Table of Contents

Introduction

What’s that classic Prince track? When Doves Cry—not When Doves Fly. Still, the play on words felt fitting after Powell’s Jackson Hole speech. The song itself has nothing to do with markets, but Powell’s surprisingly dovish tone carried a similar effect: instant recognition, a rush of energy, and a new rhythm for risk assets. Powell didn’t just hint at a softer tone; he went full dove, and risk assets took flight.

In our 8/20 report, we were already leaning bullish, suggesting Powell might be “dovish enough” to spark animal spirits.

We wrote:

“We remain in a bull market, despite the growing chorus calling for a top. Maybe this is it, maybe it isn’t — but the bears appear to be losing their grip. The recent volatility spike has already begun to fade, leaving behind a “hammer parade” across multiple indexes. As followers of our work know, hammer formations at key junctures are one of our most reliable reversal indicators. They signal that panic selling has run its course and that buyers are willing to step back in.”

Powell’s full dove re-ignited recent waning enthusiasm. His pivot wasn’t just accommodative—it was a green light for risk-taking. The Russell 2000 (RTY) surged as much as 4% on Friday in the immediate aftermath.

Much to the dismay of Fed policy experts who dismissed Jackson Hole as a non-event, we argued the opposite. The market was craving resolution. Expectations for a cut had been steadily building, and anything less would have been seen as a disappointment. Friday’s sharp rally underscores exactly why we framed this as a binary moment — one where the wrong tone from Powell would have flipped sentiment hard the other way. That’s why we advised caution. Yes, in hindsight it would have been easy to recommend loading up on all things SMID cap ahead of the event, but doing so would have been irresponsible given the uncertainty around the outcome.

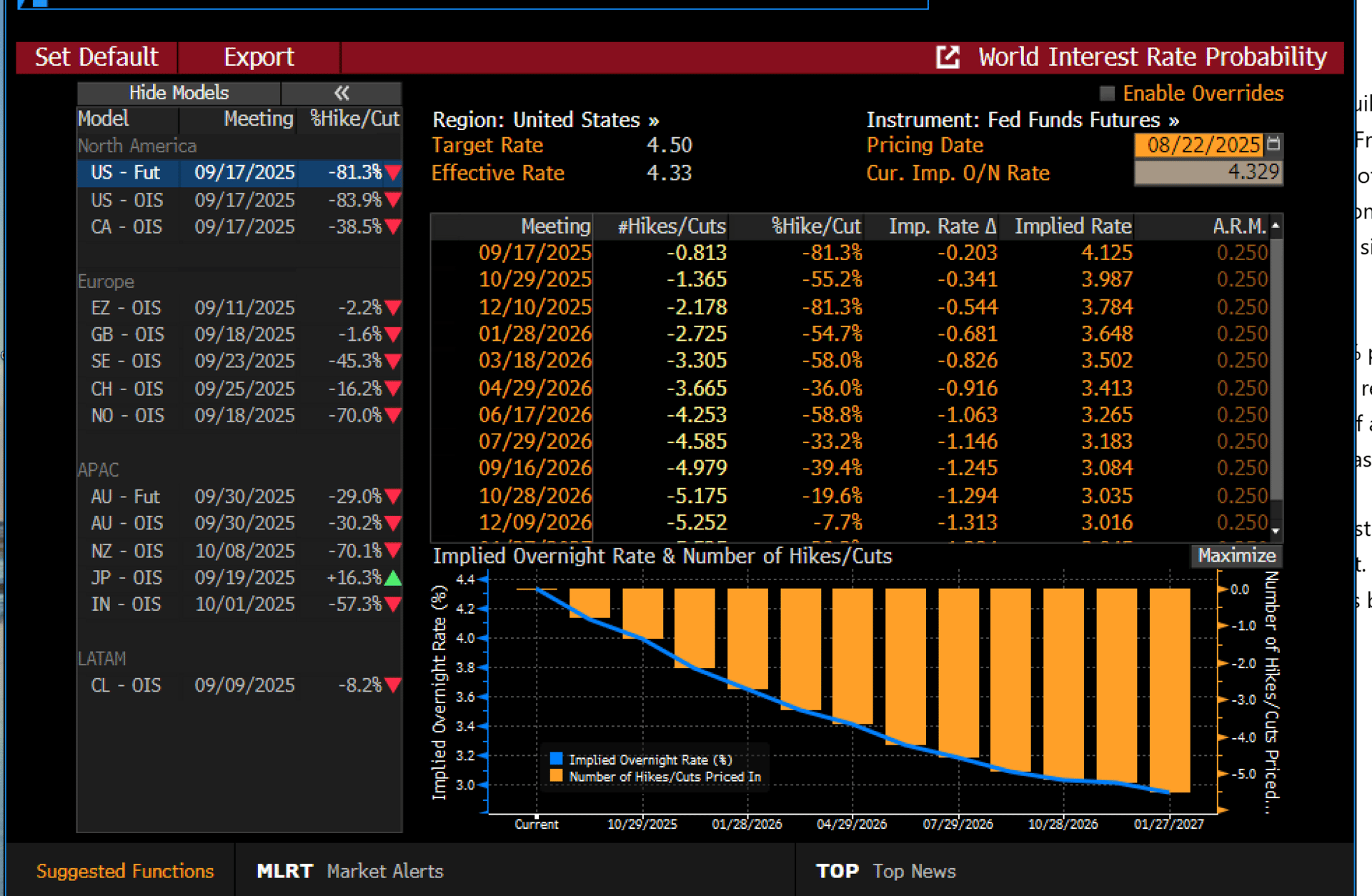

The setup was reflected clearly in Fed Fund Futures. After the CPI report, they were pricing in better than a 100% probability of a September cut — only to see that confidence slashed by a third heading into Jackson Hole. So while odds still leaned toward easing, the bond market’s directional bias had already shifted closer to neutral. Not exactly a high-conviction backdrop.

Volatility in Fed Fund Futures has become the norm, but as of now the curve is projecting two cuts by year-end — which lines up with the Fed’s most recent dot plot. What’s striking is that despite Powell’s dovish tilt, futures are still assigning only an 81% probability to a September cut. Skepticism remains, and that gap between market action and market conviction could be the next catalyst for volatility.

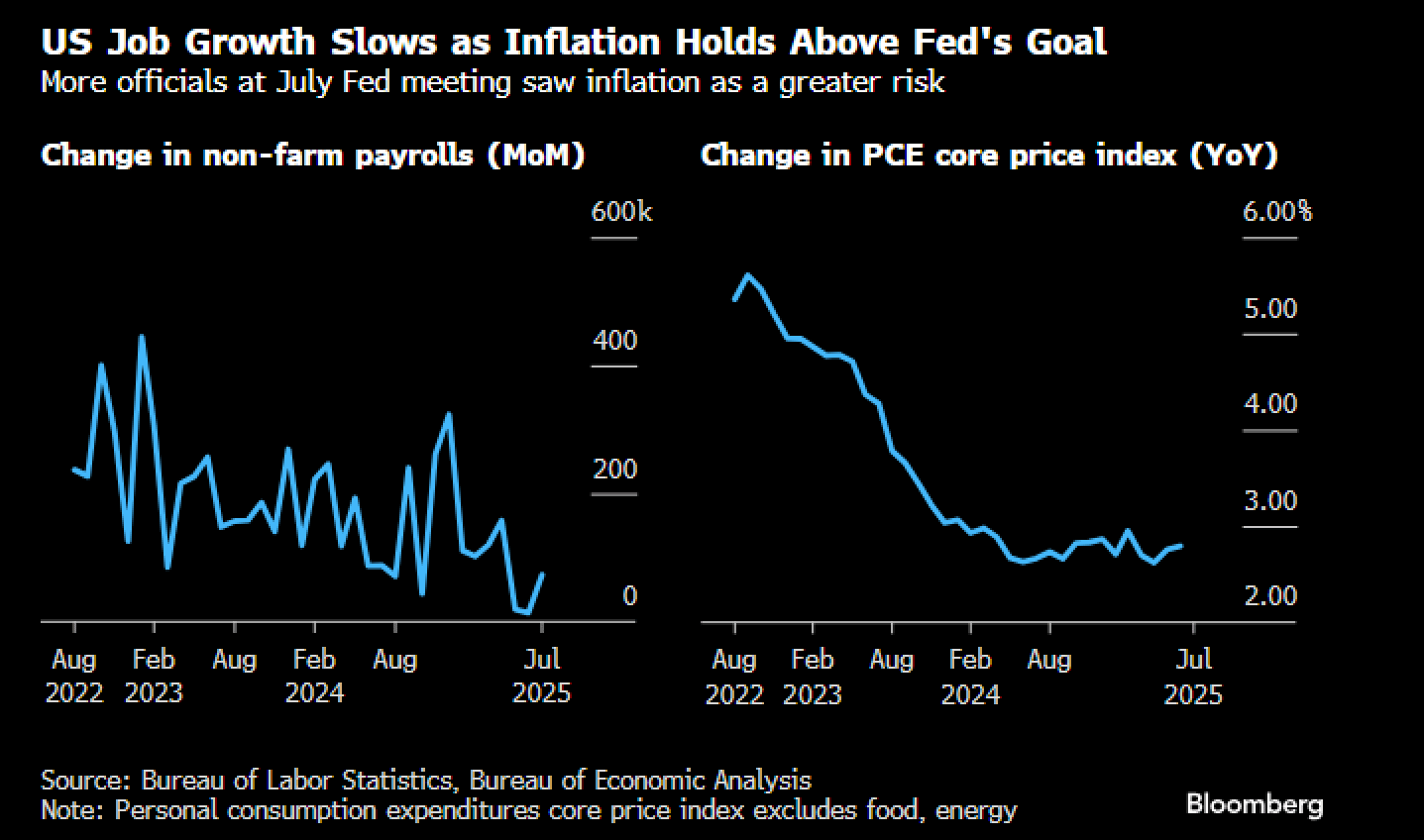

This cautious optimism makes sense, because Powell hedged himself on Friday by reiterating that the Fed remains data-dependent — and with three more inflation reports due before the next decision (including PCE this Friday), each release has the potential to spoil the bull party.

Complicating matters further is the visible dissension among Fed officials, paired with Powell’s own admission that the economy is in a “challenging situation.” Policymakers are stuck in a delicate balancing act: inflation is still running above the 2% target — and showing signs of re-acceleration — while the labor market is beginning to soften. That tension leaves little margin for error, and reinforces why this rally, though powerful, should not be mistaken for unconditional Fed support.

Another potential disruptor looms this week: NVIDIA earnings on Wednesday. The AI trade has been the dominant market driver in 2025, and anything short of spectacular results could invite the bears back onto the field. We see this as a low-probability risk — the datapoints are simply too strong to suggest the AI narrative gets derailed by one print — but with NVDA now the single largest weighting in the SPX at 8%, even a modest stumble would ripple across the tape.

Who said August was for vacations? Last week’s Jackson Hole fireworks reminded everyone that markets don’t take time off — and this week could prove just as pivotal. Never a dull moment.

With that, let’s turn to the charts.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade