Table of Contents

Introduction

The past week felt like a market version of Dodgeball—investors dodged a potential tantrum after Trump questioned Powell’s job security, absorbed a flood of bank earnings marking the unofficial start to Q2 season, and digested headlines around NVDA regaining China shipment approval. Meanwhile, inflation appeared to cool modestly, and retail sales reminded everyone the consumer isn’t tapped out just yet. After a shallow midweek dip, the market marched right back to all-time highs by Friday.

Being a bear in this market isn’t easy. Each bout of weakness is met with macro optimism or AI-driven enthusiasm, leaving skeptics with more questions than answers. But are the bullish headlines really that constructive—or are they just bricks in a growing wall of worry? The persistent grind higher may look like complacency, but perhaps it’s the bears who’ve grown complacent, waiting for a reversal that never comes.

Meanwhile, Russell 2000 futures positioning shows Non-Commercial Shorts sitting at cycle lows—an important signal as we watch for what might break the current regime.

Net Non-Commercial short positions in the S&P 500 are sitting near a four-week low and are fast approaching the levels last seen in March ‘24.

Professional Asset Manager net positioning in SPX futures indicates they are notably less long than they were at the end of 2024, even as the stock market trades at all-time highs.

Is this what you'd expect to see at a market top? We often write about lopsided sentiment—how full boats tend to capsize. But in this case, the boat doesn’t look overly crowded on the long side. If anything, sentiment remains surprisingly subdued.

NAAIM Exposure Index actually dipped again last week, suggesting that active managers aren’t chasing highs, despite the S&P printing fresh records.

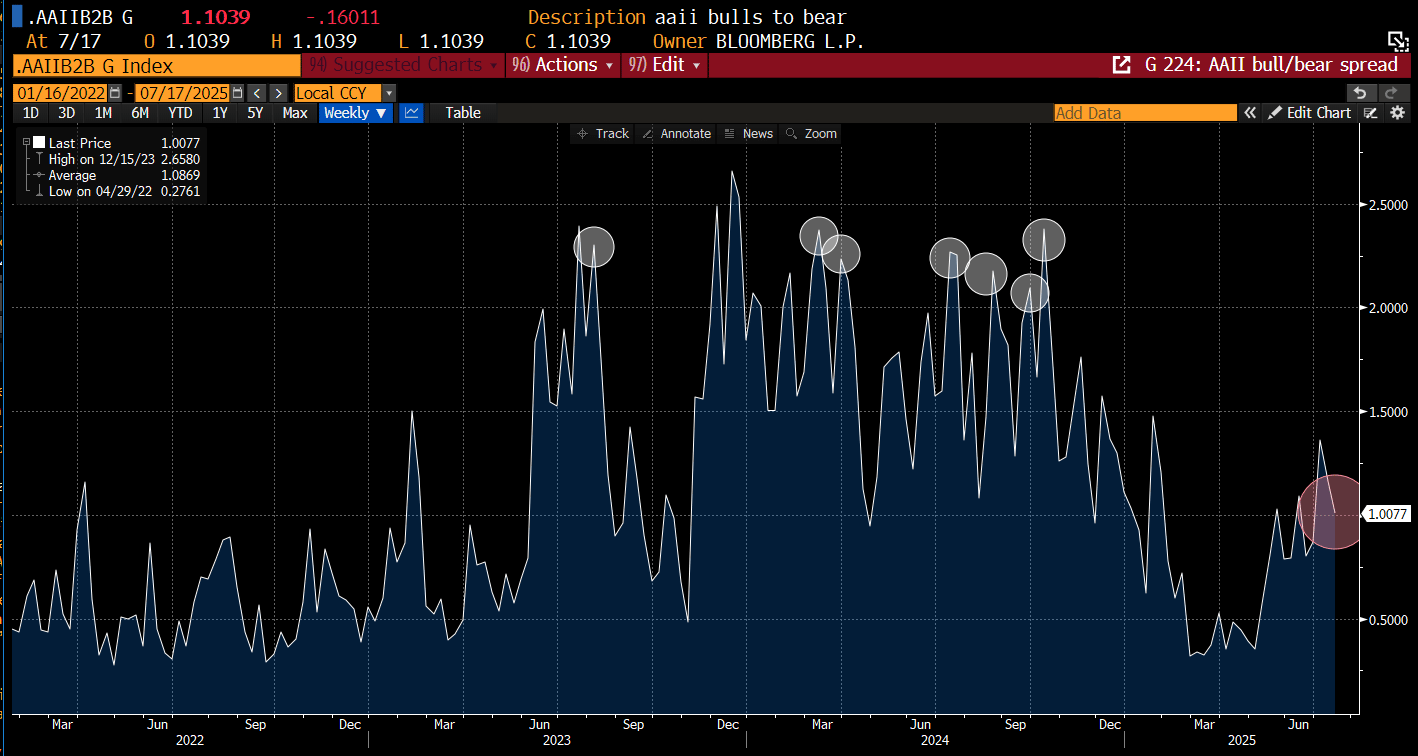

The AAII Bull-Bear Spread has also retreated back to neutral, reinforcing the idea that enthusiasm among individual investors has cooled. Taken together with low NAAIM exposure and light speculative futures positioning, it’s hard to argue that sentiment is euphoric. In fact, the market continues to climb with skepticism still intact—a dynamic that often frustrates bears and fuels further gains.

This has to be one of the more peculiar market backdrops we've seen in some time. Most professional investors are skeptical or outright bearish—yet the market grinds higher. Ironically, the one group embracing the rally is retail, who at this moment might just be the smart money. Retail trading activity has surged back above 20% of total market volume—a level not seen since the post-pandemic frenzy.

You can argue with the rally all you want—but the market doesn’t care what you think. That’s exactly why we follow price first. Wrong opinions cost money. Our job is to help clients profit when the trend is favorable, and right now, the SPX continues to grind higher. Shallow pullbacks are being bought aggressively, leaving little opportunity for under-invested managers to re-enter at attractive levels.

The chart below highlights two key accumulation indicators: On-Balance Volume (OBV) and Money Flow Index (MFI). Are there any meaningful divergences with price? We’d argue no. OBV is printing new highs, and MFI is tightly coiled—not rolling over. If real money were exiting, it would be visible here. Instead, we’re seeing signs of ongoing accumulation, not distribution. That doesn’t mean a pullback isn’t possible—but calling for a major top here looks premature.

There will always be bearish narratives—and for bulls, that’s a feature, not a bug. Doubt is fuel for bull markets. Skepticism keeps positioning in check and prevents euphoria from taking over too soon.

Right now, the bears are leaning on familiar concerns: that Q2 earnings will disappoint, valuations are stretched, the Fed won’t cut rates, and stagflation looms this summer. But none of these arguments are new, and the market has continued to climb in spite of them. In fact, it's that persistent wall of worry that may be helping extend the rally.

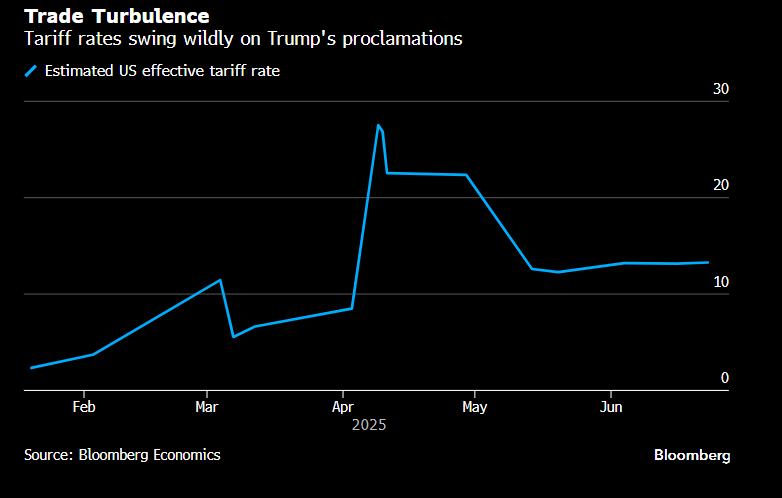

We’re not dismissing any of these risks—they all carry weight and could materialize. But if Q2 earnings and outlooks come in stronger than expected, the bearish narrative will simply shift. The focus will move to Q3 as the next “trap door.” If the economy proves more resilient through the summer, the concern will pivot to a slowdown later in the year, with tariffs supposedly working their way through to holiday pricing. The goalposts are always moving—this is the nature of skeptical markets.

Whether the Fed raises rates to fight inflation or cuts them in response to slowing growth, there will always be a prevailing narrative to justify either fear or hope. These narratives shift constantly. Our advice: tune out the noise, follow the price action, and respect the trend. That’s the core philosophy behind this report—and we hope you've found value in riding this remarkable bull run alongside us.

Now, let’s turn to the charts.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade