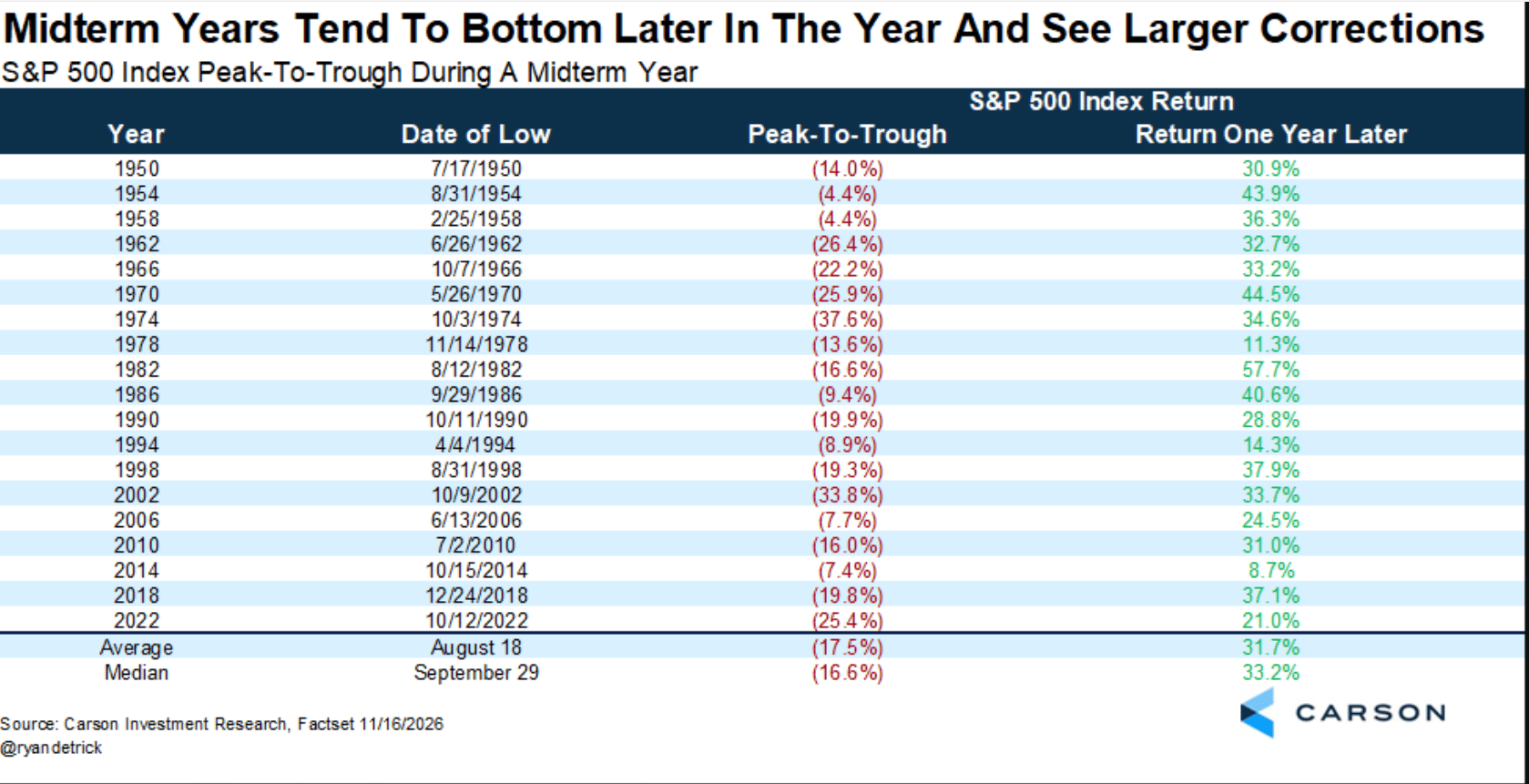

The other macro narrative you’ll hear repeated endlessly is that mid-term years tend to be volatile. We don’t dispute that. In fact, we said back in December that the market may correct in the first half — not because of the presidential cycle itself, but because of likely DeMark signal alignment.

That said, cycles matter. And when multiple cycles begin to rhyme — fundamentals, technicals, and seasonality — the probability of volatility rises.

According to Carson Research, mid-term years historically experience the largest peak-to-trough corrections, with meaningful reversals often coming later in the year. That framework fits cleanly with our base case: a potential 1H correction — and one we want to be prepared for — before opportunity sets up again in the back half.

However, it’s also possible Trump attempts to disrupt the usual market cyclicality by pushing through more radical policy shifts. We’ve already seen several ideas floated — from lowering prescription drug prices, to rolling back tariffs, to issuing directives aimed at bringing mortgage rates down. He’s also discussed banning institutional investors from purchasing single-family homes, and most recently, even capping credit-card interest rates.

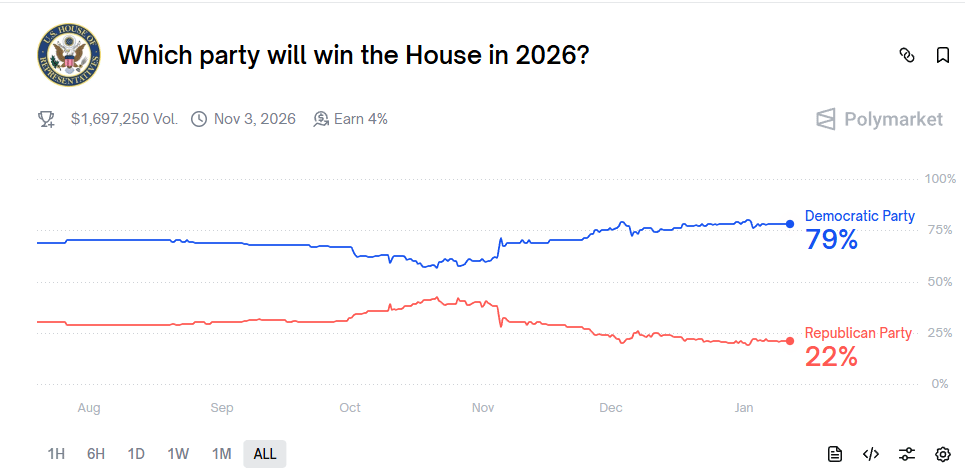

Whether any of these proposals ultimately become policy — or even prove effective — is anyone’s guess. But if prediction markets are any guide, the odds of meaningful implementation appear low, with Polymarket currently implying a bleak probability of follow-through.

Regardless, the common thread across these proposals is clear: they’re stimulative by design — and even the hint of stimulus can be enough to juice market returns, at least in the short run.

Just look at the tape. The Homebuilders ETF (XHB) surged back into favor last week following the housing-related announcements, as investors immediately began repricing the implications for mortgage rates, housing demand, and affordability.

In this market, perception becomes positioning long before policy becomes law.

Trying to predict what Trump will — or won’t — do is like playing high-speed whack-a-mole. You might nail a few, but odds are you’ll rack up plenty of misses along the way.

To us, it doesn’t really matter.

We don’t trade opinions — we study price. And when price is signaling bullish conditions, we stay bullish and let the market do the talking.

Now let’s see what the charts are saying.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade