Table of Contents

Introduction

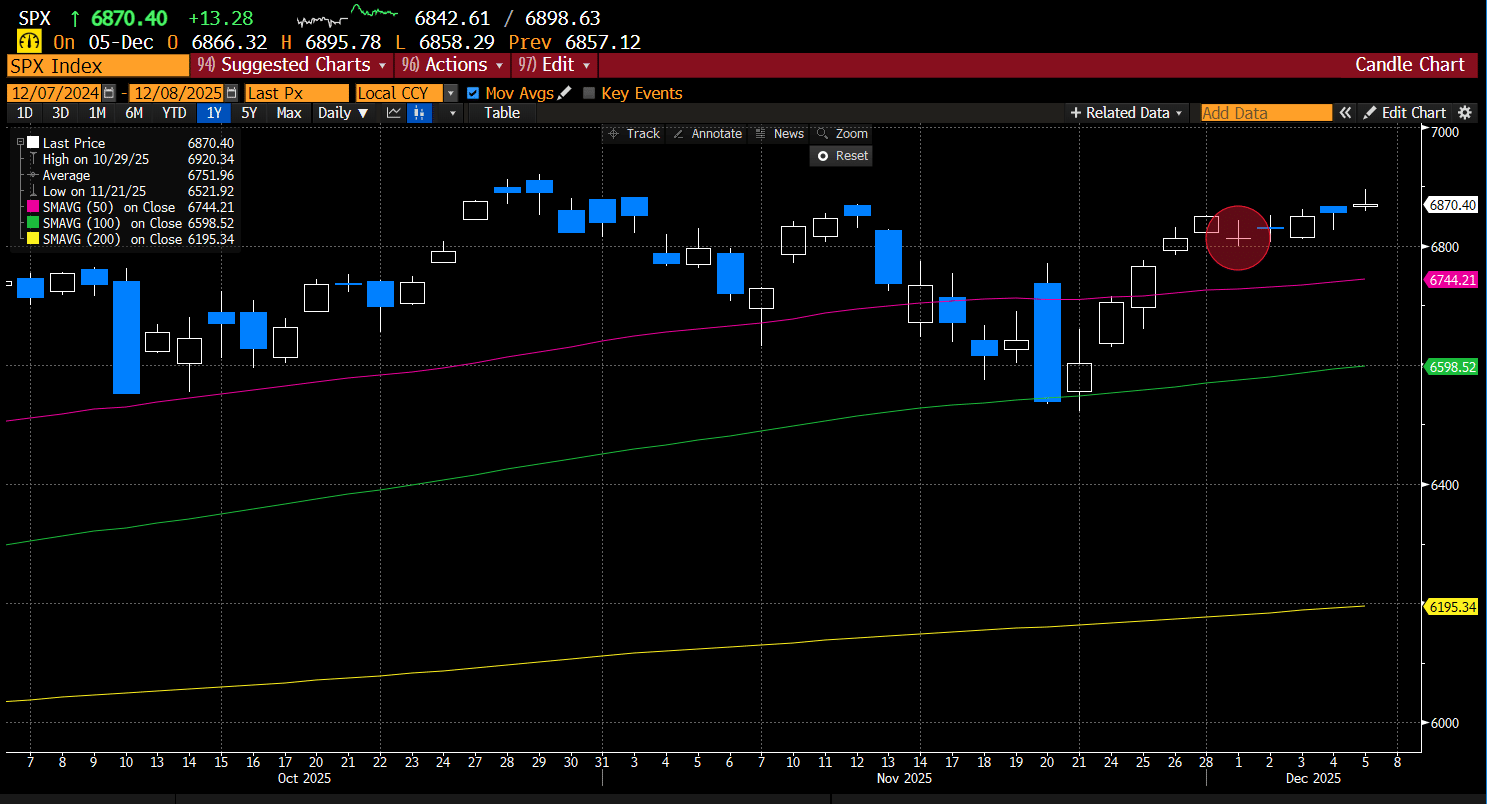

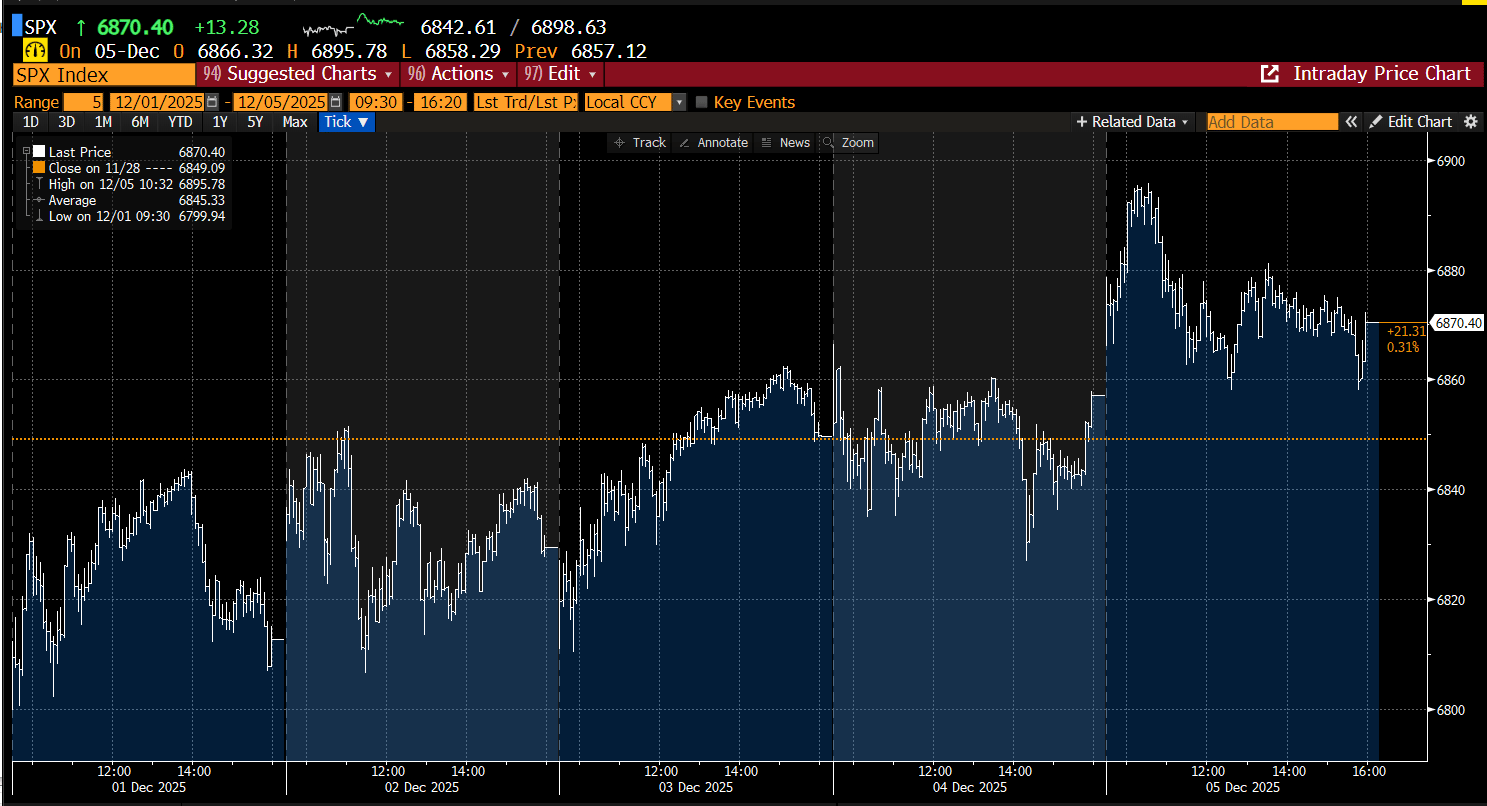

Are we walking into a classic “sell the news” setup ahead of the most anticipated event of Q4—the FOMC? It sure feels that way. The S&P has rallied in 9 of the last 10 sessions, sentiment is stretched, and price is pressing into an event that has the power to reset expectations rather than confirm them.

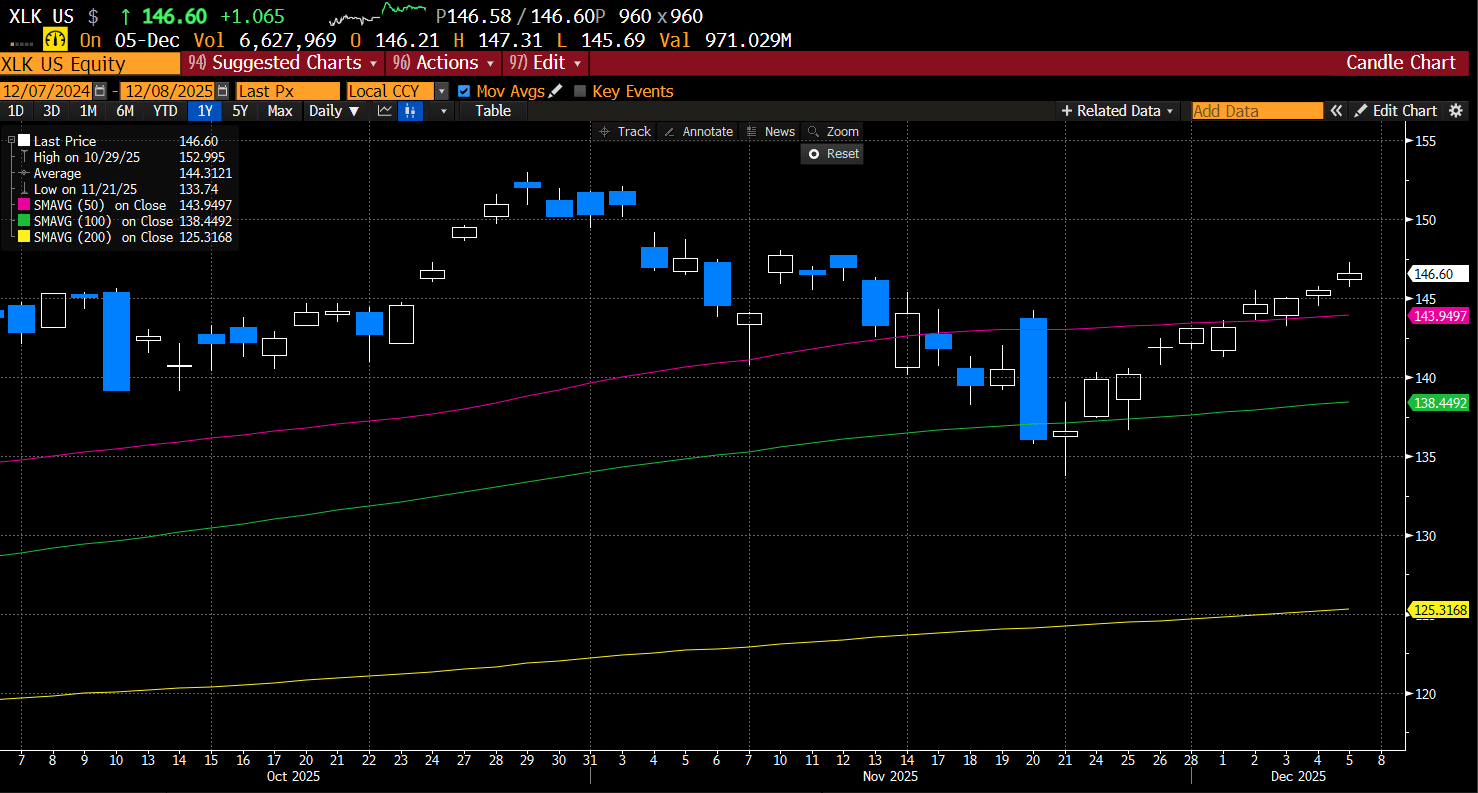

Technology stocks are driving the bus, and the accelerator is pinned. XLK has finished higher in 10 consecutive sessions, an unsustainable streak that raises the odds of a pause—or something sharper—once the FOMC hits the tape.

Surprisingly, technology isn’t the top dog here. Communication Services is out front, with Consumer Discretionary right behind it—a leadership profile that screams risk-on behavior rather than defensive positioning.

This matters because the sectors currently leading are emblematic of true bull-market behavior. When gauging the durability of an advance, leadership composition is everything—and right now, it’s the right mix. The final confirmation piece is always Financials. Bull markets don’t get very far without support from the banks; if they’re lagging, the rally is a house of cards. That’s not the case today. Since 11/21, Financials have quietly posted an impressive fourth-place performance, up nearly 4% over the last 10 sessions. Even better, the sector just reclaimed our pivot resistance last week and now looks positioned for higher prices.

All of this is happening beneath the surface, yet the bears are screaming from the rooftops that the bull market is on borrowed time. History disagrees. Outside of an exogenous shock, bull markets don’t die because someone declares them over—they end when the Fed shuts off the liquidity spigot. And that’s not the setup we have today. Fed Funds Futures are pricing in a near-100% probability of a rate cut this week, a stance that is the opposite of restrictive. Liquidity is not being withdrawn; it’s being telegraphed as increasingly accommodative.

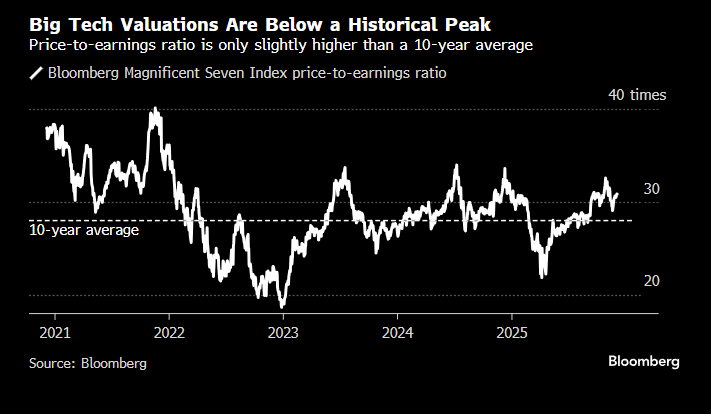

The popular narrative is that the Fed is inflating an unsustainable bubble destined to end in spectacular fashion. That may ultimately prove true—but the operative question is timing. Are we actually there yet? The evidence says no. Valuations in mega-cap tech are elevated, but hardly irrational when measured against the scale of their earnings beats and cash-flow generation. Expensive stocks without earnings are bubbles; dominant platforms posting record profits are simply repricing higher.

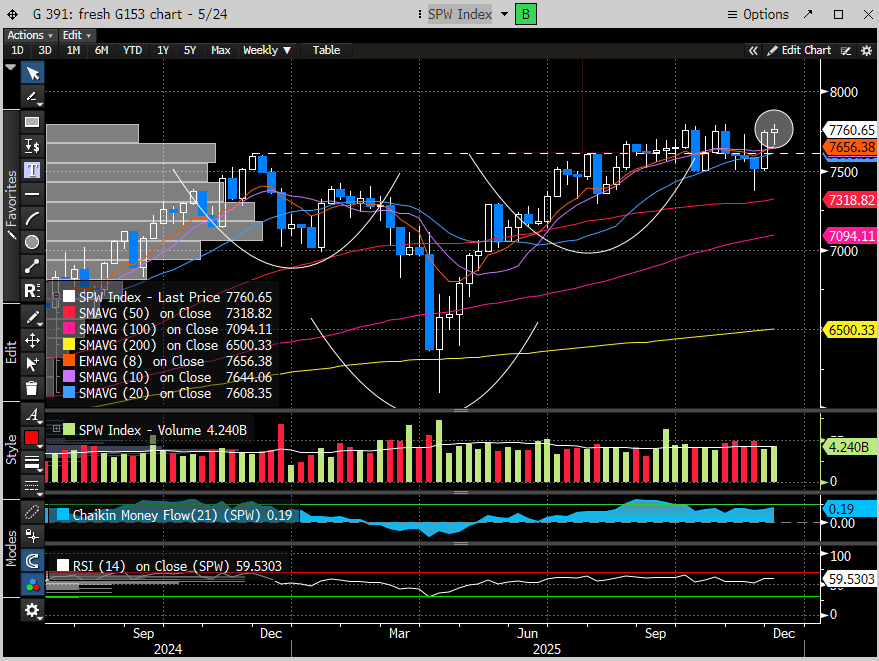

But this bull isn’t just a mega-cap story. The equal-weight S&P 500—where every stock carries the same influence—closed at its highest level in history on Friday. That breakout isn’t noise; it's confirmation. The index has now completed and validated the inverse head-and-shoulders continuation pattern we’ve been tracking, signaling broad participation beneath the surface. Bull markets built solely on a handful of names are fragile. This one isn’t.

Small caps live higher on the risk spectrum and feel interest-rate policy more acutely than any other equity cohort. They’re the canary in the liquidity coal mine. If financing conditions are hostile, small caps get crushed. Yet on Friday, the Russell 2000 (RTY)—our preferred small-cap proxy—closed at its highest level in history. That’s not risk aversion; that’s investors embracing exposure at the precise point in the cycle when they should be retreating if the bear narrative had any credibility.

What makes this breakout even more compelling is the context: it’s happening after years of relative underperformance. Small caps have been left for dead while mega-cap tech monopolized flows, creating one of the widest performance gaps in modern market history. The setup for mean reversion is massive. This implies a scenario where most stocks can surge simply by closing that gap—even if the major indexes themselves grind sideways. In other words, the bull market still has plenty of fuel, and the participation phase may just be getting started.

What makes the small-cap setup even more intriguing is the backdrop. Consensus forecasts are calling for nearly 50% EPS growth next year for the Russell 2000—an extraordinary inflection following two consecutive years of negative earnings growth in 2023 and 2024. That’s not a marginal improvement; it’s a regime shift. Layer on top the new fiscal initiatives being rolled out, and you have a structural catalyst that disproportionately benefits smaller companies. The fundamentals are finally aligning with the technicals—never a coincidence at major turning points.

In our last two reports, we laid out a clear framework: stay bullish, but get paid by being opportunistic on weakness. We wrote in our 11/30 report:

“Consolidation or a modest pullback into the FOMC would be normal, not a reason to abandon the broader move. In fact, we intend to be opportunistic during that phase, looking to add ideas that fit our framework rather than chasing extended price.”

So far, that playbook has delivered. Instead of unraveling, the market has executed a textbook grind higher, carving out a steady sequence of higher lows and higher highs. Dip buying hasn’t just worked—it’s been the defining characteristic of the advance.

None of this is bulletproof. The entire setup can unravel in an instant if Powell opts to play the Grinch and steal Christmas from the bulls. Seasonality is squarely on the side of higher prices—the final two weeks of December are historically the strongest period of the year for equities. Since 1950, those weeks have delivered an average 1.4% gain, according to Mark Hackett, Chief Market Strategist at Nationwide. The stage is set for an end-of-year melt-up.

The question now is whether the market has already priced in that optimism—leaving little room for upside if Powell disappoints on Wednesday. Enthusiasm without fresh fuel can flip to exhaustion quickly.

Let’s turn to the charts and see what the market is actually telling us.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade