Due to the holidays, this week’s report will be abbreviated, and the paywall has been removed. As a reminder, research pricing will increase in 2026 for new subscribers only. Subscribe now to lock in lifetime access at current pricing.

Introduction

It’s been a wild year—one where the resolve of the bulls was tested repeatedly. The so-called Tariff Tantrum sent equities reeling +20%, convincing many that the cycle had finally turned. Instead, the rebound was swift, violent, and unforgiving—sending the bears into an early hibernation.

October and November delivered back-to-back corrective moves of 4–9%, each one confidently declared “the end of the bull market.” And yet, each time, the market responded the same way: relentless upside. The bears’ growl was quickly silenced as buyers stepped in with force, ultimately driving the SPX to new all-time highs, with other major indexes close behind.

Once again, the lesson was clear: underestimate this bull market at your own peril. After a year of mistimed calls and false alarms, it’s no surprise the bears find themselves firmly planted at the top of Santa’s naughty list.

2025 marked the second straight year in which stocks weathered a bear-market correction—an unusual setup that has historically preceded periods of calmer, not more chaotic, market conditions. Bears will predictably protest, citing elevated valuations and claiming the rally has already priced in all the good news—a familiar refrain that has aged poorly throughout this cycle.

…arguing that inflation will soon reassert itself even as economic growth slows and labor-market conditions deteriorate.

A cocktail that, according to the bears, will ultimately force the Fed to raise rates to contain a renewed inflationary impulse—just as growth slows and the labor market weakens. Maybe they’ll be right. But those risks are neither novel nor unrecognized; they are widely known, heavily debated, and continuously modeled.

Very few, however, foresaw the Trump administration launching a contentious trade war in March—one that sent stocks careening toward the abyss in a matter of weeks. More often than not, it’s exogenous shocks, not well-telegraphed macro fears, that catch markets offside. If history is any guide, the dominant worries of today rarely arrive in the neat, discounted fashion many expect.

Which raises an obvious question: if the future is so uncertain, why do so many insist on making grandiose calls about where markets must end up? Much of it reads less like analysis and more like sensationalism—clickbait dressed up as conviction.

Wall Street strategists offer their own version of fortune-telling, confidently projecting year-end SPX targets and crafting tidy narratives to justify them. In reality, most of these forecasts serve a single purpose: providing cover to stay invested. And for anyone taking them too seriously, disappointment is almost assured. The irony is that the consensus expectation—roughly an 8% gain for the SPX—amounts to little more than the historical average. We struggle to see how that constitutes value-add insight.

We take a different tack.

Rather than attempting to divine where the market should be months from now, we focus on what the evidence is telling us today. Our approach is rooted in a weight-of-the-evidence framework—one that keeps our readers aligned with the dominant market narrative while continually reassessing risks as conditions evolve. Fighting the primary trend has never been a reliable way to make money in equities. Staying aligned with it, on the other hand, is a prerequisite not just for performance, but for outperformance.

That philosophy guided us throughout the year. We remained bullish for most of 2025, grew cautious in late February—just days after the market peaked—and then reversed course the weekend before the April lows, advising clients to begin accumulating equities. We will never capture every wiggle, nor is that the objective. The goal is to stay in the meat of the move.

Yes, markets trend. Attempting to nail exact tops and bottoms may be intellectually satisfying, but it is a low-probability endeavor riddled with error. While we did identify the precise April low, that was not the intent. Our objective is simpler: participate meaningfully on the way up while avoiding the drawdowns that permanently impair performance. If that requires sacrificing some upside while waiting for confirmation, so be it.

Our December 17 report—Bulls Are Against the Ropes, Again—exemplified this approach. As the title implied, the bullish structure was under pressure and at risk of breaking.

We wrote:

“The indexes—and the broader market—are hanging by a thread…. That said, this does not imply an imminent collapse. Conditions are beginning to align for at least a tradable response, and a meaningful rebound—potentially starting as soon as tomorrow.”

What followed was not a breakdown, but a tradable bottom—one the market never looked back from.

Did the market confirm a structural failure? It did not. Our subsequent report shifted decisively, calling for new all-time highs.

On December 21, we wrote:

“When most stocks are holding up, semiconductors are stabilizing, major indexes are reclaiming key resistance, and the Magnificent 7 is pressing toward a breakout, fighting the tape makes little sense. The weight of the evidence suggests the major market indexes are positioning to print new all-time highs.”

A few days later, that view was validated, with the SPX forging a new all-time high on December 24—while many bears were still positioning for collapse.

This is what we do. We keep you aligned with the trend—much like a lighthouse guiding ships safely through rough waters.

So as we look ahead to 2026, the real question becomes: who do you want guiding you forward? The strategist with a vanilla year-end target, marginally differentiated from peers and almost guaranteed to be revised mid-year? Or a disciplined, evidence-based process designed to keep you on the right side of major trends, ahead of key inflection points, and insulated from destructive drawdowns?

We know our answer.

Index Analysis

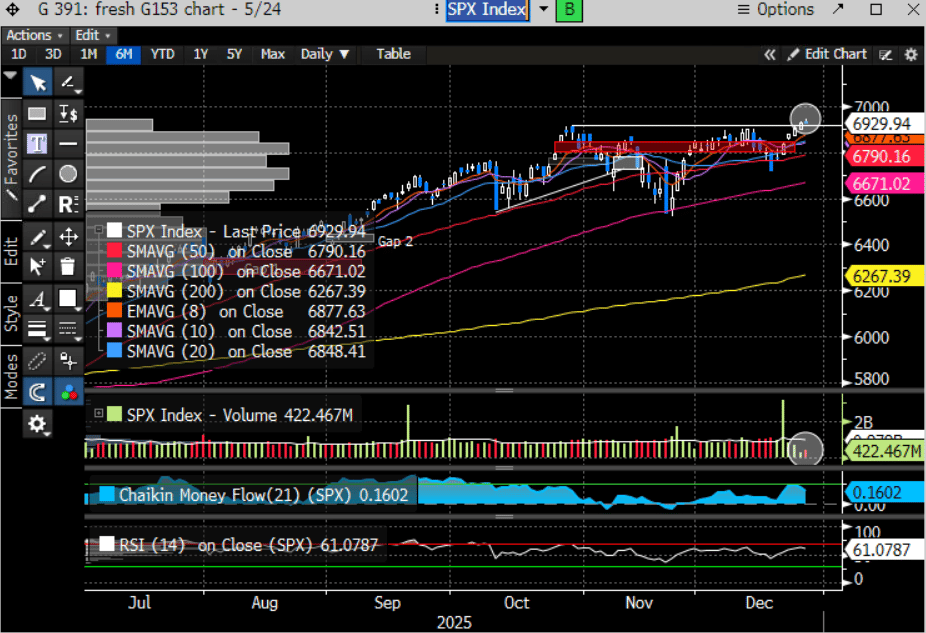

As discussed, the SPX pushed to a new all-time high last week, formally confirming the cup-and-handle continuation pattern we have been highlighting. With the breakout now validated, the measured-move objective for this formation projects toward ~7,250.

However, Friday’s volume was uninspiring—understandably so given the holiday backdrop—which suggests the breakout, for now, remains difficult to confirm.

Volume is likely to remain light this week as many market participants are still on holiday. That creates an interesting setup—and one the bears may attempt to exploit. The SPX is two sessions away from printing a new DeMark Combo 13 sell signal. Notably, the prior Combo 13 sell marked the October peak, which preceded a nearly 6% correction.

This sets up an interesting start to January. The SPX is potentially staring at an eighth consecutive monthly advance, hovering near fresh all-time highs, while DeMark signals continue to align. A monthly DeMark Sequential 13 sell is likely to print by the end of January.

It bears repeating that 13 signals are valid for 12 price bars, giving them relevance for up to a year. Historically, each instance in which a monthly Sequential or Combo 13 sell has printed has been followed by a meaningful decline within one to four months. If that pattern holds, it would suggest that the first quarter of 2026 carries an elevated risk of a sizeable correction.

While timing is always the most difficult aspect of identifying a major retracement, our signals should provide sufficient advance notice of a developing downside turn. We saw a similar setup earlier this year. In our February 21 report, issued just two days after the February peak, we turned cautious ahead of the subsequent 21% decline into the March lows.

At the time, we wrote:

“…index construction has turned sharply negative following the momentum breaches we highlighted in our 2/19 report, and we don’t believe the selling is over…we remain cautious and tactical, looking to sell bounces.”

Importantly, the Nasdaq has not confirmed the SPX’s new all-time high. Should it fail within the current structure—where it is testing yellow gap window resistance—that would represent an additional challenge for the broader market. This divergence echoes our analysis of the prior cycle, in which the Nasdaq peaked roughly two months ahead of the SPX.

That blemish remains unresolved and will persist until the Nasdaq itself breaks out to new highs. Until then, it remains a risk worth monitoring closely.

The Nasdaq is also contending with a newly printed DeMark Sequential 13 sell, which registered on 12/24. The most recent Sequential 13 sell occurred just days ahead of the prior peak and was followed by a decline of more than 4% into the 12/17 lows.

DeMark signals are always treated as warnings, not conclusions. When they begin to cluster across multiple instruments and time frames, we look for additional evidence that might support a potential trend change. This is precisely why we incorporate multiple internal and breadth measures—to improve probabilities rather than rely on any single signal.

That improving internal backdrop was a key reason we expected a reversion in our 12/17 report.

Notably, On-Balance Volume (OBV) for the Nasdaq has already broken out to new highs, even as the index itself continues to lag. This positive divergence argues for catch-up, and tempers the otherwise cautionary signal set.

The SPX’s On-Balance Volume (OBV) also pushed to new highs ahead of the index printing a new all-time high. That sequence should be viewed as an important reference point and strengthens the case for the Nasdaq to eventually follow suit.

The SPX advance/decline line continues to register new all-time highs and remains a bullish input for the broader market. A meaningful divergence here would warrant greater concern, but for now, breadth continues to support the trend.

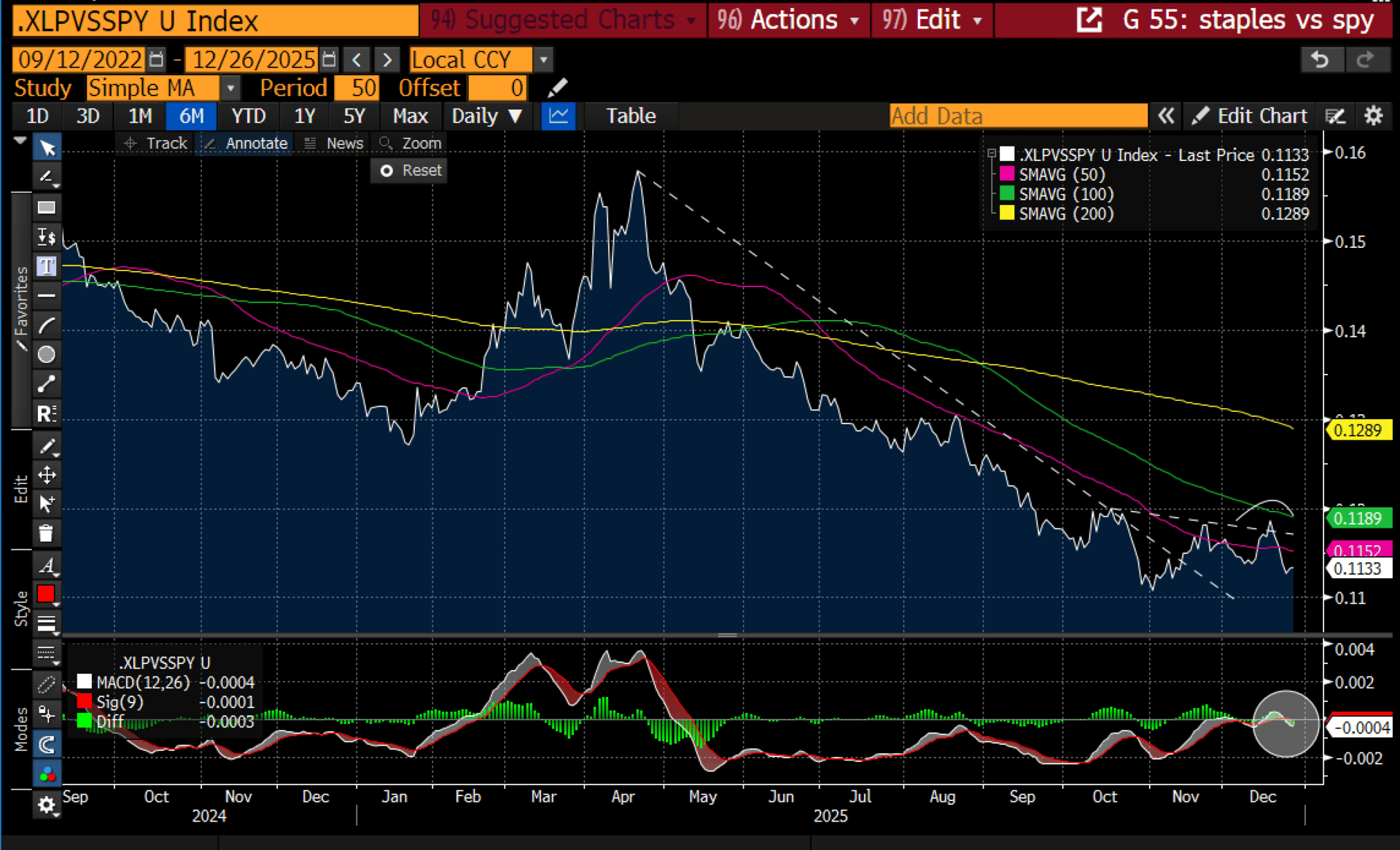

The Staples vs. SPY ratio failed to confirm a higher high and has since registered a new swing low, with the MACD rolling over and slipping below the zero line. Defensive leadership continues to underperform, reinforcing that offensive positioning remains firmly in control.

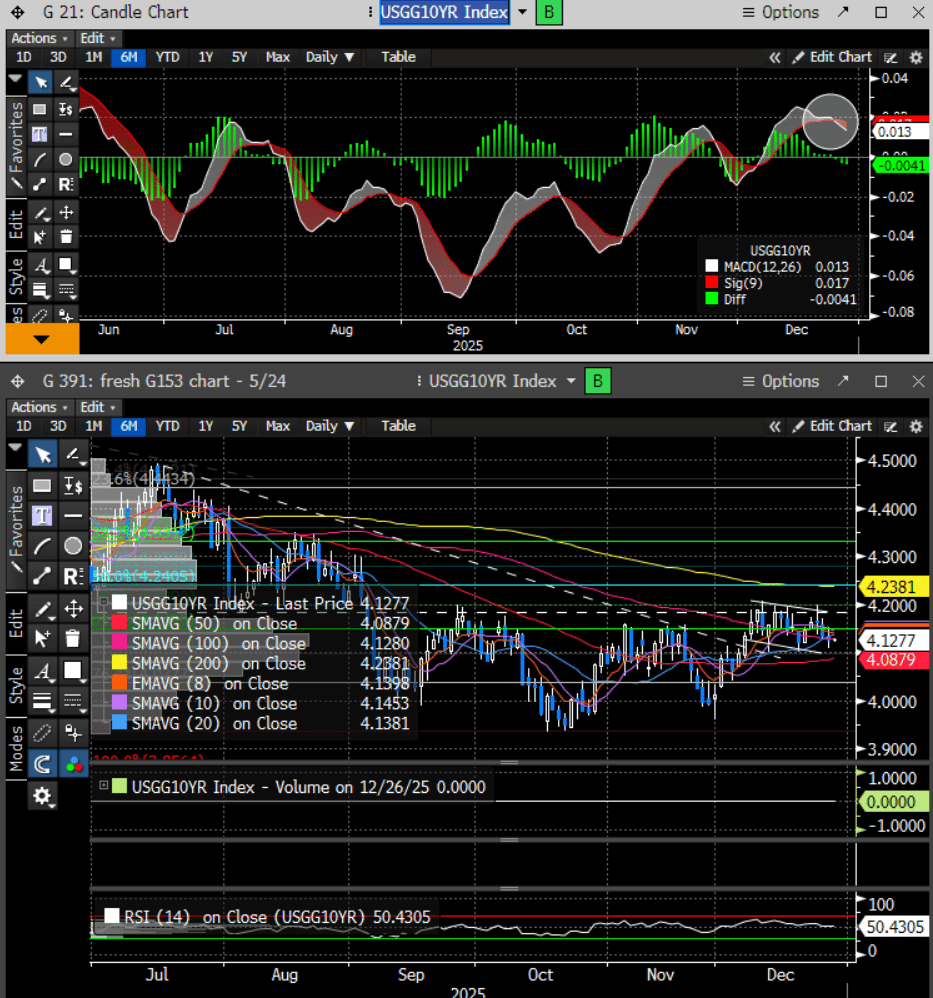

The 10-year Treasury continues to build out a bull-flag structure, though momentum—as measured by MACD—is beginning to roll over. A confirmed breakout was one of our near-term risk factors for equities, but that outcome appears less likely at present, easing immediate rate pressure on stocks.

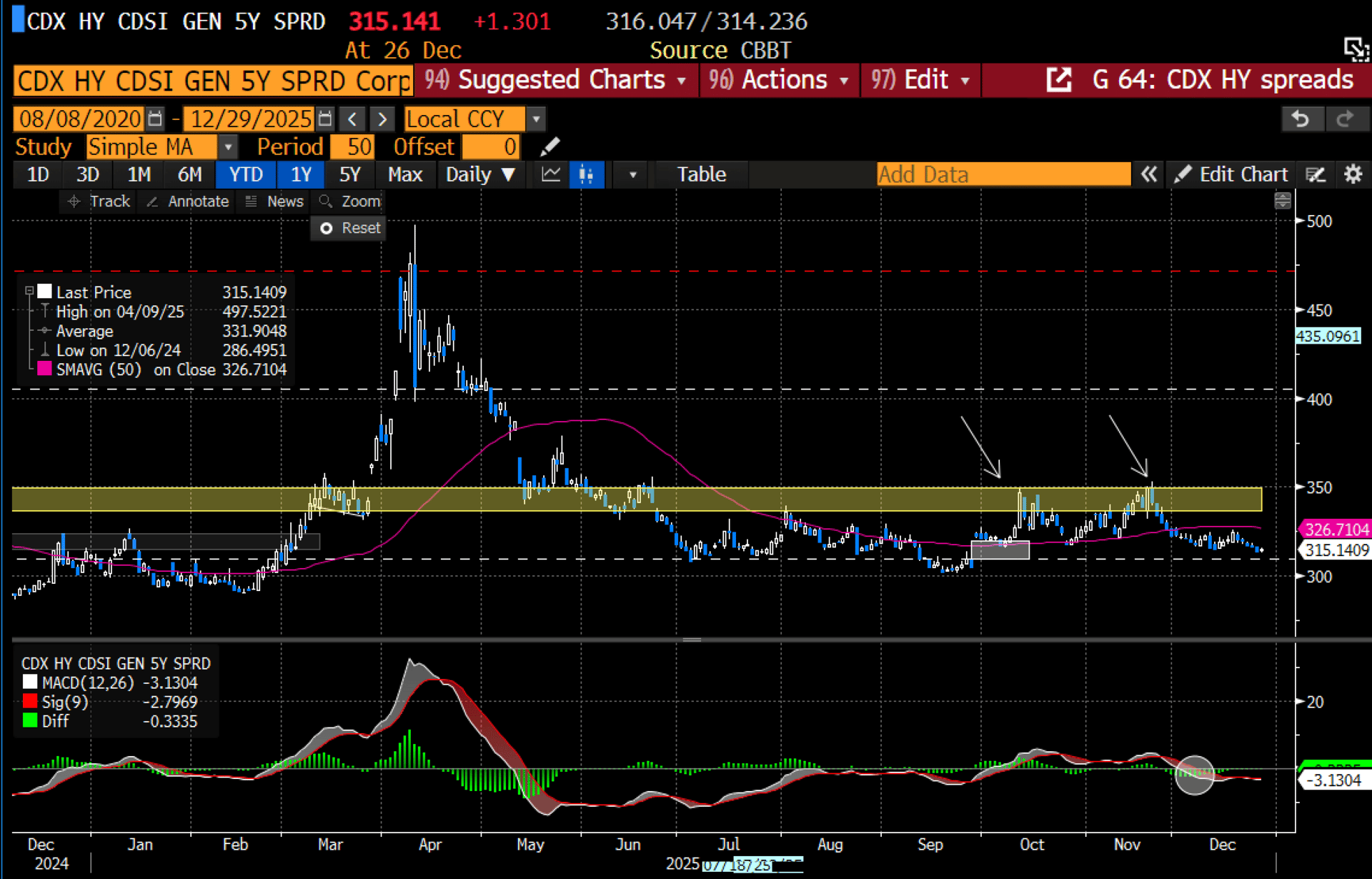

High-yield CDX continues to trend lower and remains a non-factor in constraining further near-term equity market progress.

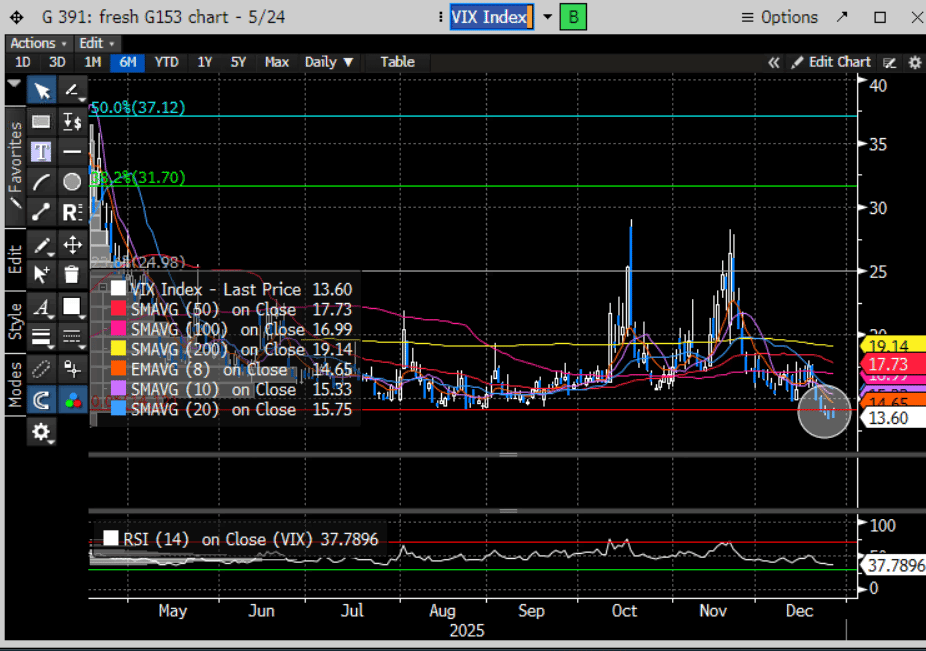

The VIX broke key support last week and is not signaling elevated concern.

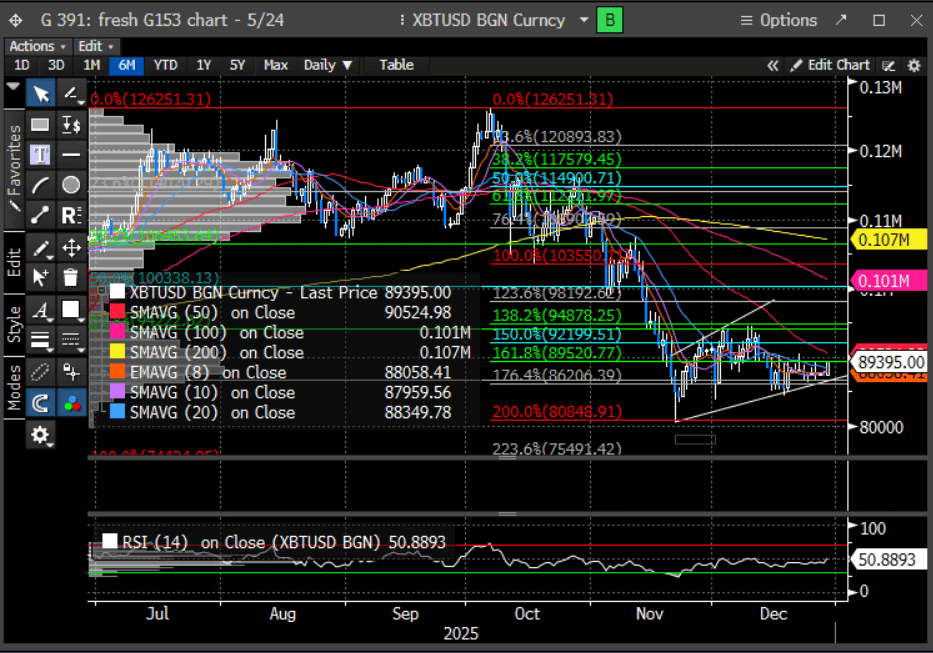

We have also been tracking Bitcoin as a potential canary in the coal mine. Despite breaking its recent bear-flag structure, the lack of follow-through is notable. Given our view of Bitcoin as a risk and liquidity proxy, how this resolves remains important, and we will be watching closely for additional clues.

We will leave it at that. There is not yet enough new information to justify a more definitive directional call. How the year closes—and, just as importantly, how the new year begins—should provide greater clarity. Our stance favoring higher prices has been detailed in prior reports, and at this point, we see no compelling reason to deviate from that view.

We have also discussed the Santa Claus rally phenomenon, which historically extends through January 2nd. This is typically a constructive period for equities—but equally informative is what happens when that seasonal tailwind fails to materialize. Research from Carson Research highlights that when Santa does not show up, forward returns tend to be notably more volatile and choppy.

As always, we will let the evidence guide us.

That’s it for us. We hope you enjoy the remainder of the holiday season.

Given the holiday-shortened week, we will forgo our usual mid-week report and resume normal coverage as conditions warrant.

CSC Team

Coiled Spring Capital LLC, Founder

http://www.coiledspringcapital.com

Terms of Subscription and Service of Coiled Spring Capital, LLC.

All subscribers (“You”) to Coiled Spring Capital, LLC (CSC) services hereby agree to the following terms of use of the services provided by CSC.

You acknowledge that CSC and all individuals or affiliates associated with CSC are not licensed nor serving as an investment advisor or broker dealer with respect to you. CSC does not recommend or suggest which securities You should buy or sell for yourself. You agree that CSC shall have no liability whatsoever for investment or other decisions based upon any content provided in the service or any contrarian view of any content. All investment decisions are solely made by You.

None of the information contained from time to time while You are a subscriber constitutes a recommendation of a particular security, portfolio, transaction or investment strategy is suitable for any specific person. You specifically agree by subscribing to this service that under no circumstances shall CSC be liable for any loss or damage of any kind whatsoever by your reliance upon information obtained from CSC’s website. You acknowledge the fact that stock trading involves risk and is not suitable for all investors, including You.

All opinions are based upon information considered reliable but

You acknowledge that CSC does not warrant the completeness or accuracy of such information. While efforts are made to ensure the accuracy of such information, CSC is under no obligation to update or correct any such information. All information is subject to change without notice.

CSC engages solely in general trading information and education and is not based upon any specific investment objectives of a particular subscriber. You should not rely solely on the information provided by CSC. Instead you should use the information as a starting point for doing additional independent research in order to form your own opinion regarding investments. You should always check with your licensed financial advisor, tax advisor or other professional in order to determine the suitability of any investment.

You must not assume that the information provided by CSC will be profitable or that the information will not result in losses. Past results of information provided by CSC are not indicative of future returns. Individual trading results will vary.

DISCLAIMERS AND MANDATORY ARBITRATION OF DISPUTES

CSC MAKES NO REPRESENTATIONS OR WARRANTIES WITH RESPECT TO THE INFORMATION PROVIDED. ALL INFORMATION PROVIDED IS ON AN “AS IS”, “AS AVAILABLE” BASIS, WITHOUT REPRESENTATIONS OR WARRANTIES OF ANY KIND WHATSOEVER TO THE FULLEST EXTENT PERMITTED BY LAW. CSC DISCLAIMS ANY AND ALL REPRESENTATIONS AND WARRANTIES, WHETHER EXPRESS, IMPLIED, ARISING BY STATUTE, CUSTOM, COURSE OF DEALING, COURSE OF PERFORMANCE OR IN ANY OTHER WAY. CSC DISCLAIM ALL REPRESENTATIONS AND WARRANTIES OF TITLE, NON-INFRINGEMENT, MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE OF THE INFORMATION PROVIDED OR THAT THE CONTENT OF THE INFORMATION PROVIDED IS ACCURATE, COMPLETE OR CURRENT. CSC DOES NOT REPRESENT OR WARRANT THAT THE INFORMATION AND ANY TRANSMISSIONS SENT FROM CSC IS FREE OF ANY HARMFUL COMPONENTS, INCLUDING BUT NOT LIMITED TO COMPUTER SOFTWARE VIRUSES. YOU HEREBY AGREE TO THE HEREINABOVE MENTIONED DISCLAIMERS.

TO THE FULLEST EXTENT PERMITTED BY LAW, CSC ON ITS OWN BEHALF AND ON BEHALF OF ITS OWNERS, DIRECTORS, OFFICERS, EMPLOYEES, AGENTS, SUPPLIERS AND AFFILIATES EXCLUDE AND DISCLAIM LIABILITY FOR ANY LOSSES AND EXPENSES OF ANY NATURE WHATSOEVER, INCLUDING BUT NOT LIMITED TO DIRECT, INDIRECT, GENERAL, SPECIAL, PUNITIVE, INCIDENTAL OR CONSEQUENTIAL DAMAGES, LOSS OF USE, INCOME OR PROFIT, LOSS OF OR DAMAGE TO PROPERTY, CLAIMS OF THIRD PARTIES FOR INDEMNICATION OR SUBROGATION OR OTHERWISE WHETHER LIABILITY IS BASED UPON CONTRACT, TORT OR STRICT LIABILIY OR ANY OTHER BASIS. YOU AGREE TO THESE DISCLAIMERS BY USE OF THE WEBSITE SUBSCRIPTION.

APPLICABLE LAW IN SOME STATES MAY NOT ALLOW THE LIMITATION OF CERTAIN WARRANTIES, SO ALL OR PART OF THIS DISCLAIMER OF WARRANTIES MAY NOT APPLY TO YOU.

MANDATORY ARBITRATION AND WAIVER OF JURY TRIAL.

YOU AGREE THAT ANY AND ALL DISPUTES BETWEEN YOU AND CSC SHALL BE SUBJECT TO BINDING ARBITRATION PURSUANT TO THE FEDERAL ARBITRATION ACT OR COMPARABLE STATE ARBITRATION IF THE FEDERAL ACT IS FOR ANY REASON DETERMINED NOT TO BE AVAILABLE. IF NO STATE HAS SUCH ARBITRATION AVAILABLE THEN THE PARTIES HEREBY AGREE TO USE THE AMERICAN ARBITRATION ASSOCIATION SERVICES. THE VENUE FOR ANY SUCH ARBITRATION SHALL BE IN THE STATE OF TEXAS AND THE CITY OF AUSTIN.

YOU AGREE TO WAIVE YOUR RIGHT TO A COURT OR JURY TRIAL AND TO PARTICIPATE IN ANY CLASS ACTION.