Table of Contents

Introduction

Slowing growth has become the dominant narrative on Wall Street, with traders and investors rushing to offload stocks amid concerns of an impending economic slowdown, exacerbated by the rapid rollout of Trump’s tariff and DOGE initiatives. This shift was catalyzed by recent consumer confidence reports, which highlight growing public unease. Given that consumer spending drives 70% of U.S. GDP, any downturn in sentiment carries significant economic implications.

Anecdotally, small businesses are showing hesitation in ramping up spending due to the heightened uncertainty, while large universities are implementing hiring and spending freezes over fears of government funding cuts. This hesitancy reflects a broader trend of economic caution taking hold across the country. The chaos emanating from Washington is undoubtedly creating a pause in demand and services across multiple sectors.

This slowdown is now yet reflected in the latest Atlanta Fed GDP Nowcast model, which is currently projecting negative GDP growth for Q1.

A key factor in this equation is the inventory distortion caused by companies double- and triple-ordering in anticipation of tariff implementation. This artificial demand surge is now creating an air pocket that will likely weigh on corporate earnings over the next 1–2 quarters. And this doesn’t even account for the potential ripple effects of government layoffs, which could further accelerate the economic slowdown.

Slowing growth, combined with unfavorable seasonal trends, sets the stage for a challenging environment for stocks. The impact has been felt most acutely in the growth sector, where valuations are highly sensitive to shifts in the economic landscape.

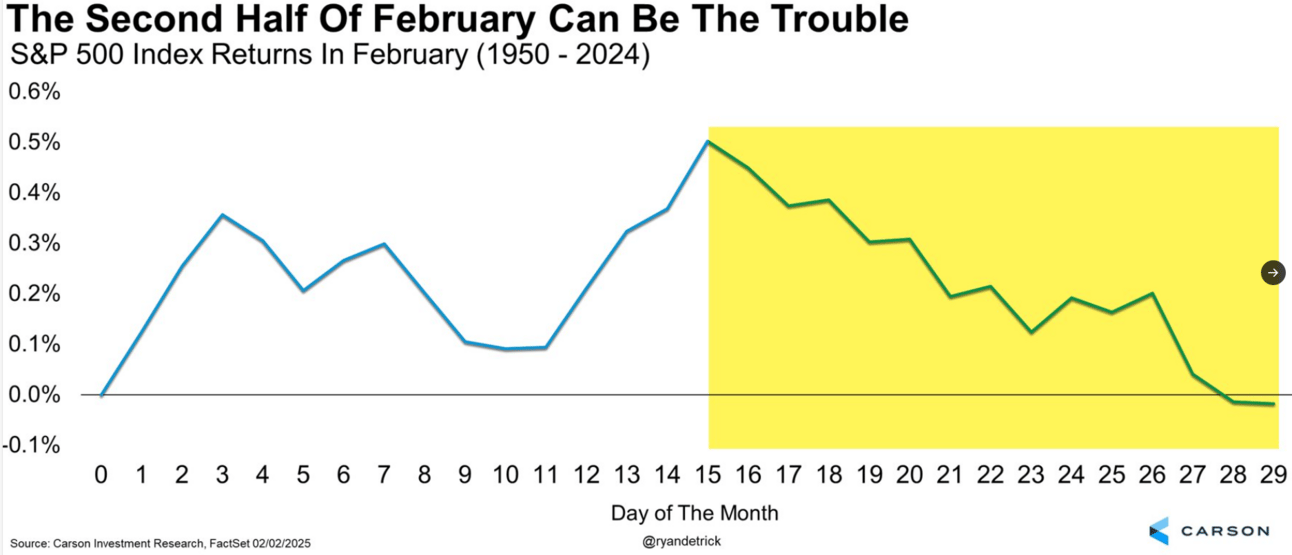

As we highlighted in early February, seasonality historically turns negative in the back half of the month—especially in an election year.

To reiterate, here’s that seasonality chart.

Below is a chart of specific instrument performance since monthly seasonality turned negative. The worst hit sectors have been in high-growth (ARKK, FFTY, Mag7).

Our 2/17 report noted that there was little evidence of an imminent market downturn, and just days later, the SPX reached a new all-time high. However, given the seasonal backdrop, we remained vigilant for potential reversals. As we stated in that report:

"If the SPX fails at the all-time high test and reverses aggressively lower, we’ll adjust our stance accordingly."

By our 2/19 report, we began flagging momentum breaches beneath the surface—early warning signs that warranted increased caution. Those breaches ultimately triggered a sharp unraveling, with the SPX shedding nearly 5% in just seven trading days.

Markets move at a relentless pace, often catching the unprepared off guard. Our research is designed to help readers anticipate these moments, and while we weren’t outright bearish, reducing exposure helped sidestep much of the recent drawdown.

Now, with prices lower, the question shifts: Is it time to get more aggressive?

Let’s check the charts.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade