Table of Contents

Introduction

Come On In, The Water’s Warm… Or Is It?

Let’s be honest—the water isn’t just cold, it’s full of piranhas. That’s the best analogy we can offer for the current investment landscape. There’s very little drawing investors in right now—very little that feels stable enough to justify meaningful risk exposure.

The latest dislocation? The bond market.

The usual safe-haven status of Treasuries has been thrown into question, likely due to a basis trade unwind that’s rattling fixed income markets. As a result, yields have exploded higher, adding another layer of stress to an already fragile environment. The 10-year yield just moved 73 basis points in five trading sessions—a stunning surge that takes us back to levels not seen since the SPX peaked on February 19th.

That kind of move isn’t in any finance textbook—and it certainly doesn’t align with historical precedent. Treasuries are supposed to attract capital during times of crisis, not repel it. When uncertainty is peaking and equities are dropping like a cement block into the ocean, bonds are typically the life raft.

But not this time.

Much to the dismay of the Trump administration—who’s been relentlessly pressuring Powell to cut rates—the bond market had other ideas. Whether this move is the result of forced selling tied to highly leveraged basis trades or a symptom of capital flight amid growing distrust in U.S. trade policy, the cause is almost secondary to the consequence.

Because here’s the bottom line: when the world’s most important and liquid instrument—U.S. Treasuries—starts behaving like a meme stock, it deserves serious attention. It’s not just a bond market story; it’s a macro volatility signal.

And make no mistake, this kind of dysfunction likely spooked the White House into its sudden pivot on tariffs. The chaos unleashed by those policies isn’t operating in a vacuum—the bond market is voting with its feet, and the message is loud and clear.

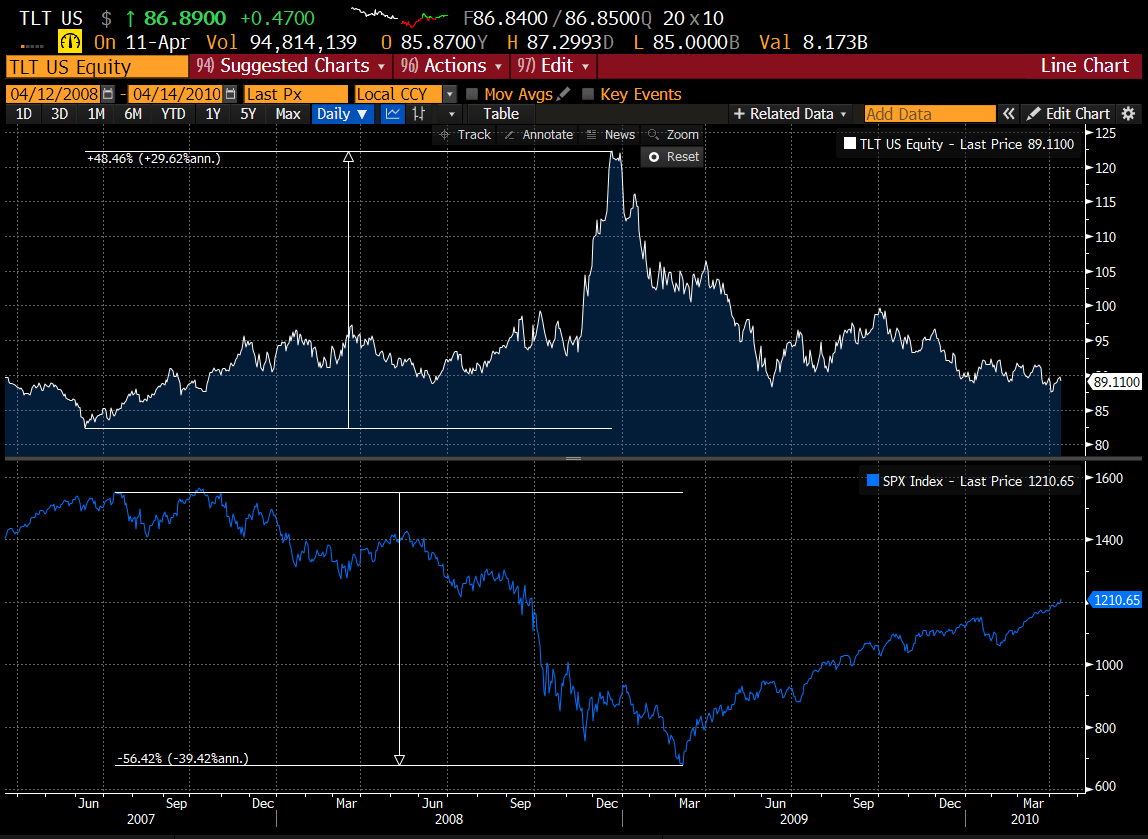

To frame it in historical terms, let’s compare the move using TLT, the 20-year Treasury ETF. During the depths of the 2008 financial crisis, TLT rose 48% as the S&P 500 plunged 56%. That’s what typical flight-to-safety looks like. What we just witnessed last week? That’s the exact opposite—and that should set off alarm bells.

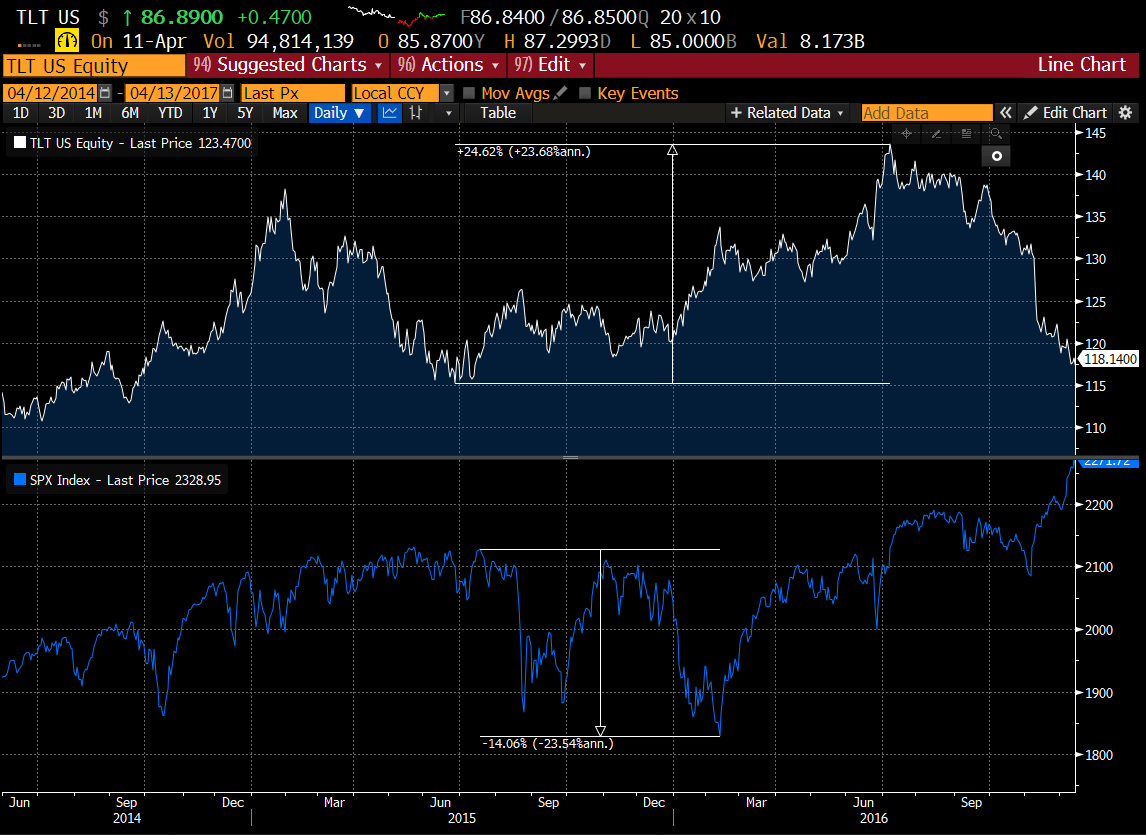

During the 2015 China currency devaluation correction, TLT returned 24% while the SPX sunk 14%.

During Trump’s first presidency in 2018, in the midst of an escalating trade war with China and the Fed removing QE, TLT returned 10% and the SPX lost almost 20%.

During the Covid crash, TLT returned 24% and the SPX lost 34%.

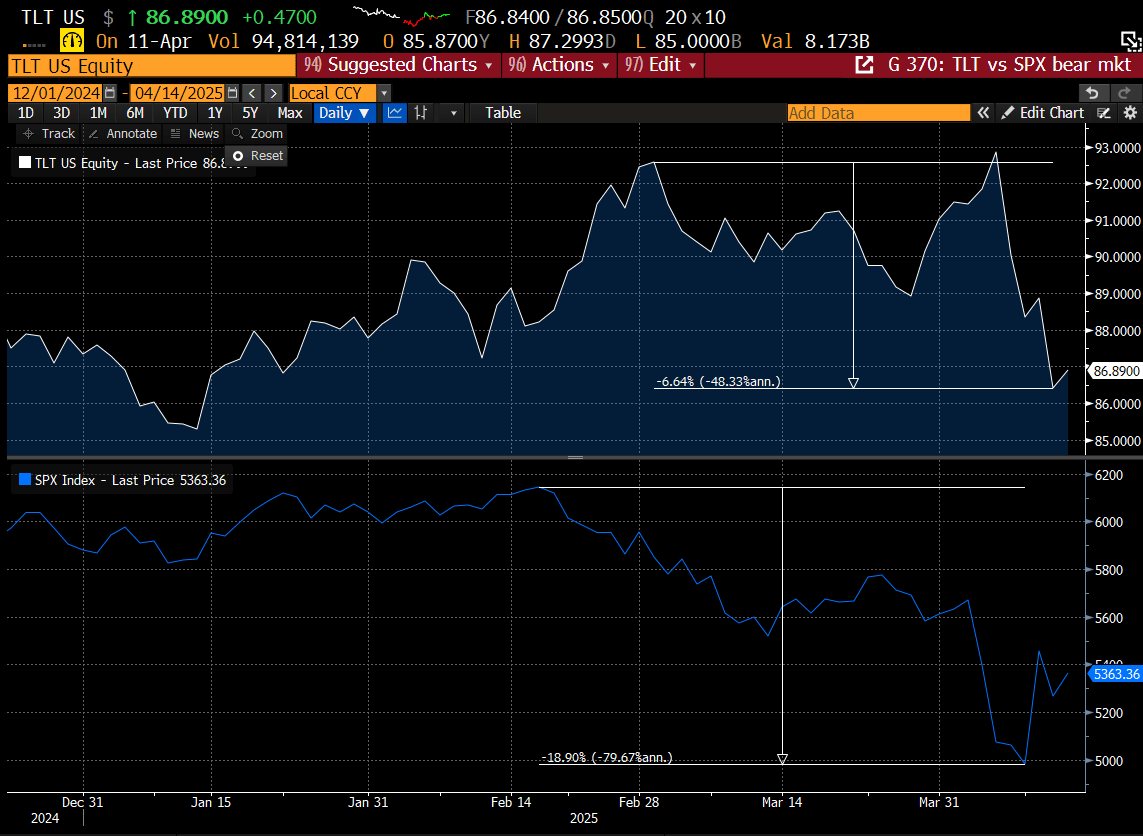

During the recent “Liberation Day” massacre, this inverse relationship between bonds and stocks have flipped. TLT has lost 7% while the SPX has lost 19%.

“Houston, we have a problem.” We always caution our readers: when the bond market starts flashing extreme volatility and delivering outsized rate-of-change moves, things tend to break. Now layer in the fact that bonds have deviated from their traditional inverse correlation to equities, and what you’re left with is a financial time bomb.

It’s no surprise the alarm bells were ringing loudly in the halls of the White House and the Fed. That fear likely contributed to the administration’s sudden decision to walk back its aggressive tariff stance—for now. The 90-day pause may not offer clarity, but it was enough to light a fire under equities, triggering one of the largest single-day stock market rallies since the 2008 GFC.

Fortunately for our readers, we were ready for it. In last weekend’s report, we called for a “sizeable counter-trend rally” and our 4/9 report advised that while the easy money off the lows had likely been made, a tradeable low was forming—and that dips should be bought. Thursday’s powerful reversal was supported technically, and by Friday, the SPX had already taken out Thursday’s high—a textbook follow-through, exactly as we mapped out.

Over the weekend, the Trump administration doubled down on the retreat, floating the idea of pausing tariffs on semiconductors and smartphones. That may provide an additional boost into Monday’s session. But make no mistake—the policy environment remains volatile and unpredictable. Investors remain wary of another tape bomb dropping at any moment, which means conviction to aggressively re-risk portfolios remains low.

Bottom line: volatility is here to stay. Tactical flexibility is the only rational approach in this environment.

Sorry folks, the water’s not warm. It’s cold, choppy—and full of sharks.

Let’s review the charts.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade