Finally, a powerful CRM—made simple.

Attio is the AI-native CRM built to scale your company from seed stage to category leader. Powerful, flexible, and intuitive to use, Attio is the CRM for the next-generation of teams.

Sync your email and calendar, and Attio instantly builds your CRM—enriching every company, contact, and interaction with actionable insights in seconds.

With Attio, AI isn’t just a feature—it’s the foundation.

Instantly find and route leads with research agents

Get real-time AI insights during customer conversations

Build AI automations for your most complex workflows

Join fast growing teams like Flatfile, Replicate, Modal, and more.

Table of Contents

Introduction

It’s never easy to go against the grain—especially when everything seems to be working. Meme stocks are flying. Major indexes are tagging new all-time highs daily. Dips are shallow and relentlessly bought. Macro noise is getting tuned out. The Magnificent 7 are blowing out earnings. It’s a momentum machine.

But rule #1 in markets: when it feels too easy to make money, it’s probably the end of the move.

Just when sentiment gets comfortable, the market yanks the rug. That’s how it works. This isn’t a feeless ATM where you withdraw profits without paying a toll. The toll is volatility—and it always comes back. And when it does, it usually means the bank wants some of its money back.

Last week, in just two sessions, the entire slow-burn July rally was erased. The quiet summer melt-up turned into a freight train through your bedroom—reminding us that markets don’t hand out free T-shirts at the checkout.

If you’ve been following our work, this pullback shouldn’t be a surprise.

We’ve spent the last two weeks preparing for this moment. Our July 13th report—Time to Be Cautious—made our stance clear. At the time, the call to reduce risk felt contrarian, even reckless. But as always, risk builds slowly—then hits all at once.

Below, we review excerpts from each of our recent reports to illustrate how we saw this developing in real time:

From 7/13:

“The indexes…setting the stage for another potential leg higher as we move deeper into earnings season…”

“We’re now growing more cautious—looking to trim positions in recent winners…Our view remains that any retracement will be mild (3-5%) and likely come from elevated levels.”

From 7/16:

“The evidence continues to build for a potential market retracement… cracks like these often foreshadow trouble…”

“Earnings season could push markets to new highs first… the setup is ripe for a reversal… using any residual strength to raise cash and reduce risk.”

From 7/20:

“…any larger correction would most likely originate from the higher index levels we’ve identified as potential resistance zones—levels that aren’t far off now… trim positions on strength, preserving capital to redeploy at more attractive entry points.”

From 7/23:

“We believe a correction could be on the horizon… our approach remains: sell into strength and raise cash in preparation for a possible reversion.”

From 7/27:

“The setup for a short-term pullback is in place… We remain opportunistic—trimming strength… and raising cash for more attractive entry points.”

From 7/30:

“How the week closes will be critical… our short-term topping thesis may still prove valid… our stance remains unchanged: we’re opportunistic sellers into strength, staying patient and selective as we await better entry points.”

The messaging has been consistent: strength first, then correction. Trim winners, raise cash, and prepare to redeploy. This wasn't a vague warning—it was precise.

In fact, since early July we’ve highlighted 6378–6400 as a likely SPX topping zone. Last Thursday, the SPX peaked at 6427.

Here’s an excerpt from our July 6 report:

We hope readers recognize the precision of our analysis—it stands apart from much of what we’ve seen from even the largest Wall Street firms in terms of identifying and contextualizing the underlying trend. Our clients had a full two-week window to systematically de-gross into strength ahead of last week’s sharp reversal. As a result, they’re now in the enviable position of assessing far more attractive entry points with fresh capital and less exposure.

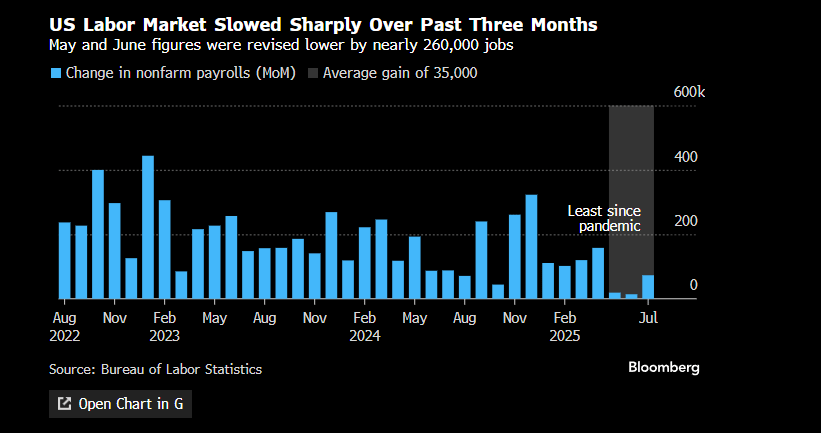

So, what triggered the sudden shift back to macro sensitivity? Friday’s employment report was a wake-up call—not because the headline print missed expectations by 30K, but because the prior two months were revised sharply lower. That’s what really caught the market’s attention.

The report’s weakness prompted an immediate and dramatic response: President Trump fired the Commissioner of Labor Statistics responsible for overseeing the data. While the reaction may seem harsh, his frustration isn’t entirely misplaced. Had this information—particularly the significant downward revisions—been available earlier, the Fed might have acted more proactively on the rate front.

The bottom line: the step down in hiring is alarming. The report showed the steepest downward revisions to U.S. job growth since the pandemic began. A massive 258K revision effectively erased recent payroll gains, shifting the narrative from solid job growth to near stagnation. This suggests labor demand is now declining more rapidly than labor supply—a key shift that could have significant policy implications.

What’s also drawing headlines is the surge in first-time job seekers, which jumped from 275K to nearly 1 million in July—the largest one-month increase on record.

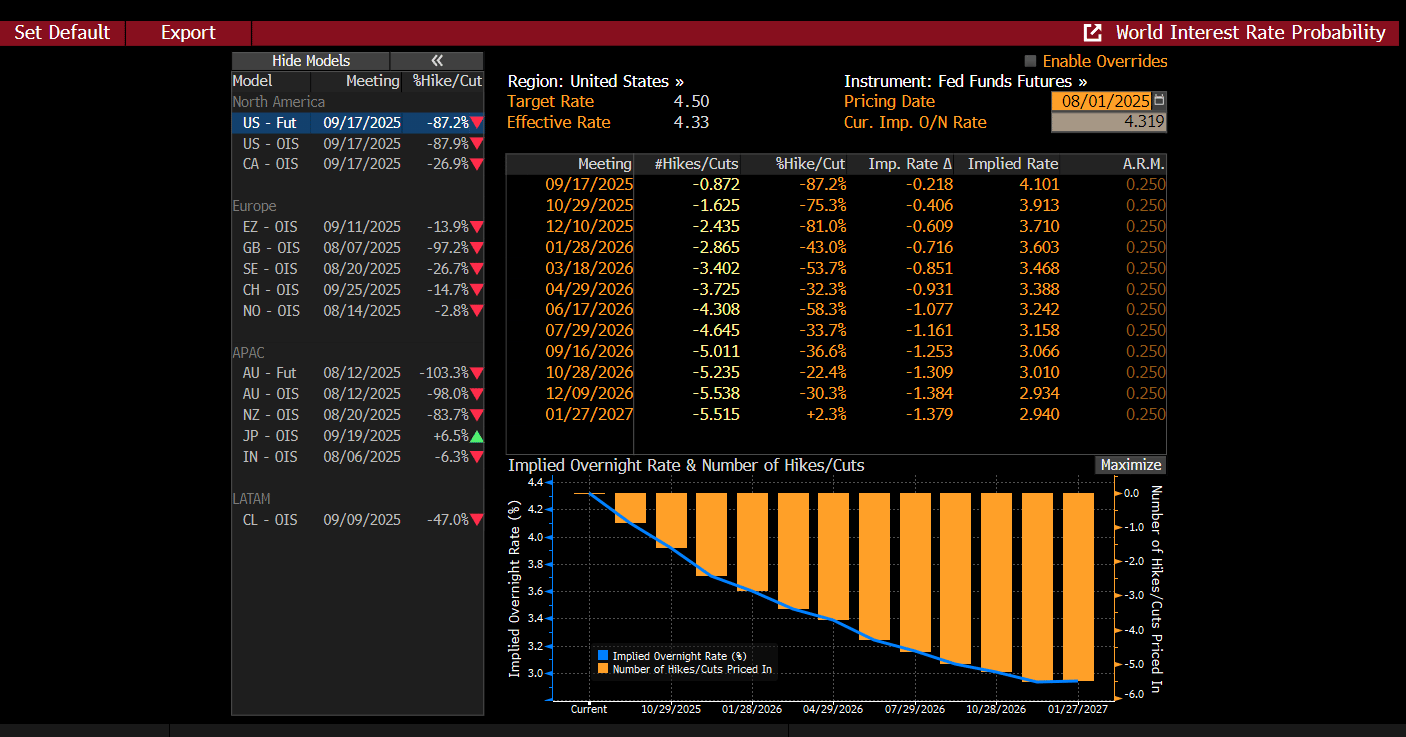

This shocking development has dramatically shifted market expectations, pushing the probability of a September rate cut to approximately 87%—up from less than 40% prior to the report.

Markets are now pricing in 61 basis points of rate cuts by the December FOMC meeting.

Friday’s payroll report triggered the largest one-day drop in the 2-year Treasury yield—widely viewed as a proxy for short-term rate expectations—since December 2023.

In our 7/27 report, we flagged the potential for lower short-term yields following the DeMark Sequential 13 sell signal. However, sharp dislocations in the Treasury market—especially those driven by macro surprises—are rarely welcomed by risk assets. These kinds of moves tend to introduce instability, not relief. This volatility spike is unfolding just as we anticipated heading into August.

Here’s the excerpt:

Another excerpt from last week’s report (below) correctly anticipated a move lower in short-term yields. However, the sequence of events unfolded in reverse. The stock market first surged on the back of strong mega-cap earnings, creating a blow-off top. Then came the macro shock—Friday’s employment report—which triggered a sharp reversal in risk assets, leading to the cascade lower.

So where does that leave us?

We accurately anticipated a corrective move as we approached August. While the timing was off by about a week, the price range we identified for the peak was spot on. Since then, the indexes have taken on meaningful technical damage—damage that can be resolved either through time (sideways consolidation) or further downside in price.

Which brings us to the key question: Has the market already seen the worst of the correction?

Let’s dig into the charts.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade