Table of Contents

In our 2/9 report, "Broken Record," we highlighted the market’s repetitive pattern—mid-week strength fading by Friday, followed by dip buying on Monday. This pattern held for over three weeks—until last week, when things finally changed.

The chart below encapsulates 2025’s market rhythm, where Mondays and Fridays have been the weakest-performing days.

This choppy action has led to multiple low-single-digit drawdowns, only to be quickly scooped back up. That’s precisely why we’ve advocated a tactical approach. But this past week broke the "sell Friday, sell harder Monday" cycle—a welcome shift from the "Broken Record" playbook.

Wednesday’s hot CPI print seemed poised to spark another market selloff. We were skeptical that buyers would step in at support—and we were wrong. The SPX bounced perfectly off its uptrend line (UTL) and 50-day MA, likely anticipating the softer-than-expected PPI and Retail Sales reports that followed.

The hammer reversal candle at the 50-day MA is a key signal—it suggests the market is looking past the CPI report and ahead to more favorable conditions.

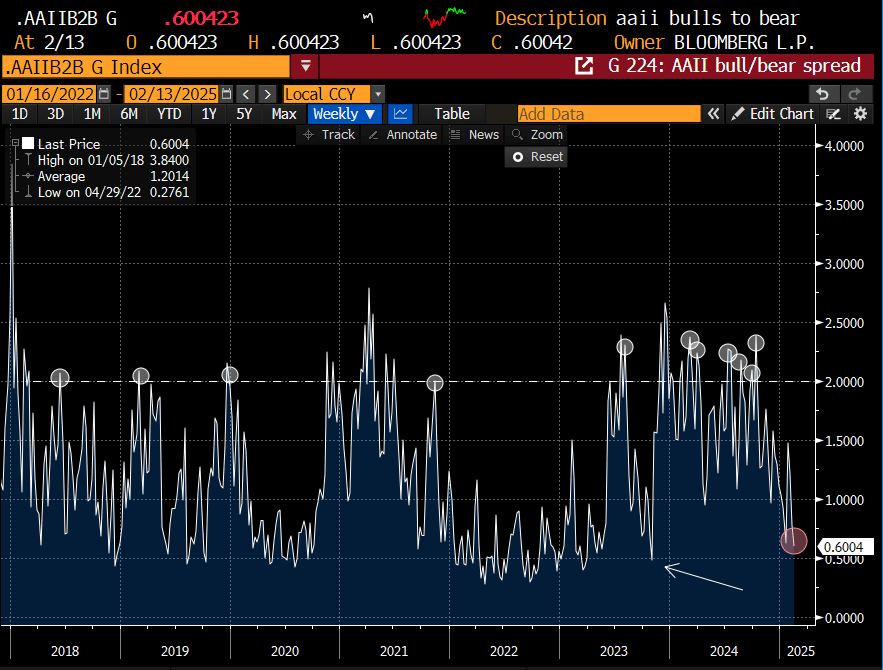

That resilience shouldn’t be surprising given how negative sentiment has become. Markets rarely top when most participants are already positioned for a decline. The latest AAII bull/bear survey hit its lowest level since November ‘23, confirming widespread caution.

So, while many may believe that the stock market is defying logic, that’s what markets do and why it’s essential to understand the variables that drive price. Sentiment is one of the more powerful variables as it offers real-time assessment of positioning.

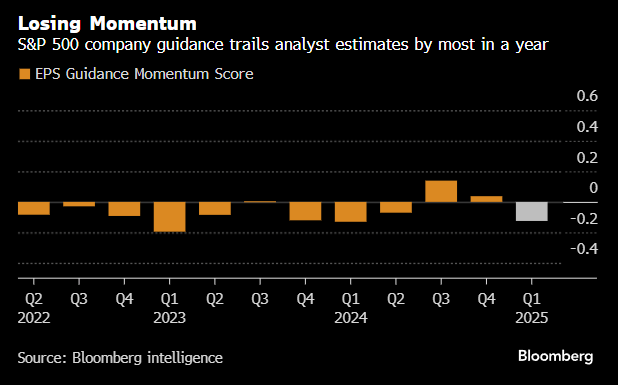

As we near the end of Q4 earnings season, results have been solid, but guidance is slipping. Most companies issuing forward estimates have trailed analysts’ expectations.

That said, corporate caution makes sense—trade wars, sticky inflation, and uncertainty around Trump’s policies are enough reasons for management to be conservative. But with the SPX just shy of a new all-time high (ATH), the market seems to be interpreting guidance as a low bar for future beats. Analysts have also kept estimates subdued, further easing the path for upside surprises.

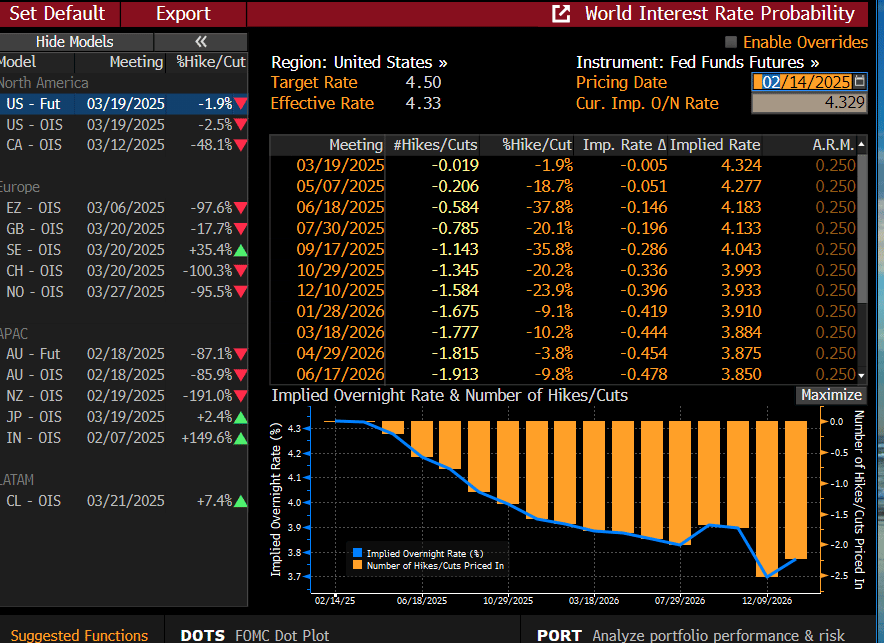

After the CPI report, Fed Fund Futures were pricing in just one rate cut by December. But after Friday’s weak retail sales data, expectations for an additional cut surged to 60%.

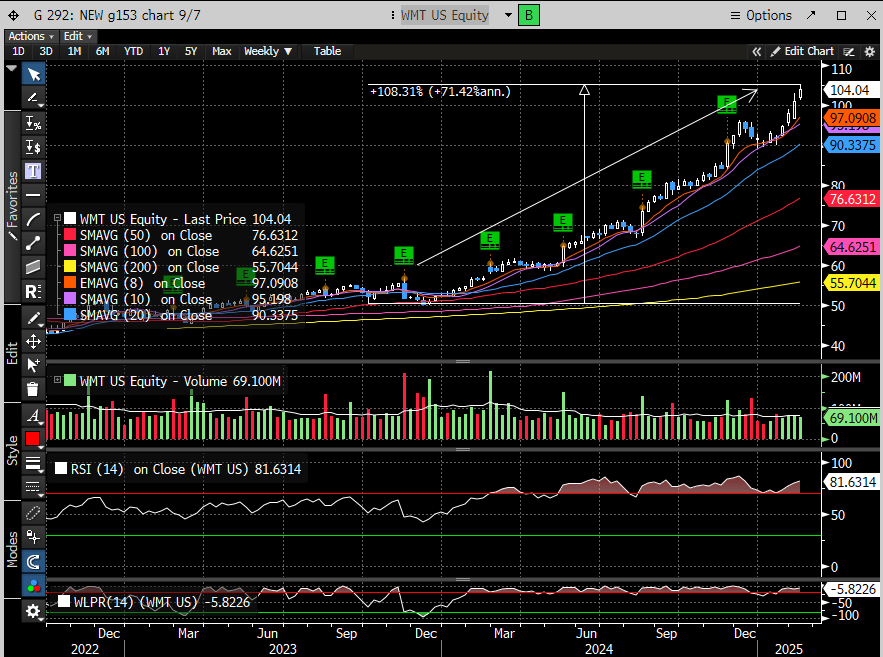

Consumers are already pulling back on spending—January retail sales saw their sharpest decline in two years. This makes this week's Walmart (WMT) earnings a must-watch event. The stock has rallied over 100% since October ‘23, pricing in a strong consumer, but any weakness in guidance could change the narrative.

Beyond WMT, Wednesday’s Fed minutes will also be crucial, providing more insight into policy direction.

Breakout or Bull Trap?

After last week’s logic-defying rally, the market appears set to break out to new ATHs. But are bulls getting ahead of their skis?

Let’s dig into the charts.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade