Introduction

Who would have guessed that October would win for the best scary costume this year? The month of October not only ends with Halloween, but it also has the notorious reputation for being one of the scariest months of the year for the stock market. Yet, October fooled us all, disguised as an apparition, yet in reality it was a bull in costume.

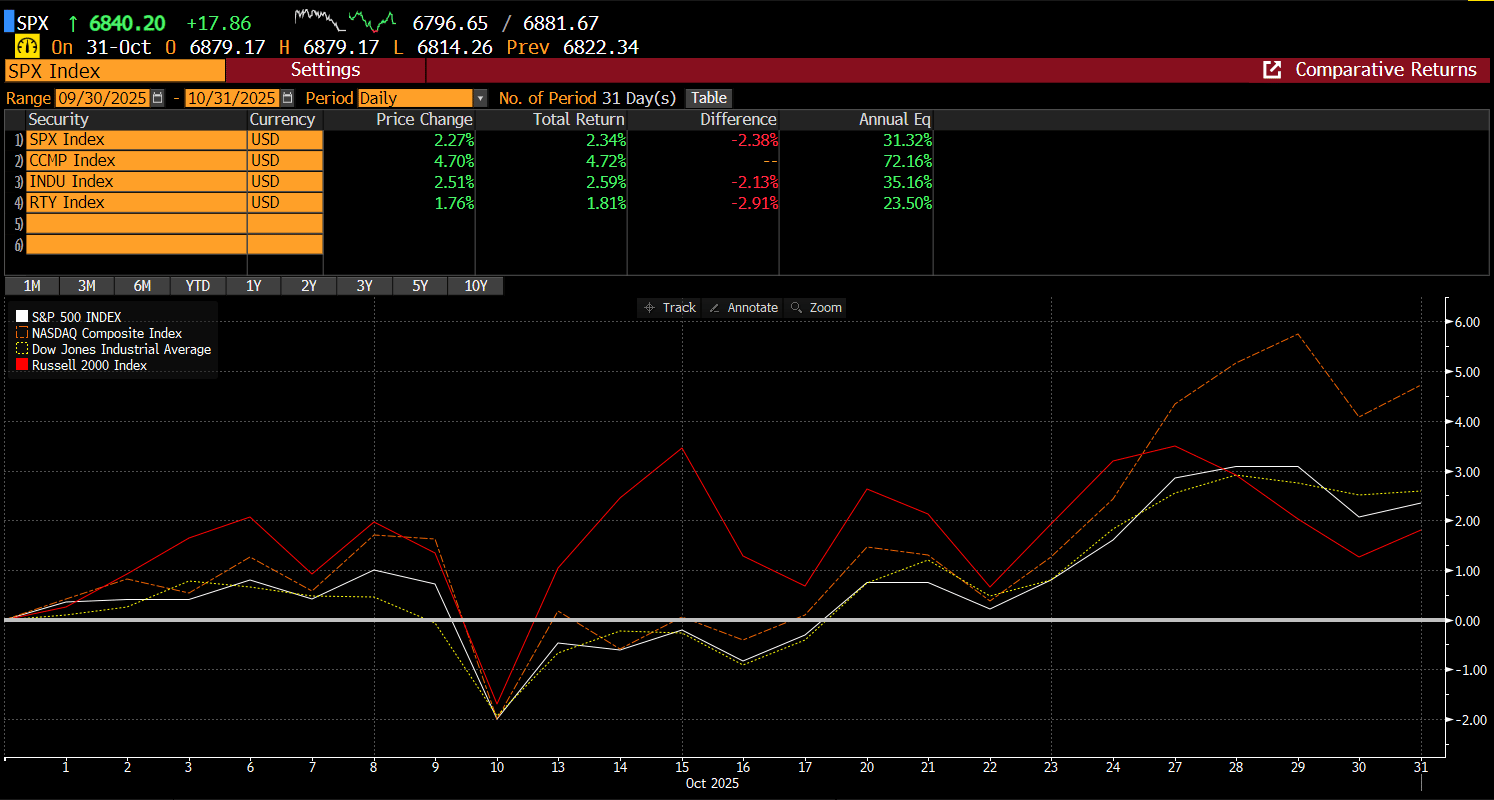

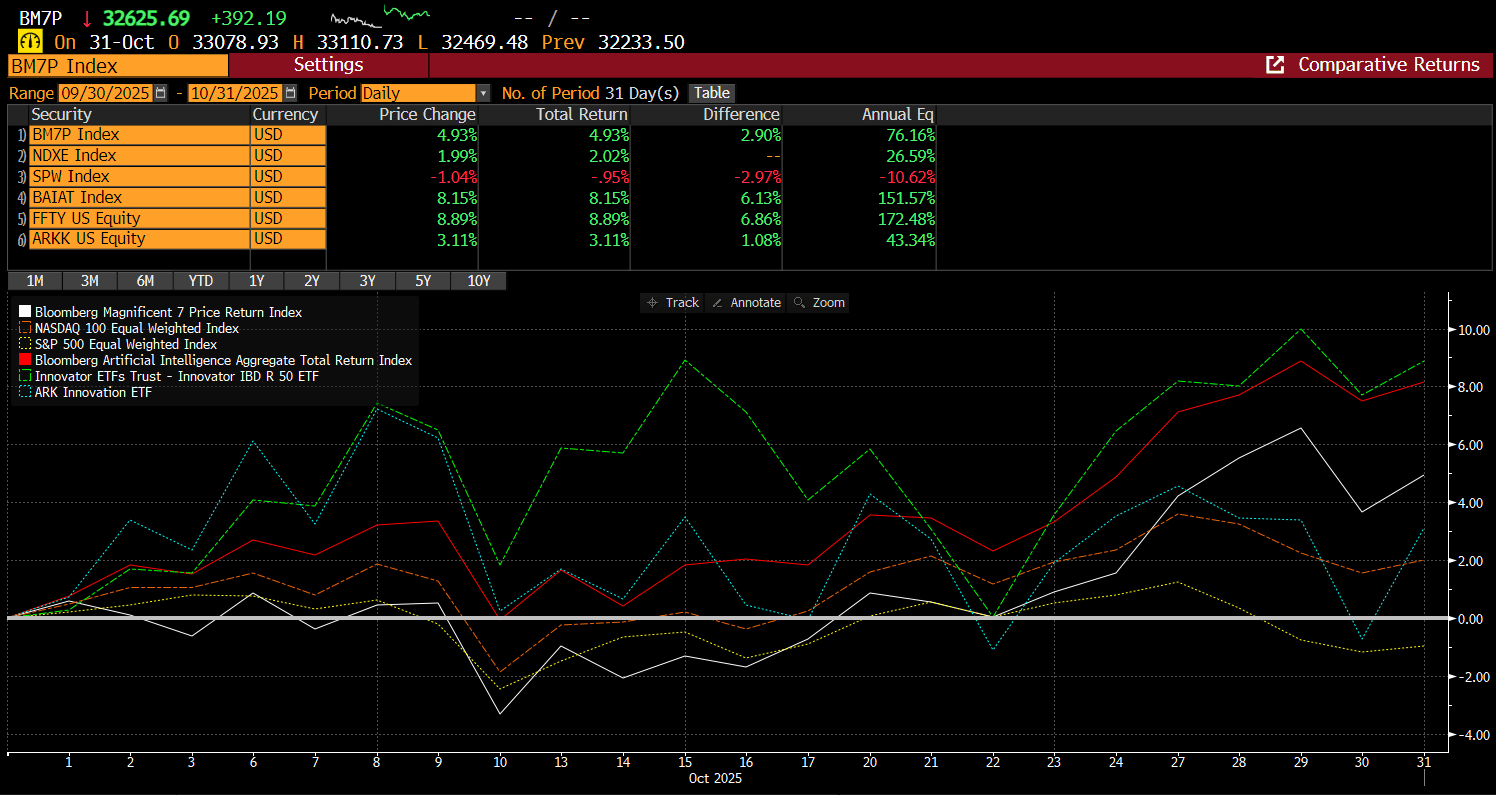

The S&P 500 continued its ascent to new highs amid a sixth consecutive month of gains. However, the major driver was the Nasdaq 100 Index, as major tech stocks moved through earnings season and AI-related buying continued at a strong clip. Markets shrugged off macro concerns such as the government shutdown, a brief escalation in China trade tensions and a small-lived selloff in regional banks. Fed’s Powell pushed back on a December rate cut at the FOMC meeting, but it did little to stop the stock-market advance.

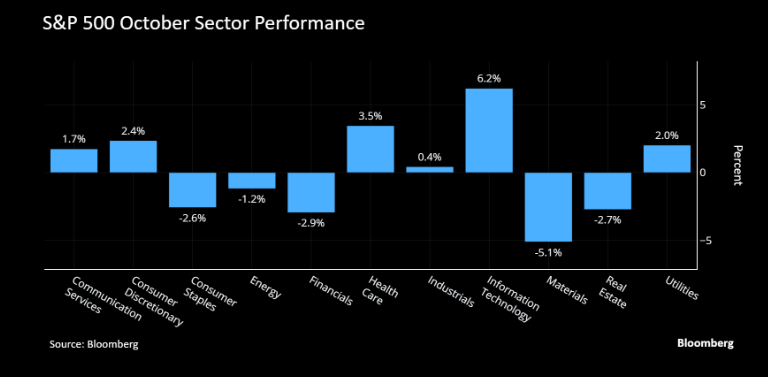

October finished the month in robust fashion, with technology stocks once again leading the charge, while our uncorrelated sector idea—healthcare—secured a strong and respectable second place.

Recall what we’ve often said about healthy bull markets—they should be led by high-beta sectors, particularly technology. So, it should come as no surprise that this group continues to do the heavy lifting for the broader market. We’ve also noted that much of this strength remains concentrated in the largest names, most notably the “Mag 7.” However, leadership has also extended to stocks leveraged to AI (as reflected in the BAIAT Index) and other high-growth leaders (FFTY), both of which continue to outperform. In contrast, the equal-weighted S&P 500 (SPW Index) tells a different story—if you’re not positioned in the right stocks, odds are you’re underperforming meaningfully.

Despite the ongoing swirl of macro crosscurrents and a relative lull in major economic releases, corporate earnings have continued to deliver.

Next week ushers in November—historically one of the most bullish months of the year. Bears will argue that since markets navigated the seasonally weak window relatively unscathed, the upcoming “bullish window” may already be priced in. That thesis has some merit, and it’s worth considering. Still, we’ve long maintained that seasonality alone is never a sufficient signal—it must align with the broader framework of our analysis.

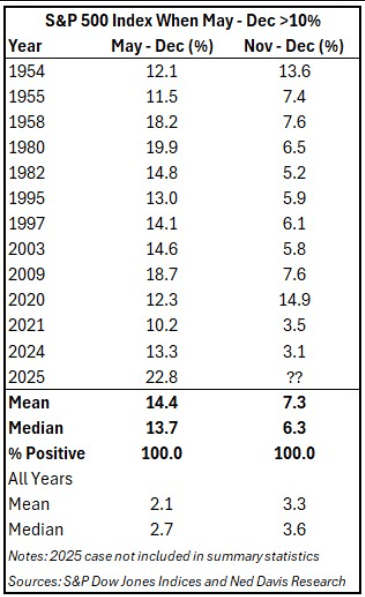

That said, dismissing the potential for continued strength simply because “it can’t last” would be ignoring history. The S&P 500’s +22.8% gain from May through October marks its strongest such stretch since 1942. Historically, when the index has risen more than 10% over that same period, it has advanced another 12 out of 12 times in November–December, with a median gain of +6.3%.

Bottom line: According to Ned Davis Research, strength during seasonally weak periods has historically been followed by further gains during seasonally favorable ones.

Of course, there’s more. Carson Research adds another compelling wrinkle: when the S&P 500 enters November up more than 15% year-to-date, November tends to outperform its already-strong seasonal backdrop, averaging a 2.7% gain versus the typical 1.9%. But the more eye-catching stat? The market has finished higher in November and December 20 out of the past 21 times under that same setup.

Put simply: strength has tended to beget strength.

It seems clear that market inertia remains firmly in place. As the saying goes, “an object in motion tends to stay in motion.” In market terms: momentum begets more momentum.

That said, the market is far from perfect. As noted earlier, the SPW Index (equal-weighted S&P 500) finished lower for the month, a reminder that the average stock is not sharing in October’s strength—masking weakness beneath the surface. This divergence is further illustrated by the percentage of S&P 500 stocks trading above their respective moving averages. Most notably, only about 40% of stocks remain above their 50-day MAs, even as the headline indexes hover near all-time highs.

At first glance, that might sound troubling—but is it really? We’ll address that shortly.

As we’ve stated repeatedly, November tends to be a very friendly market environment. Most of the major earnings reports are now behind us, corporate buybacks are set to resume in earnest, the latest flare-up in the China trade narrative is fading, and the Fed appears on track to end quantitative tightening while keeping its rate-cut trajectory intact.

With just two months left in the year and many professional managers still lagging their benchmarks, the path of least resistance seems clear—and it’s pointing in one direction.

Time to check the charts.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade