The headlines that actually moves markets

Tired of missing the trades that actually move markets?

Every weekday, you’ll get a 5-minute Elite Trade Club newsletter covering the top stories, market-moving headlines, and the hottest stocks — delivered before the opening bell.

Whether you’re a casual trader or a serious investor, it’s everything you need to know before making your next move.

Join 200K+ traders who read our 5-minute premarket report to see which stocks are setting up for the day, what news is breaking, and where the smart money’s moving.

By joining, you’ll receive Elite Trade Club emails and select partner insights. See Privacy Policy.

Table of Contents

Introduction

From our 2/4 report:

“It’s how we close the week that matters most — not the noise in between. This week’s finish will be important.”

That distinction matters.

Trading days are filled with noise—fear, emotion, positioning games, and misdirection. When you over-weight a single session, you risk missing the broader signal entirely. That’s not to say one day can’t define a trend—it can. But as regular readers know, our work emphasizes higher-time-frame analysis for a reason: it cuts through the noise.

More data leads to better conclusions. Researchers don’t draw inferences from a single observation; they evaluate large samples, multiple variables, and competing explanations before rejecting a null hypothesis. Statisticians stress robustness, not anecdotes. Markets are no different.

Global financial markets are complex systems—constantly balancing conflicting forces in real time. The only way to interpret that struggle is by observing who ultimately gains control over time. We don’t award gold medals to the runner who wins the first heat. We reward the one who endures and finishes strongest.

So when buyers and sellers collide, the key question isn’t who dominates intraday—it’s who exhausts first. Time is the arbiter. Persistence reveals control.

That context matters, because last week’s intra-week volatility was extreme, particularly across growth and momentum stocks. According to Bloomberg, momentum experienced its worst single-day rout since the pandemic. The Nasdaq 100 was now down more than 6% from its late-January peak, with the bulk of those losses beginning early last week.

Yet beneath the surface, the message was more nuanced.

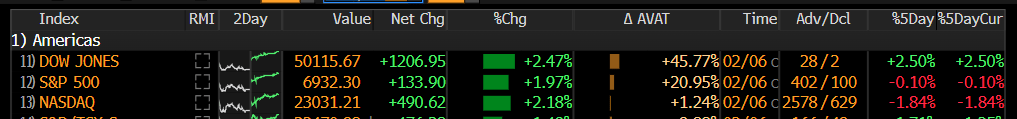

The S&P 500 finished the week roughly flat. The Dow Jones Industrial Average rose nearly 2.5%.

Yes—the rotation is real.

And more importantly, it’s telling us something about who is losing control.

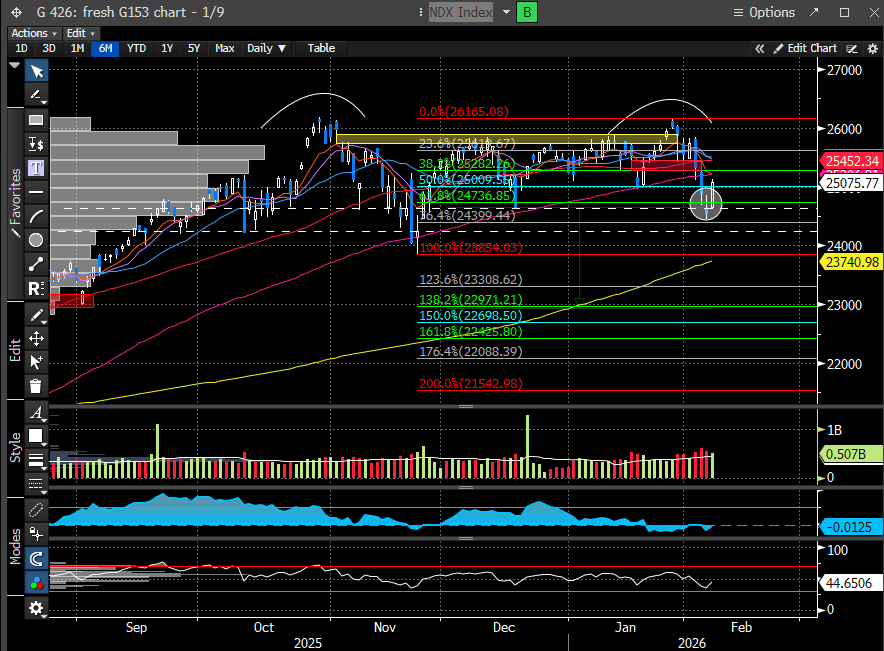

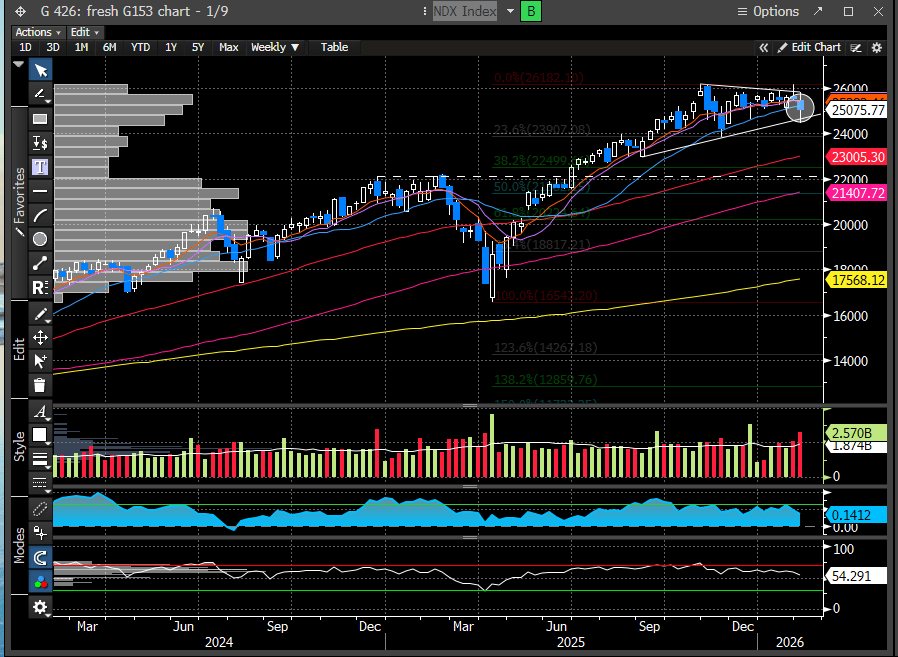

In our 2/4 report, we identified key support zones for the NDX. While those levels briefly appeared to fail intraday, the market quickly reclaimed them, closing back above support by week’s end—confirming their relevance. By Friday’s close, the NDX had regained the 61.8% Fibonacci retracement, which sits squarely above our defined pivot support zone.

More importantly, what initially appeared to be a breakdown in the weekly structure was ultimately defended, resulting in the formation of an indecision candle (Doji).

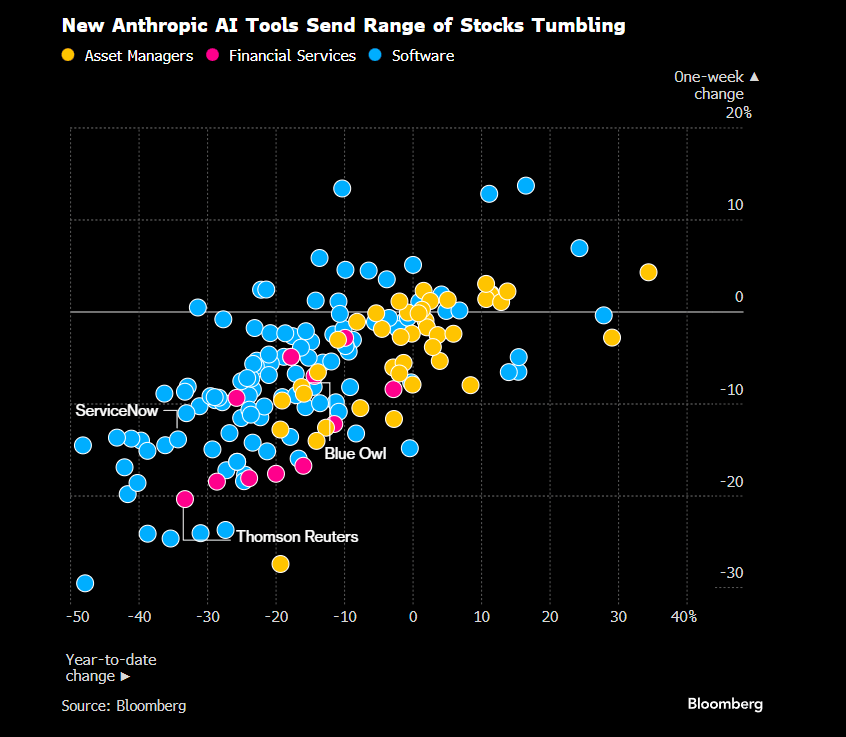

What’s driving much of the volatility in technology stocks is renewed fear around AI-driven disruption. Last week’s catalyst was Anthropic, which released new tools aimed at automating work across a wide range of industries—from legal and data services to financial research. While the developments were incremental rather than revolutionary, the announcements reignited concerns that accelerating AI adoption could materially disrupt existing business models, pressuring valuations across the space.

Software has borne the brunt of the selling, with valuations now reflecting levels not seen in decades. A basket of software stocks tracked by Goldman Sachs has fallen to a record low of roughly 21x forward earnings, down from a peak north of 100x in late 2021. Whether this reset is ultimately justified is not for us to judge, but multiple compression is likely to persist until the market gains greater clarity on the real economic impact of accelerated AI-driven innovation. For now, the mindset is simple: shoot first, ask questions later.

Meanwhile, bearish positioning continues to build.

All of this is unfolding while software earnings estimates continue to move higher.

The IGV (Software ETF) just registered its most oversold RSI reading in more than a decade (and likely longer, though Bloomberg’s daily data does not extend further back). Software is now the most aggressively net-sold sector year-to-date, according to Goldman Sachs prime brokerage data. Hedge funds’ net exposure to software has collapsed to a record low—below 3% as of February 3—down from a peak near 18% in 2023.

Something has to give. In our view, the odds increasingly favor reversion.

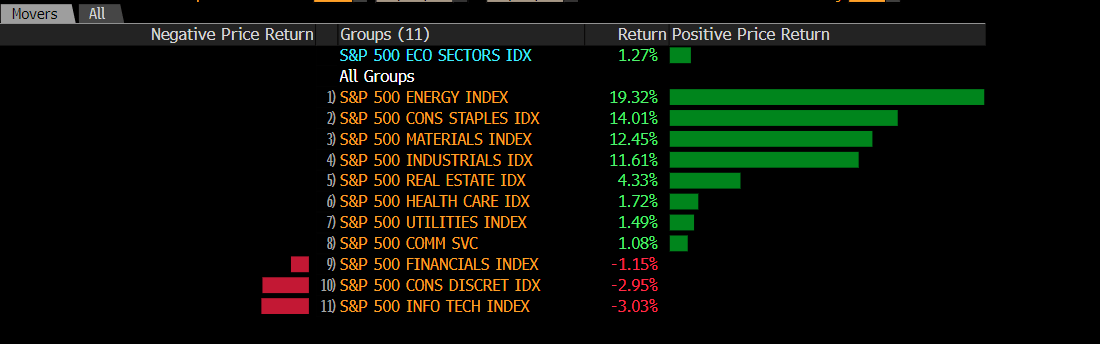

Why does this matter? Because we have consistently argued that stabilization within the technology complex is a prerequisite for the broader market to maintain its trajectory. Last week, the equal-weight S&P 500 (SPW Index) pushed to a new all-time high—clear evidence that rotation into more cyclical areas remains intact.

That rotation can continue. But if TMT continues to slide, the sheer index weight—roughly 40% of the S&P 500—will eventually bleed into the rest of the market. Gravity always wins. That’s why stabilization in technology matters.

Software is a critical component of that equation. If software can find its footing, the market has a clear path to recover from its recent drawdown. If it can’t, the broader tape will struggle to look through the noise.

The leadership board continues to favor a cyclical tilt, but after substantial outperformance, some mean reversion should be expected—particularly if technology stabilizes following the recent rout. We are not calling for a leadership reversal; rather, we see growing opportunity within selectively beaten-down technology names as conditions normalize.

With that context in mind, let’s turn to the charts.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade