6 free tools to communicate better at work

Smart Brevity is built to fix inbox — and information — overload. Its science-backed methodology can take any communication from confusing to clear.

Unlock our free resources on the communication…

Method that makes work more efficient

Tactic that hooks busy readers

Format that structures sharper updates

Start making every word work harder so your readers don’t have to.

Table of Contents

Introduction

In our 8/13 report, we highlighted how a benign CPI print gave the Fed cover to lean dovish, writing:

“Barring a disastrous PPI reading on Thursday, Powell now has the runway to concede to easing — and may signal as much at next week’s Jackson Hole meeting.”

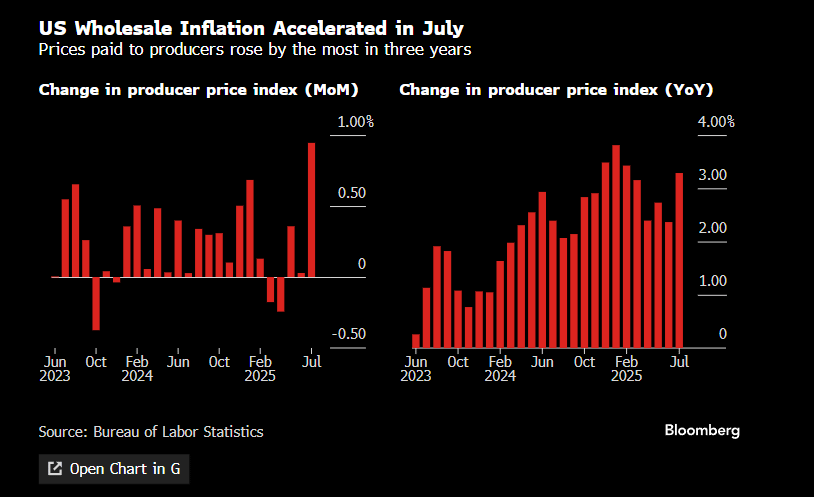

What followed was precisely the risk we outlined: a much hotter-than-expected PPI, the sharpest rise in three years. That surprise erased much of the prior day’s CPI-fueled enthusiasm, hitting SMID caps hardest — the cohort most sensitive to Fed easing. At one point, half the Russell 2000’s CPI rally had been unwound. Crypto, another high-beta risk asset, also reversed lower. Meanwhile, the S&P 500 barely flinched, pushing to fresh all-time highs before OPEX-related weakness trimmed gains. Net-net, markets ended the week higher, but the leadership picture has turned murky again.

Earlier this month, we stressed a defensive tilt toward large-cap equities, precious metals, and AI-linked utilities as buffers against seasonal chop and sticky inflation. The CPI release then encouraged a rotation back into SMID caps — a view that looked promising until the PPI surprise muddied the waters. Rising import costs tied to tariffs appear to be feeding through to producer prices, raising the risk that inflation proves more stubborn than markets assumed.

Looking ahead, Powell’s tone at Jackson Hole takes on even greater significance. Acknowledging progress on CPI while cautioning on producer inflation could keep markets guessing on the timing and scope of rate cuts. For investors, the setup argues for balance: maintain core exposure to large-cap leaders and hard assets, while selectively redeploying into SMID caps where policy tailwinds eventually reassert themselves. The next phase of leadership hinges less on the last data point and more on how the Fed frames its policy flexibility in the weeks ahead.

Companies have so far absorbed much of the tariff-driven cost increases, but with margins under pressure, it is increasingly unclear how long that restraint can last. The question of pass-through inflation is now front and center for the Fed as policymakers gather in Jackson Hole this Thursday and Friday. Powell’s remarks on Friday could set the tone for how markets trade into late August and September — historically one of the most treacherous stretches of the calendar. With inflation still running above target and the labor market showing rapid signs of cooling, the Fed faces an unusually difficult policy dilemma, compounded by intensifying political pressure from the Trump administration.

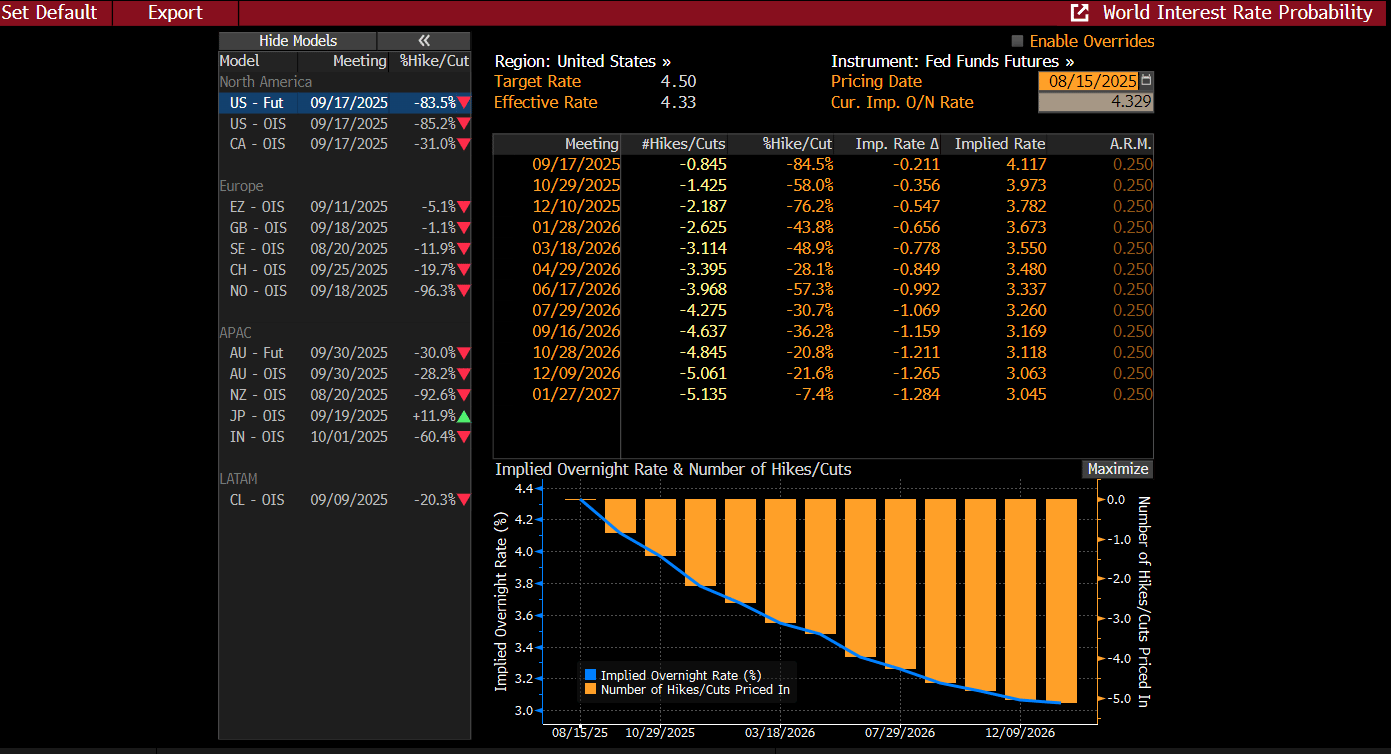

While consumer spending remains resilient, sentiment is slipping — often a leading signal for future demand. This disconnect has complicated the outlook for rate cuts. Before last week’s PPI release, Fed funds futures were pricing in near-certainty (~107%) of a 25 bps cut in September. By Friday, that conviction had eroded to 84%. This shift underscores the binary setup heading into Jackson Hole: a supportive, dovish Powell could quickly restore market confidence in a September cut and revive the SMID cap rotation, while a cautious, data-dependent stance risks unwinding much of last week’s optimism.

The market rarely makes things easy. As much as we’d like to offer a definitive call, the reality is less clear-cut. The bond market still points toward a potential September rate cut, but the road to that outcome looks increasingly uneven. Should we really be surprised? After an exceptionally strong rally off the April lows, August was always likely to turn messy. That’s exactly why we advised raising cash into July strength and leaning on large caps and uncorrelated assets in early August.

For now, we continue to believe that’s the prudent stance — maintain flexibility, lean defensive, and let Powell’s message provide the next signal on rate direction.

Let’s turn to the charts.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade