Amazon Prime members: See what you could get, no strings attached

If you spend a good amount on Amazon, this card could easily be worth $100s in cash back every year. And — even better — you could get approved extremely fast. If approved, you’ll receive an insanely valuable welcome bonus deposited straight into your Amazon account, ready to use immediately.

You also don’t have to jump through any hoops to get this bonus. No extra work or special spending requirements. Get approved, and it’s yours.

This might be one of the most powerful cash back cards available, especially considering how much most people spend on Amazon each month. It gives you the chance to earn cash back on the purchases you’re already making, turning your routine shopping into something that actually pays you back.

If you shop at Amazon or Whole Foods, this card could help you earn meaningful cash back on every purchase you make. But this offer won’t last forever — and if you’re an Amazon Prime member, this card is as close to a no-brainer as it gets.

Amazon Prime members: See what you could get, no strings attached

Table of Contents

Introduction

Every week when we sit down to write this report, we’re reminded there is no shortage of crosscurrents to navigate. Since Trump took the helm, U.S. markets have become a near-constant series of powder-keg moments — events that feel capable of dethroning the persistent bid underneath equities at any time.

From geopolitical shocks to domestic dysfunction, the curveballs are coming faster than a Roger Clemens fastball. It has created one of the most difficult investing environments in years — for professionals and novices alike. We don’t claim to have all the answers, nor do we pretend to know how this apparent reshuffling of the global order ultimately ends.

What we do know is this: price is truth.

Why? Because price reflects the collective positioning, risk tolerance, and decision-making of the largest and most informed pools of capital in the world. That doesn’t make price easy to interpret — in fact, it’s extraordinarily difficult. But consistently reading those signals correctly is why we’ve remained on the right side of the market and, more importantly, helped our clients stay protected when risks were building beneath the surface.

A case in point: last week we warned that gold was likely approaching a major correction — possibly even a top. While we didn’t know the precise catalyst that would spark Friday’s sharp reversal in precious metals, we did know the risk was elevated and the setup was stretched.

In our January 25th report, The Pot is Boiling, we wrote:

“Gold (XAU) continues to levitate, and amid growing macro uncertainty and crosscurrents, that strength may persist… That said, the move is becoming increasingly extended, raising the risk of a sharp, and potentially violent, mean reversion.”

That wasn’t just commentary — it was a clear signal to reduce exposure and lock in gains while complacency was still high.

We wrote:

Gold was bludgeoned on Friday, plunging almost 16% from the highs in only two days — a sharp reminder of how quickly crowded trades can unwind.

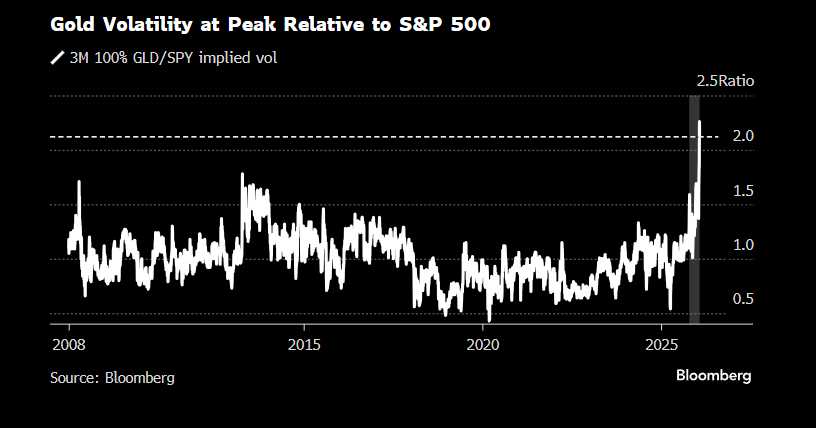

Volatile much? Gold’s volatility relative to the S&P 500 is now the highest on record, according to data compiled by Bloomberg.

While gold gets most of the attention, it was silver that delivered the real shock. Spot silver plunged nearly 40% from its highs intraday on Friday.

Turnover in the iShares Silver Trust (SLV) exploded to the highest level on record, with a staggering $41 billion traded on Friday.

While headlines pointed to reports that Trump planned to nominate Kevin Warsh to lead the Federal Reserve, which sparked a surge in the dollar, the specific trigger is largely irrelevant to us.

The precious metals complex was already primed for a break.

Speculative capital had driven prices into a parabolic advance — the kind fueled more by momentum and crowding than sustainable positioning. Moves like that don’t unwind gently. They almost always end the same way: with sharp, air-pocket declines once the marginal buyer disappears.

The news didn’t cause the fragility. It simply exposed it.

When a highly leveraged asset class breaks, the damage spreads — not because fundamentals everywhere suddenly deteriorate — but because balance sheets are forced to contract.

Price decline → Margin calls → Forced selling → More price decline

That feedback loop is how isolated stress turns into broader market instability.

We’ll learn more in the coming days about the full aftermath of last week’s move, but it would not surprise us to hear about entity-level insolvencies or funds facing significant distress. These events tend to surface with a lag.

For weeks, we have been telling clients that our concern level was rising. That doesn’t automatically mean a crash is imminent — but it does mean capital should be deployed more selectively and risk managed more tightly.

In fact, we wrote the following in our January 25th conclusion:

“This is the type of environment where conviction must be paired with flexibility. We are seeing more evidence of rotation, distribution, and fatigue — not outright collapse. That favors a tactical approach: trimming into strength, buying defined pullbacks, and avoiding emotional decisions driven by headlines.”

That approach proved valuable. Selling winners into strength allowed us to capture the bulk of the move in small caps before momentum unraveled. We advocated getting long into January strength, then reducing exposure near the recent peak. That trade produced roughly a 10% advance into the highs, before retracing about half that gain after we advised taking profits.

We won’t rehash the full rationale here — recent reports lay that out in detail — but the takeaway is simple:

Tactical precision matters most when conditions become unstable.

And right now, conditions are becoming increasingly unstable.

There are real cracks forming beneath the surface of this market — themes we’ve been discussing in detail for several weeks. This is unfolding as we enter one of the seasonally more difficult stretches of the year, within the window of weakness we previously outlined.

Market tops are a process, not a single event. And yes, there’s never a shortage of doomsayers calling for imminent collapse. Maybe they’ll be right. Maybe they won’t. Making dramatic predictions isn’t our job.

Our job is to keep clients aligned with the prevailing trend — and when that trend begins to show signs of stress, we shift to a more cautious, tactical posture.

If we had turned outright bearish every time the market experienced a volatility spike or sentiment scare, we would have missed much of the bull market advance since the 2022 lows — including the powerful rally off the April 2025 bottom.

That said, it’s entirely possible this cycle has already peaked. We’ve openly discussed that risk since November. But we don’t act on possibility alone — we require confirmation. And while risks are clearly building, the major indexes have not yet delivered definitive technical confirmation of a broader breakdown.

That can change quickly — which is exactly why we conduct a full, disciplined review every weekend.

Our goal is simple: participate in upside when conditions allow, and protect capital when conditions deteriorate. Avoiding major drawdowns is not luck — it’s process, discipline, and risk management.

With that framework in mind, let’s turn to the charts.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade