Diversified Crypto in One Stock – 60+ cryptocurrencies, one investment.

Gain exposure to 60+ cryptocurrencies in a single stock. DeFi Technologies (CBOE: DEFI OTC: DEFTF) offers broad access to the $3T crypto market—without the complexity of wallets or exchanges.

Introduction

Here we go again. Sunday night futures point to another gap-down open for the stock market on a Monday. Is it déjà vu all over again? Last Sunday, we braced for the DeepSeek AI release and the damage it would inflict on equities.

We navigated that event well, pinpointing the exact support zone where the indexes would rebound. That tactical approach proved highly effective, delivering an almost 2.5% gain in the SPX and nearly 4% in the Nasdaq in a short span. These are significant index moves, reinforcing our stance on tactical trading. Since the start of the year, the SPX has seen sharp drops of 4% and nearly 3%, only to swiftly recover—in line with our prediction in December when we warned of a volatile Q1.

Yet despite the turbulence, January closed strong, with the SPX up nearly 3% and the Dow gaining almost 5%. That’s an impressive showing, especially following two consecutive strong years for the stock market.

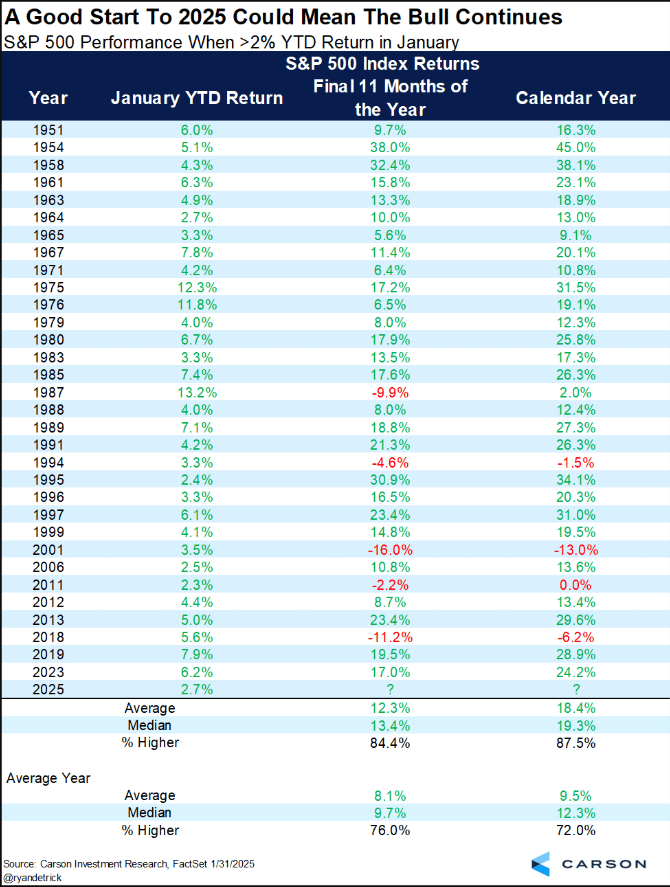

In our 1/29 report, we highlighted the statistical significance of a positive January (January Barometer). Not only was this January’s performance historically relevant, but it was also the best January since 2001. And what happens when January posts a >2% gain? According to Carson Research, the market has an 84% positivity rate for the rest of the year, with a low double-digit average return. This is a key factor to remember every time the market panics over a weekend headline.

That said, near-term downside remains a possibility, and this weekend’s tariff headlines could spark extended corrective action. Ironically, before Trump’s late-day Friday announcement sending algo-driven sell programs into overdrive, the SPX had nearly made a new all-time high, coming within 8 points. Trump effectively bailed out the bearish camp, whose calls for AI spending excesses unraveling the market had been somewhat debunked last week as hyperscalers doubled down on their AI infrastructure commitments.

Now, the bears are pivoting to a new narrative: a trade war-induced economic slowdown that could destabilize the disinflationary trend of the past year. The risks are real, and markets loathe uncertainty, but let’s not forget—tariffs were already expected. The real unknown was how the targeted countries would respond.

We won’t speculate on the long-term economic consequences of a tariff war, but duration is the key risk. Trump’s tariffs are a negotiation tactic, and while his demands may not be insurmountable, an aggressive initial response from trading partners is inevitable—no leader wants to appear weak or bullied into submission.

What Does This Mean for the Stock Market? Uncertainty breeds volatility. Expect initial market dislocation. However, being overly draconian about tariffs may be premature. Trump has a habit of walking back harsh policies with vague reassurances anytime markets react negatively. During his last presidency, "Trade talks are going well" tweets became a near-daily occurrence, prompting algorithmic buying.

There’s no way to predict Trump’s next market-moving comment, but we must stay prepared for abrupt trend reversals. As we emphasized in December, Q1 would be choppy and volatile—and here we are.

Welcome to Trump 2.0.

Déjà vu indeed.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade