Table of Contents

Introduction

Just when it felt safe to lean back into the bullish narrative, Trump decided to splinter market momentum with a fresh round of tariff threats—this time aimed at NATO allies—as he ramps up his ambitions around Greenland and Denmark. If there’s one constant under a Trump presidency, it’s this: expect the unexpected macro curveball to land at precisely the wrong time for consensus.

While we’ll refrain from editorializing on the merits of the endeavor, markets care less about motives and more about mechanics. The key question is whether this latest flare-up is simply a negotiating tactic—loud headlines designed to force a conversation—or a credible escalation that introduces real policy risk. Complicating matters is the legal backdrop as well, with the Supreme Court potentially weighing in on the scope of executive authority to implement tariffs.

So the question for markets becomes straightforward: does the TACO trade get revisited, or does this one stick? Do investors fade the headlines and buy weakness—assuming the rhetoric is more bark than bite—or do we get a sharper reaction similar to last April’s tariff escalation, one that finally breaks the lagging Nasdaq and pushes the broader market into a corrective phase?

We have no edge in predicting the political outcome—and pretending otherwise would be foolish—so our focus this week is purely tactical. That means approaching the setup with a two-track plan: one for a risk-off breakdown scenario, and one for the “buy-the-gap” reflex that has defined this tape for months. We outline both roadmaps below.

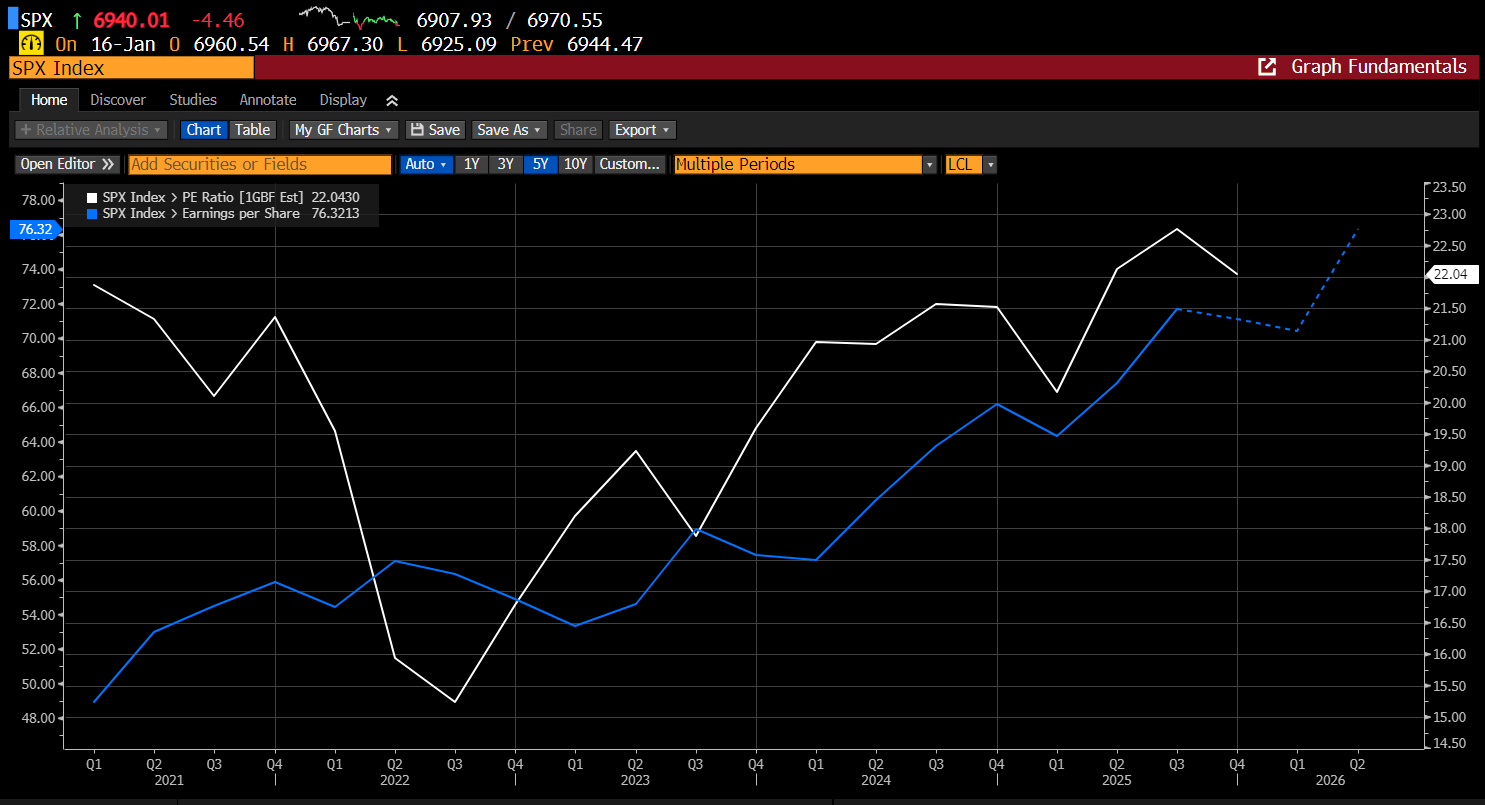

Layered on top of the macro noise: earnings season is now shifting into a higher gear. With only 33 S&P 500 companies reported so far—and an ~88% beat rate—results have been strong out of the gate. But this is still early innings, and expectations can tighten quickly as the volume and market impact of reports accelerates.

It’s also worth noting that EPS expectations have been drifting lower into the reporting period—as is typical—as analysts reduce the bar and make it easier for companies to clear. Even so, valuations remain elevated, which means the market has less tolerance for disappointment. Any meaningful earnings misses or cautious guidance could quickly translate into higher volatility and a sharper repricing of risk.

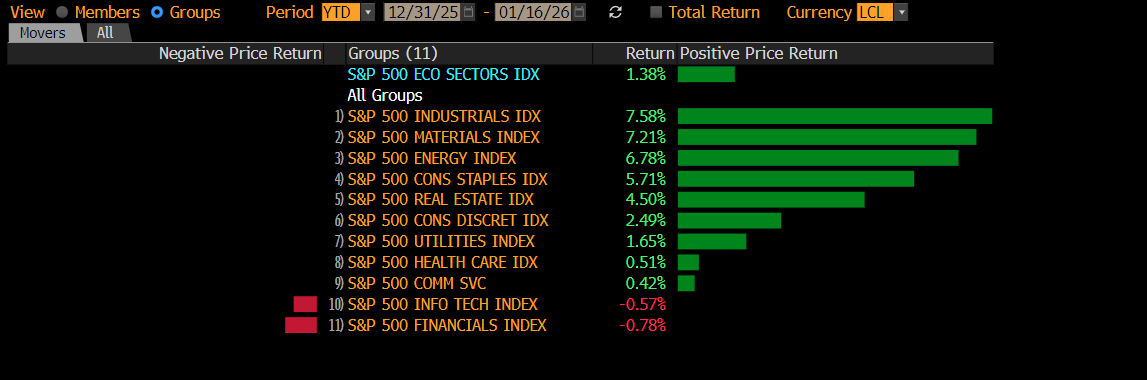

Last week we highlighted the year-to-date sector leaderboard as a way to better assess where true market leadership is emerging. As we suggested was likely, Energy has already ceded the top spot. Industrials have now taken the lead after just three weeks—an important development that says a lot about the market’s evolving view of the economic trajectory.

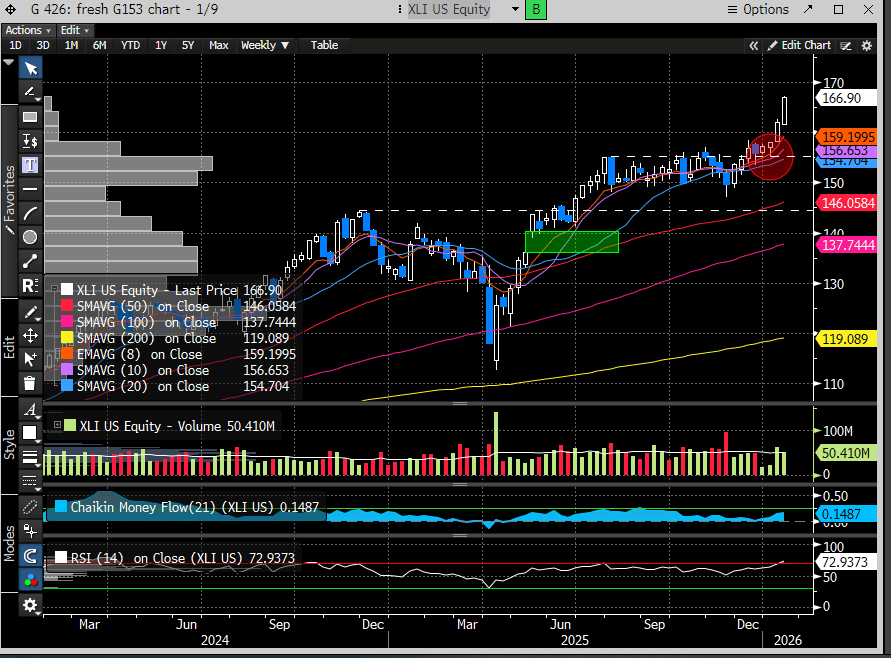

Industrials are highly macro-sensitive. If the group is breaking out to new all-time highs while leading the broader tape, it’s a strong signal that bearish growth narratives may be misplaced. In other words, price is doing the talking—and right now, it’s not confirming an imminent economic rollover.

Industrials (XLI) broke out to fresh all-time highs in early January and closed last week near the highs—an encouraging signal for a market that has been rotating away from the legacy technology leadership.

Thanks to continued Mag 7 underperformance, the Technology sector is now negative on the year and only marginally ahead of Financials. This type of bifurcation can become problematic, as sustained bull markets typically require participation from both growth and financial leadership to maintain momentum. We’ve discussed this dynamic in prior reports, and it remains an important development to monitor in the weeks ahead.

The recent underperformance in the Magnificent 7 is notable—and historically rare given how central the group has been to this cycle. The three-year bull market has been driven disproportionately by the mega-cap tech giants, with Nvidia, Alphabet, Microsoft, and Apple alone accounting for more than one-third of the S&P 500’s gains since the move began in October 2022.

But enthusiasm is clearly cooling as investor interest broadens across the rest of the index. With Big Tech earnings growth decelerating, markets are becoming less willing to pay for long-duration narratives and “AI promises” alone—investors want to see measurable returns and operational follow-through.

Bloomberg Intelligence data reinforces this shift: Magnificent 7 profit growth is expected to rise roughly 18% in 2026, the slowest pace since 2022 and not dramatically better than the ~13% growth projected for the other 493 companies. In other words, the earnings growth gap that justified extreme concentration is narrowing—at the same time participation is widening. That combination helps explain why leadership is rotating away from the old winners.

The encouraging development is that while the Magnificent 7 remain expensive versus history, valuations have already come down materially from the extremes. The group now trades around 29x forward earnings—well below the 40x-plus multiples we saw earlier in the decade. That multiple compression matters, as it reduces some of the valuation risk that had built up during peak AI enthusiasm.

Financials (XLF) moved into focus this week as the major banks began reporting. The initial market reaction was poor until Goldman posted strong results, which appeared to stabilize sentiment across the group. For now, the larger technical picture remains constructive: the weekly consolidation is still intact, and the 10-week moving average continues to be defended on an intra-week basis.

In our recent report, “Chop ’til You Drop,” we highlighted how single-stock volatility has continued to plague the tape even as the major indexes barely moved. As earnings season ramps up, we should expect more of the same—index-level calm masking increasingly violent dispersion beneath the surface.

The week appears set to start on the wrong foot for bulls—but the question is whether early weakness gets bought, or whether this is the beginning of a more meaningful corrective push lower. Either way, this is a textbook case of Momentum Meets Macro.

Let’s turn to the charts.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade