The Market Closes Early Tomorrow — And So Does This Offer

As a quick heads-up: U.S. markets will close at 1 PM ET tomorrow and remain closed on Friday. There will be no formal MR report tonight, but below the paywall you’ll find a brief SPX update we’ll expand on over the weekend.

Now for the good stuff.

We’re offering a private 25% discount on our Idea Tier annual subscription — exclusively for current newsletter subscribers who haven’t yet upgraded.

This tier houses our highest-conviction trade ideas — and the results speak for themselves.

✅ Our idea portfolio continues to outperform (see stats below). ✅ We are leaning into the recent market rally with 19 single-stock and 23 option open positions that are performing quite well. ✅ Beyond that, we’ve delivered several long-term setups via the newsletter — names like $UBER (+40%) and $MU (+50%) before trimming into strength. Other ideas have gained +10%, +30%, +50%, +150%, and many more — with only one position currently underwater.

**These long-term newsletter-only ideas are not even included in our official performance sheets.

We publish research here twice a week — actionable, timely, guiding us through this historic market run. When the market is firing on all cylinders, we aim to be max long — and our idea-tier shows you how.

📈 If you’re looking for ways to capitalize on this environment — this is your moment.

See below the performance of our closed ideas since inception:

Stock only

Option Only

Even with the 20% market decline in April, our Idea Tier portfolio is still printing all-time highs — a testament to the process, not luck.

Every trade is time-stamped and transparent — no fluff, no cherry-picking, just results.

The market has been on fire lately, and this is exactly when you want to be pressing your advantage.

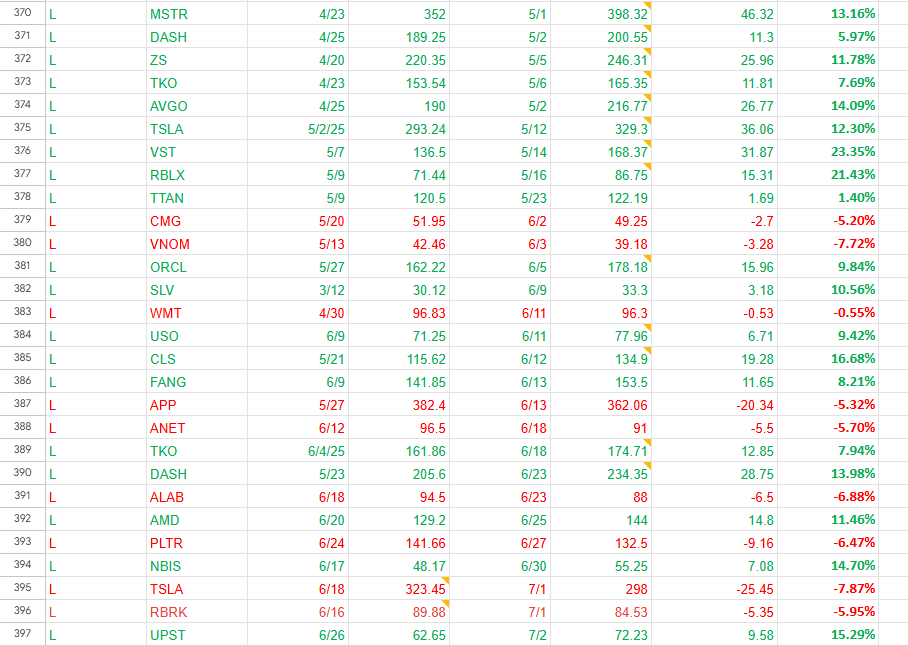

Take a look at our closed trades from the past 60 days — the scoreboard speaks for itself.

Single stocks:

Options

We aim to keep losses controlled in our single-stock portfolio by honoring stop losses. Yes, it’s frustrating to get stopped out and watch a name rip — but that’s trading. Small, manageable losses are part of the game, and protecting capital is what keeps us in the game.

The bottom line: we’re offering our subscribers multiple ways to win. This isn’t about benchmarking against the SPX (though we’re confident we’re crushing it). It’s about giving you a cost-effective, risk-managed framework to participate in the market with conviction.

Gains tend to come in bunches — and the longer you stay in the game, the more those gains compound.

If you’ve been on the sidelines or just following our free content, now’s your chance to level up.

🎯 25% off our Idea-Tier annual plan— only for current subscribers ⏳ Offer expires tomorrow at midnight

We hope you’ll join us.

As mentioned above, we did want to flag a quick update on the SPX, which you'll find posted below the paywall. It’s a key development we’ll be expanding on over the weekend.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade