What Will Your Retirement Look Like?

Planning for retirement raises many questions. Have you considered how much it will cost, and how you’ll generate the income you’ll need to pay for it? For many, these questions can feel overwhelming, but answering them is a crucial step forward for a comfortable future.

Start by understanding your goals, estimating your expenses and identifying potential income streams. The Definitive Guide to Retirement Income can help you navigate these essential questions. If you have $1,000,000 or more saved for retirement, download your free guide today to learn how to build a clear and effective retirement income plan. Discover ways to align your portfolio with your long-term goals, so you can reach the future you deserve.

Table of Contents

Introduction

Another week has passed, and once again the macro backdrop feels like a high-stakes dodgeball game where the curveballs keep coming faster than markets can digest them. Last week’s flashpoint began with Denmark and Trump’s incendiary remarks about acquiring Greenland — comments that were quickly walked back at Davos — only for attention to shift almost immediately to a new front. Over the weekend, tensions escalated with Canadian Prime Minister Mark Carney, including the administration floating the possibility of 100% tariffs on Canada should they move forward with a trade agreement with China. In an environment like this, separating signal from noise becomes nearly impossible, and markets are left to price uncertainty without a reliable framework.

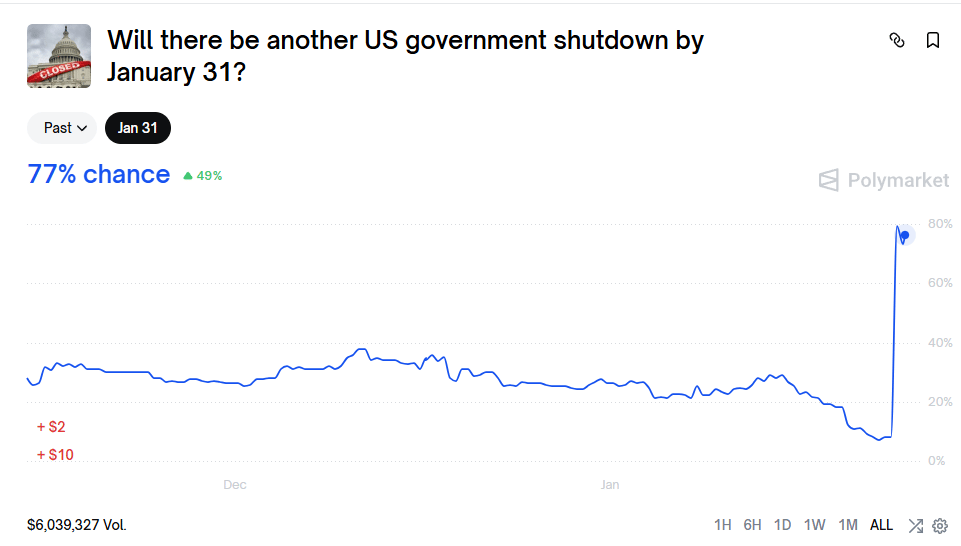

The domestic political backdrop offers little relief. This weekend’s tragic incidents in Minnesota sparked renewed political outrage, with Democrats now threatening to block the funding bill needed to keep the government open unless Immigration and Customs Enforcement (ICE) is defunded. This sets the stage for yet another high-stakes confrontation — one that pits geopolitical and domestic political risk directly against the economic trajectory. The result is a familiar but dangerous mix: heightened volatility, policy uncertainty, and fragile market confidence.

And, of course, looming over it all is the Federal Reserve, which delivers its next interest-rate decision on January 28. Never a dull moment.

According to Polymarket, the probability of a government shutdown by July 31st has surged to 77%, underscoring just how elevated political risk has become — and why markets remain on edge.

How long will markets continue to look past the current dysfunction? How much of the recent volatility has already been absorbed by retail flows — and what happens if that marginal buyer steps away?

These are questions we don’t have definitive answers to. But one thing is clear: The Pot is Boiling.

In environments like this, when headlines are flying and narratives shift by the hour, our only real defense is price. Not opinions. Not predictions. Price. How does the market behave at key support levels? Do buyers show up when they’re supposed to? And just as importantly, how does the market close the week relative to how it began? That tells you far more about underlying demand than any intraday panic ever will.

We emphasized this exact framework in last week’s report — urging readers not to overreact to headlines before making large capital allocation decisions. That discipline proved valuable, as the lows of the week were carved out on Tuesday, right when fear and noise were peaking.

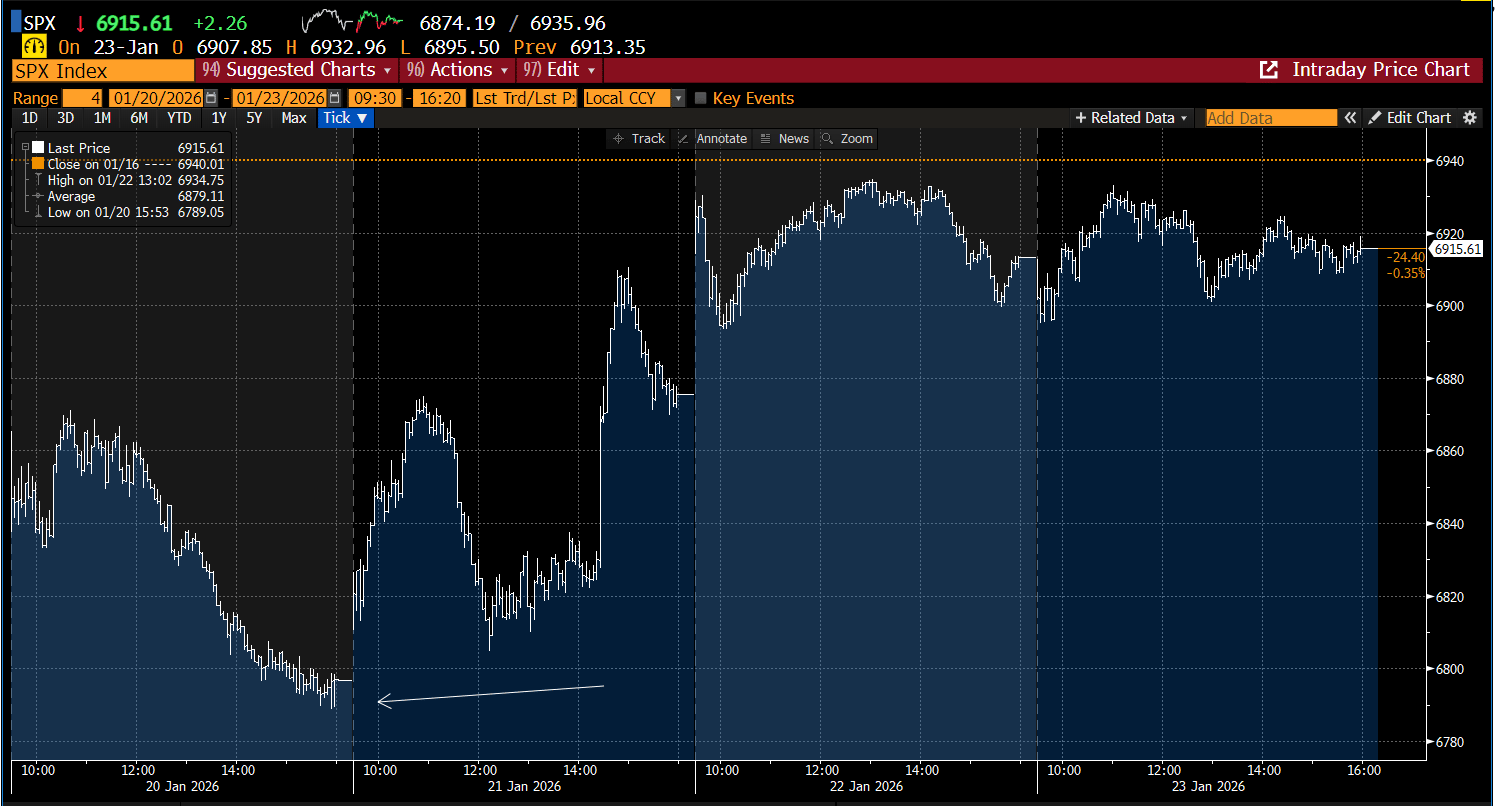

That said, just because last week resolved constructively does not mean this week will follow the same script. At some point, fatigue from constantly battling macro crosscurrents can begin to weigh on prices. The technical damage from Tuesday’s gap lower has not been fully repaired, and that remains an important warning sign. More on that shortly.

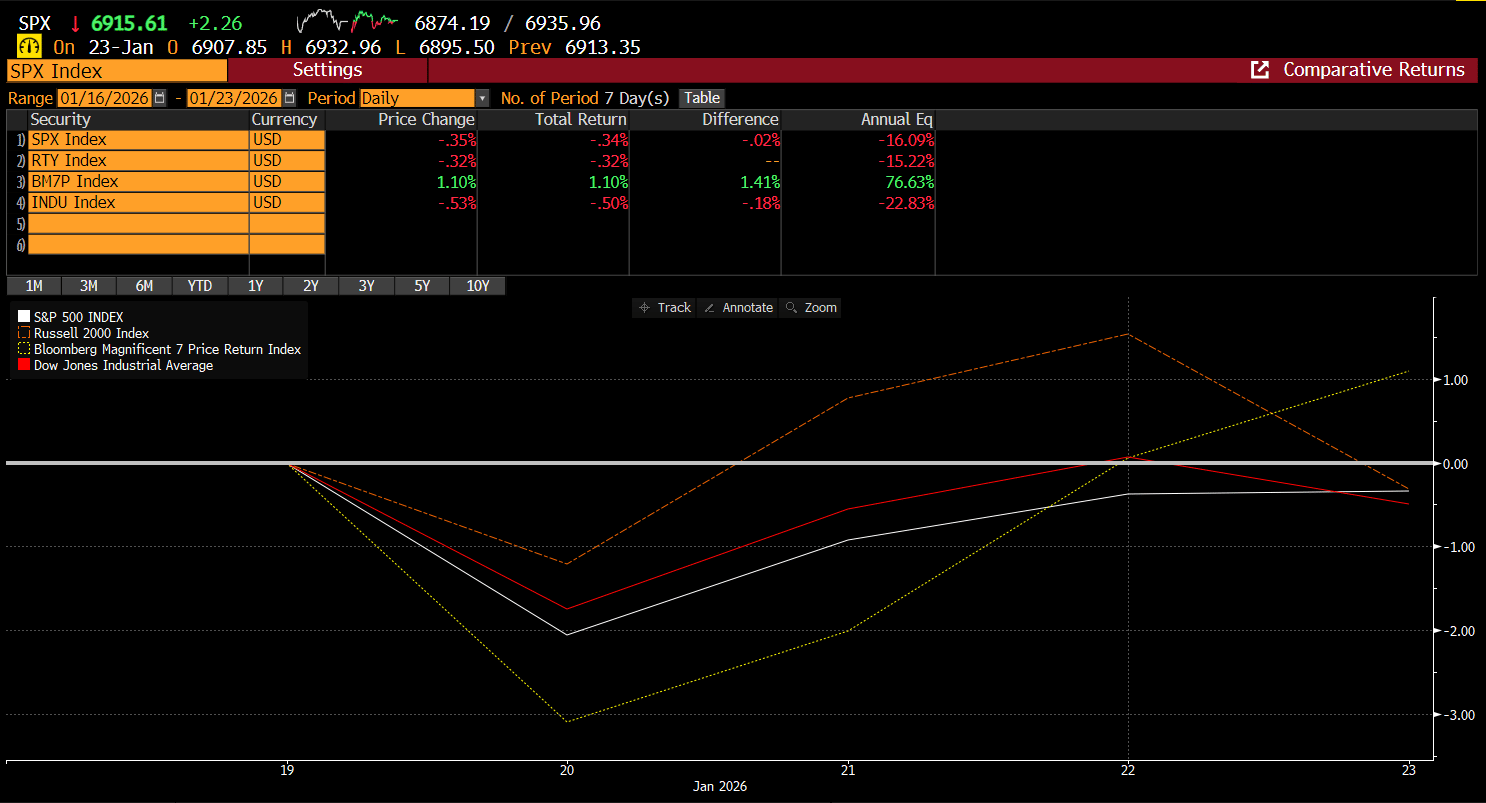

What did change this week was a reversal in one of the year’s most crowded trades: SMID cap leadership, with rotation flowing back into large caps. And yes — we called that turn with precision.

Our work had already positioned subscribers for SMID cap outperformance heading into 2026, but we also advised selling into last week’s strength. In our January 14th report, we wrote:

“While the disparity between large caps and SMID caps continues to widen by the day, it’s reasonable to expect some mean reversion over the course of the year — particularly as OPEX passes and earnings season ramps in earnest, both of which can shift flows and leadership.”

Earnings season for large-cap tech — the Mag 7 — kicks off this week, making that timing especially notable. The Mag 7 (BM7P) outperformed by roughly 150 basis points last week, while the Russell 2000 (RTY) finally cooled after its torrid start to 2026.

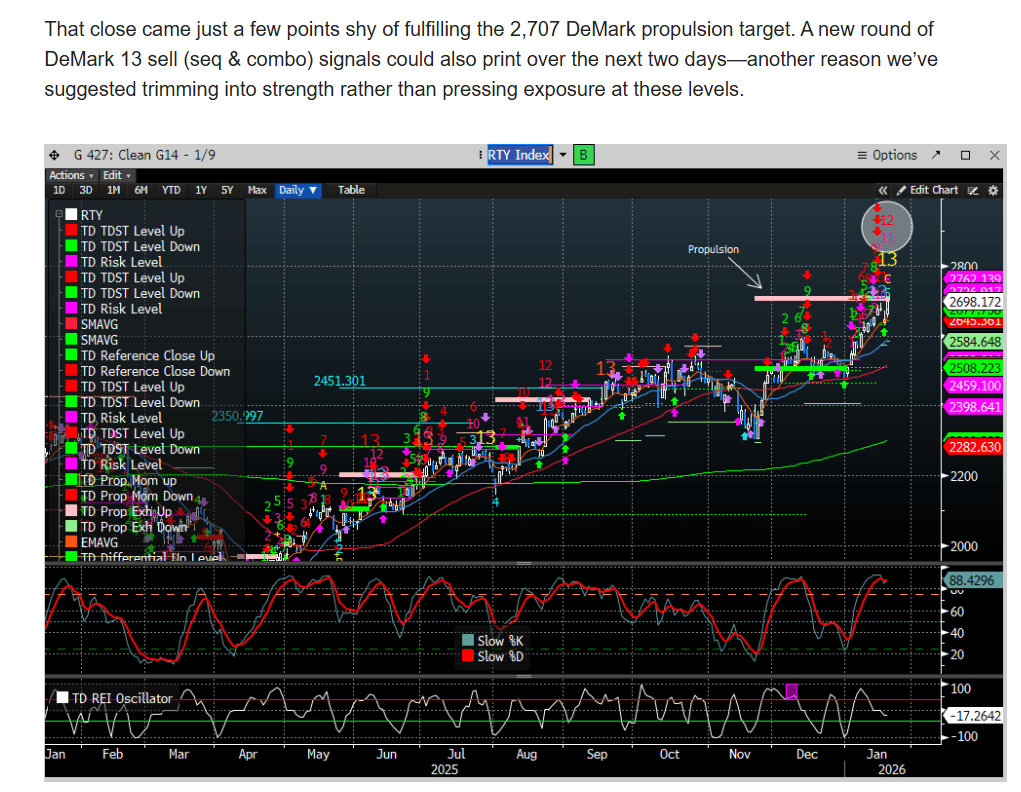

We didn’t just hint at a potential SMID-cap pause — we doubled down on that view in our January 18th report, explicitly advising readers to consider trimming gains.

We wrote:

“We’ve expressed our bullish index view primarily through SMID caps (Russell 2000 / RTY), where the outperformance has remained substantial—roughly ~1,000 bps versus the Magnificent 7 year-to-date. As we discussed at length, however, the widening performance gap was unlikely to remain sustainable indefinitely. With our near-term upside targets met, we argued for trimming exposure and reducing risk.”

This wasn’t luck, and it wasn’t a one-off. If you’ve followed our work, you know this is the result of a repeatable process. We combine macro positioning, technical structure, and DeMark exhaustion signals. When those factors align, we don’t hesitate — we act.

At the time of that report, the Russell 2000 and other key SMID-cap proxies were flashing clear DeMark signal confluence. We outlined it plainly:

“Three additional reasons suggest the SMID-cap trade is due for a breather:”

1) The S&P 500 Equal Weight Index (SPW) printed multiple DeMark sell signals last week (9 Sell / Combo and a Sequential 13 Sell).

2) The S&P MidCap 400 displayed a similar cluster of DeMark sell signals, reinforcing the message that breadth had become stretched and mean reversion risk was rising.

3) The Value Line Geometric Index also flashed DeMark exhaustion, printing both a 9 Sell and a Sequential 13 Sell.

This alignment across breadth-sensitive indexes was a key tell. It suggested the SMID-cap leadership trade was becoming crowded, extended, and vulnerable to rotation.

We reinforced that message again in our January 21st report, where we wrote:

Here is the excerpt:

Our research is built with one objective in mind: to generate alpha. Last week’s rotation was simply the latest example of that process at work.

Moving on.

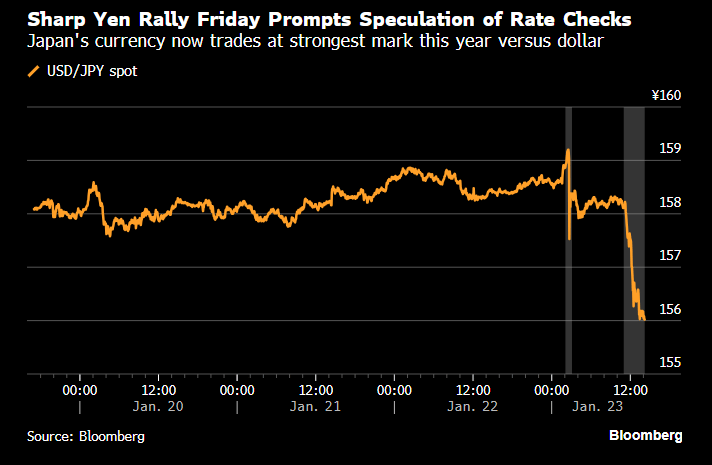

The final macro variable we want to address is the growing speculation around potential yen intervention by the Bank of Japan — possibly with tacit coordination from the United States. Rumors began circulating late Friday after traders reported that the Federal Reserve Bank of New York had contacted several financial institutions to inquire about conditions in the yen market. While no official confirmation has surfaced, that type of outreach is often interpreted as a precursor to, or at least preparation for, currency market intervention.

Given the yen’s sharp moves and its importance to global liquidity dynamics, any coordinated action could ripple well beyond FX markets, influencing rates, equities, and cross-border capital flows. In an environment already defined by policy uncertainty and geopolitical tension, this is another pot beginning to simmer.

While we don’t pretend to have a precise fundamental forecast for how potential yen intervention would translate into equity performance, one thing is clear: currency intervention rarely comes quietly. Volatility should be expected.

Positioning matters here. The market remains structurally short the yen, a cornerstone of the global carry trade. Any credible intervention — or even the threat of one — could force rapid position adjustments. If investors are compelled to unwind yen-funded carry trades, the resulting flows can spill into rates, equities, and broader risk assets, amplifying volatility well beyond the FX market itself.

So yes — The Pot is Boiling.

With macro, policy, and positioning risks all simmering at once, the only objective lens left is price.

Let’s see what the charts have to say.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade