Reddit’s Top Stocks Beat the S&P by 40%

Buffett-era investing was all about company performance. The new era is about investor behavior.

Sure, you can still make good returns investing in solid businesses over 10-20 years.

But in the meantime, you might miss out on 224.29% gainers like Robinhood (the #6 most-mentioned stock on Reddit over the past 6 months).

Reddit's top 15 stocks gained 60% in six months. The S&P 500? 18.7%.

AltIndex's AI processes 100,000s of Reddit comments and factors them into its stock ratings.

We've teamed up with AltIndex to get our readers free access to their app for a limited time.

The market constantly signals which stocks might pop off next. Will you look in the right places this time?

Past performance does not guarantee future results. Investing involves risk including possible loss of principal.

Table of Contents

Introduction

Volatility has officially entered the room—and she doesn’t do subtle. Should we be surprised? Not really. It’s October, after all—the market’s most infamously unpredictable month. The reasons behind this seasonal turbulence are often elusive, but history leaves little doubt: October tends to invite drama. Heading into 10/10, the S&P 500 went 33 consecutive trading days without a 1% move—complacency at its peak. That kind of calm is the perfect setup for a showstopping entrance. And true to form, volatility doesn’t stroll in quietly—it bursts through the doors with a full entourage, smoke machines, and flashing cameras, determined to reclaim the spotlight.

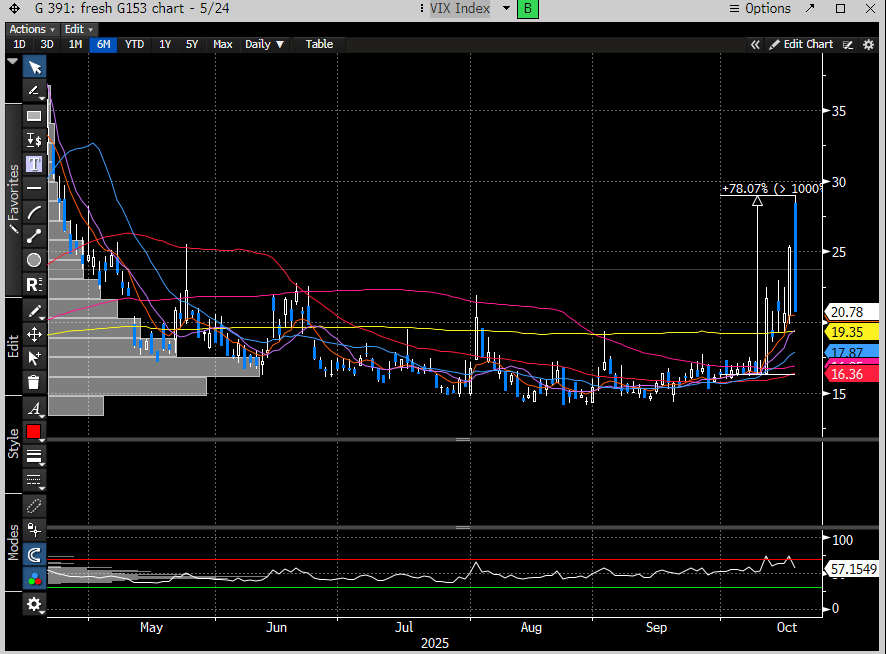

The VIX didn’t just rise—it erupted, soaring nearly 80% into Friday’s high since the start of the month. When volatility decides to make an entrance, it makes sure everyone feels it.

That’s quite the entrance. Even more impressive, the S&P 500 shrugged it off—closing the week up +1.7% and hovering just a few points shy of record highs. It’s hard to recall another moment when volatility stormed the stage this loudly while the market barely flinched.

This feels like panic—not from those overexposed, but from the under-invested masses still haunted by every shadow of risk. Each flicker of bad news sparks a hedging frenzy and a wave of bearish bets. Make no mistake—this is still a hated rally.

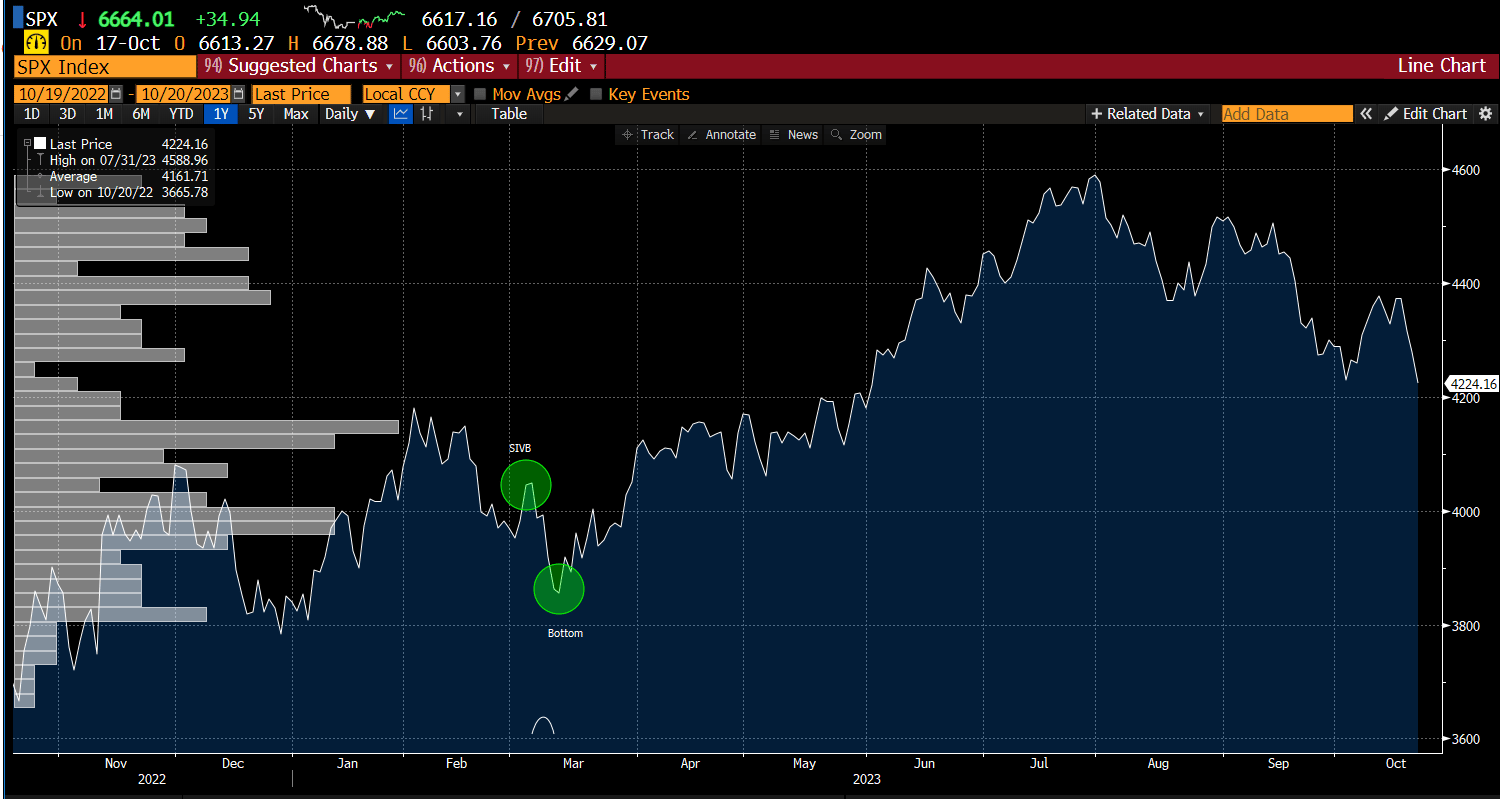

The spark came when President Trump reopened the trade-war playbook with China, but the real fuel arrived via the banks. Zions and Western Alliance dropped bombshells in their Q3 reports—fraudulent loans tied to distressed-debt funds—right on the heels of Tricolor Holdings’ collapse and First Brands Group’s implosion. That one-two punch stirred flashbacks of March 2023, when Silicon Valley Bank fell seemingly overnight.

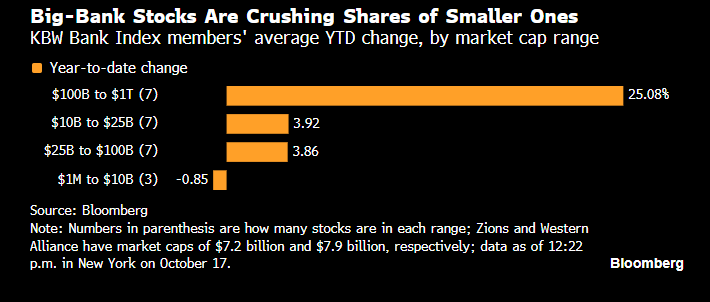

Cue the “cockroach theory”: if there’s one, there’s more. The KBW Bank Index promptly dove as investors braced for another round of regional-bank turbulence. And nothing kills the mood of a bull-market party faster than whispers of credit contagion. The ghosts of 2008 still linger in every trader’s mind.

What makes it even more ironic is that this panic came right after record earnings from the too-big-to-fail money-center banks. Those are the players that actually set the tone for market health. But when sentiment’s brittle, logic takes a backseat—the market was already nervous and simply needed an excuse to hit the sell button.

Fortunately, our readers saw this coming. We didn’t need to know why volatility would return—just that it would. For weeks, we’d been urging subscribers to sell into lingering market strength heading into late October. DeMark signals once again earned their keep, flashing warnings well before Mr. Volatility showed up.

As for the regional bank scare, we’re not claiming it can’t spread—it could. But let’s keep perspective: this looks like a blip compared to the Silicon Valley Bank meltdown, which markets digested and moved past in less than a week. Panic sells headlines faster than it sells stocks.

If you really want to know what the smart money thinks of this “crisis,” look to credit. The CDX High Yield spreads—the market’s early warning system—couldn’t break above their resistance band on Friday. That rejection speaks volumes. If real credit stress were brewing, it would be flashing red here. Instead, the move looks more like nerves than distress.

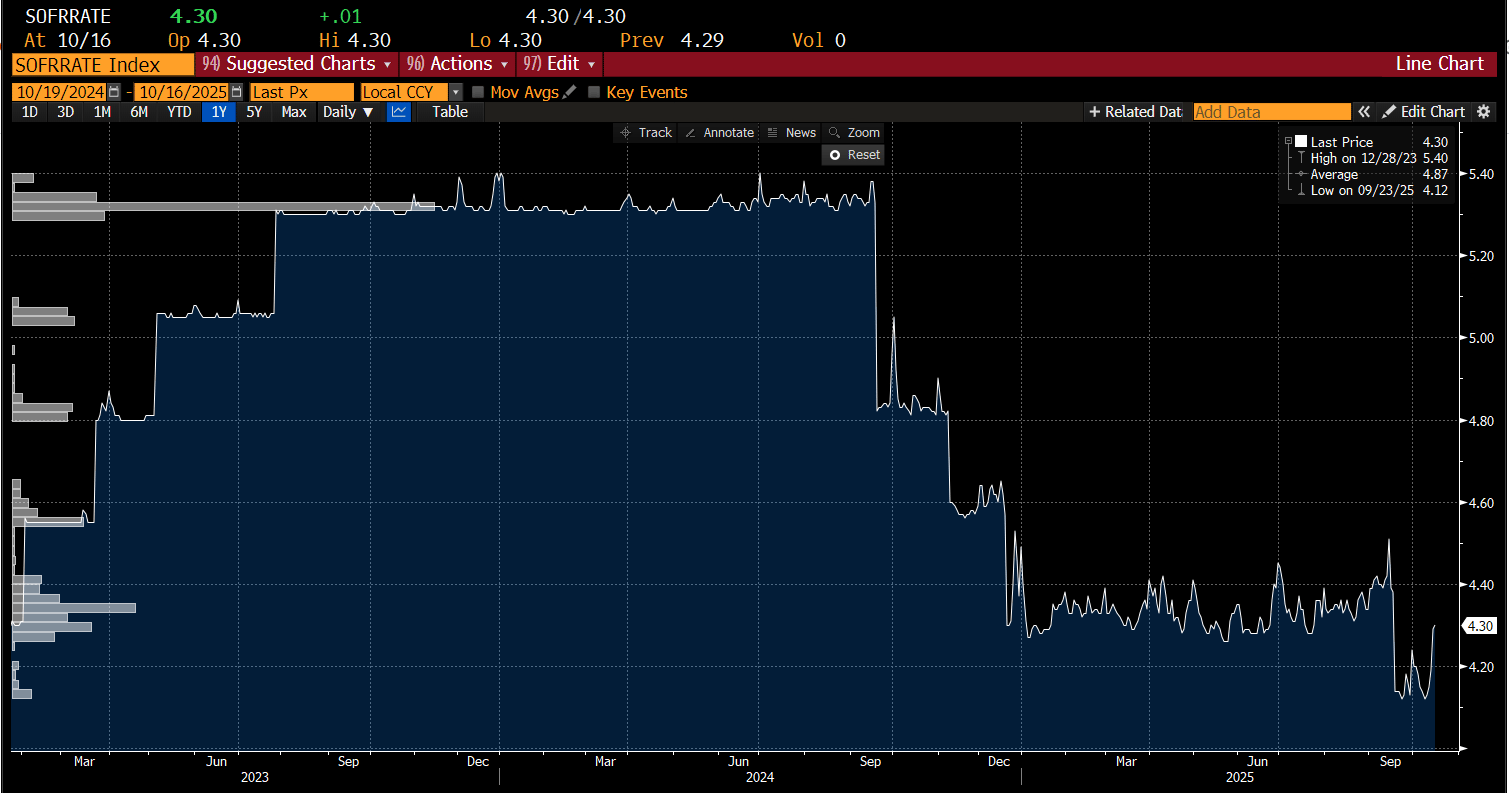

To really test the market’s nerves, look at the bank funding markets. The SOFR rate—the overnight borrowing cost—flinched last week, but the move was more of a tremor than a quake. It’s a blip, not a break. As long as SOFR cools off early next week, it’ll send a reassuring message to equities: liquidity is holding up, and panic is premature.

Last week had plenty of fireworks, but the finale was surprisingly upbeat. Trump toned down his trade-war theatrics with China, calling high tariffs “not sustainable.” Translation: TACO is alive, and the Trump put still hovers over this market. Whenever fear creeps in, a dose of optimism isn’t far behind.

By week’s end, the market printed an inside week—a pause that often precedes a breakout. Strip it down another layer, and you’ll see every major sector finished green—except, of course, financials. If this were the start of a major rollover, you’d expect widespread damage. Instead, what we saw was opportunistic buying across the board. That’s not fear—that’s accumulation.

We’re still stuck in the middle of a government shutdown—Polymarket odds say it could drag into mid-November—leaving markets flying half-blind without the usual macro data drip. The next real catalyst arrives Friday with CPI, which could easily tilt the week’s tone one way or the other.

On the brighter side, earnings season is heating up, and some of the Mag-7 titans take the stage over the next two weeks. Their numbers will likely dictate the market’s next act—and our read is that the results should be solid. Mr. Volatility may be loud, but Big Tech still owns the spotlight.

With that said, it’s time to pull back the curtain and let the charts do the talking.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade