Table of Contents

Introduction

The current state of the market is anything but pretty. The first 12 trading days of November have delivered the 8th-worst start on record since 1950, according to BlueKurtic Market Insights. That’s a sharp departure from the widespread belief that positive seasonality would carry equities smoothly into year-end. This is precisely why relying on indicator singularity—one data point, one seasonal trend, one narrative—is dangerous when navigating complex markets. It’s never that simple, and it never has been.

Our multi-factor, multi-tiered framework began flagging trouble in early October. A series of cross-asset signals suggested the risk profile was deteriorating beneath the surface. The first major tell was the breakdown in Bitcoin on October 10th, the market’s most sensitive liquidity barometer. From there, weakness seeped into the speculative corners of the equity market and continued to broaden.

We won’t rehash the entire sequence of warnings—we’ve covered them extensively in prior reports—but the conclusion was clear: stick with leadership and prioritize defensive strength. Healthcare and other key leadership groups have largely outperformed the broader indices through the first week of November, validating that approach.

Over the past two weeks, we’ve grown increasingly cautious as a widening set of assets began to buckle under mounting liquidity constraints. We’ve repeatedly highlighted that deteriorating liquidity and a rising cost of capital were creating a hostile backdrop for risk assets—especially those dependent on leverage. When liquidity tightens and borrowing costs rise, leverage is forced out of the system, and asset prices cascade. That dynamic has now produced a meaningful correction across the major indices.

Then came Thursday—a massive reversal across most asset classes following what appeared to be a strong quarter from NVDA. And this is exactly why we cautioned in our 11/19 report that the weekly close mattered far more than whatever the NVDA-led futures spike was signaling on Wednesday night.

As we wrote:

“…right now there are simply too many negatives to overlook. As noted above, we prefer to see how this week closes out before adjusting our cautious stance.”

“…we need a more coherent alignment of evidence before probability-weighting an upgrade in our outlook. At the moment, that alignment is still missing. For now, we remain cautious, tactical, and patient.”

We did not anticipate the magnitude of Thursday's reversal, but we did recognize that the market still had unresolved structural issues—making it premature to declare an “all clear.” The real question now is whether Friday’s follow-through marked the end of the current drawdown, or if more weakness lies ahead. We’ll address that shortly.

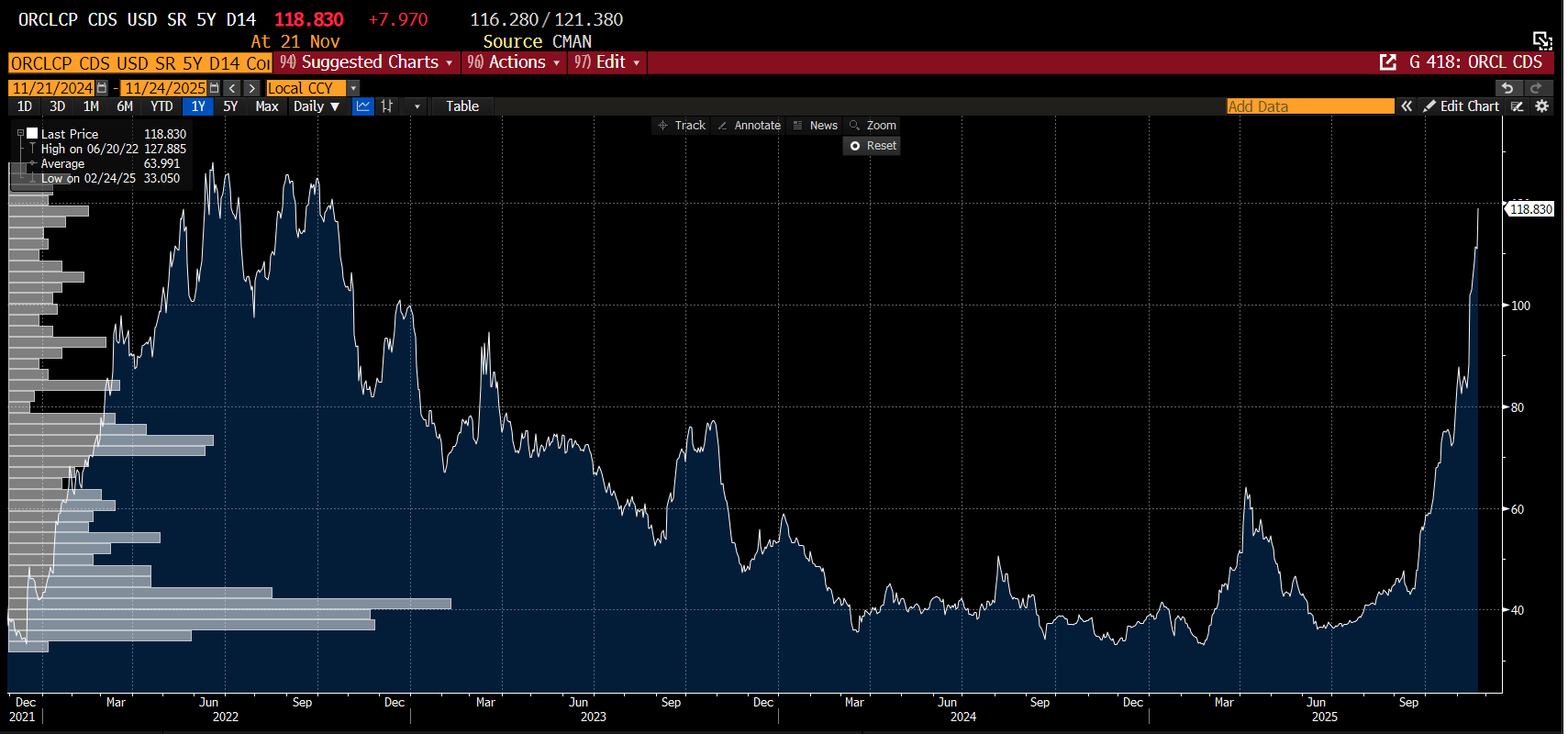

As for what may have triggered the violent reversal, one plausible driver is growing market concern about whether massive AI-driven capital expenditures are producing enough revenue and profit to justify themselves. For evidence, look no further than Oracle’s credit default swaps (CDS). CDS reflects the cost of insuring against a company’s debt default, and ORCL’s CDS has exploded higher since early October. That kind of move is rarely benign. Reversals will not sustain if ORCL CDS continues to climb—because it signals stress in a core beneficiary of the AI narrative. The last time ORCL CDS reached these levels was during the 2022 bear market.

The rising fear of default has crushed what had been a leading software stock, resulting in its largest monthly decline since 2001.

The spreading fear is now pushing implied volatility for the Nasdaq 100 to its highest level of the year. Investors are rushing to hedge and are increasingly willing to pay a premium to protect—and lock in—their gains for 2024.

…which has helped unravel many of the leveraged AI-thematic trades.

For all the fear that has seeped into the market, the SPX is only about 6% off its peak. We’re not suggesting that this isn’t a healthy correction—it is, and it’s been far more painful for anyone overexposed to the speculative areas of the market that are down 20–70%. But the reality is that speed bumps like this are a normal part of the investment cycle. They reset euphoria, shake out excesses, and ultimately extend the life of a bull market. None of this necessarily means the AI trade has popped or that the SPX has topped.

Skepticism is the fuel for new bull legs. What we’re seeing now appears far more driven by liquidity dynamics than by fundamental deterioration. Whether those liquidity pressures ease before the next Fed meeting—still more than three weeks away—remains to be seen. It’s entirely possible the market bottomed on Friday, but it’s equally plausible that we have more handwringing and volatility ahead before a durable reversal takes shape.

Let’s see what the charts are saying.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade