Table of Contents

Introduction

We’ve been in this game a long time, and if there’s one lesson the market teaches over and over again, it’s this: Logic is Overrated.

Six weeks ago, markets were in freefall—reeling from the uncertainty around Trump’s global tariff war. It was one of the fastest double-digit declines in history. Fast forward to today, and despite one major trade deal, and two tariff “pauses”—the S&P 500 is just 3% off all-time highs.

Is that move logical? Not really. But the market doesn’t trade on logic—it trades on expectations and positioning. Arguing with every tick of the 23% rally since the April 7th low would have been costly. The narrative may have shifted from hardline Trump to something more conciliatory, but the market began pricing in that shift long before headlines confirmed it.

That’s why following price matters. It leads the news. And that’s exactly why we turned bullish in our 4/6 report, which proved extremely timely for our readers—whether it helped you lean in or simply challenged a bearish bias.

We’ve come a long way since those April 7th lows. Along the way, we’ve seen a series of bullish structural changes that we urged readers not to ignore. Each one increased the probability of higher prices. Now, after 28 trading days, the SPX has crossed into RSI overbought territory. Notably, if you bought when it hit oversold, you would have captured nearly the entire rally.

Never underestimate the power of disciplined technical analysis.

We’re proud of the work we do and even prouder of the results it helps generate.

Our objective has always been to blend technical signals with macro context to identify high-conviction entry points—and that’s exactly why we turned officially bullish on April 6th. In our May 11th report, we highlighted that the “pain trade” was still higher. The very next trading day, on May 12th, the S&P 500 gapped above its 200-day moving average—a critical technical and psychological level closely watched by institutions.

That move forced many underexposed investors off the sidelines. The 200-day MA doesn’t just represent trend—it represents conviction. When markets gap above it, particularly in the context of bullish breadth and structural shifts, it often triggers a wave of FOMO-driven buying.

The results speak for themselves: the S&P 500 surged 5% and the Nasdaq jumped 7%—in a single week. That’s nearly a year’s worth of returns compressed into just five sessions. It’s a textbook pain trade, as under-positioned investors were forced to chase strength.

Last week’s macro data did little to shift the broader narrative. Inflation remained subdued despite the tariff impact, while retail sales showed a decline—adding to signs of softening demand. Meanwhile, Friday’s University of Michigan survey revealed consumer sentiment falling to near record lows. These reports initially pressured yields lower, but that move was short-lived as yields reversed higher by the end of the week.

The yield reversal on Friday likely had more to do with Moody’s downgrade of the U.S. credit rating, which was issued after the market closed. Moody’s lowered the U.S. rating from Aaa to Aa1, citing the growing budget deficit and long-term fiscal concerns. This marks the third time a major credit agency has downgraded U.S. sovereign debt. Here's how markets reacted in previous instances:

S&P Downgrade – August 5, 2011: S&P lowered the U.S. rating from AAA to AA+ due to a debt ceiling impasse. Markets responded with immediate volatility, with the S&P 500 dropping nearly 6% in a matter of days. However, the index rebounded over the following months, gaining approximately 10% by year-end, aided by accommodative monetary policy and improving macro data.

Fitch Downgrade – August 1, 2023: Fitch cited fiscal slippage and governance challenges in its downgrade from AAA to AA+. The initial reaction was relatively muted, with the S&P 500 falling just 0.9% over the next week. By mid-August, the index was down 3.0%, driven by a combination of the downgrade, rising Treasury yields (with the 10-year nearing 4.2%), and inflation concerns. Notably, from that point through the end of the year the S&P 500 gained almost 7.5%, underscoring that the downgrade had minimal lasting impact on equities as focus shifted to earnings and economic resilience.

While historical precedent shows markets tend to recover from these downgrades fairly quickly, there are implications worth monitoring. Most notably, such moves may put upward pressure on longer-dated yields as investors demand greater compensation for increased credit risk. This can, in turn, weigh on the U.S. dollar—and together, these forces could challenge an already overbought equity market. In short, the downgrade introduces another layer of risk in an environment already primed for some consolidation.

Let’s examine the charts.

Index Analysis

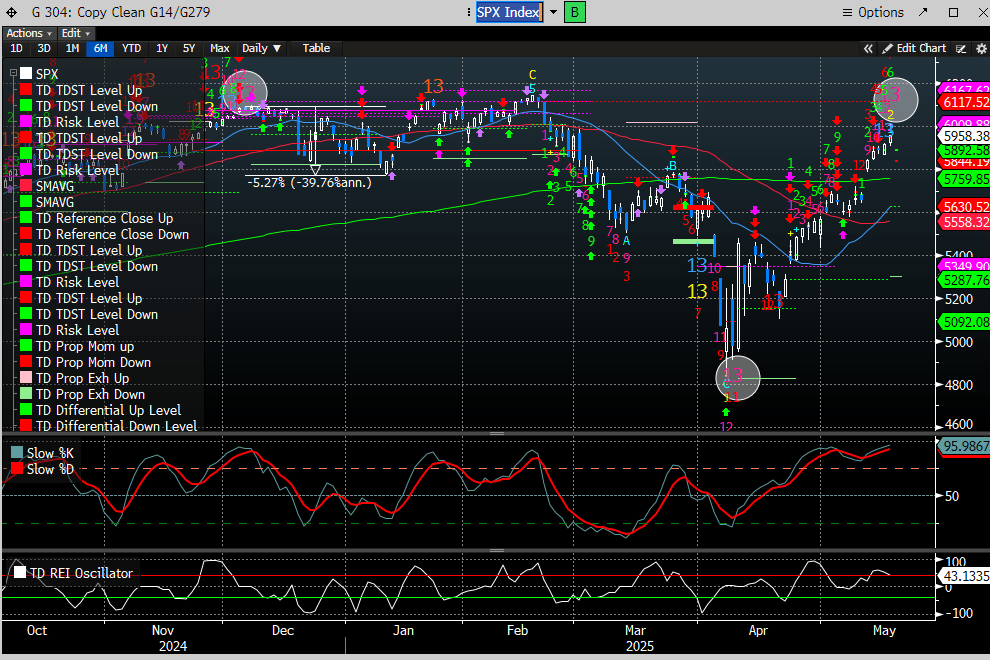

In our 5/14 report, we highlighted the potential for DeMark sell signals to begin firing across the major indexes. On Friday, the SPX confirmed a Combo 13 Sell, just as we anticipated, and is now three days away from potentially printing a new 9 Sell. Recall that the last Combo 13 Buy marked the April 8th bottom—underscoring the reliability of these signals. Friday also brought a fresh catalyst for volatility via Moody’s credit downgrade, adding further weight to our cautionary stance. As we’ve noted repeatedly, DeMark signals have a curious habit of showing up at key turning points. Given how far the market has run, we suspect a short-term top is either close—or already in.

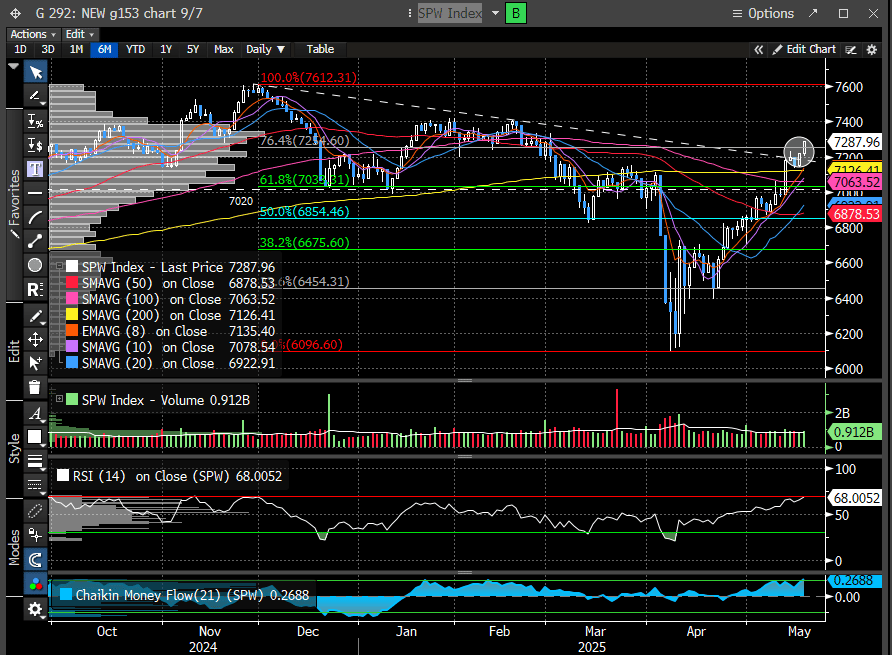

As illustrated in the chart above, the SPX has officially reached the overbought (OB) threshold on the RSI, adding another reason to approach the market with increased caution. Additionally, the DeMark TrendFactor (DTF) level of 5952, which we outlined in our 5/14 report, has now been met. With this target reached and DeMark counts nearing completion, a more defensive posture is warranted. However, if the SPX decisively clears 5952, the next upside target shifts to 6094.

That level would also coincide with the Point of Control (POC) around 6050, reinforcing the significance of this resistance zone. The bottom line: the market is now confronting substantial overhead resistance just as fresh sell signals are emerging in an overheated environment. This is typically not the time to get aggressive with new long positions without some degree of reset or consolidation.

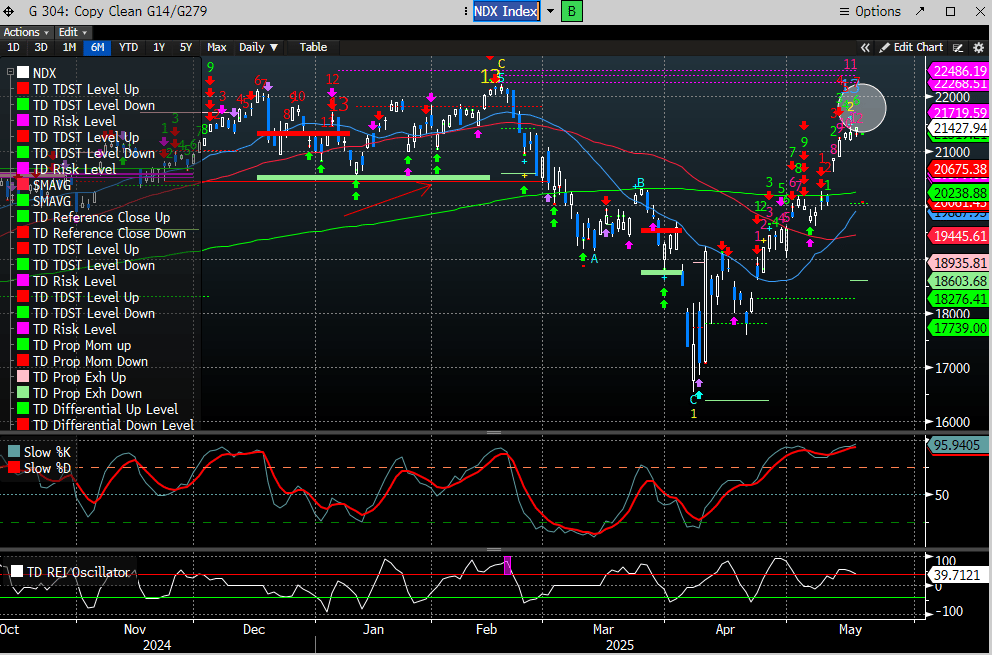

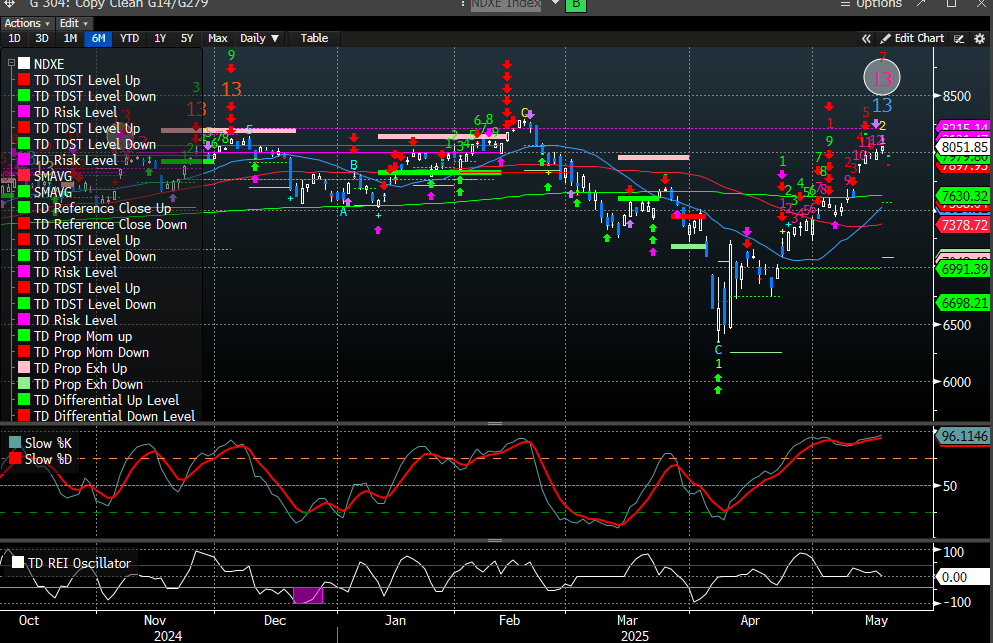

The Nasdaq is also on deck to print DeMark sell signals in three days (combo 13 and 9 sell, potentially).

Similarly, the Nasdaq has reached its DTF level resistance with 19609 next should 19173 get taken out convincingly.

Like the SPX, the Nasdaq is also crossing the OB threshold.

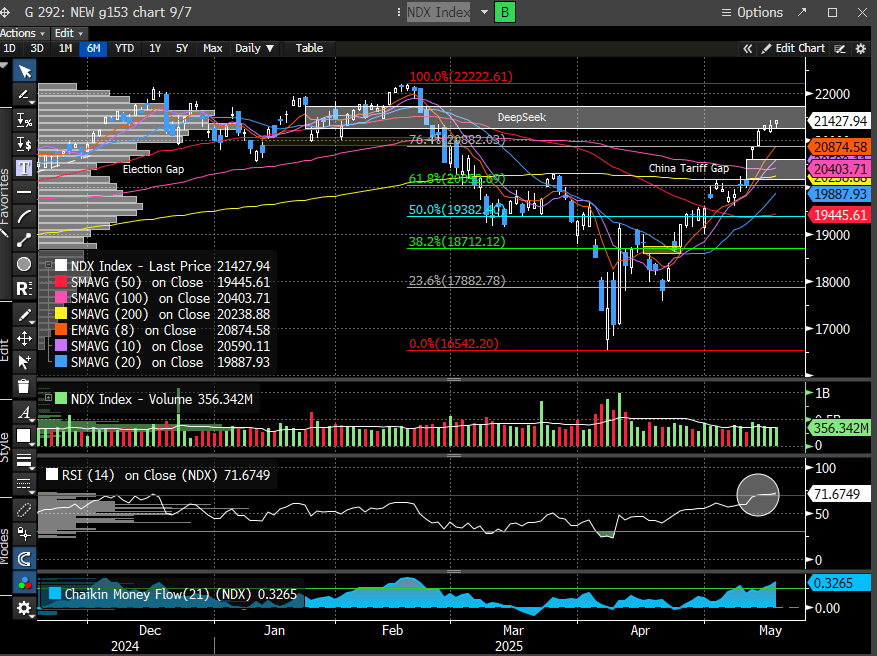

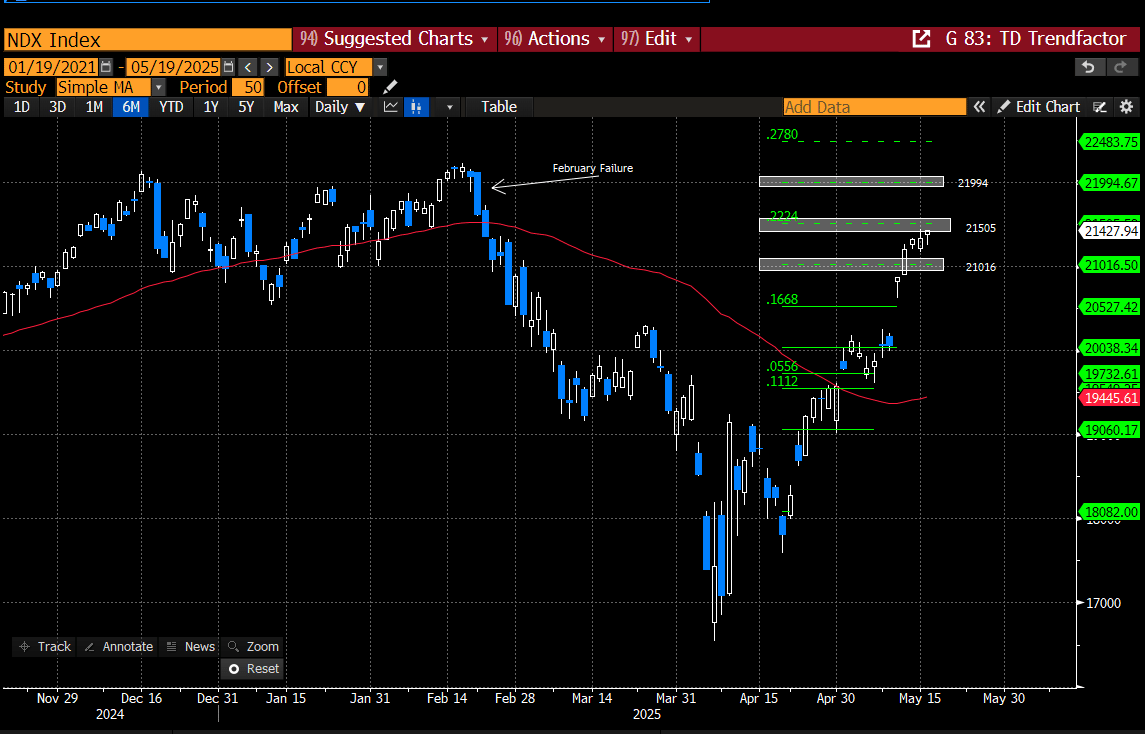

The Nasdaq 100 Index (NDX) can print its DeMark combo 13 buy in one day, with a new 9 buy, only three days behind it.

These signals are occurring while the NDX is OB per RSI, and back into the DeepSeek gap window.

The NDX is challenging its DTF level (21505) as well.

While the market may be overheated in the near term and due for a pause, underlying market internals continue to improve. Notably, the equal-weight S&P 500 (SPW Index) has reclaimed its 200-day moving average and broken above the downtrend line (DTL) from its previous peak. This suggests the rally is broadening beyond just the mega caps, which is a constructive development for market health.

The Nasdaq Equal Weight Index (NDXE) has been participating constructively and is now approaching its December 2024 pivot. Interestingly, the NDXE is less than 3% from its all-time high, compared to just under 5% for the Nasdaq Composite and 3.6% for the Nasdaq 100 (NDX). This suggests stronger participation beneath the surface, rather than just leadership from a few mega caps—a bullish development for the broader market.

The NDXE printed a DeMark combo 13 sell on Friday, while also being OB. This area would be a logical place for the NDXE to stall out.

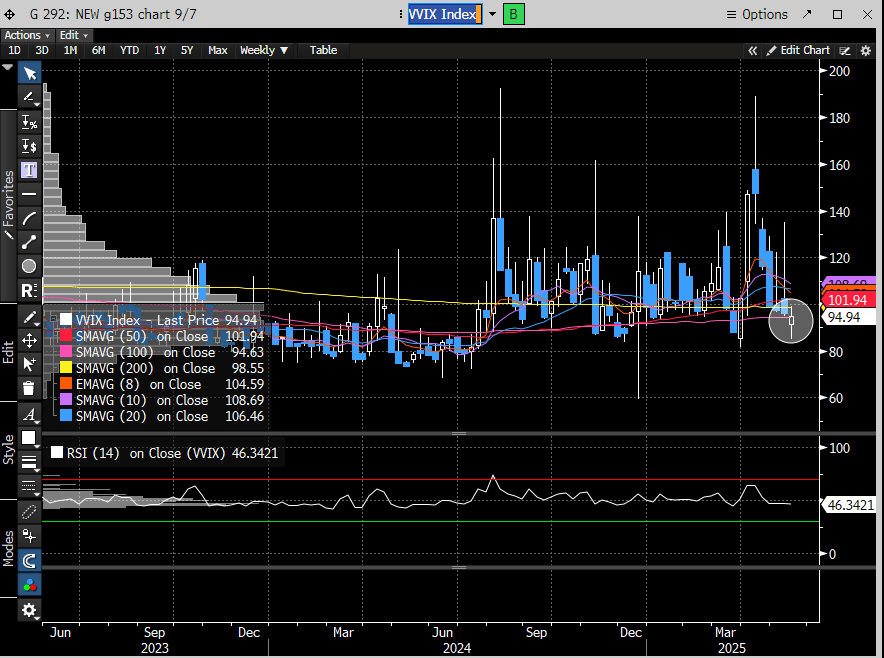

DeMark signal alignment is taking shape across all major indexes on the daily timeframe this week. Adding to this setup, the VIX is on track to print a new DeMark 9 buy signal on Monday, with a potential combo 13 buy just three days away. While the previous 9 buy in the VIX failed to spark a reaction, the current broader alignment across equity indexes creates a more compelling case. This growing confluence of signals raises the probability of a pause or near-term retracement in the markets.

The Volatility of Volatility Index (VVIX) printed a weekly indecision candle (Doji), potentially signaling a rise in market volatility in the near term.

Macro Updates

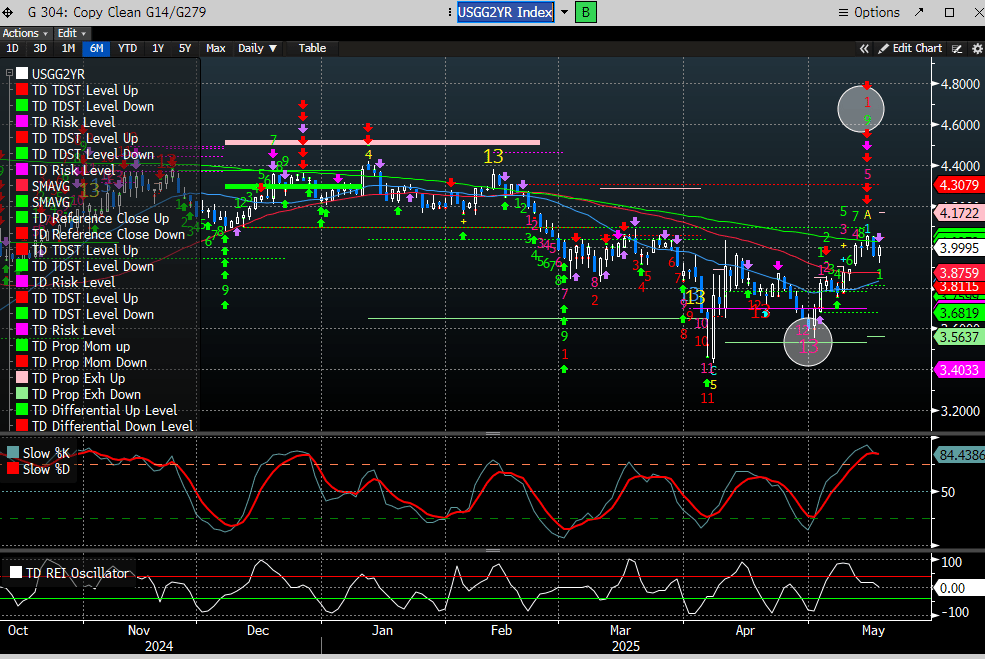

In our 5/11 report, we anticipated a pause or possible reversal in yields following the DeMark 9 signal. While a brief pullback did occur, it lasted only one day before yields resumed their climb.

The sharp reversal suggests sellers were opportunistic, indicating that yields are likely to either stabilize or continue pushing higher from here. This remains a significant risk to the stock market rally if yields keep climbing.

Meanwhile, High Yield (HYG) has shown little reaction so far, maintaining its bullish breakout.

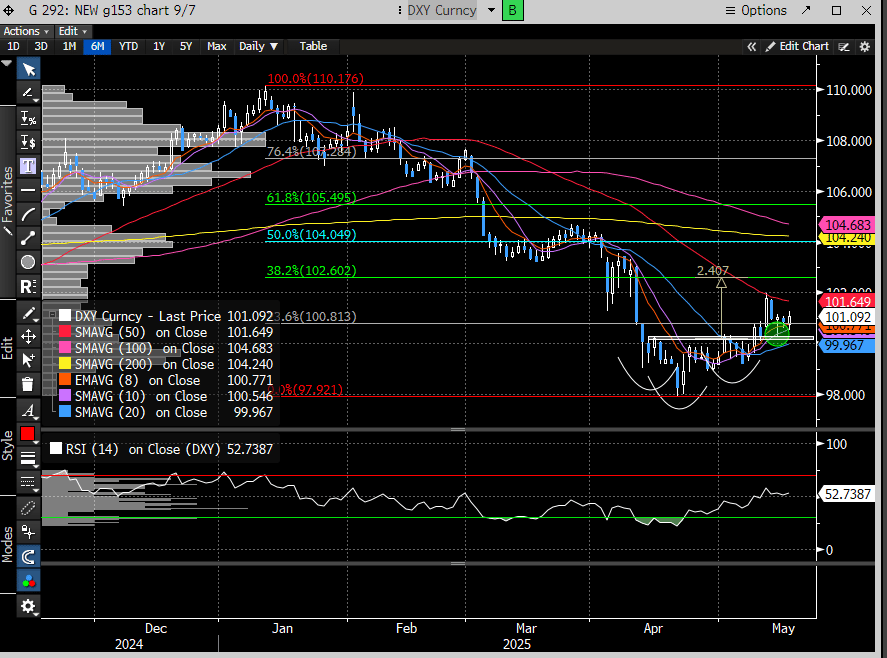

The $USD (DXY) is back testing its breakout successively, for now.

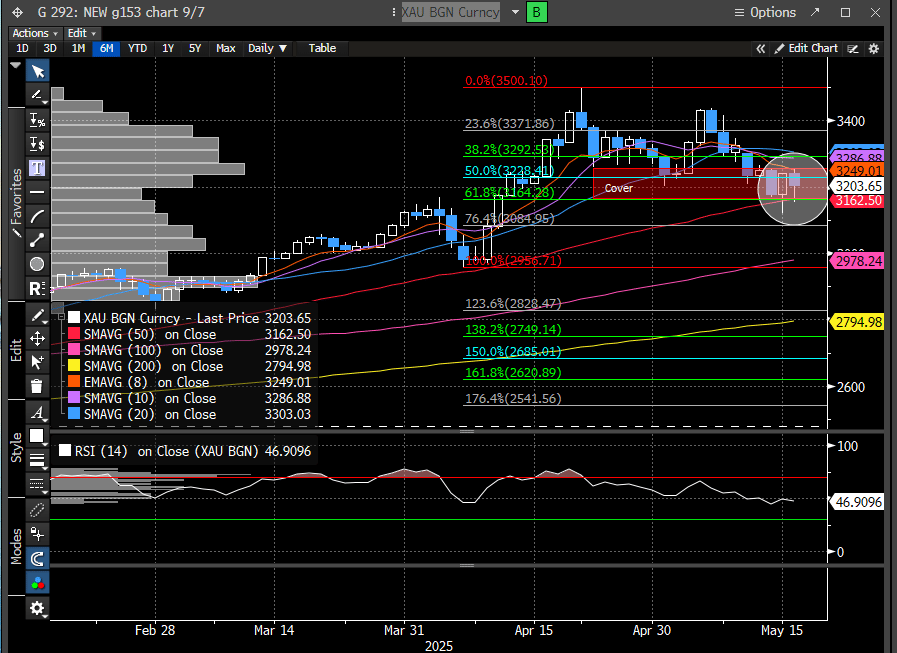

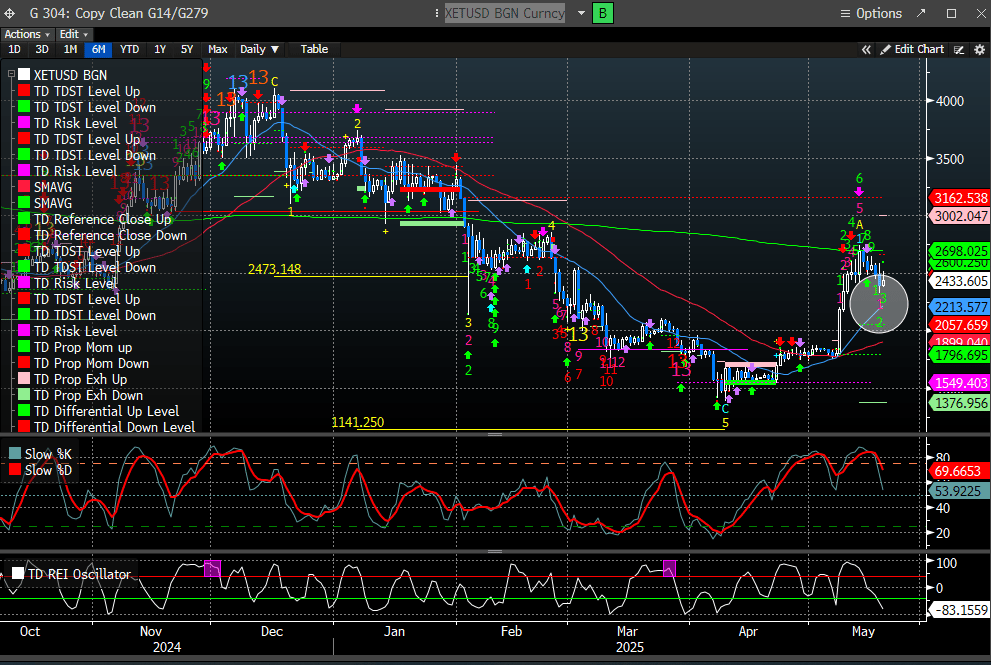

Gold (XAU Index) has found support at the 50-day MA/61.8% Fib level. Recall, this was our level to cover shorts and consider revisiting the long side.

We were hoping for DeMark buy signal alignment, but that remains three days away. However, a TD REI buy signal printed on Friday (purple arrow), which often sparks a market reaction. Given this, the risk/reward for a long entry has improved and is worth considering.

Below is a chart of gold highlighting TD REI buy signals (green arrows). Historically, most of these signals have been followed by sustained upward trends.

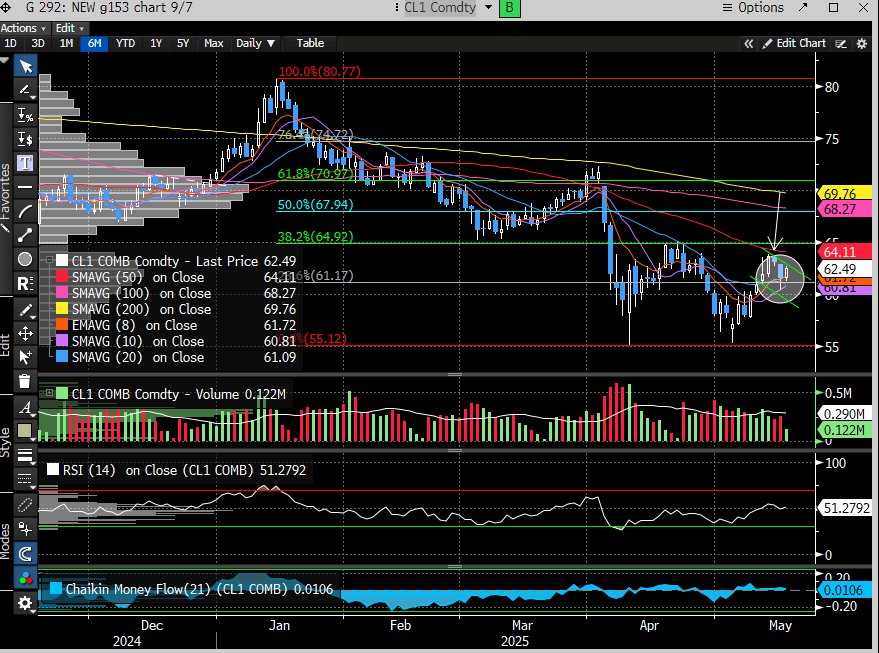

Oil approached our near-term target near $64 but pulled back slightly. It remains supported, finding buyers at the 8-day EMA while forming a bull flag—a classic continuation pattern signaling potential further upside.

A new DeMark 9 sell signal could trigger in two days, but only if oil closes above $63.15 on Tuesday. We remain confident in our target to sell in the $64–$65 range, particularly if that 9 sell signal confirms.

Internals

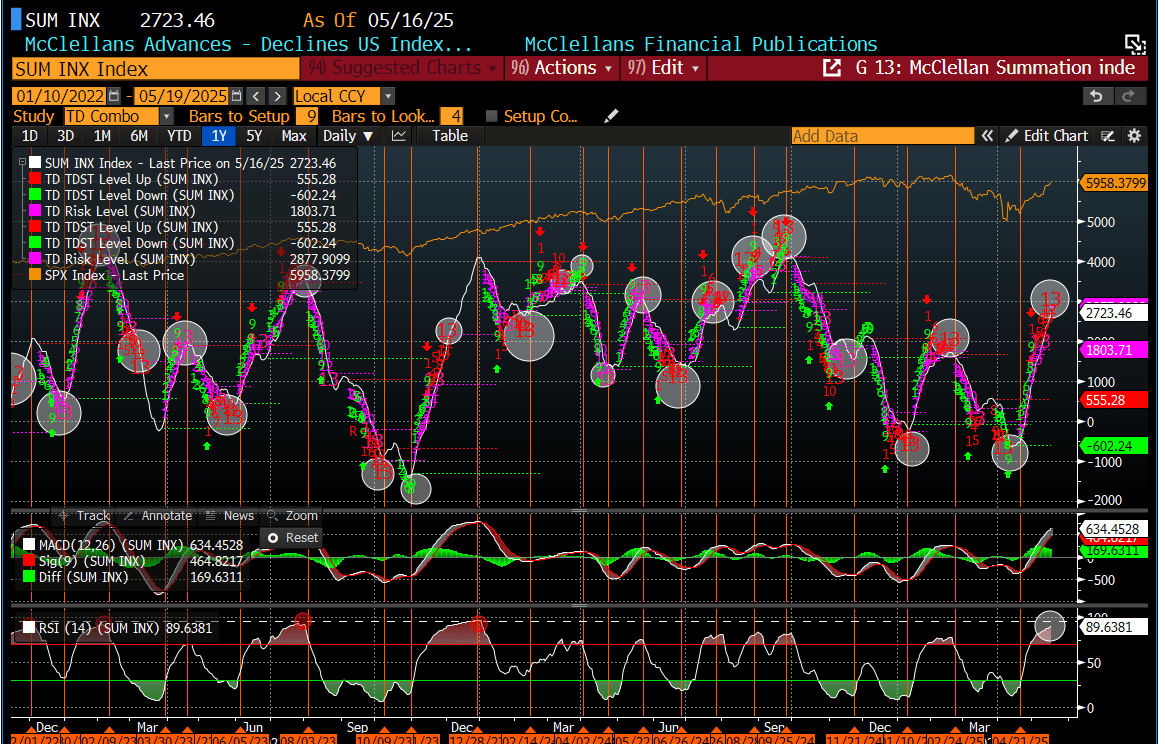

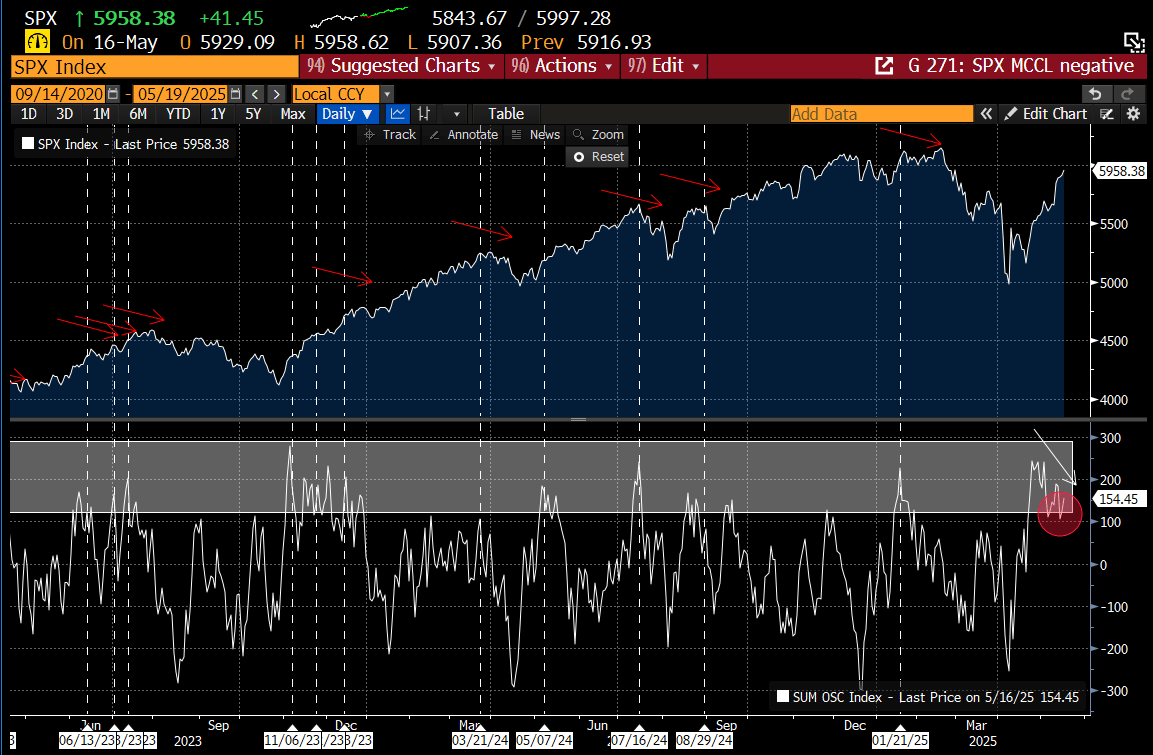

As highlighted in our 5/11 report, the McClellan Summation Index (MSI) printed a sequential 13 sell signal on Friday, coinciding with its RSI entering the extreme zone. Historically, the last three seq 13 signals have marked major MSI turning points. When the MSI shifts, the major indexes typically follow suit.

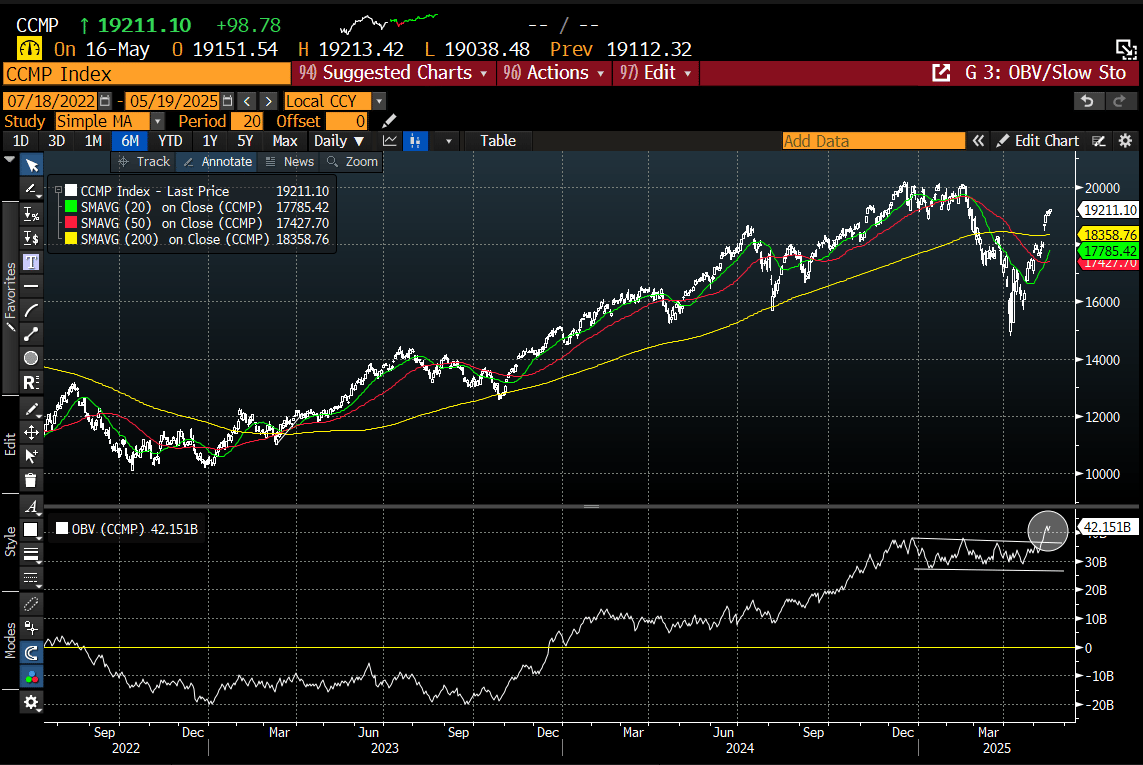

In our 5/11 report, we highlighted the On-Balance-Volume (OBV) charts for the major indexes, which have continued to push higher since then. This is a bullish sign, indicating strong buying pressure and suggesting that any pullbacks are likely to be shallow.

We also want to highlight the Nasdaq’s OBV chart specifically. While it was consolidating last week, it has now broken out of a bull flag pattern, reinforcing the bullish momentum.

Another reason to view pullbacks as buying opportunities is the SPX Advance/Decline line, which continues to make new all-time highs, indicating strong underlying support for the current rally. While the Advance/Decline line’s RSI is approaching overbought levels—not a sell signal per se—it typically signals that a cooling-off period may be approaching.

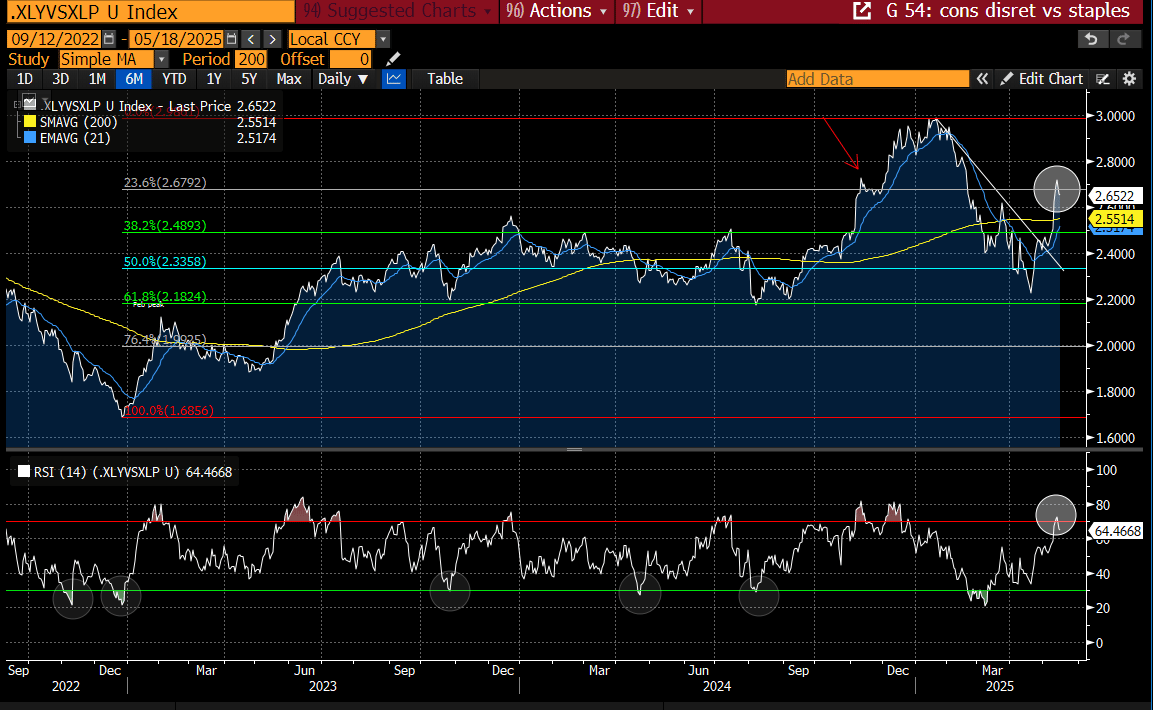

The consumer discretionary versus staples ratio is a reliable barometer of risk appetite. We highlighted this chart last week as a bullish signal, and since then it has surged significantly. However, the ratio encountered resistance at the 23.6% Fibonacci retracement level and pulled back on Friday, potentially signaling an upcoming risk-off move. With its RSI also in overbought territory, a pause or consolidation in this ratio should be anticipated.

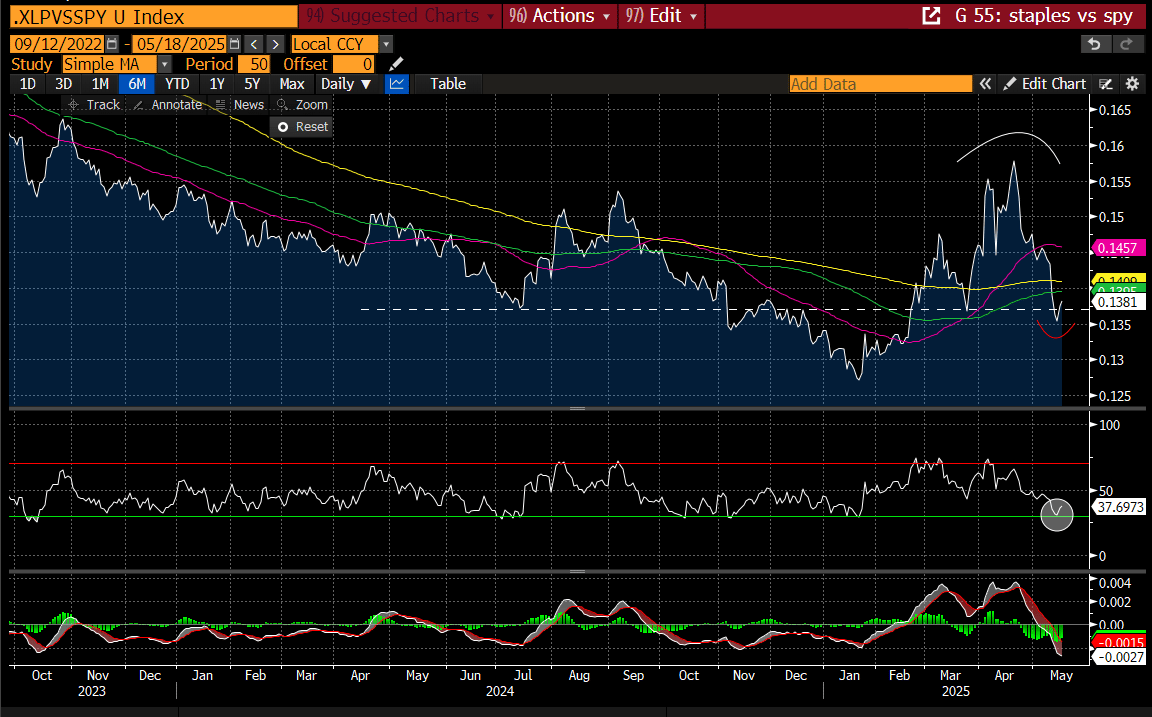

The Staples vs. SPY ratio offers another perspective on risk appetite. This week, the ratio briefly broke a key pivot level but then reversed to reclaim it. Notably, its RSI is oversold, which often precedes a reversion. This behavior could also be an early signal that a risk-off move is underway.

The Mega Cap vs. Value ratio is currently testing resistance at two converging trendlines, with its RSI deep in overbought territory. This setup suggests a potential pause or pullback. Since value stocks tend to lead during risk-off periods, this chart may be signaling an upcoming rotation toward value.

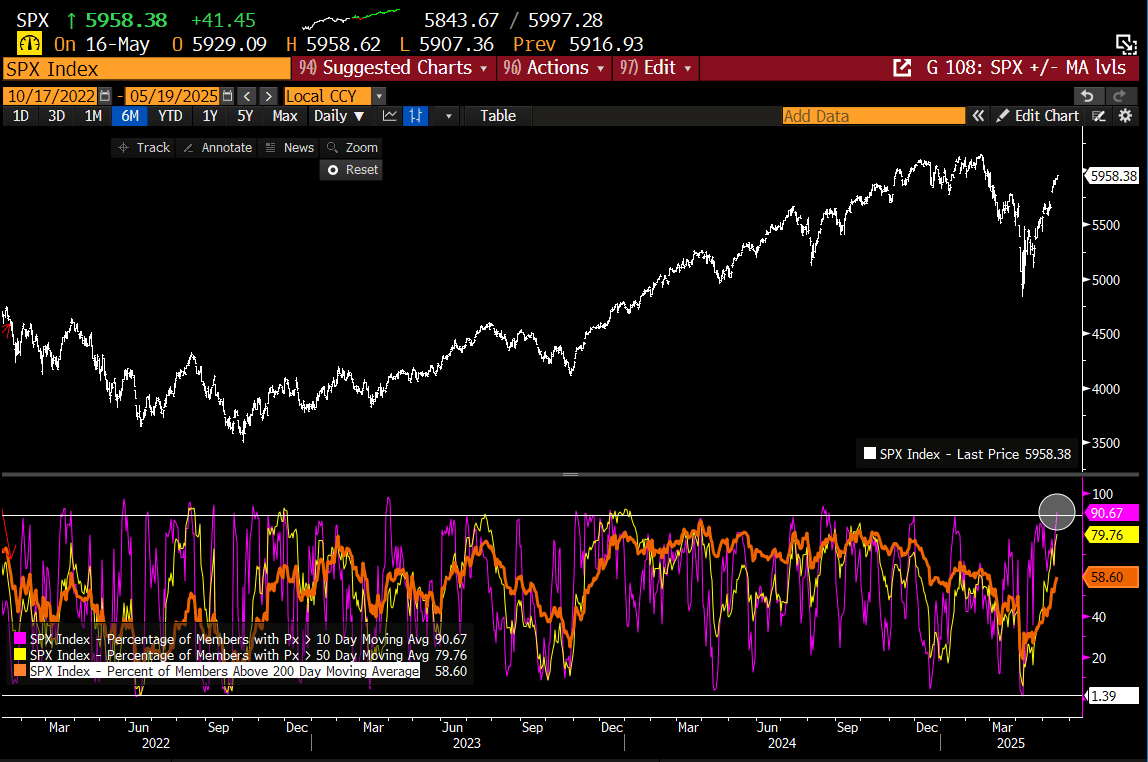

Over 90% of stocks in the SPX are trading above their 10-day moving averages—an extreme reading that historically tends to revert.

The SPX McClellan Oscillator (MO) remains elevated but is failing to make new highs alongside the index, showing negative divergence—a potential early warning sign of a market downturn.

The Nasdaq MO is showing a similar negative divergence.

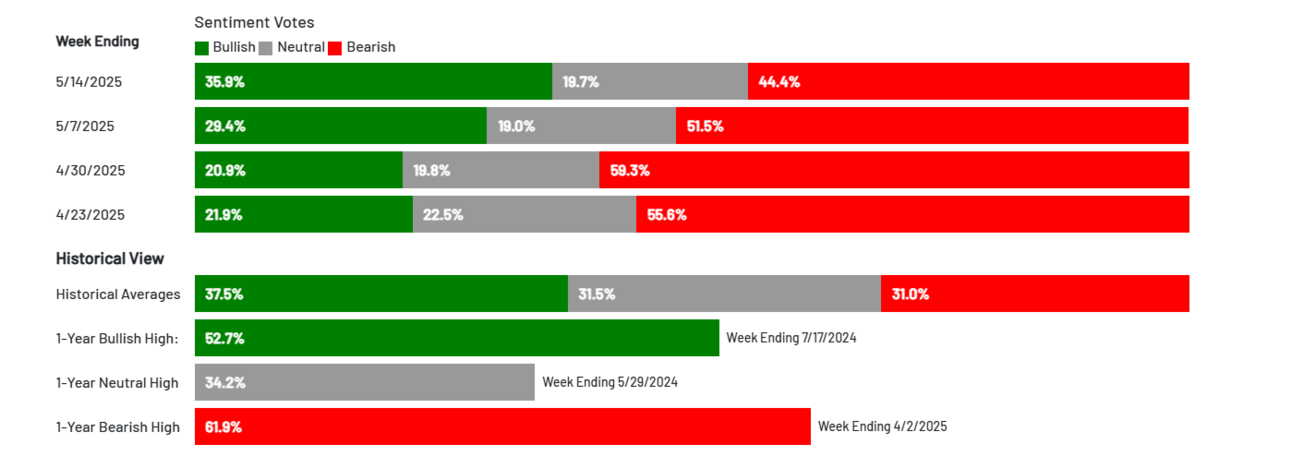

Sentiment per the AAII finally saw reversion as individuals have become less bearish and more bullish vs. the last survey.

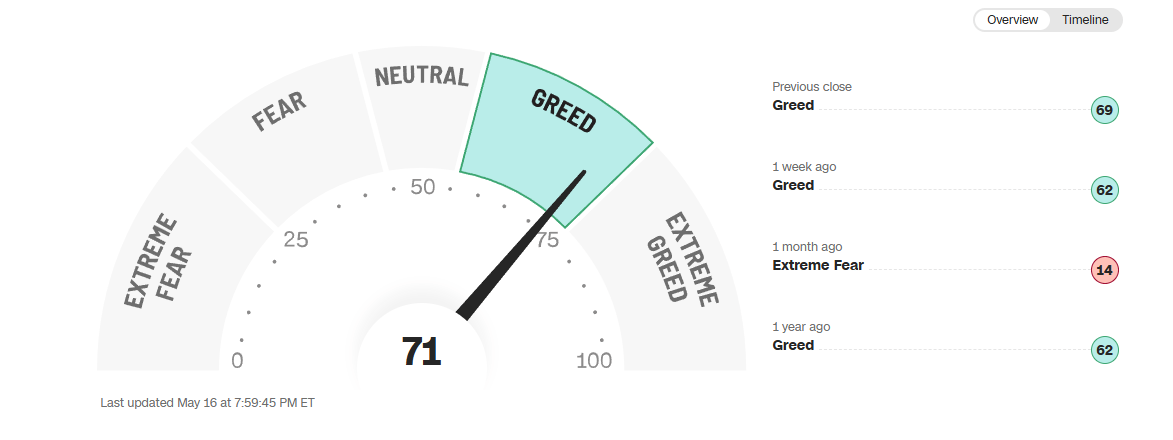

The CNN Fear and Greed Index is back into the “Greed” bucket.

Interestingly, the NAAIM Exposure Index declined last week. Regardless, sentiment is no longer a major tailwind.

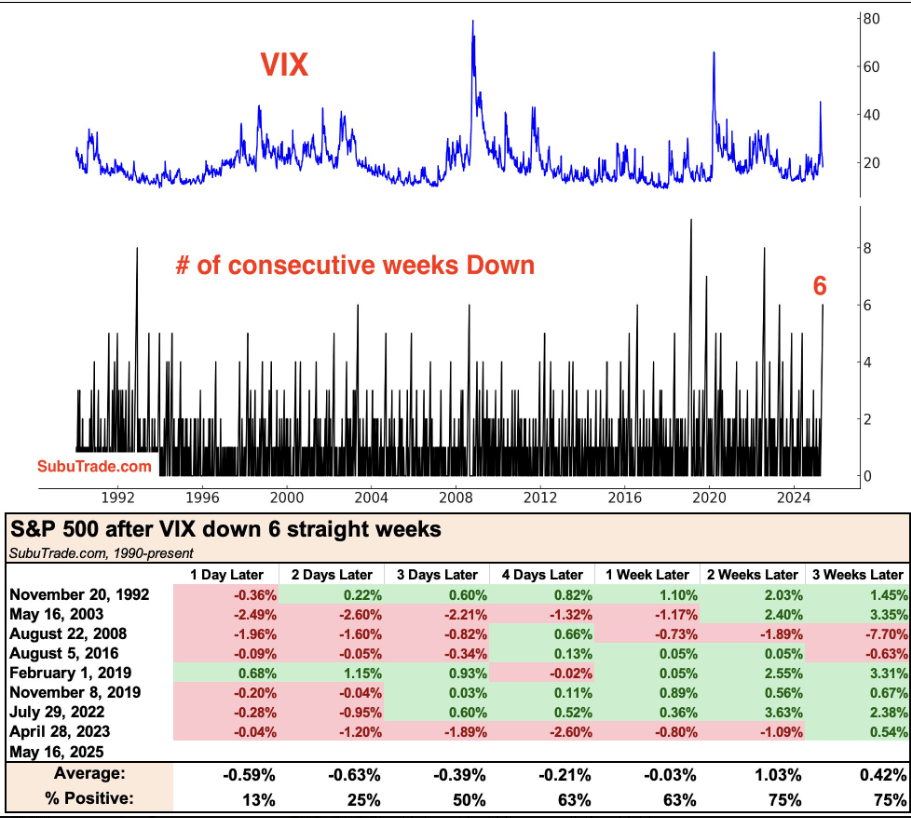

This chart from @Subutrade suggests we should expect choppy near-term waters after the VIX declines for six straight weeks.

Crypto

Bitcoin has been forming a bull flag over the past two weeks. Although it attempted a breakout over the weekend, it has yet to do so convincingly. Upside potential appears limited to the all-time highs, with a risk of failure beforehand, as RSI is showing negative divergence and the MACD has recently crossed down.

The DeMark count stands at 9, implying a combo 13 sell can occur in four days. We would consider selling or trimming on that signal.

Ethereum failed at the 200 day/50% retracement level. The rejection seems mild, but the MACD is now beginning to cross bearishly. This likely consolidates in the near term before resuming the uptrend.

The DeMark 9 sell never perfected and has now started a new buy count (6 days from a 9 buy).

Conclusion

As we finish this report, futures are down following Moody’s credit downgrade—an unsurprising reaction given the market’s recent overheated condition and vulnerability to a reversal. Often, all it takes is a catalyst. DeMark signal alignment across major indexes, combined with overbought indicators and corroborating internal breadth, has us growing increasingly cautious. Importantly, this caution would have arisen regardless of Moody’s action; our largely quantitative analysis clearly signals a reversion is due. Markets rarely move in a straight line, and while we anticipate a near-term pullback, we don’t expect the correction to be severe.

Our reversal target, detailed in the 5/14 report, centers around a potential test of the 200-day moving average and the “China Tariff” pause gap fill zone between 5690-5790 on the SPX. We view dips into this area as attractive buying opportunities. As always, price action around these key levels will reveal the true strength of the rally. To date, price has guided us well, keeping us on the right side of the trend. Should the market decisively break below this zone, it would cast doubt on the rally’s sustainability. Until then, the bullish case remains intact.

Given the evolving nature of tariff negotiations, we remain vigilant to all outcomes. Should progress stall or deteriorate, downside risks would increase, making our identified support levels vulnerable. However, nothing in our current analysis suggests that scenario is imminent. For now, we maintain our course and plan to buy opportunistically on meaningful pullbacks.

That’s it for us. Have a great week!

CSC Team

Coiled Spring Capital LLC, Founder

http://www.coiledspringcapital.com

Terms of Subscription and Service of Coiled Spring Capital, LLC.

All subscribers (“You”) to Coiled Spring Capital, LLC (CSC) services hereby agree to the following terms of use of the services provided by CSC.

You acknowledge that CSC and all individuals or affiliates associated with CSC are not licensed nor serving as an investment advisor or broker dealer with respect to you. CSC does not recommend or suggest which securities You should buy or sell for yourself. You agree that CSC shall have no liability whatsoever for investment or other decisions based upon any content provided in the service or any contrarian view of any content. All investment decisions are solely made by You.

None of the information contained from time to time while You are a subscriber constitutes a recommendation of a particular security, portfolio, transaction or investment strategy is suitable for any specific person. You specifically agree by subscribing to this service that under no circumstances shall CSC be liable for any loss or damage of any kind whatsoever by your reliance upon information obtained from CSC’s website. You acknowledge the fact that stock trading involves risk and is not suitable for all investors, including You.

All opinions are based upon information considered reliable but

You acknowledge that CSC does not warrant the completeness or accuracy of such information. While efforts are made to ensure the accuracy of such information, CSC is under no obligation to update or correct any such information. All information is subject to change without notice.

CSC engages solely in general trading information and education and is not based upon any specific investment objectives of a particular subscriber. You should not rely solely on the information provided by CSC. Instead you should use the information as a starting point for doing additional independent research in order to form your own opinion regarding investments. You should always check with your licensed financial advisor, tax advisor or other professional in order to determine the suitability of any investment.

You must not assume that the information provided by CSC will be profitable or that the information will not result in losses. Past results of information provided by CSC are not indicative of future returns. Individual trading results will vary.

DISCLAIMERS AND MANDATORY ARBITRATION OF DISPUTES

CSC MAKES NO REPRESENTATIONS OR WARRANTIES WITH RESPECT TO THE INFORMATION PROVIDED. ALL INFORMATION PROVIDED IS ON AN “AS IS”, “AS AVAILABLE” BASIS, WITHOUT REPRESENTATIONS OR WARRANTIES OF ANY KIND WHATSOEVER TO THE FULLEST EXTENT PERMITTED BY LAW. CSC DISCLAIMS ANY AND ALL REPRESENTATIONS AND WARRANTIES, WHETHER EXPRESS, IMPLIED, ARISING BY STATUTE, CUSTOM, COURSE OF DEALING, COURSE OF PERFORMANCE OR IN ANY OTHER WAY. CSC DISCLAIM ALL REPRESENTATIONS AND WARRANTIES OF TITLE, NON-INFRINGEMENT, MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE OF THE INFORMATION PROVIDED OR THAT THE CONTENT OF THE INFORMATION PROVIDED IS ACCURATE, COMPLETE OR CURRENT. CSC DOES NOT REPRESENT OR WARRANT THAT THE INFORMATION AND ANY TRANSMISSIONS SENT FROM CSC IS FREE OF ANY HARMFUL COMPONENTS, INCLUDING BUT NOT LIMITED TO COMPUTER SOFTWARE VIRUSES. YOU HEREBY AGREE TO THE HEREINABOVE MENTIONED DISCLAIMERS.

TO THE FULLEST EXTENT PERMITTED BY LAW, CSC ON ITS OWN BEHALF AND ON BEHALF OF ITS OWNERS, DIRECTORS, OFFICERS, EMPLOYEES, AGENTS, SUPPLIERS AND AFFILIATES EXCLUDE AND DISCLAIM LIABILITY FOR ANY LOSSES AND EXPENSES OF ANY NATURE WHATSOEVER, INCLUDING BUT NOT LIMITED TO DIRECT, INDIRECT, GENERAL, SPECIAL, PUNITIVE, INCIDENTAL OR CONSEQUENTIAL DAMAGES, LOSS OF USE, INCOME OR PROFIT, LOSS OF OR DAMAGE TO PROPERTY, CLAIMS OF THIRD PARTIES FOR INDEMNICATION OR SUBROGATION OR OTHERWISE WHETHER LIABILITY IS BASED UPON CONTRACT, TORT OR STRICT LIABILIY OR ANY OTHER BASIS. YOU AGREE TO THESE DISCLAIMERS BY USE OF THE WEBSITE SUBSCRIPTION.

APPLICABLE LAW IN SOME STATES MAY NOT ALLOW THE LIMITATION OF CERTAIN WARRANTIES, SO ALL OR PART OF THIS DISCLAIMER OF WARRANTIES MAY NOT APPLY TO YOU.

MANDATORY ARBITRATION AND WAIVER OF JURY TRIAL.

YOU AGREE THAT ANY AND ALL DISPUTES BETWEEN YOU AND CSC SHALL BE SUBJECT TO BINDING ARBITRATION PURSUANT TO THE FEDERAL ARBITRATION ACT OR COMPARABLE STATE ARBITRATION IF THE FEDERAL ACT IS FOR ANY REASON DETERMINED NOT TO BE AVAILABLE. IF NO STATE HAS SUCH ARBITRATION AVAILABLE THEN THE PARTIES HEREBY AGREE TO USE THE AMERICAN ARBITRATION ASSOCIATION SERVICES. THE VENUE FOR ANY SUCH ARBITRATION SHALL BE IN THE STATE OF TEXAS AND THE CITY OF AUSTIN.

YOU AGREE TO WAIVE YOUR RIGHT TO A COURT OR JURY TRIAL AND TO PARTICIPATE IN ANY CLASS ACTION.