Table of Contents

Introduction

Think back to the classic Wizard of Oz scene when Dorothy nervously chanted, "Lions and tigers and bears, oh my!"—a reflection of her fear about what lay ahead on the yellow brick road. In a similar vein, the fear now brewing for stock market bears isn't ferocious beasts, but rather the rapidly improving bullish construction across major indexes and key instruments (FTD’s, Island Reversals and Breadth Thrusts, oh my).

This structural improvement is happening alongside a noticeably more conciliatory tone from President Trump on the trade front. Much like the "great and powerful" Oz, Trump’s hardline posture is increasingly being revealed as a mirage—an illusion of control masking behind-the-scenes pressure from public companies alarmed by the real-world consequences of tariff escalation. A fresh wave of warnings from retail CEOs, cautioning that maintaining current tariffs would leave shelves empty and prices soaring, appears to have forced yet another rhetorical pivot.

Whether this CEO pressure was the decisive catalyst or not, the reality is the market had already begun to anticipate this softening. As we highlighted in our 4/20 report:

"…we believe the market is discounting resolution. The first indication of that came on April 9, when Trump paused the tariffs. Don’t overlook that move—it was a clear repricing event, and in our view, it marked the beginning of a shift in what’s discounted."

Ignoring these construction changes carries serious risks in a fast-moving environment. Those who dismissed the April 9 rally as just another bear market bounce have now watched a 14% move off the lows—and a return right back to the "Liberation Day" gap area.

Could we be witnessing a "V" bottom without a retest of recent lows? That probability has meaningfully improved. If the rally continues, underinvested bears may find themselves forced to chase higher prices.

Fortunately, we had already been advocating a tactical long bias before Trump softened his tariff stance—and have been steadily increasing exposure on weakness. Now the key question becomes: is it time to pull the ripcord or push more chips into the market? We'll address that in more detail in our index analysis section.

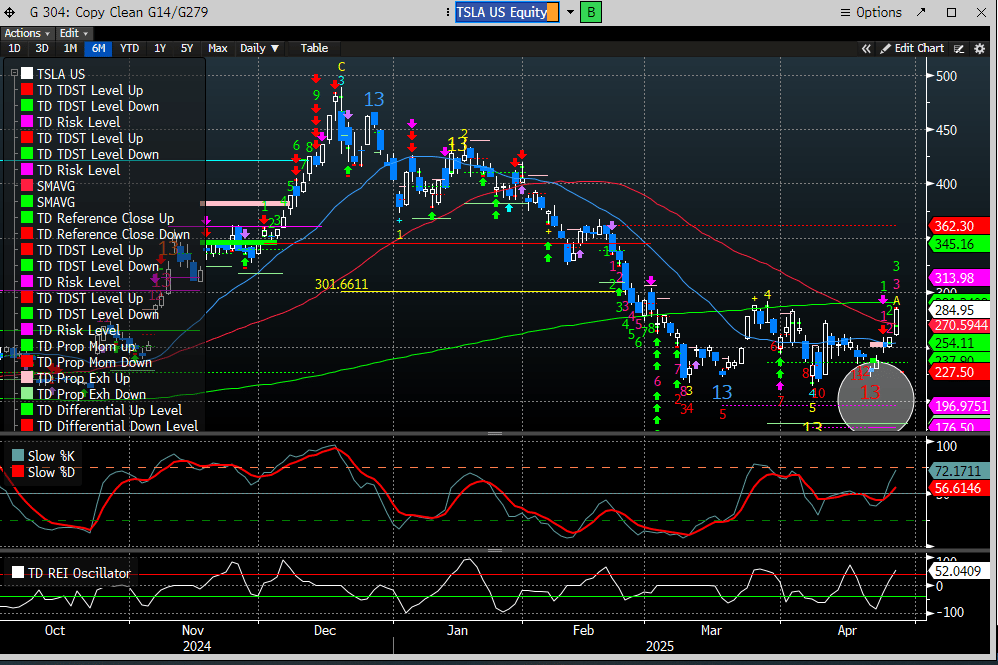

This week will serve as a true litmus test for investor sentiment, with most of the "Mag 7" reporting earnings. Last week, Tesla (TSLA) delivered fairly disappointing results, yet the stock rallied in response. Skeptics will argue it's just a bear market rally—but is it really? As technicians at heart, we trust the wisdom of price. When instruments begin to respond positively to bad news, it often signals that the worst has already been discounted.

Notably, TSLA broke its downtrend line (DTL) from the peak and reclaimed the 50-day moving average last week—a feat it hadn't achieved since the last earnings report.

The weekly candle closed with a bullish engulfing pattern, increasing the probability that the downtrend is either over—or at the very least, paused. Just as notable, TSLA found support right at the 200-week simple moving average, perfectly aligning with the downtrend line (DTL) drawn from the 2021 peak. Coincidence? Hardly.

Adding to the evidence that TSLA has carved out a near-term floor, the recent lows also coincided with a DeMark Sequential 13 buy signal.

Further reinforcing the case for a bottom, the entire Mag 7 Index also registered a DeMark Sequential 13 buy at the recent lows—a rare and powerful signal suggesting broader stabilization across key leadership stocks.

Or consider that both recent lows in the SPX were also marked by DeMark Combo and Sequential 13 buys. If you recall, we emphasized in our March 5th report that the market was unlikely to find a durable low until a DeMark 13 buy signal printed. That roadmap has played out precisely as expected.

Regardless, the market's next move will likely be driven by earnings reactions. While most of the Mag 7 stocks have rallied meaningfully off their lows, there remains a real risk of disappointment, which could trigger adverse reactions. Analyst estimates remain stubbornly high, expecting 1% profit growth in 2025, a forecast that hasn’t seen much degradation since tariff policy was enacted.

This increases the risk of disappointment given the four mega caps reporting this week have a roughly 20% weighting in the SPX. However, this is occurring with notably lower stock prices, implying that mediocre results, similar to TSLA will be forgiven.

Regardless, the asymmetric risk setup we highlighted near the SPX lows has now been largely erased, and the market faces a much stiffer test—one that likely requires positive and satisfying news flow to break through current resistance.

In The Wizard of Oz, the Yellow Brick Road seemed clear—until the journey revealed new tests at every turn. Similarly, while the path higher still exists, the road ahead is far more challenging.

It's time to see what the charts are suggesting.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade