Table of Contents

Introduction

We’ll admit it—finding a unifying theme for each week’s report isn’t always easy. Under the Trump administration, markets can shift as quickly as the headlines, and the crosscurrents are constant. Landmines abound, making the prediction business a humbling one. It’s all too tempting to draw directional conclusions from the news cycle, but time and again, markets have a way of defying the obvious and catching even seasoned investors off guard.

The speed of this year’s rebound—rallying from the lows to fresh all-time highs in under 60 days—has been nothing short of remarkable. It’s left many professional managers scrambling to catch up after missing the early move. We don’t envy their task: staying exposed enough to participate in upside while managing downside risk is an incredibly difficult balancing act.

Our goal each week is to cut through the noise and go beyond the headlines—to dig into the data, sentiment, and price action to uncover what’s really driving the market. Not to predict the future, but to challenge assumptions and help our clients make more informed, adaptive decisions.

Last weekend, for example, we flagged signs of fatigue in the rally and said we were shifting from an aggressive stance to a more opportunistic one. That call was based on multiple indicators suggesting a near-term pause was likely. So far, that’s played out—with all major indexes pulling back last week, and dip-buyers outperforming those who chased strength.

On the surface, last week’s pullback in the indexes appears benign—typical consolidation within an ongoing bull trend. We’d agree, especially given the weekly Doji candle that formed after breaking out to new all-time highs. In technical terms, a Doji represents indecision and balance between buyers and sellers. It can signal either the end of a trend or simply a pause before continuation. That raises the key question: which is it this time?

We can never know for certain which way the wind will blow—which is exactly why we look across the full spectrum of assets and indexes for clues. Sometimes the signals are crystal clear; other times, they’re conflicting and noisy, making it difficult to decipher what’s really happening beneath the surface. Whoever said the prediction business was easy?

To the casual observer watching headlines flash across their TV screen or browser, the story seems simple: the market is strong, and everything is fine. But those of us who live in the tape know better. In fact, the past two weeks have quietly been among the worst stretches of the year for high beta portfolios.

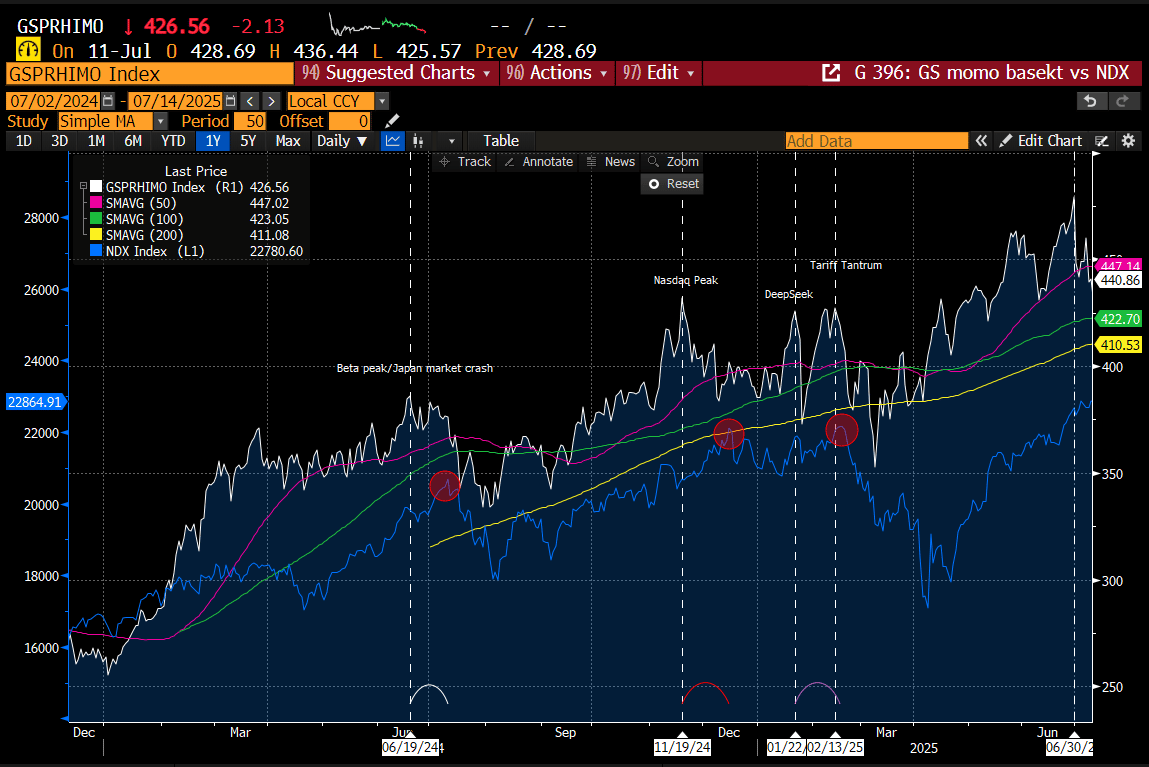

We can already hear the skepticism—after all, the SPX just tagged new highs earlier this month and is less than 0.4% off last week’s all-time high. But the damage beneath the surface is real. Our preferred proxy for this dynamic—the Goldman Sachs High Beta Momentum portfolio, which closely mirrors the factor-based positioning of many hedge funds—is down nearly 12% since the end of Q2. That’s the worst run since February’s tariff-driven tantrum.

While we don’t have access to Goldman’s proprietary positioning data, we can still extract meaningful insight from what we can observe. The takeaway is clear: hedge funds heavily exposed to popular high-beta momentum strategies are experiencing elevated volatility, often triggering forced unwinds.

This type of momentum disruption typically leads to a cascade of issues, including—but not limited to:

Large losses

Negative beta exposure

Liquidity stress

Hedging and timing dislocations

We refer to these events as momentum breaches—moments when the internal market structure loses its balance. While these breaches don’t guarantee a market-wide drawdown, they often precede one. That’s because they erode the underlying confidence and positioning equilibrium that holds the market together. Eventually, a macro catalyst—often seemingly unrelated—cracks the dam.

The chart below highlights the last four instances where we observed this type of momentum dislocation. We've also measured the number of days it took for the Nasdaq to peak following these episodes (excluding the February “Tariff Tantrum,” in which the Nasdaq peaked two days later). In the remaining three instances, the Nasdaq peaked 15, 19, and 18 days later, respectively.

By that historical rhythm, a potential Nasdaq peak could materialize between July 21st and 25th.

While this is a hypothetical scenario, it’s one worth considering—especially when weighed against the broader body of evidence we’ve been tracking. We’ll revisit that in more detail shortly.

In the meantime, this week also marks the unofficial kickoff to earnings season. Notably, both Q2 and Q3 estimates have been trending lower since the last earnings cycle, effectively lowering the bar for companies to deliver upside surprises.

Looking further out, 2025 and 2026 annual estimates have also been ratcheted down meaningfully since the start of the year. This suggests that forward guidance is now more achievable, giving companies additional room to “beat and raise.” Historically, earnings season tends to act as a positive catalyst for equities, and with expectations reset lower, this could help keep a bid under the market as we move through the bulk of corporate results.

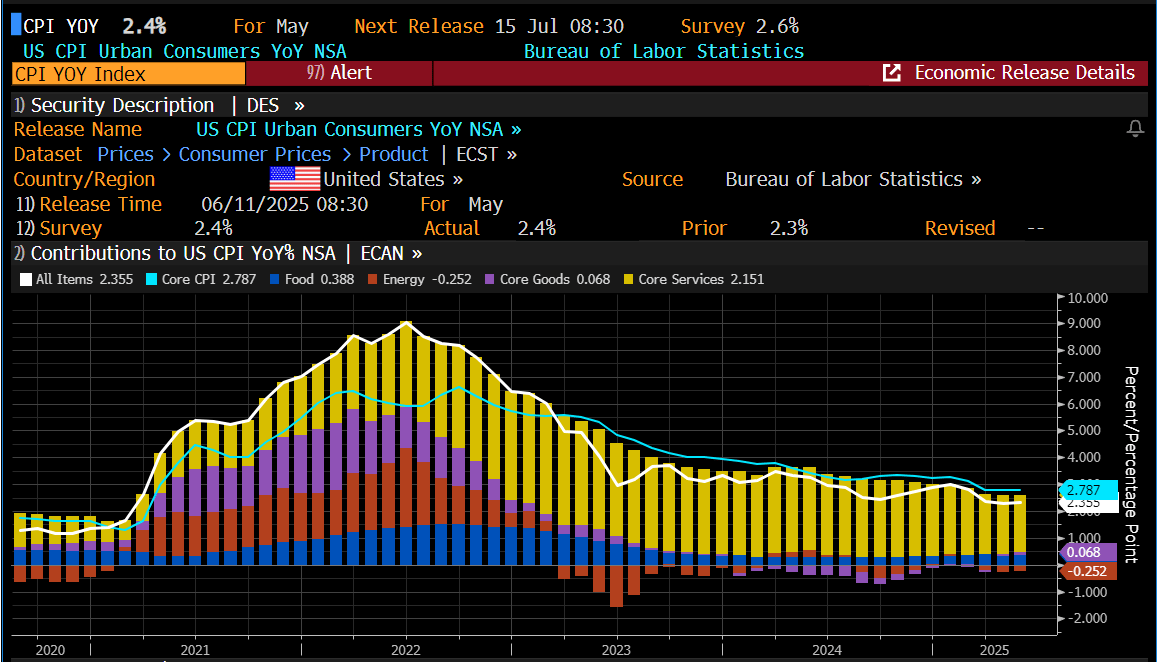

This week’s inflation reports—CPI and PPI—carry the potential to disrupt the market’s current equilibrium. While Trump’s delay of reciprocal tariffs may push out inflationary pressures by a few months, the renewed escalation in tariff rhetoric over the past week could amplify the market’s reaction to any deviation from consensus expectations.

June’s CPI is anticipated to come in soft overall, and even a mild uptick in PPI likely won’t meaningfully impact the PCE reading later this month—which remains the Fed’s preferred inflation gauge. As such, we don’t expect this week’s data to shift the bond market’s outlook meaningfully toward additional rate cuts in the near term.

All of this sets the stage for an action-packed week—one that could very well set the wheels in motion for the market’s next major directional move.

Is it time to tap the brakes or hit the accelerator?

Let’s turn to the charts and find out.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade