Table of Contents

Introduction

The Market Feels Like a Broken Record

We may be dating ourselves with this reference, but the stock market feels like a broken record. For those unfamiliar, this expression comes from the early days of recorded music, when a scratched vinyl would cause the needle to skip back and replay the same section repeatedly.

Lately, the market has mirrored this phenomenon—a strong week wiped out by Friday’s headlines, leading to a gap down on Monday, only to be bid right back to where it started.

This is the very definition of a tactical market, and why we have consistently advocated for a tactical approach since January. We’ve taken some criticism for not committing to a singular directional view, but would you rather we fill this report with sensational Wall Street narratives to confirm biases—or continue delivering accurate, actionable insights? We choose the latter, and the results speak for themselves.

On 2/2, before Monday’s tariff-induced gap down, we wrote:

"…we think buying the dip tomorrow can work, although we caution against assuming a lasting rebound. Internal indicators do not yet signal washout conditions, suggesting that any short-term bounce should be sold. Tactical positioning remains key until we see clearer evidence of a durable bottom.”

Following this playbook has been profitable. Since the start of the year, we’ve seen multiple mini-drawdowns in the SPX (~4%, ~3%, and ~3%), all within five weeks. There’s nothing wrong with volatility if you are positioned to capitalize on it. One of the core goals of this report is to help you navigate these setups week in and week out.

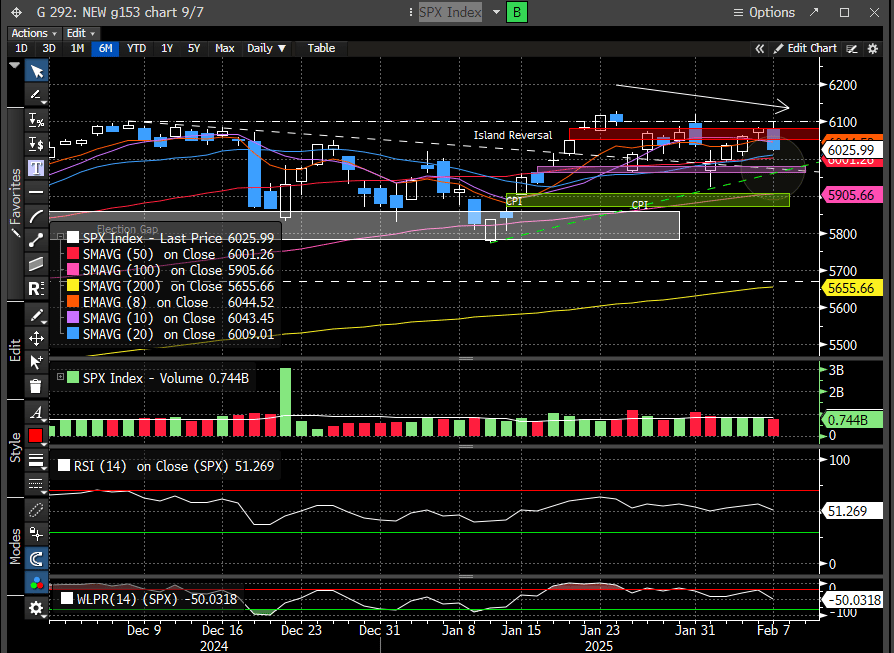

Once again, we find ourselves in the same setup as the last two weekends. The SPX chart continues to define a choppy, stair-step-down market—a textbook sign of distribution.

What does distribution mean? It implies that institutions are selling into strength and becoming more defensive.

This is inherently bearish, but until the market breaks its range, we caution against committing too strongly to a single bias.

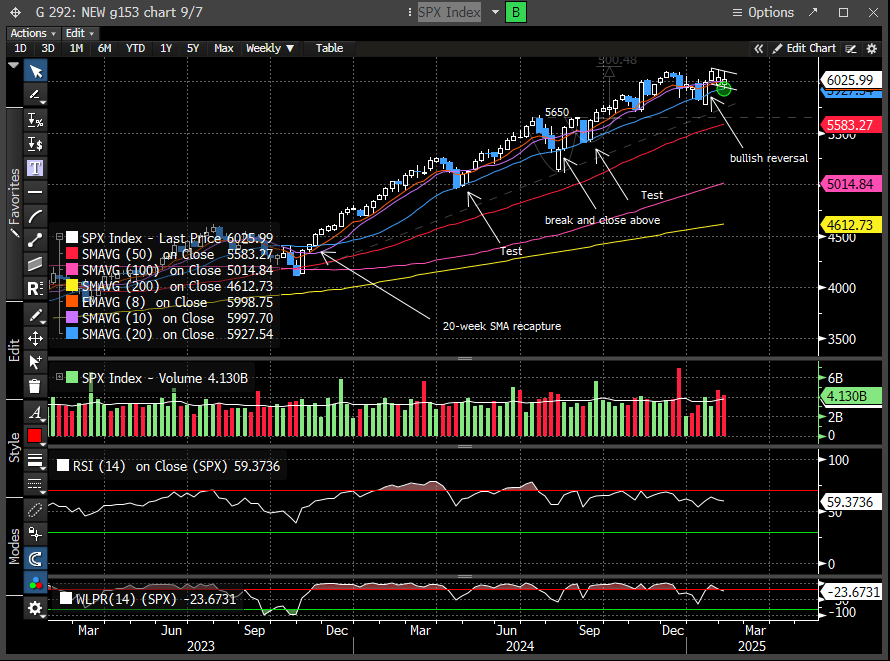

The daily SPX chart looks noisy and uncertain. The weekly SPX chart, however, remains bullish. A mid-January reversal bar led to a bull-flag consolidation at the upper end of the pattern's range. The 20-week SMA has held since November, and Friday’s lows found support there again.

The monthly SPX chart also remains constructive. If the index breaks out of this four-month consolidation, the next move could be significantly higher. Conversely, if it fails, that would be bearish—but we need more evidence before making any assumptions.

Consolidations in a bull trend are typical, much like we saw in March-May of 2024 before the trend resumed higher. As it stands today, there is nothing bearish about this structure. Could it change? Absolutely, and why we write a comprehensive weekly review to uncover under-the-surface structure changes. More on the later.

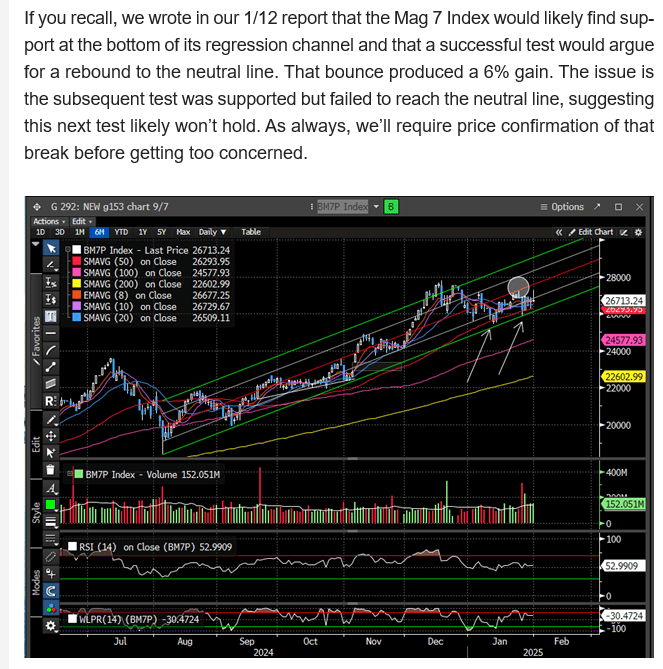

Earnings season for six of the Magnificent 7 wrapped up this week, and the results were mixed at best. Our 2/2 report warned about the deteriorating technical structure of the Mag 7 Index. Prices were indicating a group that was losing leadership.

Here is the 2/2 report excerpt:

“the subsequent test was supported but failed to reach the neutral line, suggesting this next test likely won’t hold.”

Fast forward a week:

The Mag 7 Index has broken its regression trendline and is now testing its 2025 lows.

Meanwhile, the broader market continues to put up solid gains. The Mag 7 is down for the year—while other sectors are outperforming.

This is the very definition of market rotation. Rotation is not bearish—it’s bullish. It signals that capital is moving into new leadership areas rather than exiting the market entirely.

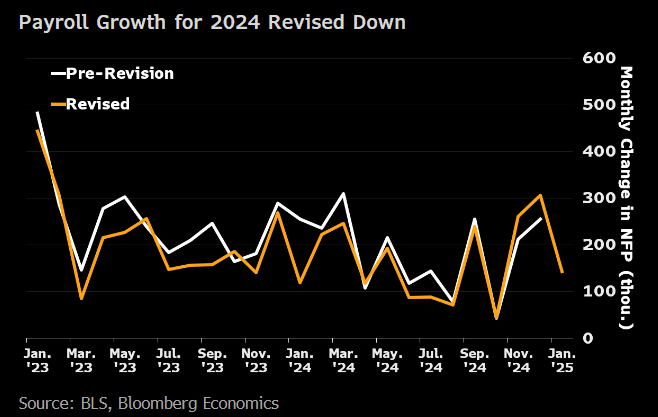

Friday’s market reaction was a reminder of how sensitive investors remain to economic data. We anticipated potential disruptions from the payroll report, but it wasn’t the jobs number that rattled markets—it was a drop in consumer confidence.

January payrolls cooled to 143K (from an upwardly revised 307K), dropping unemployment to 4%.

Consumer sentiment (U. Michigan) declined further in February, driven by intensifying inflation fears and new tariff concerns. Year-over-year inflation expectations surged to 4.3% (from 3.3%), the highest since November 2023.

This triggered a sharp selloff in consumer-related sectors, which were the worst performers on Friday.

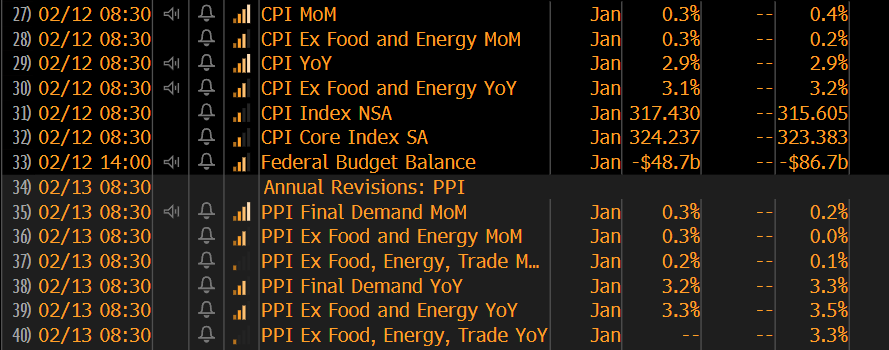

Looking ahead, this week’s CPI (Tuesday) and PPI (Wednesday) could be pivotal macro catalysts.

Bottom Line: The market cycle appears stuck on repeat, but our tactical approach continues to work. We remain focused on positioning ahead of major moves rather than reacting to them.

Now, let’s take a deeper dive under the hood…

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade