Table of Contents

Introduction

In Dragons Love Tacos by Adam Rubin, dragons devour tacos with boundless enthusiasm—but they can't tolerate spicy salsa. When a boy mistakenly serves them tacos laced with the forbidden heat, chaos erupts as dragons unleash fiery destruction. The story delivers a humorous but pointed lesson: failing to understand others’ sensitivities can lead to unintended and explosive consequences.

In 2025, the acronym “TACO”—short for Trump Always Chickens Out—surfaced as a shorthand for President Trump’s recurring pattern of announcing sweeping tariffs only to walk them back days later. This erratic posturing has injected volatility into markets, giving rise to the so-called “TACO trade”—a tactical play on the predictable cycle of sell-offs and relief rallies. The pattern reveals the deeper cost of policy inconsistency for markets.Just as the boy’s salsa oversight ignited mayhem, the administration’s tariff theatrics have sown confusion and diplomatic strain.

Last week, a CNBC reporter introducing the “TACO” acronym seemed to provoke a return of Trump’s hardline rhetoric, reigniting threats toward nations perceived as stalling trade negotiations. Yet, surprisingly, markets took the renewed bluster in stride: Friday opened lower but closed at session highs. Was this the TACO trade at work again, or simply a case of routine month-end rebalancing?

Regardless, the outcome capped one of the strongest Mays for the stock market in 35 years—and the best monthly performance since November 2023.

So much for the bear case—it's been steamrolled by relentless momentum off the April lows. Whether the move is justified is beside the point. Our focus isn’t on why markets behave the way they do, but on what they’re doing. Chasing narratives can be costly; price action speaks louder than theory.

Since the April lows, the S&P 500 is up over 23%, and for those who knew where to look, the market has offered ample opportunity to generate alpha.

If you're constantly searching for reasons to be bearish, the monthly chart of the S&P 500 isn’t one of them. The massive hammer reversal off the December 2021 high pivot, followed by a decisive reclaim of the bullish monthly consolidation that’s been building since last September, paints anything but a bearish picture.

Taking a 10,000-foot view is essential when assessing the dominant trend—and right now, that trend continues to support higher prices over the intermediate term.

The bears are quick to point out what they see as a developing head and shoulders top in the S&P 500. We highlighted this potential back in April—well before it became a popular talking point. Now, many are warning their clients that a breakdown is imminent, which would complete the pattern’s right shoulder.

While that outcome is possible, we believe the setup leans more bullish. There are short-term conditions that would need to resolve lower before we give serious weight to the bearish scenario—conditions we'll break down in detail later.

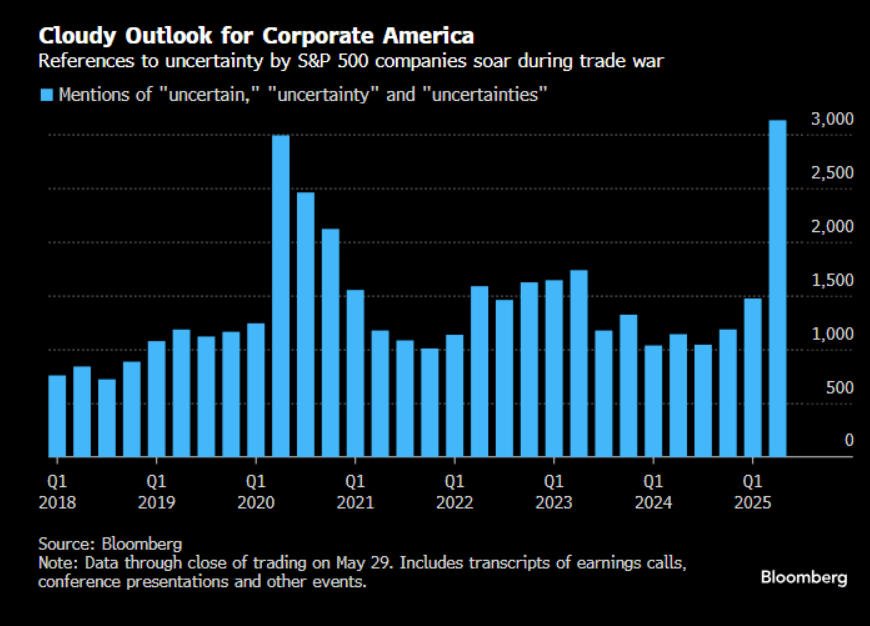

Last week’s PCE and NVIDIA reports barely moved the needle in market price action. PCE came in softer than expected, and NVIDIA delivered yet another strong print, keeping AI enthusiasm alive. Yet despite these supportive data points, corporate America continues to cite uncertainty at levels not seen in years.

So much for logic driving this rally—just as we explored in our recent note, “Logic is Overrated.”

And just like that, big tech is back. That’s not bearish—far from it. Given their outsized weight in the index and the strength of their spending, the health of these names is critical to the broader market narrative.

According to Bloomberg, the “Magnificent Seven” have outperformed the S&P 500 over the past eight weeks and are responsible for more than half of the index’s gains since the April bottom. When these stocks are humming, it’s hard to make a convincing bearish case.

Our call over the past two weeks was straightforward: expect consolidation to work off some overheated indicators, with dips presenting buyable opportunities within clearly defined ranges. That outlook played out nearly to the letter—despite all the noise, the S&P 500 is right where it was when we published our May 18th report.

Here’s what we said then:

“Our reversal target, detailed in the 5/14 report, centers around a potential test of the 200-day moving average and the ‘China Tariff’ pause gap fill zone between 5690–5790 on the SPX. We view dips into this area as attractive buying opportunities.”

Last week, the market tested that zone—and buyers stepped in, forming yet another bullish consolidation above both the gap and the 200-day. As long as we’re holding above that key area, it’s hard to argue for a bearish stance.

That said, markets don’t move in straight lines, and unexpected headlines—especially over a weekend—can always disrupt the picture.

Let’s check the charts.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade