Decentraland 2.0 is now live

Decentraland is a virtual social world where you can meet new friends, join events, and make memories—no matter where you are. Whether exploring the open, community-built landscape, partying on the dancefloor, or watching a binary sunset on the beach, Decentraland is where people from everywhere come together.

Table of Contents

Introduction

“V” is Victory, right? Or maybe “V” is for a V-shaped bounce? However you want to interpret it, that’s what the US market did last week and how we predicted it.

So, we’ll take both.

Below is the 10-day chart of the SPX. If you are counting, that’s a 4% round trip in less than 10 days.

The major indexes staged a strong resurgence, ending the week with their best performance since November. That rally marked the peak for the indexes at the time.

On Friday, the SPX encountered resistance precisely where we projected it would stall, reinforcing the predictive nature of our analysis.

The SPX is now less than 2% away from a new ATH. The stock market’s renewed momentum was fueled by moderating inflation reports, which triggered a sharp reversal in the rate complex. Adding to the optimism was renewed enthusiasm for the "Trump trade," as his presidency officially began on Monday.

Below is a resurfaced Fundstrat chart that highlights the typical performance of a Republican presidency, with January often seeing declines. However, this year bucks that trend, as year-to-date gains have propelled the indexes to positive territory.

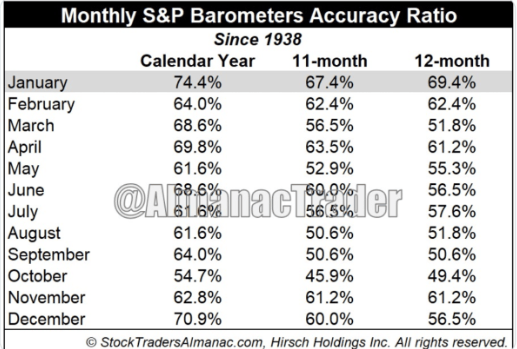

While the so-called “January Barometer” (a predictor of yearly performance) is in the green, with two weeks and earnings season ahead, these readings remain tentative.

Historically, the barometer has shown <70% accuracy, according to Stock Trader’s Almanac.

In our recent reports, we outlined the anticipated path for the SPX, which, so far, has played out precisely. Below is the chart we shared last week, now updated with current prices:

"‘V’ for precision?” – sorry, we couldn’t resist."

The big question now is whether the market will turn downward to complete the anticipated “C” wave correction. We’ll delve deeper into this in our index analysis section.

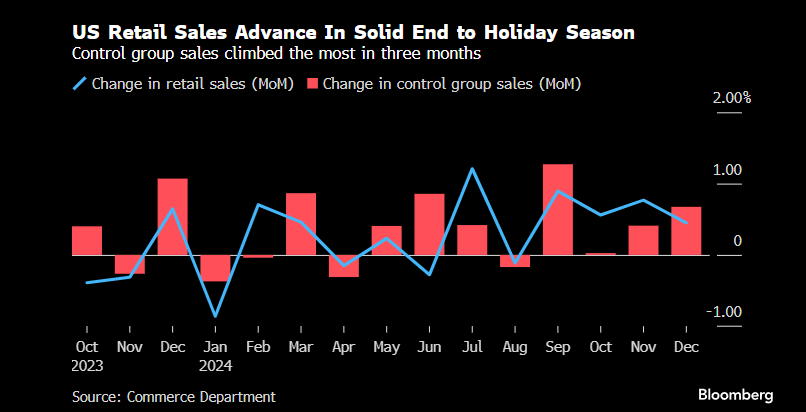

Our 1/15 report predicted that a strong retail sales report would be treated as “good news” for the market, shifting away from prior reports that stoked inflation fears.

Here is an excerpt from that report:

"We couldn’t have scripted it better."

While last week’s reversal sparked optimism, inflation and rates remain unresolved issues. Even with the moderating CPI report, core inflation (year-over-year) has shown signs of stalling in the second half of ‘24.

Rising energy prices (oil is up 18% in five weeks) could lead to inflation re-accelerating as higher oil costs filter through to goods and services.

Fed Reserve Gov. Chris Waller suggested the possibility of multiple rate cuts in 2025, contrasting the Fed Funds Futures projection of just one. This divergence supported a bond market rally and bolstered stocks, coinciding with Trump’s debut as president.

But is it sustainable?

Let’s dig into the charts…

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade