Stop Drowning in Market News. Focus On Making Money.

Every day: 847 financial headlines, 2,300 Reddit stock mentions, 156 Twitter trading threads, 12 IPO updates, 94 crypto developments.

Your problem isn't lack of information; you have too much.

While you're scanning headlines wondering what matters, profitable trades slip by. The signal gets buried in noise.

What if someone did the heavy lifting for you?

Stocks & Income reads everything:

Twitter traders

Reddit buzz

IPO announcements

Crypto insider takes

Crowdfunding opportunities

Market news

Then we send you only what can actually move your portfolio.

No fluff. No useless news. Just actionable stock insights in 5 minutes.

We track every source so you don't have to. You get the 3-5 opportunities worth your time, delivered daily.

Stop wasting time on useless “investing news” and start thinking critically about real opportunities in the stock market.

Stocks & Income is for informational purposes only and is not intended to be used as investment advice. Do your own research.

Table of Contents

Introduction

The stock indexes are pressing up against their all-time highs—but make no mistake: The Market is a Mess. Yes, you heard that right. The underlying metrics we track are deteriorating by the day.

Last week, we highlighted the Relative Rotation Graph showing which sectors have led since Q3 began. The message remains clear: only two sectors are in leadership mode. Nearly every other sector is lagging, leaving a very small group carrying the torch.

It’s no surprise that technology is one of them—but in truth, it’s not the entire sector doing the heavy lifting. It’s large-cap tech, and even there, leadership is narrow. The rest of the group has been rolling over or churning sideways for weeks.

This creates a clear dilemma: either the indexes “catch down” to the economic reality facing most companies—slowing growth, margin pressure, and macro uncertainty—or breadth improves dramatically to support these highs, possibly ignited by a dovish Fed.

So, which will it be? That’s the challenge. On one hand, market breadth is deteriorating; on the other, the Fed is widely expected to begin an easing cycle in September. The Fed Funds Futures market is now pricing in an 89% probability of a September rate cut, providing a potential tailwind that could keep the indexes buoyant—at least in the short term.

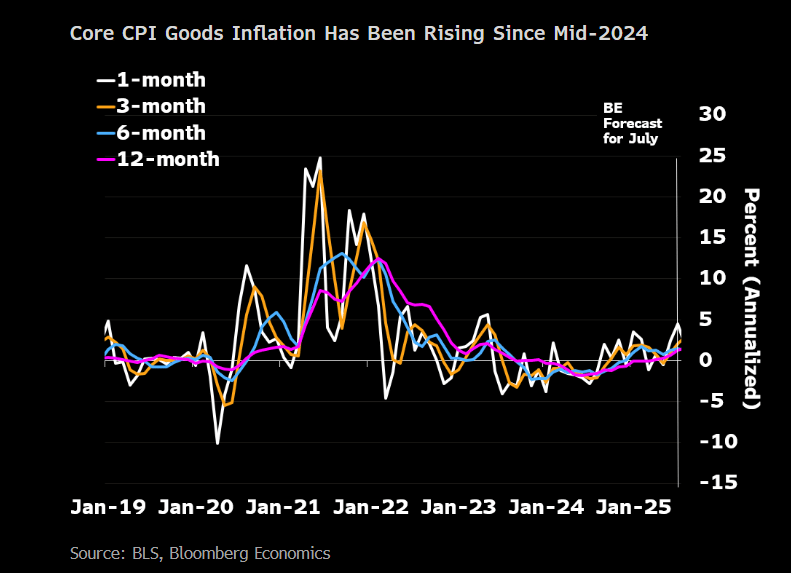

This week’s CPI and PPI readings carry outsized significance, as they represent the most pivotal macro releases before the FOMC’s Jackson Hole meeting later this month. If inflation comes in too hot, the current 89% probability of a September rate cut will likely drop sharply, reigniting stagflation concerns. Conversely, in-line or softer prints could push those odds closer to 100%, while a meaningful downside surprise could even raise speculation of a jumbo cut.

We won’t speculate on the actual CPI/PPI results, but there’s a case that tariff pass-through has been minimal—not because of political pressure to hold prices steady, but because consumers simply can’t absorb higher costs. Household real disposable income growth has been dismal, running at roughly one-third of its pandemic peak, while payroll income growth is stagnating. And while Friday’s retail sales appeared strong, it’s worth questioning how much of that was driven by bargain-hunting during Amazon’s extended Prime Day sale rather than genuine spending momentum.

PPI is likely to come in stronger, with portfolio management fees getting a lift from higher equity prices. The question is whether this detail will be enough to influence the data hawks.

Concerns over a slowing economy have been weighing on economically sensitive sectors, prompting a flight to safety into large-cap technology (the Mag 7) and rate-sensitive groups such as Precious Metals and Utilities. These have been our preferred vehicles for participating in index strength, as they stand to benefit in most market scenarios—a view we discussed in detail in our last two reports.

The impact of macro uncertainty is also evident in the stark divergence in positioning between quantitative managers and discretionary managers, highlighting just how divided market participants have become.

This dynamic sets the stage for one of two outcomes: a catch-up in most stocks as discretionary managers are forced to rotate into underperforming sectors to generate alpha, or a catch-down in the indexes if leadership falters.

According to UBS, systematic positioning is near max long—the most bullish since 2020, just before the pandemic sent stocks sharply lower (as noted by DB). However, any meaningful unwind is unlikely to begin unless the SPX breaks below 6,100. DB also notes that this level of positioning divergence between quant and discretionary managers is rare, and historically does not persist for long.

While we can’t say for certain which way the pendulum will swing, we can say this: a powder keg of risk is building, setting the stage for a binary outcome—either a melt-up or a melt-down in equities.

Could the spark come from this week’s inflation data? Or perhaps the Jackson Hole symposium on August 21–23? The exact trigger is unknowable, but the potential for sharp mean reversion is increasing by the day.

Let’s turn to the charts to see what they’re telling us.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade