Table of Contents

Introduction

We often remind readers that the macro backdrop isn’t just “another factor” in markets — it is the factor. Macro drives liquidity, and liquidity drives everything else. When those two pillars shift, the entire market setup changes with them.

Right now, that shift is happening. Inflation remains stubbornly sticky, unemployment trends are quietly deteriorating, and genuine economic strength is getting harder to validate. On top of that, Fed Fund Futures have begun to price out a December rate cut — a sharp sentiment reversal that speaks volumes about expectations.

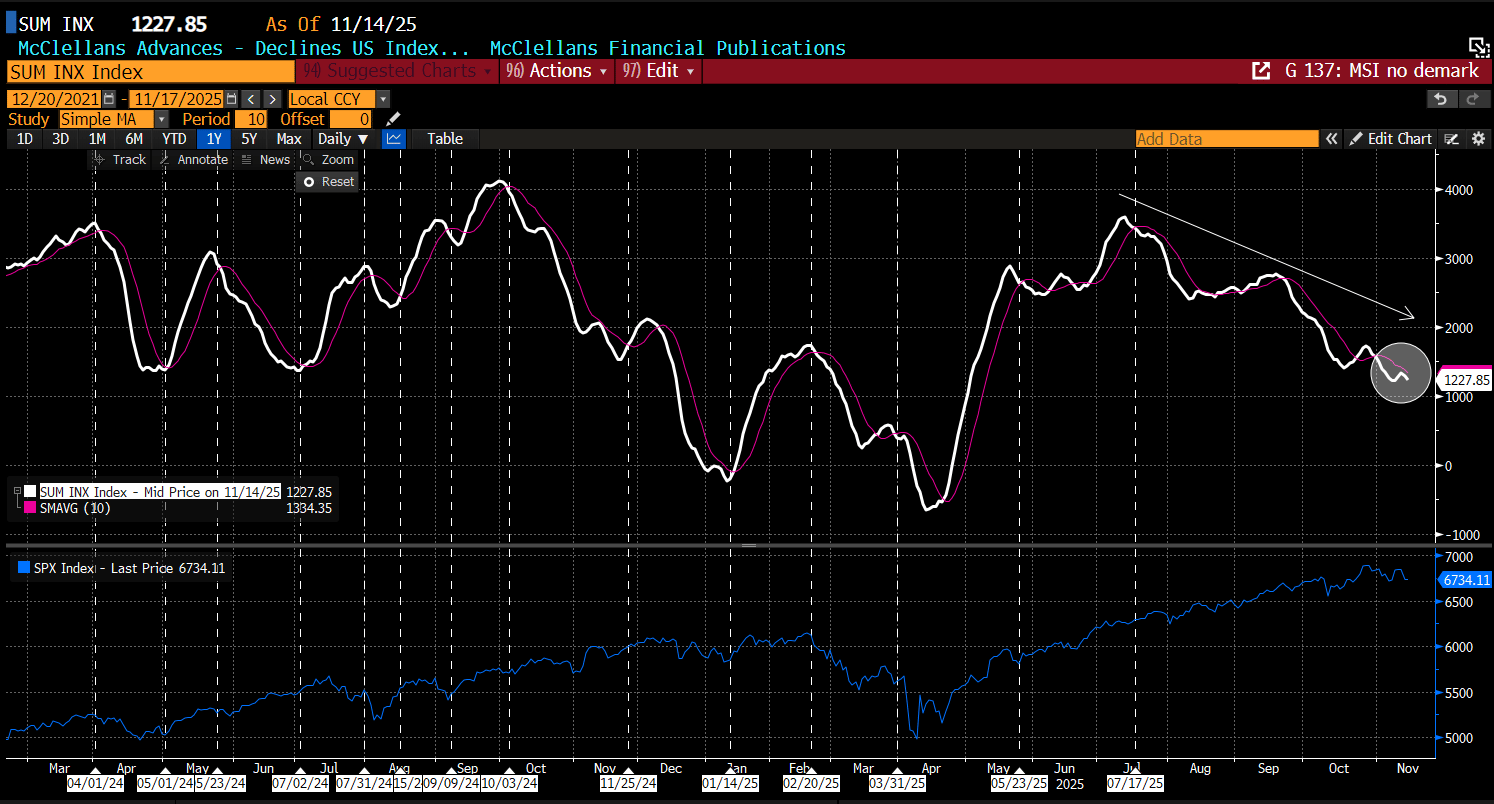

Unsurprisingly, these pressures are bleeding into equities. In fact, the deterioration has been unfolding for months. Market breadth, measured by the McClellan Summation Index, peaked back in July and has been rolling over ever since.

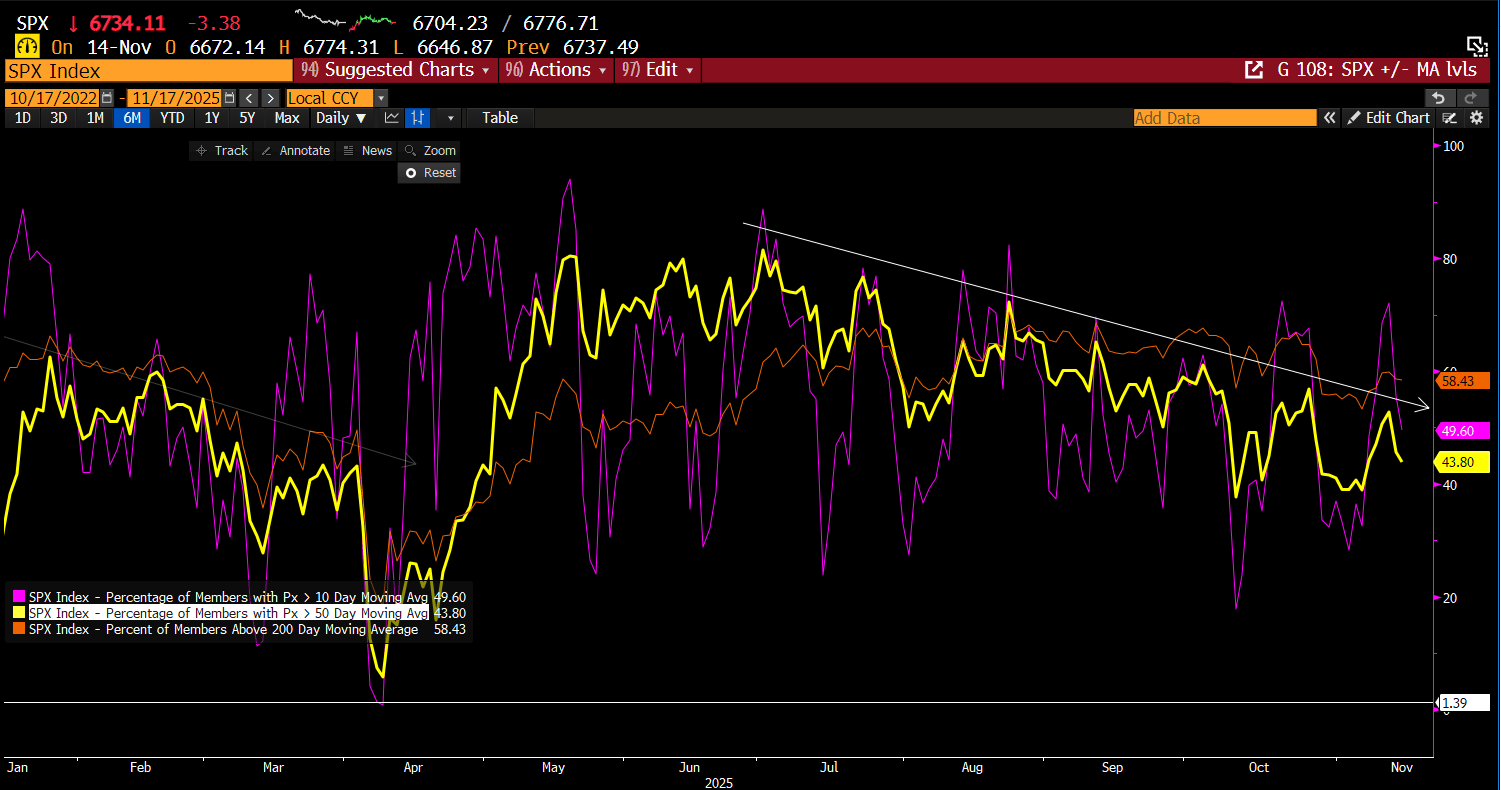

This dynamic is also evident in the chart of S&P 500 constituents trading above their 50-day moving average — a widely followed measure of trend health. As this gauge rolls over, it underscores that fewer stocks are participating in the advance, even as the index itself attempts to hold up.

Put simply, these charts make one thing clear: the market has been pricing in these macro concerns for months. The major indexes haven’t fully reflected that reality, but the underlying deterioration points to a weakening internal structure that ultimately must be resolved. A healthy advance requires broad participation — and this environment is anything but that.

To be clear, none of this is a timing tool. The market has continued to notch all-time highs along the way, including as recently as 10/29. But the market cares when the market cares, and we’re finally seeing a catch-down in the underlying components. The abrupt reversals in speculative pockets of the market in mid-October soured sentiment, and that stress is now spreading into the broader equity landscape.

Market tops are a process, not a moment, and it’s entirely possible we are witnessing the early formation of one. Are we there yet? No — but we are certainly edging closer to that possibility. And while markets attempt to price in the risk of an economic slowdown, the Fed retains the ability to alter that trajectory. The current message from price action is that the Fed is behind the curve; if they choose not to cut in December, the risk of a policy error rises materially. Tariff-related inflation is starting to filter through to consumers, spending is slowing, and major employers are now announcing meaningful workforce reductions. That is not the profile of a robust economic backdrop — which is precisely why equities are throwing a fit.

If the Fed does not respond to these softening undercurrents, the market will force the issue. Historically, that has meant lower equity prices until the policy stance resets. A parallel can be drawn to January 2019, when the “Powell Pivot” halted a similar slide. The circumstances differ, but the mechanism is the same: macro and liquidity ultimately determine when the bleeding stops.

Of course, this remains a theory — no one can know precisely why the market is reacting the way it is on any given day. But with rate-cut probabilities now sitting below 50% for December, down from near certainty only a month ago, it’s hard to ignore the macro shift bleeding into equity behavior.

The end of the government shutdown last week also means that several key economic reports will finally hit the tape. The most important among them is Thursday’s September employment report. Which direction it swings is anyone’s guess, but considering the deterioration we’ve already seen in private payroll data, there is a real possibility it reinforces the rate-cut narrative rather than undermines it.

On Friday, President Trump announced a partial reversal of select food-related tariffs in an effort to ease consumer pressure and temper the inflation that has sparked growing frustration and spending pullbacks. Whether this will meaningfully cool price pressures or reignite growth remains uncertain — but we’re skeptical. The damage may already be in the system.

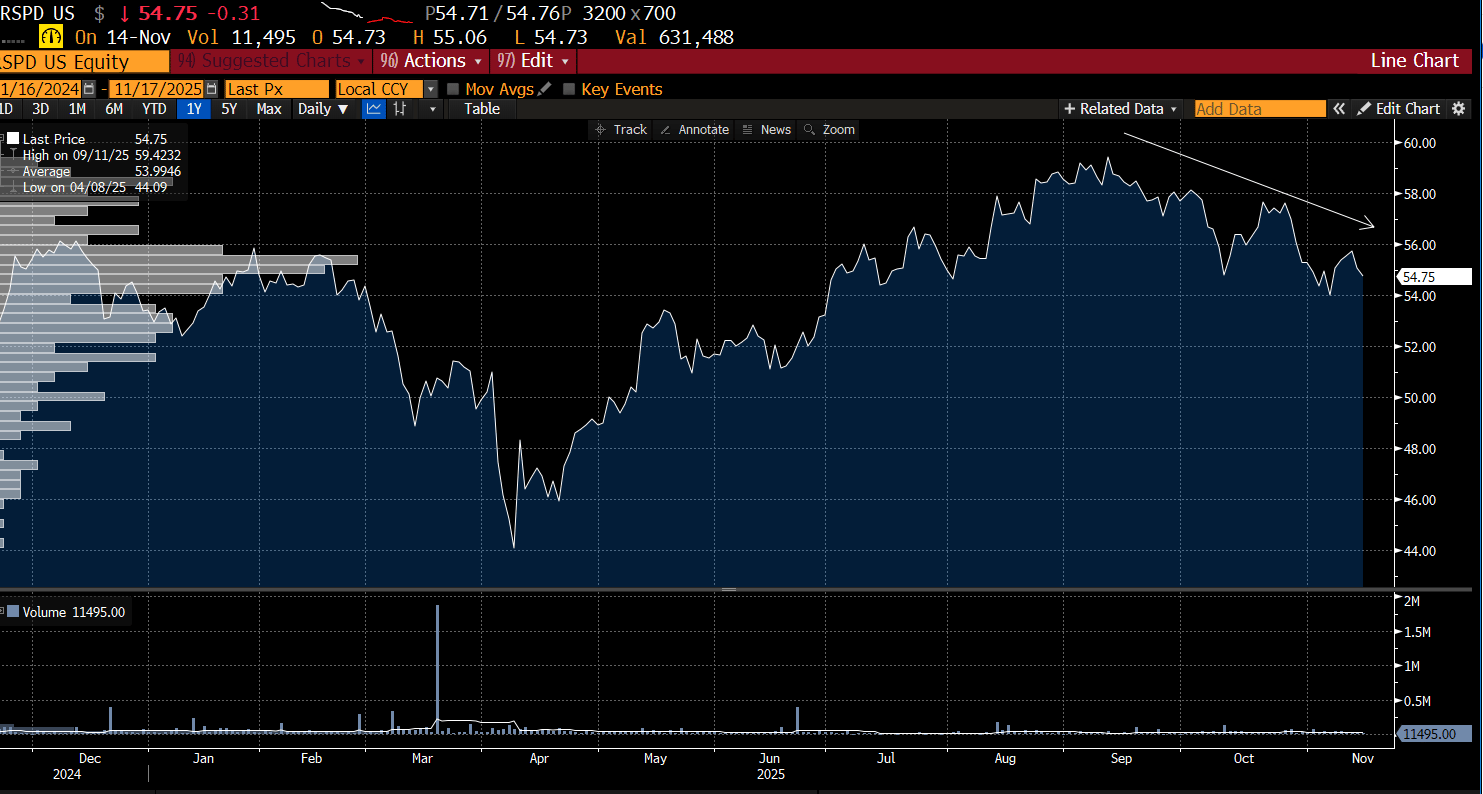

We’re also seeing this weakness manifest in market proxies. Equal-weight Consumer Discretionary (RSPD) is printing multi-month lows in November after peaking in September, a clear sign that the consumer-sensitive areas of the market are feeling the strain.

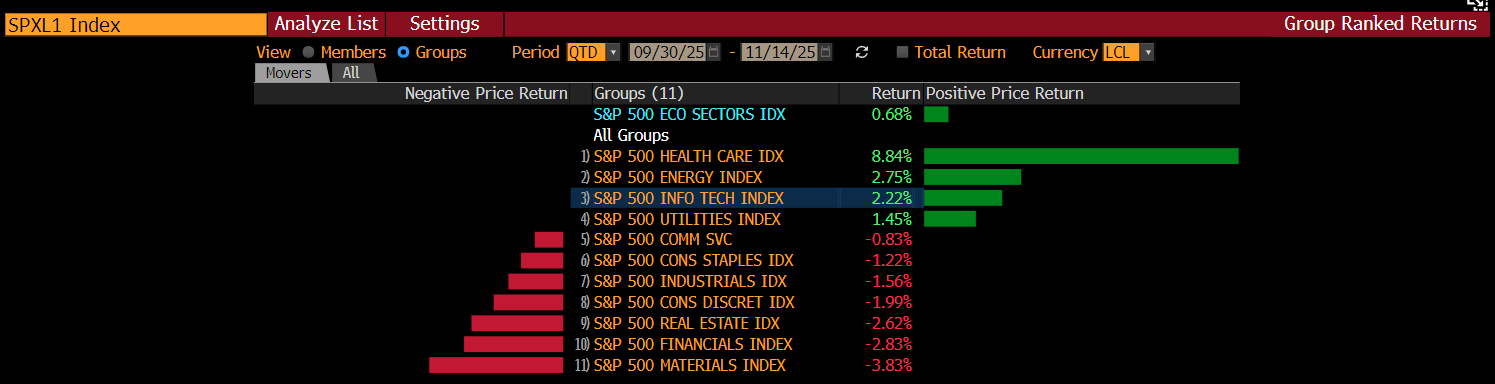

If we look at sector performance since the start of Q4, the leadership profile tells a very clear story. Healthcare and Energy are pacing the advance, with Technology rounding out the top four. Utilities are the only other sector in positive territory — everything else is negative.

Healthcare was our identified uncorrelated long idea in the 10/5 report, and it continues to behave exactly as expected. Energy, Utilities, and Healthcare are traditionally defensive in nature, which reinforces the broader message the market has been sending: investors are gravitating toward stability. Technology’s resilience is the outlier, supported largely by the ongoing AI infrastructure buildout, which remains one of the few areas still demonstrating durable demand.

The market appears to be at a genuine crossroads, increasingly dependent on the macro for its next directional cue. Which way the wind blows from here is still uncertain.

We may gain clarity once this week’s employment data is released, but — as always — the charts tend to reveal the message before the headlines do.

Let’s see what they’re telling us.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade