Stop Drowning in Market News. Focus On Making Money.

Every day: 847 financial headlines, 2,300 Reddit stock mentions, 156 Twitter trading threads, 12 IPO updates, 94 crypto developments.

Your problem isn't lack of information; you have too much.

While you're scanning headlines wondering what matters, profitable trades slip by. The signal gets buried in noise.

What if someone did the heavy lifting for you?

Stocks & Income reads everything:

Twitter traders

Reddit buzz

IPO announcements

Crypto insider takes

Crowdfunding opportunities

Market news

Then we send you only what can actually move your portfolio.

No fluff. No useless news. Just actionable stock insights in 5 minutes.

We track every source so you don't have to. You get the 3-5 opportunities worth your time, delivered daily.

Stop wasting time on useless “investing news” and start thinking critically about real opportunities in the stock market.

Stocks & Income is for informational purposes only and is not intended to be used as investment advice. Do your own research.

Table of Contents

Introduction

September was supposed to be the bears’ month. Seasonally the weakest stretch of the year, filled with macro “landmines” that strategists assured us would derail a rally built on fumes. But markets rarely follow the script. What many miss is that the market, while noisy, is largely efficient. It sees the forest through the trees and prices in the future long before the “why” becomes obvious.

We enjoy the exercise of theorizing, but trying to outguess why the market moves is a fool’s errand. The what is what matters — and the what is far more accurate. Decode the market’s message correctly and you’ll waste less time chasing flawed narratives. That doesn’t mean fundamentals don’t matter — they do, especially for private equity or value investors. But we aren’t in the business of calling where the S&P 500 will be in 2027 or slapping a multiple on some consensus EPS guess. Our lens is momentum, not valuation.

We’ve been constructive since the April lows — publicly turning long in our April 6th report — and only dialed down risk tactically during choppier stretches. That discipline has allowed us to sidestep noise and stay aligned with the market’s true driver: liquidity and momentum. Valuation matters at the troughs, not at the peaks.

Momentum drives price. And in an era where machines and quantitative flows control 70% of daily volume, mapping momentum is more relevant than ever.

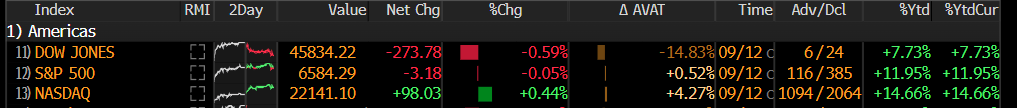

This past week proved it again. The S&P 500 notched new all-time highs on the back of weaker payrolls and benign inflation prints. The same fears that kept skeptics short — tariffs, sticky inflation, small-cap weakness — dissolved instantly. Once again, Mr. Market reminded us: opinions are usually wrong, markets rarely are. He was whispering it at the April lows, then shouting it from the rooftops with that massive monthly reversal candle.

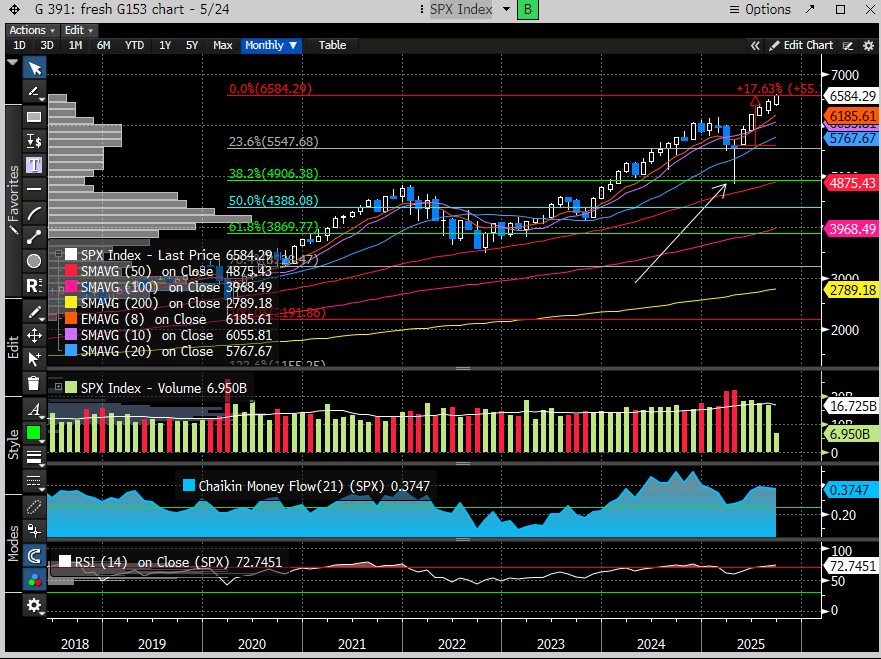

This was the skeptics’ chance to acknowledge reality and adjust. Did they? Of course not. They clung to their flawed narratives and are now scrambling to make up lost ground. Had they recognized the technical inflection after April’s monthly close — where the S&P 500 found support at the 38.2% Fibonacci retracement of the Covid Crash low, perfectly aligned with the 2021 highs — they could have captured the next 17% rally. Instead, they missed the market’s clearest signal.

The S&P 500 is up ~12% this year, which means investors didn’t need to nail the April lows to outperform. All they had to do was stay open-minded, admit they might be wrong, and acknowledge the index construction shifts we’ve been highlighting in our reports.

The study of price matters. Technical analysis matters. Why so many investors dismiss it as voodoo is beyond us. It’s simply a tool — one that can challenge or confirm any fundamental thesis. The difference with our work is that we don’t stop at charts. We integrate the full picture: macro inputs, technical construction, and fundamentals, layered into a framework we’ve refined over years. That’s why we’re rarely caught flat-footed. More often than not, we identify the dominant trend early — and last time we checked, trading with the trend is how portfolios compound. Fighting it is how they get blown up.

With that foundation in place, let’s turn to the final macro swing of September. Bears already have two outs in the bottom of the ninth, and the FOMC is stepping up to the plate. Will they finally get a hit, or will the bulls strike out the side?

Let’s check the charts.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade