Table of Contents

Introduction

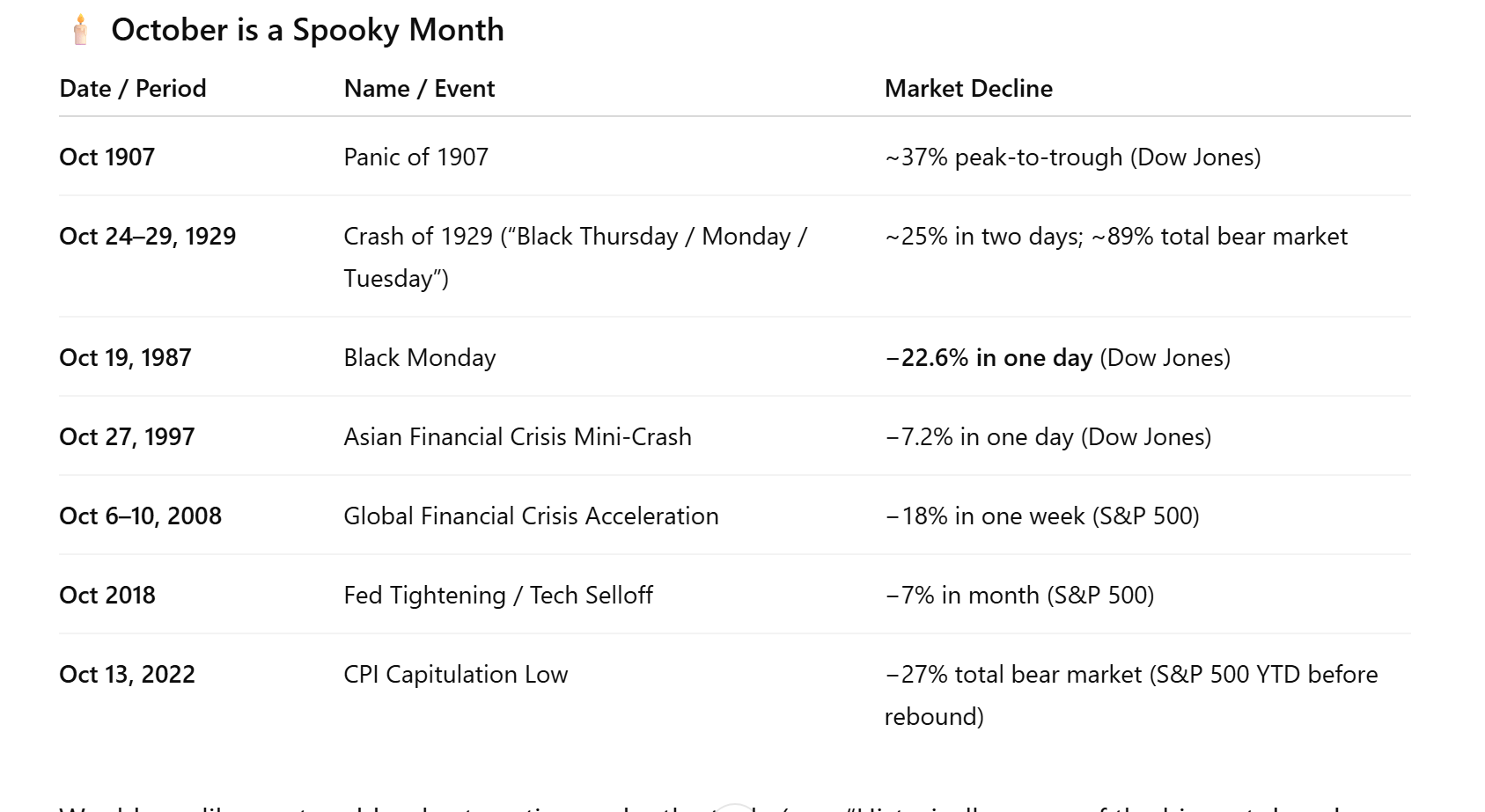

If there’s a month destined to test investors’ resolve, it’s October. History has delivered more than a few painful reminders—from breathtaking crashes to confidence-shattering sell-offs—that October can be a ruthless adversary to even the strongest bull markets.

Despite its reputation as a destroyer of confidence, October also carries the mantle of the bear killer—the month where vicious declines have historically met their end and powerful new bull markets have emerged from the ashes.

This October has only one trading week left, and the worst we’ve seen so far came on October 10th—when Trump decided to reignite the trade war with China. The S&P 500 sank nearly 3% in a single session… and then spent the next two weeks methodically erasing the decline, finishing this past Friday at fresh all-time highs. So much for October carnage.

The past week, in particular, threw plenty of potential landmines in the market’s path:

• A government shutdown stretching into its 24th day with no clear end in sight

• Oil prices surging as sanctions tightened against Russia

• Trade tensions spilling over into Canada, sparked by Trump’s criticism of an ad featuring Ronald Reagan

• The first notable earnings disappointment, with NFLX tumbling 10%

And yet—none of it mattered. The market brushed aside every headline, reclaimed the entirety of the 10/10 drop, and punched to new highs, delivering a harsh lesson to those positioned for vindication through negative news flow.

Being a bear in this environment is a painful existence. But sympathy is not something we offer to those shorting strength without evidence. We pour tremendous effort into dissecting market internals and the underlying forces that sustain trends. When the tide truly begins to turn, we will be the first to say so.

Market tops are not lightning strikes; they are slow-forming storms. Could we be approaching one? Possibly. But most major peaks don’t begin with a catastrophic bang. They require an unforeseen shock capable of altering the economic trajectory—and we do not trade based on guessing which bolt of lightning might appear. As Peter Lynch famously noted, “more money has been lost trying to call tops than lost in corrections themselves.”

Our approach is grounded in signals, structure, and institutional footprints that quietly reveal when something is shifting beneath the surface. We may not catch the exact tick of a top, but we will be close enough to protect profits when the music fades. That is how we serve our readers. That is how we keep you safe.

And this mindset works both ways. Consider why, in our 10/15 report, we stated that the October 10th sell-off likely marked the low of that correction—if you can even call it a correction. That call wasn’t bravado or blind faith; it was supported by empirical evidence. We outlined six distinct reasons why the market’s foundation remained intact and that weakness would be short-lived.

To revisit that moment, here is the exact excerpt from that report:

“Let’s revisit some of the key pivot points discussed previously (in order of importance) and why we now lean toward the view that the lows of this correction have likely been made—or are close.”

That line from our 10/15 report captured our stance with clarity. And for those keeping score, that same report also warned that Gold was likely near a short-term top or, at minimum, due for a pause. Gold topped the very next day — but we digress.

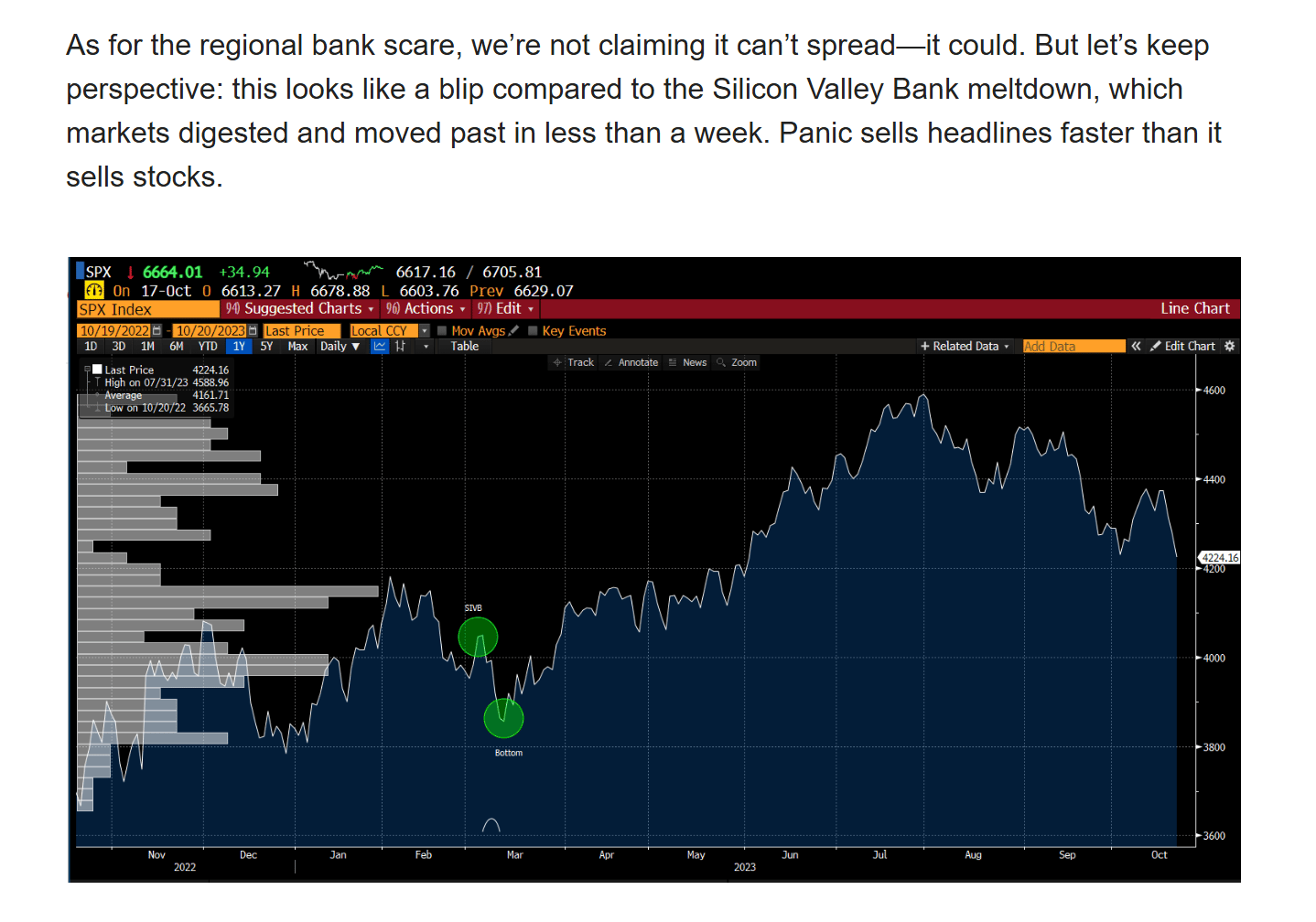

What made the bottom call especially compelling in hindsight is the timing. We issued that view before regional bank contagion fears burst back into the headlines. In that moment, we admittedly thought those concerns might undermine our thesis. But after a weekend of deeper analysis, it became clear that the fear was exaggerated — an echo of past crises rather than the start of a new one.

Below are two excerpts from our 10/19 report that detail why we stood firm in that belief:

Remember, the market itself is the clearest expression of collective psychology. When equities managed to close higher that week—despite breathless warnings of a renewed credit contagion—it spoke volumes. Price action told a different story than the weekend panic, revealing a striking absence of genuine investor fear.

But that wasn’t the only clue. Our volatility framework, which we monitor obsessively, was signaling the opposite of imminent breakdown. The setup pointed toward a volatility retrenchment—historically a constructive backdrop for equities.

As we wrote:

“…last week’s weekly shooting star reversal on the VIX suggests that volatility may have peaked on Friday, reinforcing the likelihood of stabilization or a near-term retracement in equity volatility.”

And here we are, just one week later: the VIX has dropped more than 22% after soaring nearly 80% the prior week. A breathtaking reversal—yet perfectly aligned with our signals.

We also pointed to the Magnificent 7 as a source of quiet strength. While speculative pockets endured sharp selling, the market’s true leaders never cracked. These are the stocks that matter most to the broader trend. When they hold firm—and better yet, threaten to break out—leaning bearish becomes an exercise in fighting the tape.

As we noted in the report:

“The Mag 7 Index continues to look technically strong, holding above its 10-week moving average while forming a bull flag near recent highs. A breakout from this pattern would likely serve as a catalyst for broader index strength.”

Fast-forward a week: the Mag 7 Index has surged to a new record closing high, validating the signals that leadership remains alive and well.

That report closed by forecasting new all-time highs in the major indexes—and that’s exactly what played out this week, albeit a bit ahead of our schedule:

“While this week is seasonally one of the weakest of the year, the absence of meaningful deterioration in the indexes suggests the market is building a foundation rather than cracking. With earnings season gaining momentum and macro-policy tailwinds still supportive, the stage appears set for the rally to resume and potentially push toward new all-time highs into year-end.”

Why do we take the time to revisit what we’ve already published? Simple: we want you to see how our analysis evolves and how we assemble conclusions step by step. We aren’t speculating—we’re hypothesizing, backed by layered evidence. Markets are never certain, so we build scenarios that stack the odds in our favor. Historically, we’ve been far more right than wrong—and that’s our goal for you.

What’s on deck this week?

This week brings heavy event risk: the Federal Reserve decision, earnings from the Mag 7, and major S&P 500 Index companies. A benign Friday CPI print gave the Fed room for further rate cuts. If they stray from that narrative—expect turbulence. But we view such a deviation as low probability, given the backdrop: rising unemployment trends, credit-fear still alive, inflation manageable. As of now, Fed Funds futures price in a 100% chance of two more cuts by year-end.

So far, the earnings season is off to a blazing strong start. Over a quarter of the companies in the S&P 500 have reported so far — and about 85% of them have beaten Wall Street estimates, the best showing in four years. At present, earnings are on pace to increase roughly 9% based on the data released — and if the beat cadence holds steady, there’s significant upside to that number.

The NVIDIA Corporation‐led “Magnificent 7” cohort still commands investor attention, but here’s a subtle shift beneath the surface: their earnings growth trajectory appears to be slowing, and that is beginning to stir concern.

Yet, investors remain willing to look past decelerating revenue growth — on the assumption that AI dominance will pick up any slack. The narrative is clear: growth may be moderating, but AI is expected to carry the baton forward.

Over the weekend the market received another shot of optimism—trade tensions with China are moving closer to resolution. A positive start to the week is well within range, but the question now is: how much of this good news is already priced in? Could this be the week that breaks the bull?

Let’s turn to the charts and find out.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade