Table of Contents

Introduction

Are We Having Fun Yet?

The macroeconomic backdrop has officially taken center stage—a shift we anticipated in December following the FOMC’s hawkish commentary. At that time, we warned that every macroeconomic release would become a flashpoint for market volatility, and thus far, that prediction has proven accurate. Last week’s optimism surrounding CES was swiftly undone by an ISM report revealing a sharp increase in prices paid by producers. Adding fuel to the fire, Friday’s robust employment report shifted the narrative from a "pausing rate cut cycle" to speculation about a renewed rate hiking cycle, now dominating professional investors' focus. Whether this scenario materializes or not, the market is actively pricing in these probabilities, creating significant dislocations in the process.

Repricing for a potential shift in economic outcomes invariably leads to swift and relentless pressure on prices. In a market largely driven by emotionless algorithms, the reallocation process continues unabated until their targets are met—regardless of the prices paid or sold. In this machine-dominated environment, our role as participants is to adapt and adjust accordingly.

Since September, we’ve consistently highlighted that the greatest risk to the stock market lies in the rate complex. While the market’s reaction to this risk is often delayed, it eventually "cares" at an inflection point that can be difficult to pinpoint. Typically, we excel at identifying these moments, but there are times when the signals are particularly challenging to interpret. For instance, we’ve been flagging deteriorating breadth since its October peak—a clear indication of underlying market weakness. Yet, post-election enthusiasm and year-end dynamics tempered our outright caution until January. Ironically, the stock market front-ran our concerns, delivering heightened volatility during a period that is historically among the most bullish of the year.

Last week, we anticipated short-term upside heading into CES, which played out until the ISM report derailed the narrative.

Here is the excerpt from our 1/5 Conclusion section:

Our resistance levels for the SPX, where we anticipated any bounce to stall, were identified in the 6050–6070 range. True to form, the SPX peaked at 6021 this past Monday before reversing. Unfortunately, the ISM report derailed our tactical long trade, highlighting the market's sensitivity to economic data.

So, what can we infer from a market that’s sold off in front of such well-defined resistance levels? Quite a bit. Chief among these insights is the urgency of sellers, further reinforced by the employment report, which pushed the SPX below its January 2nd low. This urgency underscores growing pessimism and a lack of conviction from buyers at higher levels.

Adding to the bearish narrative, the Fed Fund Futures market is now pricing in only one rate cut across all of 2025 and 2026, reflecting a shift in expectations for a prolonged period of elevated rates. This dynamic creates a challenging environment for equities, particularly for sectors sensitive to interest rates and liquidity.

This marks a significant shift from just 10 days ago, when market participants were pricing in a 70% probability of an additional rate cut by December 2025, along with another 70% likelihood of a third cut by December 2026. This abrupt change in expectations underscores how quickly sentiment can shift in response to macroeconomic data, reinforcing the uncertainty surrounding the economic trajectory and policy outlook. Such a recalibration puts additional pressure on equity markets as investors adjust their positioning to account for a potentially higher-for-longer rate environment.

Yes, these forecasts have been volatile, so why should we place much faith in them? It’s not about whether the predictions turn out to be accurate in the near term—it’s about the rate of change in these adjustments. Markets thrive on certainty, and the current trajectory of the rate complex is anything but predictable. This persistent uncertainty weighs heavily on sentiment and risk appetite.

Building on that, recall our December 15th report, where we discussed the relationship between price multiples and interest rates. The equation is simple: as yields rise, valuation multiples contract, leading to a step down in asset prices. This inverse relationship is a fundamental anchor in understanding market dynamics.

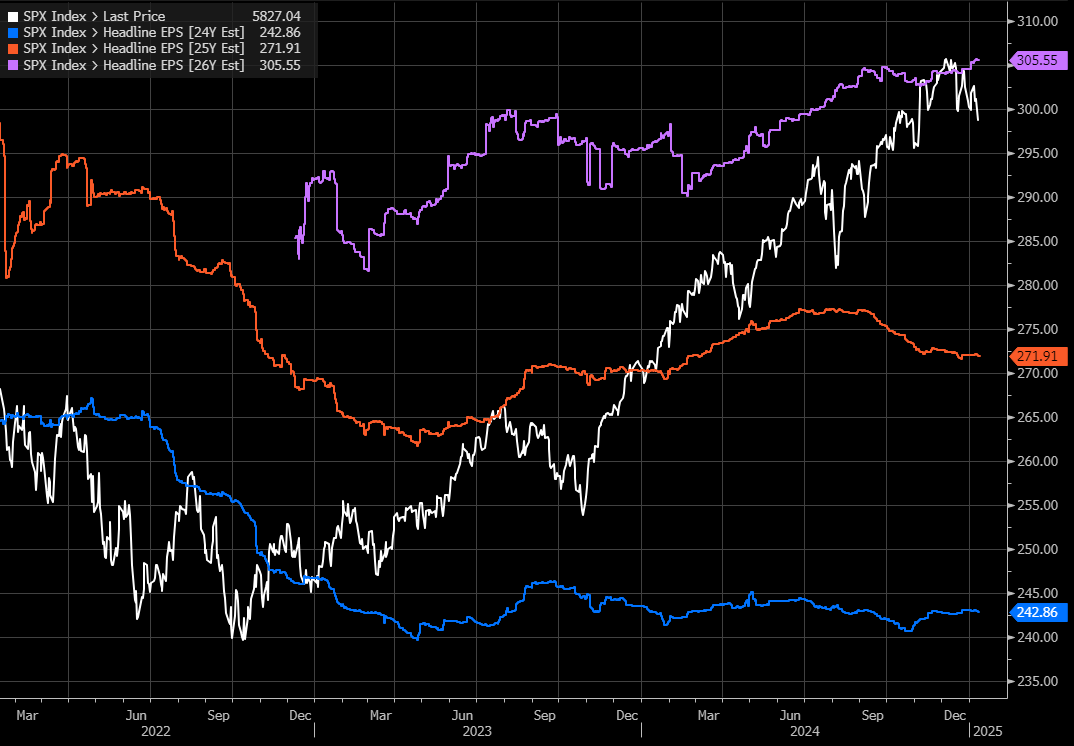

Currently, the SPX trades around 22x forward 12-month (FTM) earnings—a rich valuation by historical standards. Compounding the issue, FTM earnings estimates are declining, even as they still project double-digit earnings growth. This divergence raises questions about the sustainability of such lofty valuations in an environment where interest rates are high, and economic uncertainty persists. If the earnings revisions continue to trend lower, the SPX's multiple may face additional downward pressure, challenging the broader equity market’s resilience.

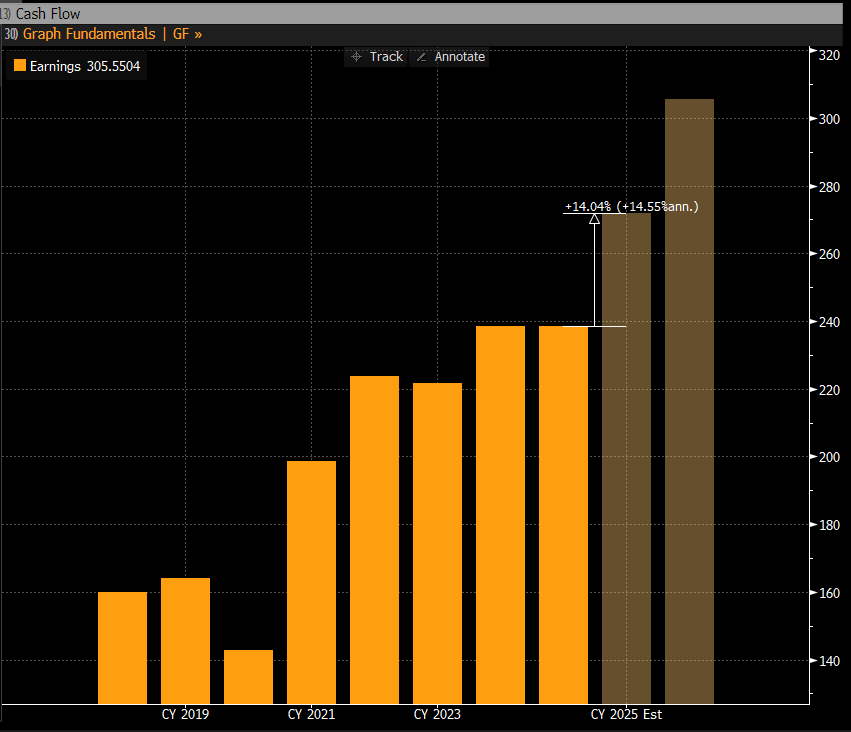

Below are the SPX earnings forecasts for Q4 2024 (set to be reported starting this week) and Q2 2025. Since their peak last April, these estimates have seen significant deterioration, reflecting growing economic uncertainty and potential headwinds to corporate profitability.

This downward revision trend underscores the challenges ahead, as the stock market grapples with elevated valuations amid declining earnings expectations. Such a dynamic often leaves limited room for error, with the risk of valuation compression intensifying should economic conditions weaken further or interest rates remain elevated. These forecasts will be pivotal in shaping market sentiment as we move deeper into the year.

CY25 earnings estimates have not yet been meaningfully adjusted lower, while CY26 projections still reflect an optimistic and significant year-over-year jump. This disconnect poses a notable risk for a stock market already trading at elevated valuations, particularly as the Federal Reserve continues its efforts to slow the economy.

The potential for rate hikes amplifies this vulnerability. Elevated earnings estimates leave little margin for error, and should those projections face downward revisions, the stock market would effectively become more expensive. Add to this scenario the possibility of a contraction in the price-to-earnings multiple due to rising yields, and the risk of a significant reversion becomes evident.

The combination of falling estimates and declining multiples creates a dangerous feedback loop for equity valuations, underscoring the importance of staying vigilant in the face of these mounting pressures.

To clarify, we are not definitively forecasting either outcome but rather highlighting the risks the market faces in the near term, which contribute to the current heightened volatility. It’s important to note that confusion drives volatility, not the other way around. This underscores why the upcoming earnings season could serve as a critical swing factor in determining the stock market's trajectory.

If we see widespread earnings guidance cuts and cautious corporate outlooks, the stock market may face another step down. On the other hand, given that estimates have already been revised downward significantly, the stage is set for potential upside surprises. Additionally, the economy remains resilient, as evidenced by the recent ISM and payroll reports, suggesting that large-scale earnings misses are unlikely.

However, corporate outlooks may still face challenges due to the multiple macroeconomic headwinds, including rising rates, a strong U.S. dollar, and the potential impact of Trump policy initiatives. These dynamics set the stage for a pivotal and potentially volatile few weeks ahead.

Let’s see what the charts say.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade