Table of Contents

Introduction

The market continues to defy skeptics, shrugging off negative summer seasonality and delivering a historic September — its best in 15 years. Bears looking for the usual reversal instead found themselves steamrolled as the FOMC reignited its rate-cut campaign, fueling risk appetite and pushing speculative corners of the market back into overdrive. Indexes have responded with an almost relentless march to new highs.

But the question remains: when does it give? Last week’s government shutdown didn’t rattle the bulls in the slightest — in fact, it forced the all-important payroll report to be delayed, extending the rally’s runway. While shutdowns are typically non-events for markets, there’s a growing sense that the advance may be getting ahead of itself.

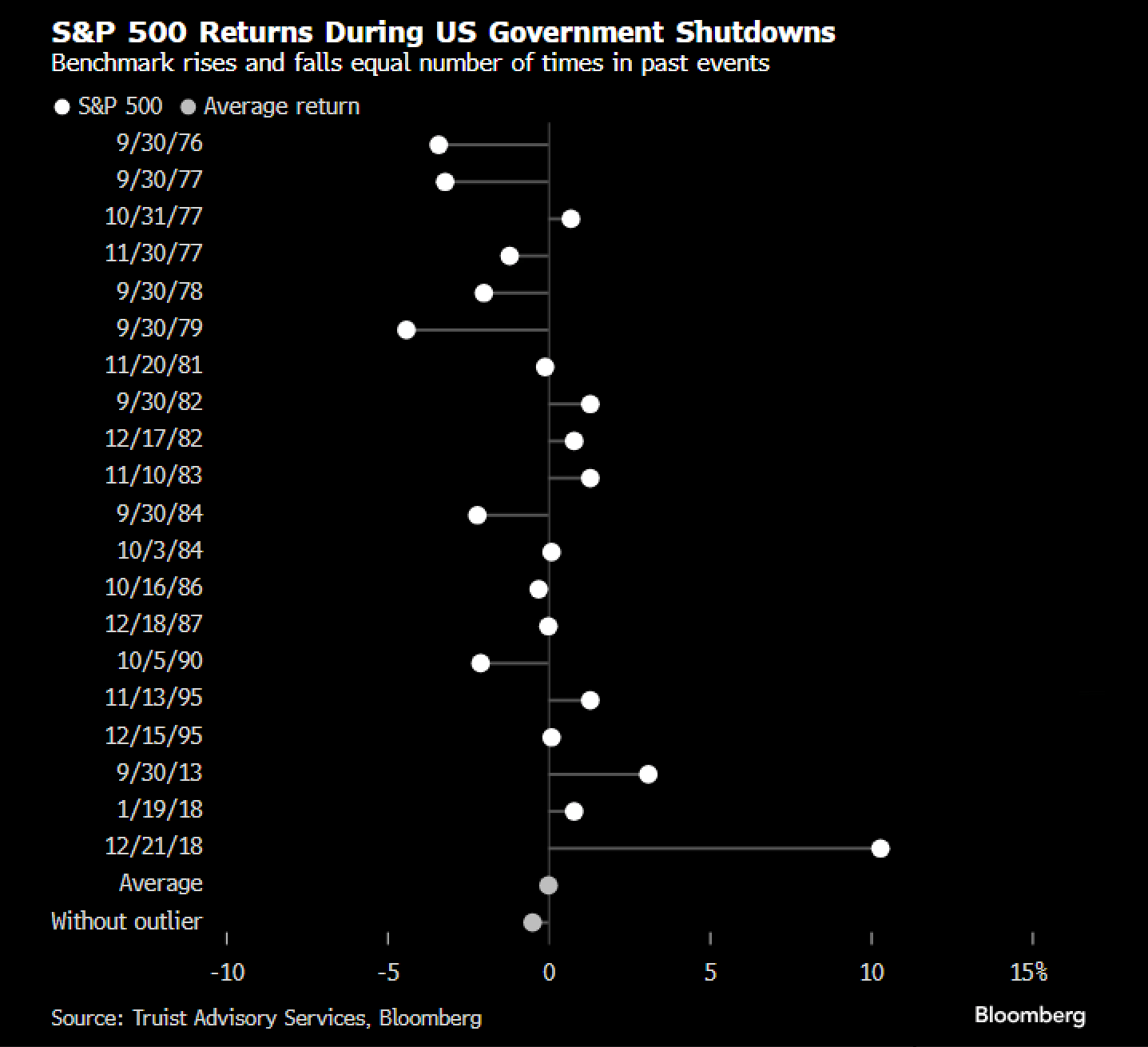

Historically, the S&P 500 has been roughly unchanged through the last 20 shutdowns since 1976, according to Truist Advisory Services. Yet when the 10% surge during the 2018 episode is excluded as an outlier, the average return slips to a -0.5% decline — a subtle reminder that even complacent tape can mask rising risk beneath the surface.

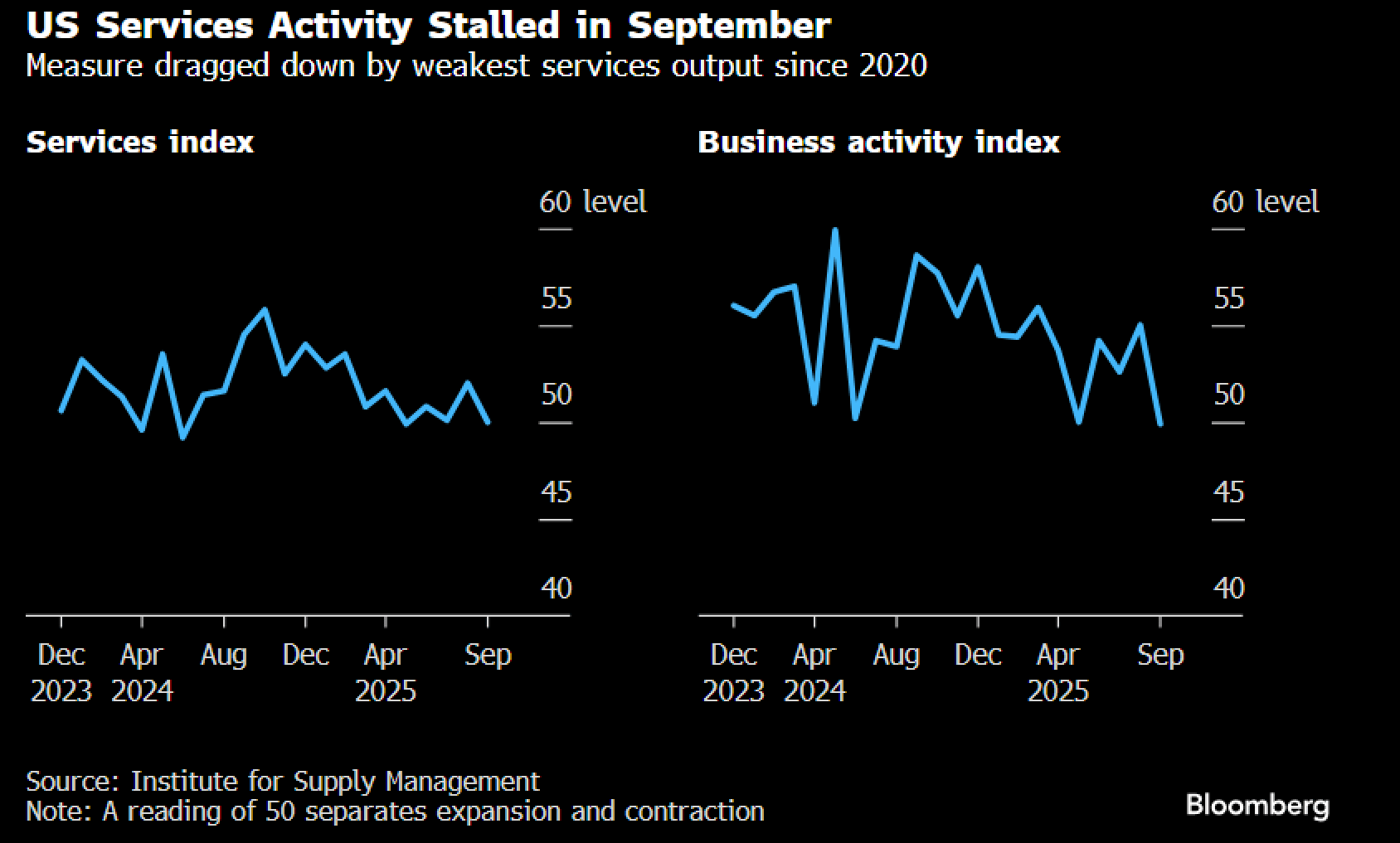

Shutdowns are inherently disruptive, and this one carries added political risk. President Trump, never one to back down from a challenge, is now threatening mass layoffs of government employees — a move that could jolt confidence and spending just as the economy shows early signs of strain. Pair that with an equity market trading at 23x forward earnings and a vacuum of meaningful macro data, and you get a potent cocktail for risk reduction. The latest ISM Services report underscored the fragility beneath the surface, showing its steepest contraction since 2020 — a reminder that the foundation under this rally may be softening even as prices push higher.

We’ll have to see how long the shutdown lasts, but the longer it drags into year-end, the greater the likelihood that portfolios accelerate their de-risking process and front-load de-grossing activity. This may already be underway. We’ve highlighted the McClellan Summation Index (MSI) several times in recent weeks, and breadth—as measured by the MSI—has been trending lower since its July peak. While this isn’t a sell signal on its own, such divergences often serve as early warnings. They can persist for a while, but they tend to cast a long shadow over the durability of any advance.

Portfolios appear to be quietly hedging this emerging tail risk. Fixed-strike volatility has risen meaningfully over the past few weeks, suggesting a pickup in demand for downside protection. At the same time, implied volatility remains elevated relative to realized volatility metrics—a sign that investors are paying up for insurance even as price action stays relatively contained.

The dispersion trade we’ve been highlighting in recent reports is unfolding as expected. This dynamic reflects rising single-stock volatility relative to the broader indexes. Low correlations across equities have effectively capped S&P 500 Index volatility, as individual stocks move in different directions and offset each other’s impact. As a result, the VIX has remained subdued even as idiosyncratic volatility surges. The spread between single-stock vol and index vol has now widened sharply—driven by low SPX-implied correlation and elevated dispersion—reaching its highest level since January.

We’re not suggesting this is a reason to sell the market outright, but it does warrant a measure of caution. While dispersion often creates fertile ground for individual stock performance, it ultimately sows the seeds for a return to higher correlations—and that reversal typically coincides with a volatility event. We haven’t identified a consistent trigger for when this transition occurs, but it tends to emerge when the Rate of Change (ROC) in volatility bottoms out. At present, that ROC is nearing its lowest levels of the past year, a condition that has historically preceded sharp shifts in market dynamics.

Again, these are not outright sell signals—just warnings. Given the backdrop of potential government shutdowns, slowing macro data, and an expensive equity market, it’s reasonable to expect some pickup in volatility as we move into earnings season over the next two weeks. Expectations are running high, which could keep the tape supported in the near term—but if companies fail to deliver, the setup is ripe for a corrective phase.

With that, it’s time to check the charts.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade