Table of Contents

Introduction

This past week, volatility stormed back into the stock market, hitting growth stocks with relentless force. In our 2/19 report, Are Monsters Hiding Under the Bed?, we flagged early warning signs, as the unwinding of key growth stocks was sending clear distress signals.

Here’s what we wrote:

Where There’s Smoke, There’s Fire. We pointed to several stocks that hinted at an undercurrent of risk-off positioning beneath the surface. When unnatural and excessive moves emerge, they can quickly spread—turning isolated tremors into a broader market shakeout.

By Friday, the SPX logged its worst day in months. The index’s decline understated the real damage beneath the surface, where growth stocks were hit with unrelenting sell pressure.

$ARKK—a key proxy for unprofitable growth—plunged nearly 6% on the day and is now down 12% from Monday’s high. Its 2.5-year breakout on the weekly chart was swiftly rejected, forming a bearish engulfing candle—a stark reversal that signals further downside risk.

$FFTY, the IBD growth ETF, plunged over 7% on Friday, capping off a brutal peak-to-trough decline of nearly 14% for the week. These are significant moves for a diversified ETF and underscore the sharp reversal growth stocks faced in what was expected to be a relatively quiet, event-light week.

So, what’s behind the sudden shift? It’s tough to pinpoint a single catalyst.

Last week, we flagged $WMT earnings as a key barometer for consumer health. The retail giant missed expectations, stoking fears that consumers are finally buckling under the weight of inflation. Those concerns were reinforced on Friday by weak Consumer Sentiment surveys, painting a bleak picture of spending resilience.

Adding to the uncertainty, Trump’s aggressive deportation and tariff rhetoric—along with Elon Musk’s DOGE initiatives—are starting to rattle confidence in the administration. The perception that policy changes are unfolding too rapidly has raised concerns about their potential drag on economic growth in the second half of the year.

And just to stir the pot further, rumors surfaced out of China about a new coronavirus strain found in bats, injecting a fresh dose of anxiety into an already fragile market.

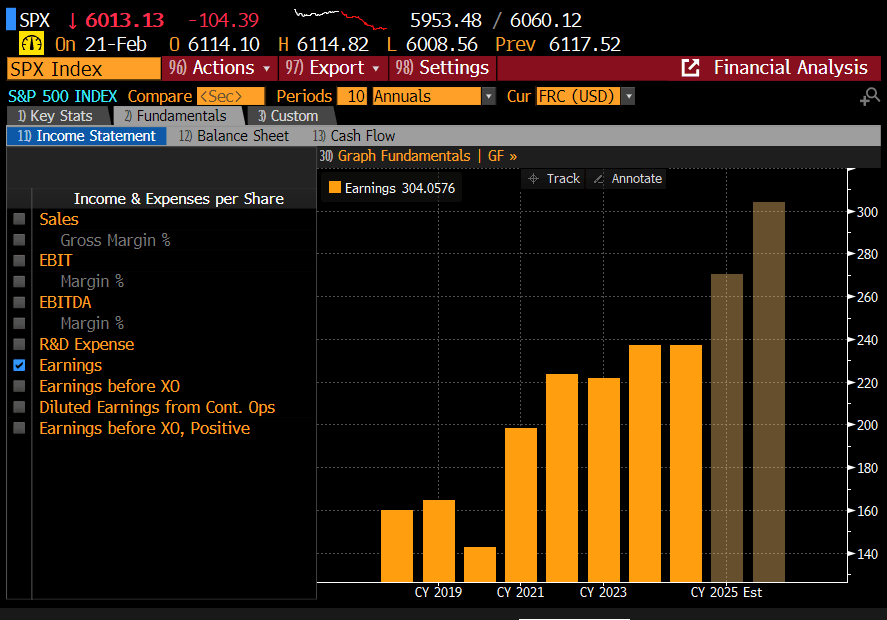

We’ve repeatedly highlighted that market valuations remain historically stretched and that analysts are banking on strong earnings growth through 2026. Given the mounting headwinds, it’s fair to question whether that optimism is beginning to crack.

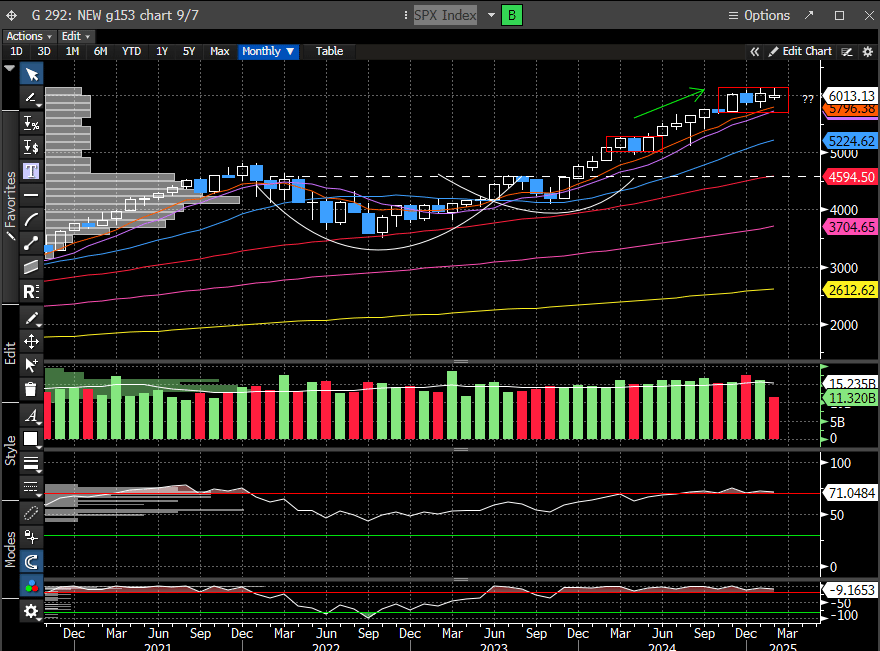

The SPX has been treading water since late November, stuck in a tight 4% range—the narrowest since 2017. The monthly chart, which we've highlighted in recent weeks, continues to reinforce this consolidation phase.

Key takeaway? There’s nothing bearish about this setup as long as the range holds. That said, we can't rule out a retest of the lower boundary, which still sits 5% below current levels.

According to Ned Davis Research, similar SPX consolidations have led to breakouts.

Short interest in the median SPX stock has climbed to its highest level since 2020, now sitting at 2% of market cap, per Bloomberg data. This, combined with fairly bearish sentiment despite being just a few percentage points from an ATH, suggests that the market remains in chop mode rather than setting up for a major drawdown.

The chart from MacroCharts.com reinforces this uncertainty, particularly among newsletter writers—a historically reliable sentiment gauge. The media, as usual, is late to the party, amplifying fear, which more often than not coincides with market bottoms rather than tops.

Coming into the year, we were adamant that Q1 would be difficult and choppy—so far, that’s proving to be an understatement.

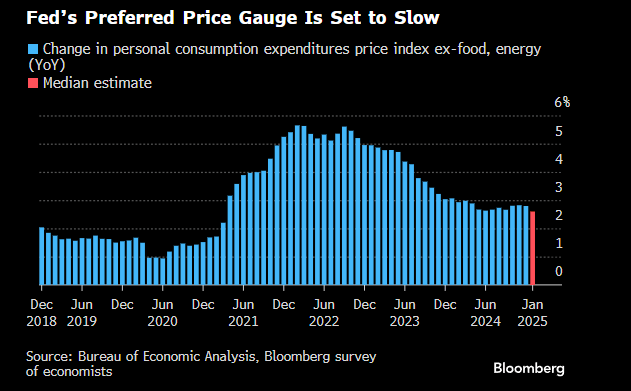

This week, the focus shifts to PCE, the Fed’s preferred inflation gauge. Expectations are for it to cool, and if that holds true, it could establish a short-term floor and spark a tradeable low in the market.

There’s plenty to be concerned about, and the market is finally reflecting that uncertainty.

The key question: How much more downside is ahead?

Let’s dig into the charts.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade