1440: Your Weekly Business Cheat Sheet

Expand your business and finance knowledge with 1440. Get clear, conversational breakdowns of the key concepts in business and finance—no paywalls, no spin. Every Thursday, 1440 delivers deep dives, interactive charts, and rapid market rundowns trusted by 100k+ professionals.

Table of Contents

Introduction

What a Week. When stock markets break out to all-time highs (ATHs), it’s more than just a number—it’s a moment. It marks progress, innovation, and above all, prosperity. These milestones deserve recognition because they signal that capital is flowing into growth, confidence is high, and the market is rewarding risk.

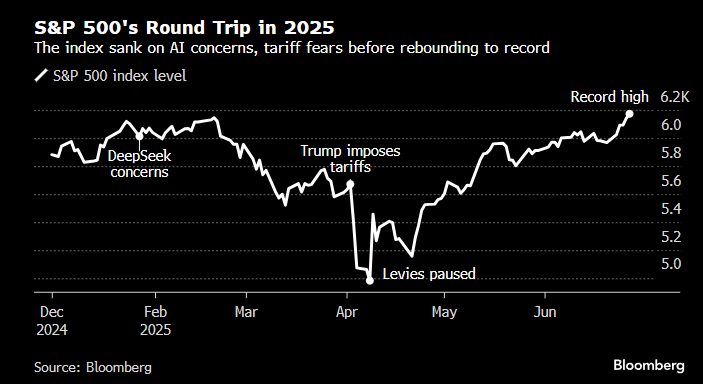

If you’re active in the markets and not participating in this powerful bull run, you’re fighting the trend—and that rarely ends well. Staying aligned with the dominant trend is the single most important principle of successful investing. That’s the core of our process. We've maintained a bullish stance since our April 6th report—just one day before the U.S. equity markets bottomed. The trend remains up, and we continue to ride it.

A few weeks back, we noted that the SPX looked poised to test its all-time highs following a decisive weekly candle breakout above a simple downtrend line from the prior peak. Sometimes the cleanest technical setups are the most powerful—don’t underestimate simplicity. That breakout came after a tight three-week consolidation and has since powered the index another 3% higher. While bears argue this is the last gasp of strength before a reversal, we see that as more hope than thesis. Momentum is building, not fading.

Technical analysis is, at its core, a study of patterns that reveal the ongoing tug-of-war between supply and demand. You don’t need to overanalyze the chart above to understand what it’s telling us—it’s bullish. Price is the ultimate judge and jury in our process, and new all-time highs (ATHs) speak for themselves.

Let’s be clear: indexes don’t make new highs in bear markets. Yes, bear markets often start from ATHs—but that requires a meaningful catalyst or an exogenous shock. Whether that risk materializes tomorrow, next month, or next year is unknowable. What is knowable is this: trying to call a top in anticipation of some hypothetical event is one of the most costly mistakes investors make. As Peter Lynch famously said:

“Far more money has been lost by investors trying to anticipate corrections than in the corrections themselves.”

With that in mind, we respect market inertia. A market in motion tends to stay in motion. A breakout to new ATHs, after four months of consolidation, argues strongly for more highs to come.

Put simply: the path of least resistance is still higher.

Of course, volatility is always the cost of admission. This week alone, we’ll be contending with multiple potential catalysts—Trump’s “Big Beautiful Bill” and its likely impact on healthcare and green energy, the July 9th tariff deadline (with lingering ambiguity on potential extensions), and the ongoing uncertainty surrounding the Middle East.

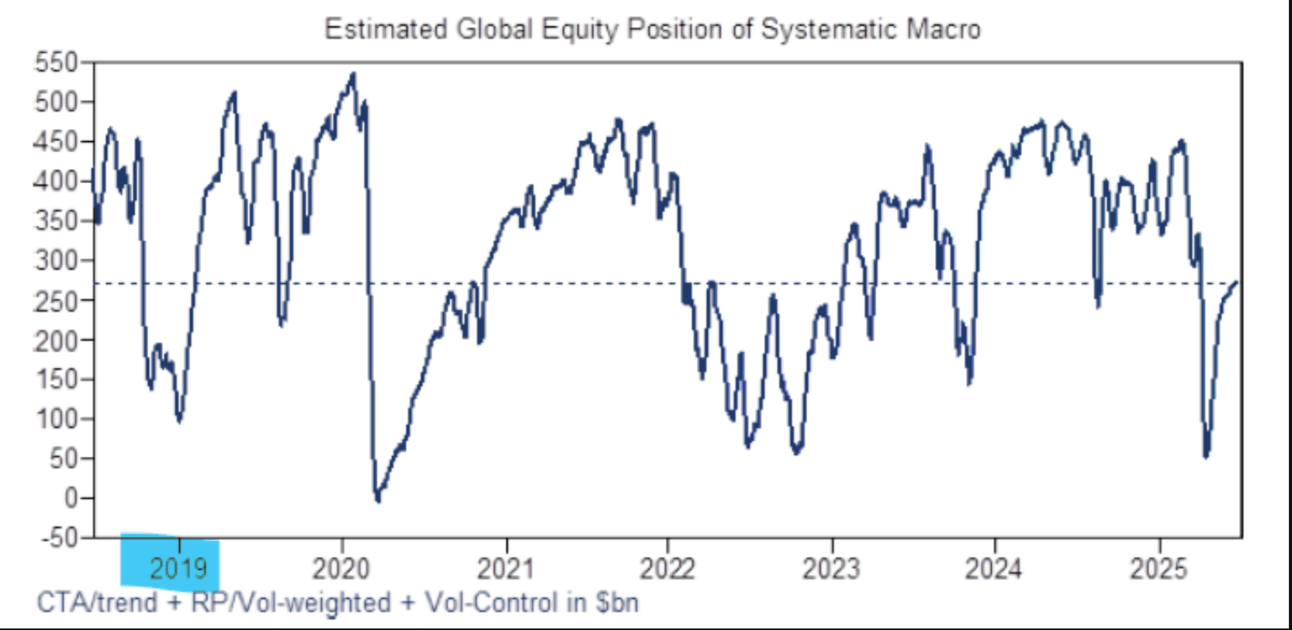

Given this backdrop, professional investors remain skeptical. That skepticism shows up clearly in sentiment indicators and in the prime brokerage positioning data we track. This Goldman Sachs chart illustrates just how neutral overall equity exposure remains. In other words, there’s still plenty of dry powder on the sidelines.

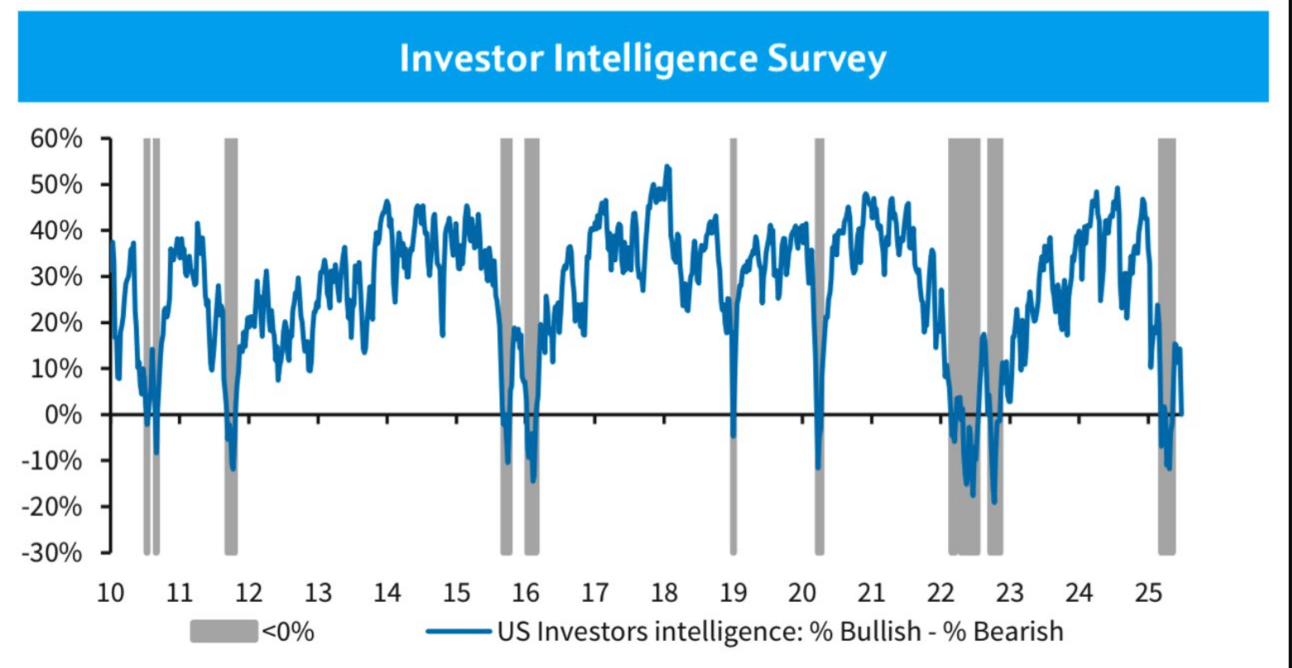

Mainstream financial media remains skeptical of the rally, as reflected in the Investors Intelligence Survey, where professional newsletter writers continue to lean cautious—even as price moves higher.

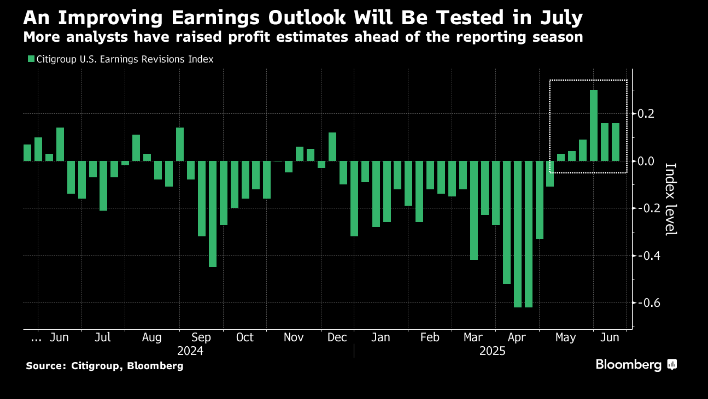

Meanwhile, the Citigroup U.S. Earnings Revision Index has now been positive for six consecutive weeks—the longest streak since early 2024. Even more impressive, the past three weeks have posted the strongest readings since March 1. Consensus estimates now project S&P 500 earnings to grow 7.1% this year, with further acceleration expected in 2026. In our experience, stock prices ultimately follow the direction of earnings—and right now, that trajectory is up.

While we can’t say with certainty that these earnings forecasts will materialize, stretched valuations leave little margin for error—any disappointment could trigger meaningful downside.

There will always be something to worry about—unexpected risks are part of the investing terrain. Markets like to climb a wall of worry, and right now, that wall is tall. But despite the headlines, the market is breaking out to new all-time highs. That’s not bearish. Price is sending a clear message—are you listening?

Our mission is to keep readers aligned with the trend. Successful investing isn't about having the perfect narrative—it’s about being on the right side of price. If you respect the trend, the returns will follow.

Plenty more to unpack. Let’s dive into the charts.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade