Happy Memorial Day to those celebrating! CSC is officially on vacation through early next week, so our reports will be abbreviated during this period. If market developments remain quiet, we may skip the mid-week update. Enjoy the unofficial start of summer!

Table of Contents

Introduction

As for the markets, our 5/18 report couldn’t have been more clear—or more precise.

We wrote:

“Our reversal target, detailed in the 5/14 report, centers around a potential test of the 200-day moving average and the ‘China Tariff’ pause gap fill zone between 5690–5790 on the SPX. We view dips into this area as attractive buying opportunities.”

On Friday, the SPX did exactly that—testing our range and the 200-day MA before bouncing.

Last weekend, we suggested the stock market was due for a pause and likely retracement following a torrid 23% rally off the SPX April lows (yes, we called those lows—see our 4/6 report). That reversal arrived right on cue, with major indexes sliding 2–3% last week.

We noted that this area would attract buyers—and despite Friday’s tariff-related headlines, which could have driven stocks lower, buyers stepped in right where it mattered, pushing prices off the lows. Price action often tells a more honest story than the headlines, and this was a perfect example. Over the weekend, tariff anxiety eased as Trump announced a pause on European tariffs until July 9th.

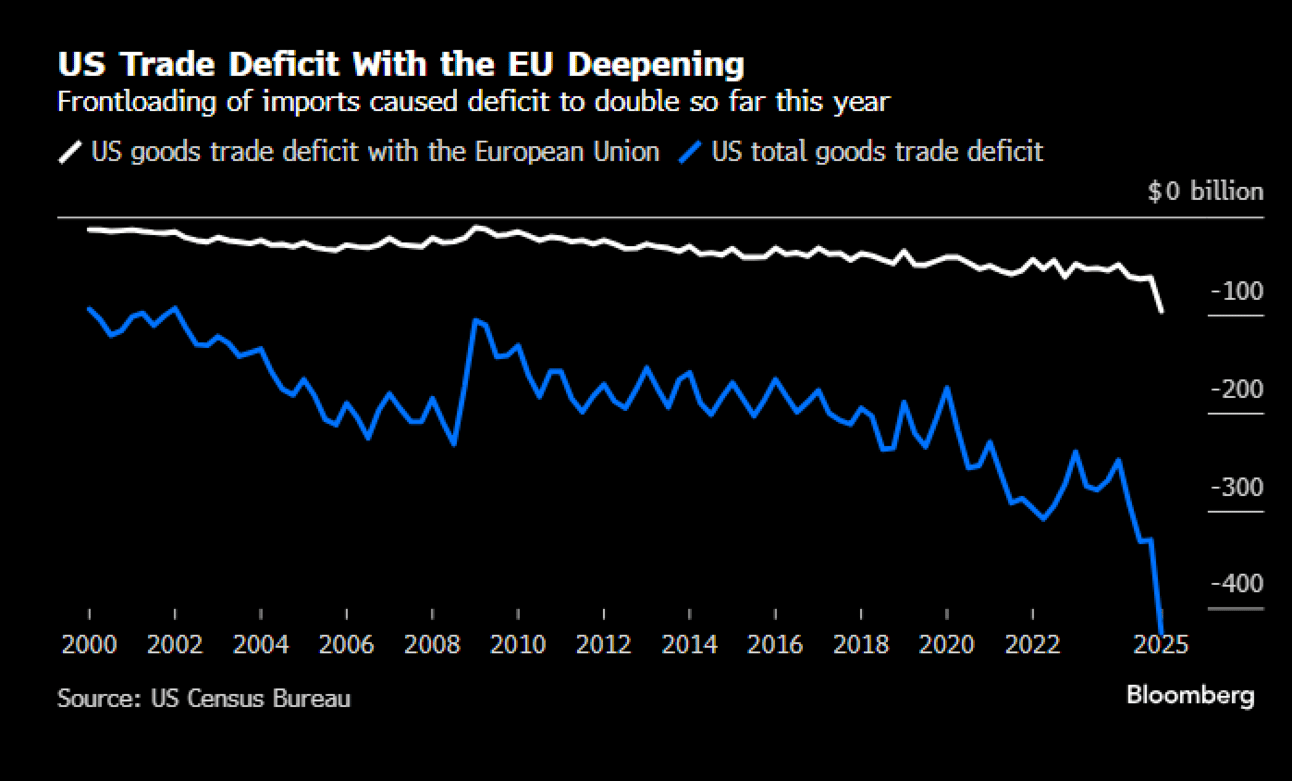

Trump’s proposed 50% tariff would impact $321 billion in U.S.-EU trade, potentially reducing U.S. GDP by nearly 0.6% and pushing prices up by more than 0.3%, according to Bloomberg Economics. While an amicable resolution remains the ideal outcome, how this plays out is uncertain. That said, the EU’s reaction to Trump’s aggressive stance—and his subsequent conciliatory response—suggests a willingness to negotiate and avoid the most economically damaging path. This development should be viewed constructively as we approach the expiration of the 90-day tariff pause, and it likely means future tariff headlines will provoke more tempered market responses.

This remains an extremely challenging environment for short sellers, especially those leaning on valuation arguments. At 22x forward earnings, the market may appear expensive, and each negative tariff headline seems like an opportunity to press downside bets. But so far, that thesis hasn’t paid off. According to S3 Partners, short interest has steadily increased since the start of the year and continued rising after the early April selloff. This buildup in bearish positioning could become fuel for a sharp countertrend move if anticipated downside fails to materialize—especially with dip buyers stepping in at key technical levels.

The biggest risk, as we've repeatedly noted, continues to come from the rates market. We highlighted this extensively in last week’s report: long-end yields need to stabilize for the market to remain on firm footing. Since our 5/21 update, yields have eased somewhat, but they remain stubbornly elevated. Notably, the 30-year Treasury yield broke out to new cycle highs last week and has since retested and held that breakout level. From a technical perspective, this does not yet look like a chart that’s ready to reverse. We’ll dig deeper into this shortly.

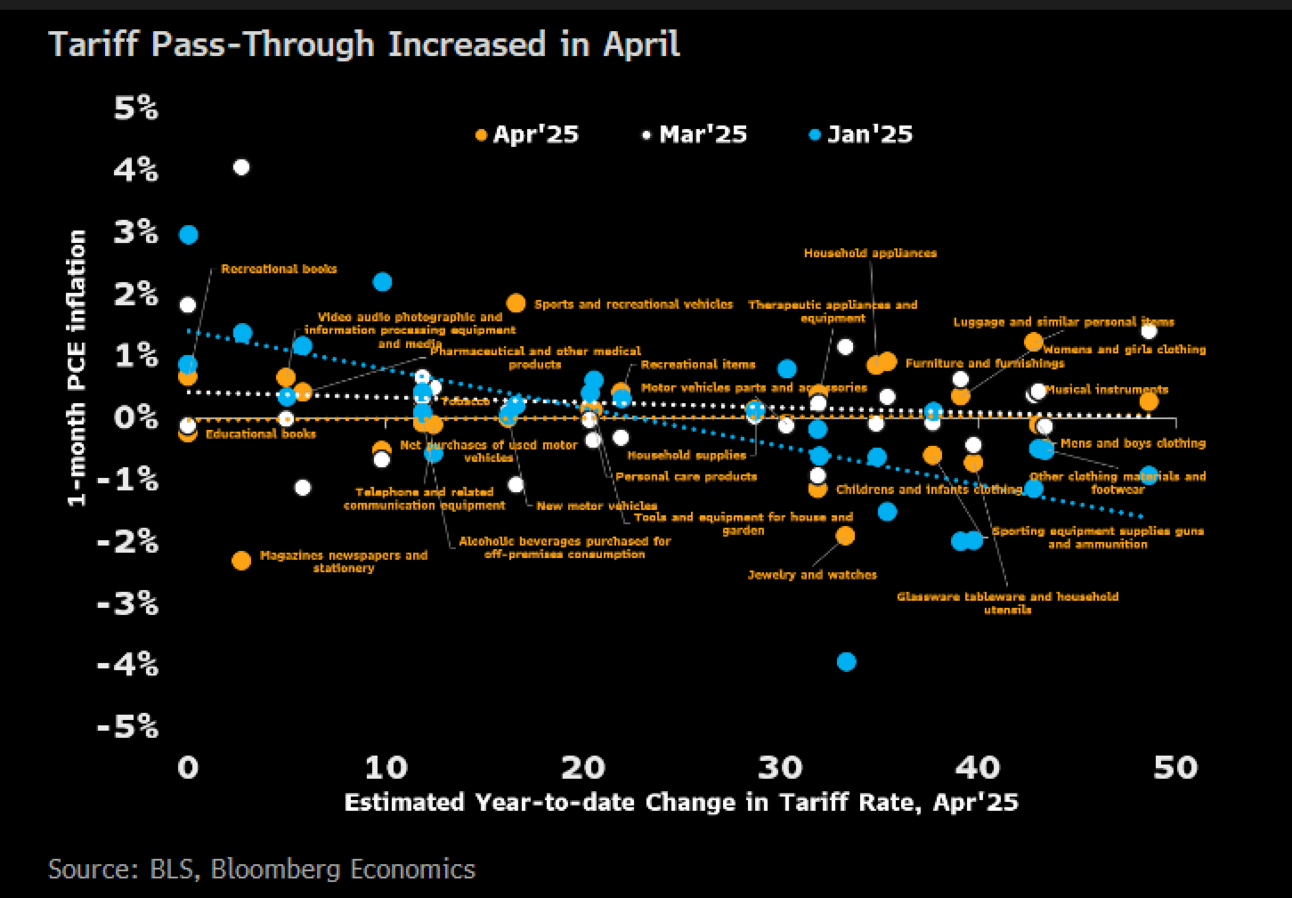

This week’s FOMC minutes and the PCE inflation report have the potential to further sway the rates market, possibly injecting additional volatility into an already fragile market backdrop. While the FOMC minutes are unlikely to reveal anything new regarding the Fed’s rate-cut trajectory, the PCE report could carry more weight. A soft PCE print would likely reflect weakening economic conditions—particularly on the consumption front, where real spending momentum is clearly fading. Tariff pressures appear to be hitting households, and this type of disinflation—the kind driven by slowing demand rather than easing supply constraints—is the "bad" kind. If growth fears begin to mount, it could weigh more heavily on investor sentiment and risk assets.

Before the PCE report, all eyes will be on NVDA. While the AI trade has taken a backseat in recent weeks, semiconductors have quietly resumed leadership since the April lows. NVDA’s earnings will serve as a key data point heading into the summer, especially in a market currently testing key support levels. A strong or weak print could inject significant volatility into an already fragile tape, potentially shaping the near-term narrative for both tech and the broader equity market.

Let’s check the charts.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade