Table of Contents

Introduction

“August is for Alpha—did we get that right?”

“Not exactly, CSC. Historically, August has been one of the toughest months of the year for equities.”

Both statements carry truth. Seasonally, August is notorious for weak performance, and in post-Election years the track record for positive returns has been a flat zero. Yet this August bucked the trend, delivering a solid +1.91% gain. Interestingly, last year’s August was even stronger at +2.28%, and this year’s showing still managed to rank 7th best in the past 15 years.

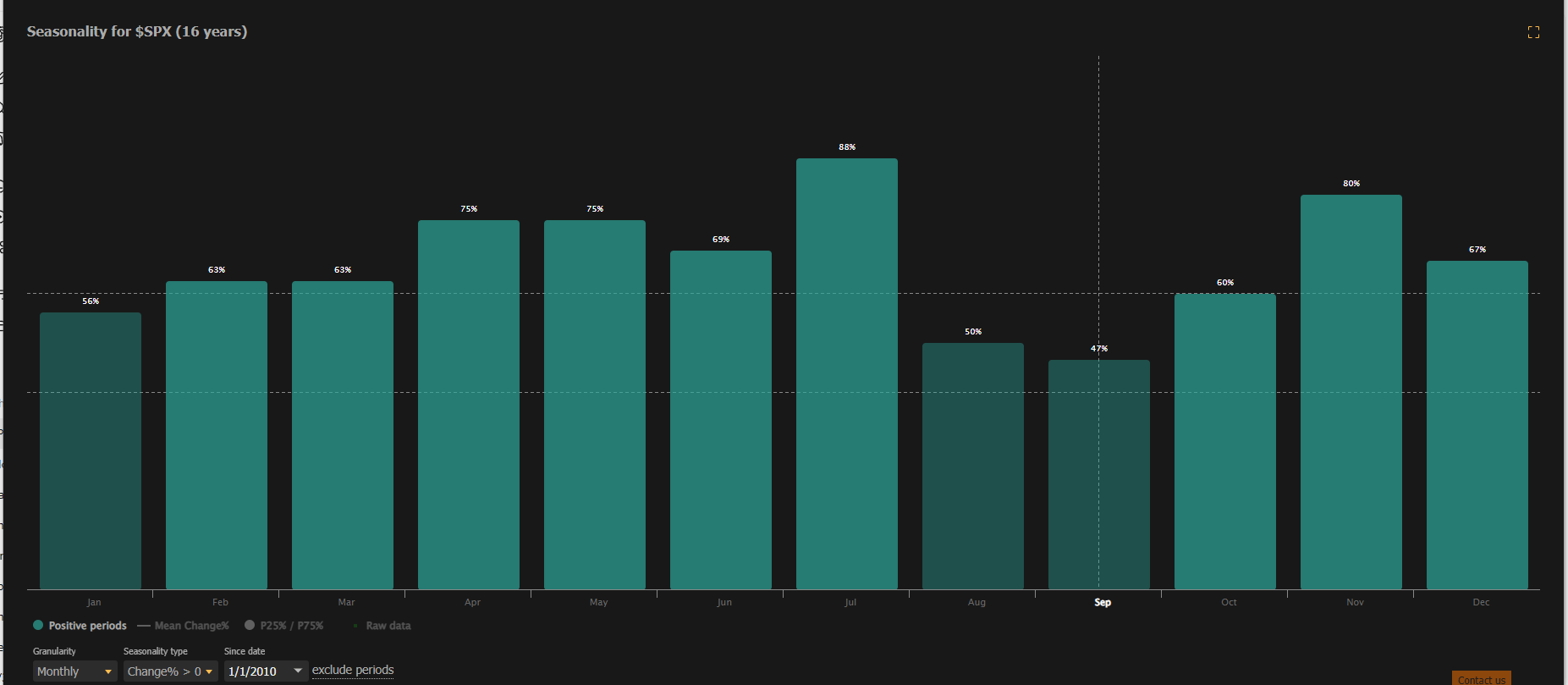

Since 2010, August has only finished negative about half the time, with an average return of –0.45%—a result that’s hardly statistically meaningful. The takeaway? Seasonality alone is not a reliable signal. It’s a useful guidepost, but never a reason in itself to buy or sell.

As for September, the track record is even weaker, with positive returns just 47% of the time. We’ll dig deeper into that later in the report.

However, this past August’s performance comes with a catch. Roughly 70% of the SPX’s gain was driven by just four stocks—a stark reminder of the distortions in market-cap weighted indexes. If you weren’t overweight those names, chances are you lagged the benchmark.

That doesn’t mean there was no alpha to be found—you just had to know where to look. Materials and Healthcare led the way as the top-performing sectors, while Technology lagged closer to the bottom of the rankings.

If you recall, we highlighted Materials as a potential source of outperformance at the start of Q3. At the time, we wrote:

“…Materials could make up lost ground in Q3 and emerge as a source of alpha going forward.”

Below is the excerpt from our 7/9 report:

We even doubled down on that call at the start of August, advocating an overweight in precious metals, a key subsector within Materials. In our 8/3 report, we wrote:

“…we continue to favor precious metals—particularly silver and gold—as attractive, uncorrelated trades while equity markets reset.”

In those early August notes, we specifically flagged the pullback in Silver as an attractive entry point and suggested adding Gold exposure—whether through the metal itself or via the miners (GDX).

The payoff has been extraordinary. The Gold & Silver Index (XAU) surged roughly +22% in August, with GDX posting an even larger gain. That compares to just +1.91% for the SPX.

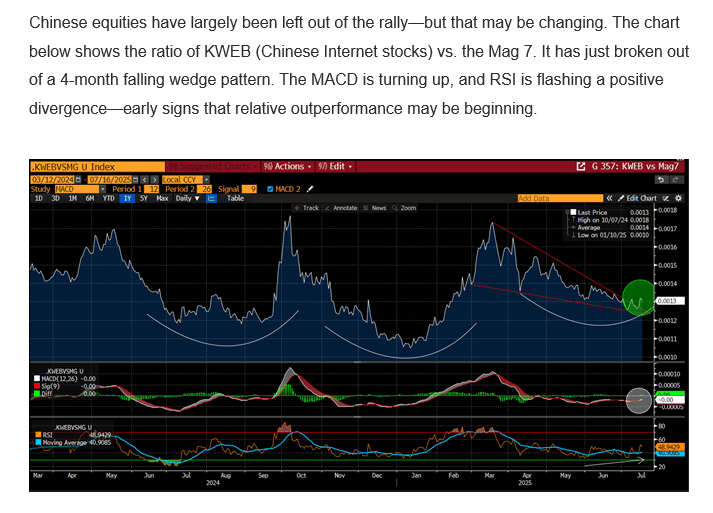

Of course, we won’t get every call right. In August, we also suggested an overweight in Utilities, a trade that ended the month down about –2%. But our China recommendation (KWEB) from 7/16 more than offset that misstep.

Here’s an excerpt from that report, highlighting our interest in the space:

Since that call, KWEB has outperformed the major indexes by 400–600 bps, and we expect that relative strength to continue in the months ahead.

Which brings us to the dreaded September. Is this where the market’s powerful ~30% rally off the April lows finally runs into resistance? Seasonally, September has a reputation as one of the toughest months, but as we’ve already shown, history alone doesn’t guarantee disaster.

Still, there’s plenty on the macro docket that could tip the apple cart. This week’s payroll report will be pivotal, with the potential to shape the trajectory for future rate cuts (odds for September remain near 88%). The following week, CPI takes center stage, leading directly into the September 17th FOMC meeting. In short, September is shaping up to be a macro maelstrom—and one that could easily knock markets lower if we see meaningful labor-market deterioration or a reacceleration in inflation.

Meanwhile, the SPX hasn’t suffered a 2% pullback in 91 sessions, its longest stretch since July 2024 (Bloomberg). Just last week, the index hit another ATH before succumbing to end-of-month rebalancing. With the SPX up ~10% YTD, it wouldn’t be surprising if September injected more volatility than we’ve grown accustomed to.

What’s even more striking is that markets appear to be underpricing this risk. According to the latest CFTC data, speculators are shorting the VIX at the highest rate in three years—a setup that could backfire sharply if volatility finally rears its head.

And according to Citi, the market is also underpricing jobs-data risk, with implied volatility around the release priced at just 85 bps—remarkably low given the stakes.

Another concern is valuation. The market is trading at 22x forward earnings, a level surpassed only twice since 1990—during the height of the dot-com bubble and in the post-pandemic rebound. At the same time, cash levels have fallen to just 3.9%, according to BofA’s latest global fund manager survey, underscoring how little dry powder remains on the sidelines.

Meanwhile, volatility has been eerily subdued. The VIX hit its lowest level of 2025 just last week, even as we enter the seasonal window where volatility typically picks up. In other words, the calm may not last.

September also marks the period when mutual funds begin rebalancing ahead of their fiscal year-end. Add to that the slowdown in retail stock buying (per Citadel), and the stage is set for some potentially wild swings.

So, is it finally time to get more defensive?

Let’s turn to the charts.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade