Introduction

Where Did All the Sellers Go?

The bears have been growling loudly since the market collapsed in April, yet despite mounting concerns over tariffs and a slowing economy, they’ve been unable to push the market meaningfully lower. Even a hawkish FOMC message was quickly absorbed by the market, with stocks engulfing the mild weakness.

Is the market climbing the classic "wall of worry," as it so often does? We think that’s a strong possibility. It’s also possible that bears are simply waiting for clearer resolution on the tariff front before re-engaging. As we’ve warned for weeks, the market has been pricing in progress on trade negotiations — and when the narrative is leaning toward resolution, it’s difficult to step in front of it.

However, once those positive catalysts are fully priced in, we expect attention will likely shift back to the softer economic data — something to keep in mind as we move forward. Rest assured, we’ll continue keeping our readers in front of any key structural changes.

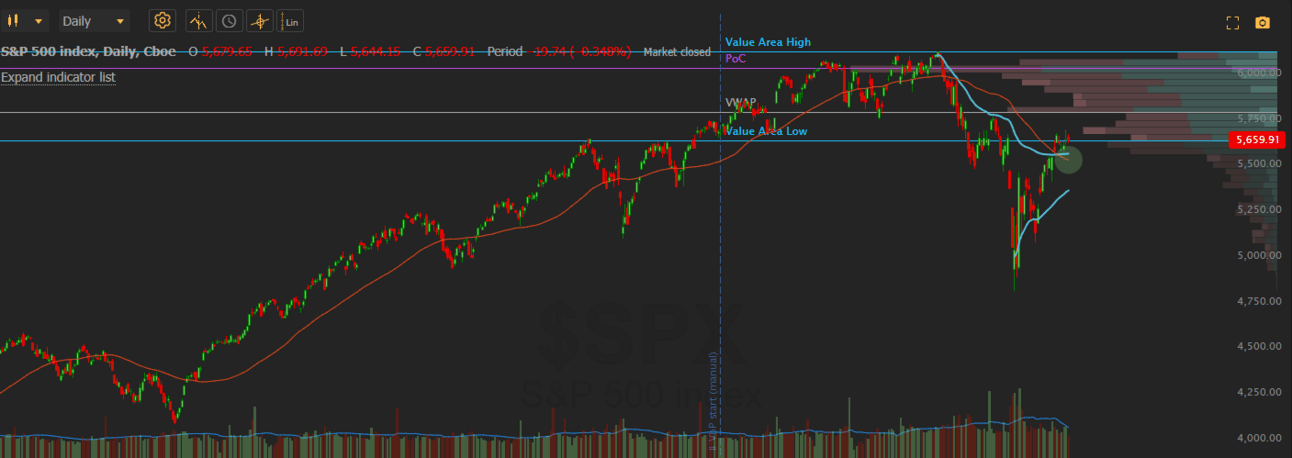

In a narrative-driven market, price action carries even more weight. With fundamentals still murky, many professional managers remain hesitant to get fully involved — but ignoring price has a cost. The SPX is now up 18% off its April lows and could push even higher if tariff news turns more favorable.

The tepid enthusiasm from professional investors is clearly reflected in this relative volume chart, highlighting the subdued participation throughout the past month.

What often escapes most people's attention is that Money Flow (MFI) has been steadily trending higher, marked by a series of higher lows and higher highs — a clear sign of underlying accumulation in the SPX.

Perhaps even more important, when we anchor the VWAP from the peak (AVWAP), the SPX has already cleared this key hurdle. Why does this matter? Because it means the volume-weighted average price of all trading since the peak is now below the current price — a strong signal that buyers have regained control.

\

I repeat — Where Did All the Sellers Go? More on the implications later.

Meanwhile, retail investors have continued to 'buy the dip' relentlessly for weeks. According to Bank of America, this retail buying streak is now the longest since 2008. Professional managers often view this as a contrarian signal — a reason to sell — but it’s worth remembering that retail was also aggressively buying the dip throughout 2022... and we all know how that ended.

Trend-following funds (CTAs) have been slowly inching back into the market, according to Goldman Sachs. After being aggressive sellers for most of the year, they still remain underinvested, per UBS. JPMorgan notes that CTAs are likely to turn into net buyers if the SPX reaches 5800 — just 2.5% above Friday’s close. This dynamic is unfolding while professional investors continue to shun the rally and remain heavily allocated to cash. Should the market receive another tariff-related boost, the cash sitting on the sidelines may be forced back into equities.

With earnings season winding down, attention will now shift to the next major macro catalysts: April CPI (due 5/13) and PPI (due 5/15). Consensus estimates for CPI are calling for a mild month-over-month uptick, but that may prove conservative given that new tariffs have already been in effect for over a month. Inflation categories most sensitive to China — such as apparel, household furnishings, and certain commodities — will be key areas to watch. Core inflation could remain unchanged due to the recent pullback in energy prices.

Bloomberg is reporting that Chinese tariffs on ships carrying cargo for major U.S. retailers could be sharply reduced between May 12–20. If realized, this would likely create a short-term disinflationary impulse and could be viewed positively for markets from a directional standpoint. However, PPI data on Thursday may tell a different story, as tariffs on steel and aluminum imports could drive inflation higher.

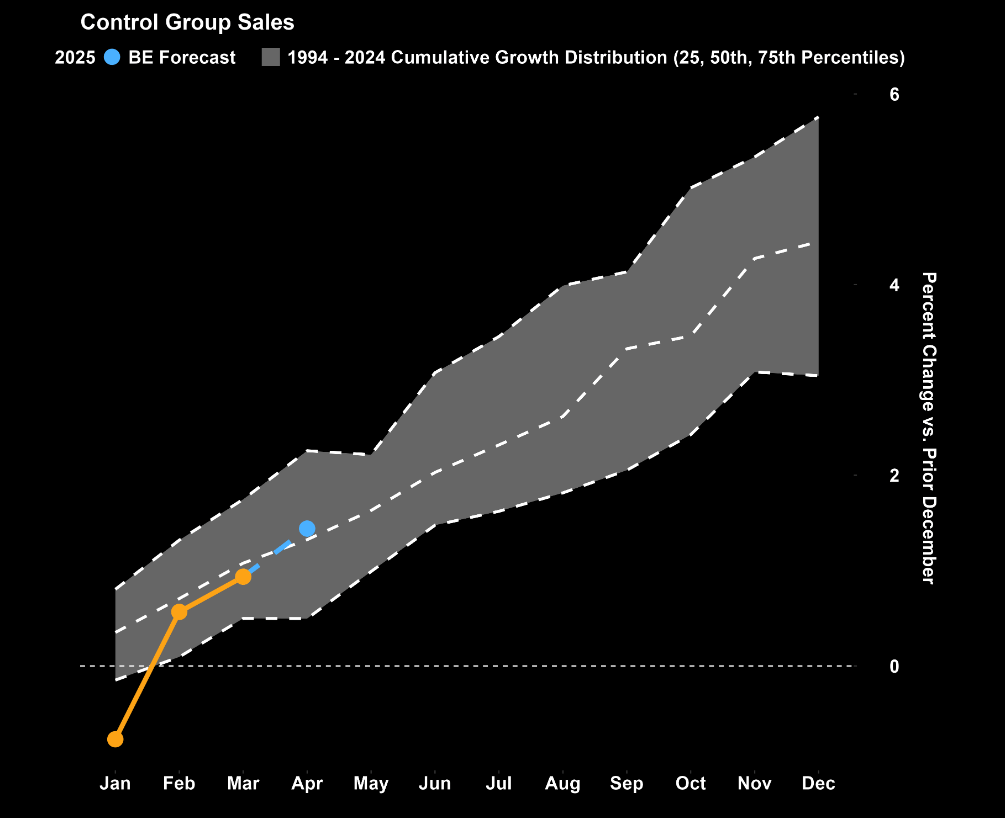

Adding another layer, slowing retail sales are helping moderate CPI advances. Thursday’s retail sales report will offer a critical look into this trend — and how markets interpret it will be key. A weak print could ignite recessionary fears and create market dislocations.

Overall, it's shaping up to be a macro-heavy week, packed with potential volatility.

While we maintained a tactical long bias throughout the April rally, we have now entered our target zones for the indexes and have shifted to a more neutral stance. At current levels, we believe the risk/reward is no longer compelling until we see further price resolution. Whether the next move is higher or lower will ultimately be determined by trade progress and likely show up in the charts.

We'll let price action be our guide.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade