Table of Contents

Introduction

Let’s be clear: the market didn’t “calmly recover”—it snapped back with force. After spending most of November flirting with a cliff, sentiment flipped on a dime as long-dormant seasonality finally decided to show up. What looked like a market ready to break turned into one of the most jarring late-month reversals on record.

The S&P clawed its way into the green, erasing what had been one of the ugliest starts to November in decades. The Nasdaq still limped in with losses, but the magnitude of the turnaround was unmistakable. The about-face was so violent and so sudden that anyone who blinked missed it.

Markets love to humiliate the consensus. Last week was a masterclass.

In a week that barely counted as a full trading stretch—just three and a half sessions—the market didn’t tiptoe higher; it charged. Most major indexes clawed back the entirety of November’s decline and now sit within arm’s reach of the all-time highs recorded at the end of October.

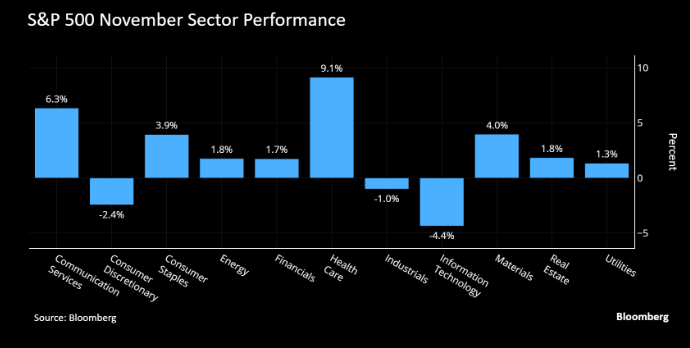

So, what gives? With economic data in short supply and no clear read on the broader trajectory of the economy, investors were left squinting through an opaque macro backdrop—hardly ideal when valuations are already stretched toward the upper end of historical norms. The unease was evident. Leveraged trades in the frothier pockets of the market began to unwind, and the selling didn’t stay contained; it bled into nearly every sector. The lone exception was healthcare, which continues to lead in Q4—ironically, the very uncorrelated sector we highlighted as a long idea in our 10/5 report.

What happened is not complicated. The Fed pumped oxygen back into deflating rate-cut expectations for December. That’s it. Don’t overthink it. Had Williams—and the Fed speakers that followed—not openly entertained the idea of a December cut, last week’s tape would have looked very different.

Consider this: the precise top in the S&P 500 coincided with the last FOMC meeting, when Powell made it clear a December cut was far from guaranteed. The market’s aggressive, V-shaped rebound didn’t materialize out of thin air—it began the moment Williams spoke on November 20th.

Sure, we can debate the role of seasonality, but it needed the right backdrop—just as a flower needs sunlight. Without it, nothing blooms. Seasonality alone wasn’t enough.

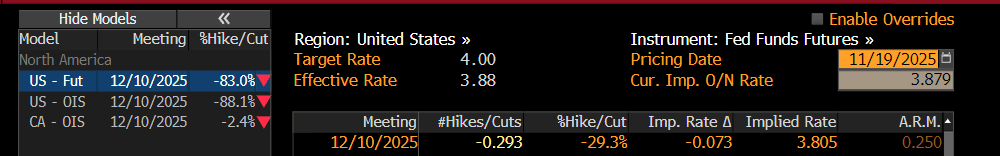

Hindsight makes everything look obvious, but let’s be honest: without the knowledge that Fed officials were about to line up and signal support for a December cut, predicting last week’s reversal was nearly impossible. Williams’s comments didn’t just nudge expectations—they detonated them. Fed Fund Futures went from pricing less than a 30% chance of a December cut on 11/19 to over 70% by 11/21. That’s not sentiment drift; that’s a regime shift.

The market is now pricing an 83% chance of a December cut. Say what you want, but macro still runs the show and usually steamrolls everything else. Heading into Williams’s remarks, the prevailing narrative was clear: if the Fed didn’t cut in December, it risked a policy mistake. Markets don’t shrug those off. The setup had uncomfortable echoes of 2018’s taper tantrum, when a perceived misstep sent equities spiraling ~20% into year-end.

The dovish drumbeat from the Fed last week effectively primed the pump for the end of QT, which kicks off tomorrow. Taken together, that shift obliterated the entire 5%–7% drawdown in the indexes since late October—declines that were rooted almost entirely in fears of a tighter liquidity regime. With that risk now perceived to be off the table, the regularly scheduled bullish programming can resume. The show hasn’t changed; the script is still called Don’t Fight the Fed.

And make no mistake, the market isn’t suddenly “easy.” Underperforming managers just got blindsided by a macro curveball and were forced to re-gross exposure into a thin, holiday-shortened week. That scramble alone helped propel indexes to one of the strongest Thanksgiving-week rallies on record. Wayne Whaley’s data confirms it: the S&P 500’s 3.73% gain last week is one of just sixteen instances since 1930 where Thanksgiving produced a move greater than 2%. Historically, that kind of price action tends to fuel a chase into year-end.

Of course, the linchpin here is the Fed. If the FOMC shocks the market and doesn’t cut in December, this entire rally—and likely more—evaporates. That’s the risk. Fed Fund Futures remain jumpy, as last week proved, and positioning continues to shift around every comment and headline. The market is still operating in a macro vacuum with few data points of consequence, outside of corporate earnings color and private surveys. Early reads on Black Friday offer some relief—Mastercard SpendingPulse shows retail sales ex-autos up 4.1% year-over-year, outpacing last year's 3.4% gain, with in-store sales rising 1.7% and online up 10.4%—but that only clears one hurdle.

In last weekend’s report, we suggested a bottom was close, but we preferred a more cathartic push lower to define the reversal. The market disagreed. It ripped higher instead. In hindsight, we should have pivoted sooner—but this is the game: when the facts change, we change. The tape isn’t waiting for anyone.

Let’s turn to the charts and see what December has in store.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade