Here’s why workplace life insurance might not be enough

Unexpected events shouldn't leave your loved ones financially exposed. And while employer coverage is a nice perk, it usually only offers 2x your salary – far below the recommended 10-15x for real security (especially with dependents). Term life insurance can bridge the gap with customizable, affordable plans. Money’s Best Life Insurance list can help you find coverage starting at just $7/month, providing the peace of mind your family deserves.

“Look Kids, there’s Big Ben,” was a quote from a classic moment in the comedy National Lampoon's European Vacation (1985), where the Griswold family, led by Clark Griswold (Chevy Chase), gets hilariously stuck in London traffic. In the scene, Clark is driving a rental car—through the busy streets of London, trying to navigate the unfamiliar roads and roundabouts. The family ends up circling a roundabout near Big Ben and the Houses of Parliament repeatedly, unable to break free from the loop.

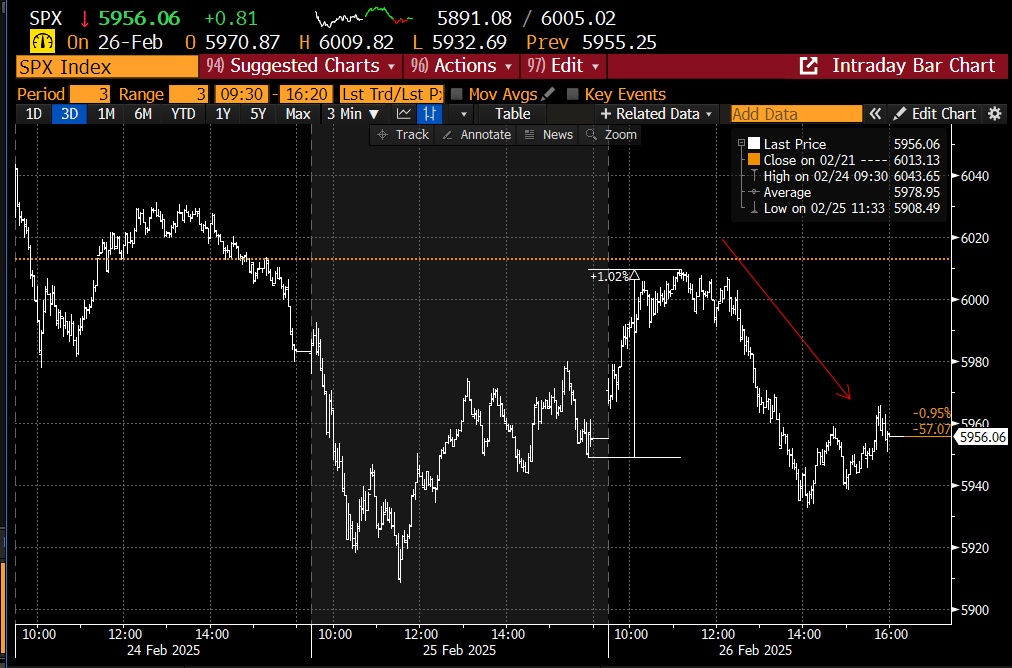

Navigating the stock market lately feels like driving in circles—plenty of motion but little progress. Markets continue to jostle between macro headlines, softening economic data, and conflicting earnings reports, yet the net result has been minimal. Since the election, the SPX has been locked in a tight 5% range and is up just over 1% year-to-date.

Back in December, we cautioned that Q1 would be challenging, as the first quarter of a presidential cycle tends to be turbulent. Newly elected leaders push to fulfill campaign promises, creating policy uncertainty. Historically, Q1 is the weakest of a president’s first year, with February ranking as the worst-performing month. Given that, the current market confusion shouldn’t come as a surprise.

Hopes were pinned on NVDA’s earnings to shake the market out of its malaise, but the results were more lukewarm than the explosive reports we’ve grown accustomed to. While guidance came in slightly ahead of expectations, gross margins are projected to be lighter than forecast—an issue given the heightened scrutiny over AI-related spending and its return on investment.

NVDA avoiding a major disappointment could help ease some of the recent selling pressure, particularly after the DeepSeek-driven shakeup, and may encourage a bit more risk-taking. However, will it be enough to break the SPX out of its stubborn 5% range? We’re skeptical.

In our 2/23 report, we anticipated further weakness before a potential bounce—likely ahead of the NVDA earnings report. That’s exactly how the market played out this week. Monday saw fresh lows, followed by a solid 1% gain today. But just as the market found its footing, Trump pulled another card from his deck, throwing cold water on the rally. Midday, renewed tariff rhetoric targeting Europe hit the headlines, swiftly erasing the day's gains and sending the major indexes back into the red.

So here we are—little new to discuss and even less to opine on. The market remains stuck in its choppy holding pattern, with no clear resolution in sight. However, Friday’s PCE report has the potential to inject some directional momentum and open up new opportunities.

For now, the indexes remain vulnerable, with technical damage that needs repairing. That can happen through time, price, or a combination of both.

Let’s check the charts.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade