Table of Contents

Introduction

Two outs, two strikes, bottom of the ninth… The “Bad News Bears” step to the plate. The pitch comes in—swing and a miss! Game over. Bulls have taken the Macro September Classic.

At the end of August, we flagged a rare opening for the bears: a trifecta of catalysts—Employment, Inflation, and the FOMC—that could derail the rally. But just like a hitter chasing high heat, they whiffed on every pitch. Each data release only reinforced momentum for rate cuts, and the final call—the FOMC delivering the first cut in nearly a year—locked in the win for the bulls.

Injecting fresh liquidity into a market already sitting at all-time highs, while growth merely slows at the margins, is hardly a recipe for a correction. Historically, that cocktail tends to do one thing: push stock prices even higher.

Even Goldman Sachs is now piling on, upping the ante with a 3-month SPX target of 6800. When the street’s most buttoned-up forecasters start chasing price higher, you know the bullish momentum isn’t just alive—it’s going mainstream.

Goldman framed it bluntly: “Our forecast for further equity market upside would be consistent with the historical pattern during rate cut cycles. Over the past 40 years, the S&P 500 has delivered a 15% median return in the 12 months following the Fed’s resumption of cuts—so long as economic growth continued.”

Ned Davis Research echoes the same point with a study on the Dow. Their work shows that when cuts occur during an expansionary phase, markets typically don’t stall—they accelerate higher.

SentimenTrader adds another layer of confirmation: their study shows that when rate cuts arrive with the S&P 500 trading within 1% of all-time highs, the forward path has historically skewed higher. In other words, liquidity injections at the very top of the range tend to extend—not end—bull markets.

So yes—priming the pump when the market is already humming has a predictable outcome: higher stocks. Should anyone really be surprised that animal spirits are roaring back in September after a choppy August?

Remember all the warnings that September would be a gauntlet? Unless the bears find a way to crash the party in the final stretch, the odds of finishing the month in the red look increasingly remote. For now, it’s the bulls who are still at bat, and they’re swinging freely.

Despite Powell’s seemingly muddled message at last Wednesday’s presser, the market shrugged it off and sent the Russell 2000 (RTY) ripping to its highest level ever. If bull markets have one defining trait, it’s this: they make new highs. That’s why we always remind readers—all-time highs are inherently bullish.

And we’ll take the victory lap here. Since May, we’ve been calling for the inverse head-and-shoulders breakout to carry RTY back to its prior peak. We thought that move might take until year-end—but Christmas came early, with the gift wrapped and delivered in September.

The RTY reclaiming all-time highs only reinforces a theme we’ve been hammering since summer: increased dispersion. This is the environment where stocks and sectors can post outsized gains even as the benchmarks churn sideways. Our uncorrelated idea set has been beating the indexes precisely because of this dynamic—and we believe the trend still has room to run.

Remember, high correlation of risk is a hallmark of downtrends. Yes, we’ll likely see correlations rise again at some point before year-end, but that doesn’t spell the end of dispersion—it simply means the window is finite. For now, it remains wide open.

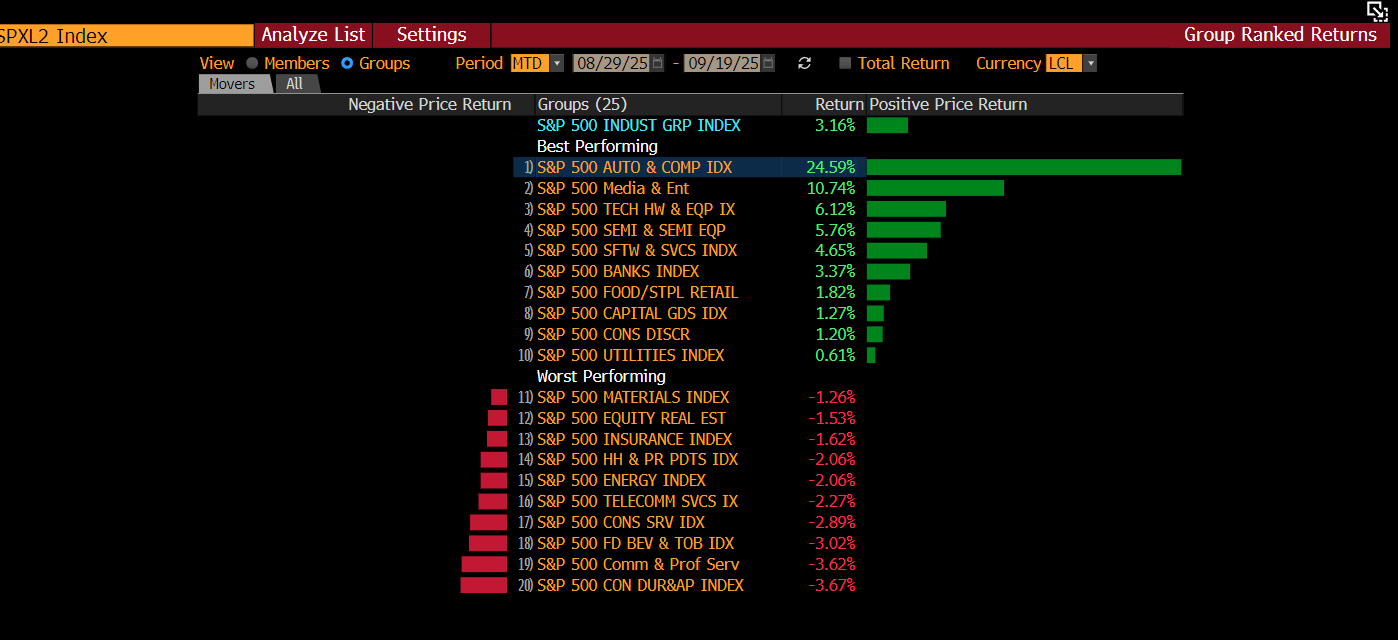

Peel back just one extra layer to the GICS Level 2 industry groups within the SPX, and the leadership isn’t coming from the usual suspects.

Autos are unexpectedly leading the charge. Yes, a big piece of that comes from TSLA’s 27% surge this month—but think about it: when was the last time Tesla actually led the tape? After peaking back in December 2024, the stock spent most of this year chopping sideways. September changed that narrative in a hurry.

Even stodgy Media stocks are the second-best performing group. While GOOGL and META account for roughly half the gains, the rest of the winners are far from the usual headliners—another sign that leadership is broadening in unexpected corners of the market.

Even within Technology, leadership isn’t coming from the flashy growth darlings—it’s the old cyclical workhorses that no one ever talks about.

So yes—don’t believe everything you read or hear on TV. The reality is that the usual headline leaders aren’t what’s driving the indexes this month—and that’s bullish. Rotation is the lifeblood of a bull market, and right now it’s happening across the board.

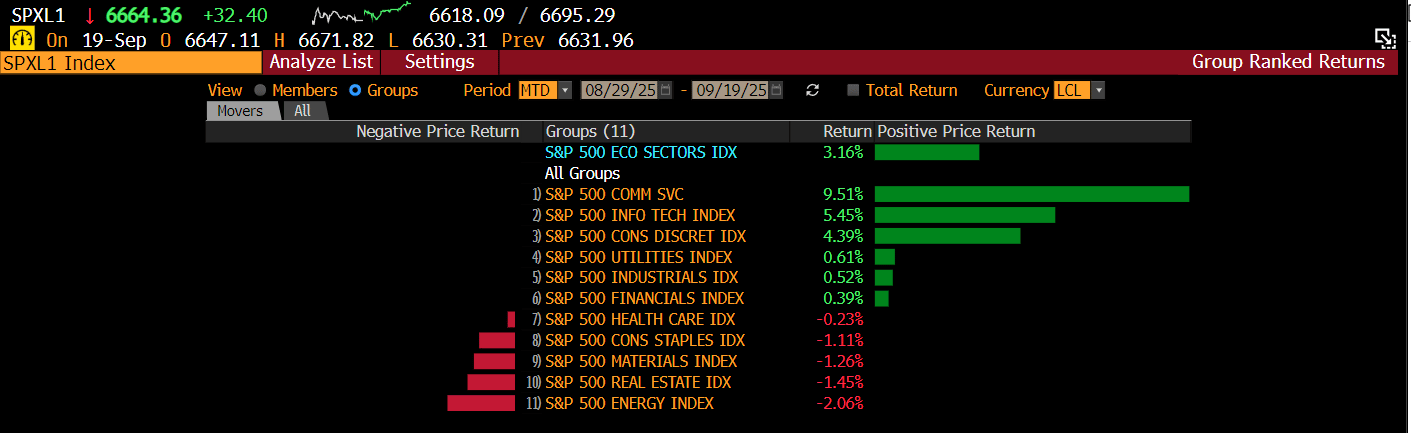

Not only are laggards stepping up to push the indexes higher, but the right sectors are taking the lead. Historically, sustained bull markets are powered by Technology and Consumer Discretionary—and that’s exactly what we’ve seen in September. All three major growth engines—Tech, Discretionary, and Communication Services—just notched fresh all-time highs this week.

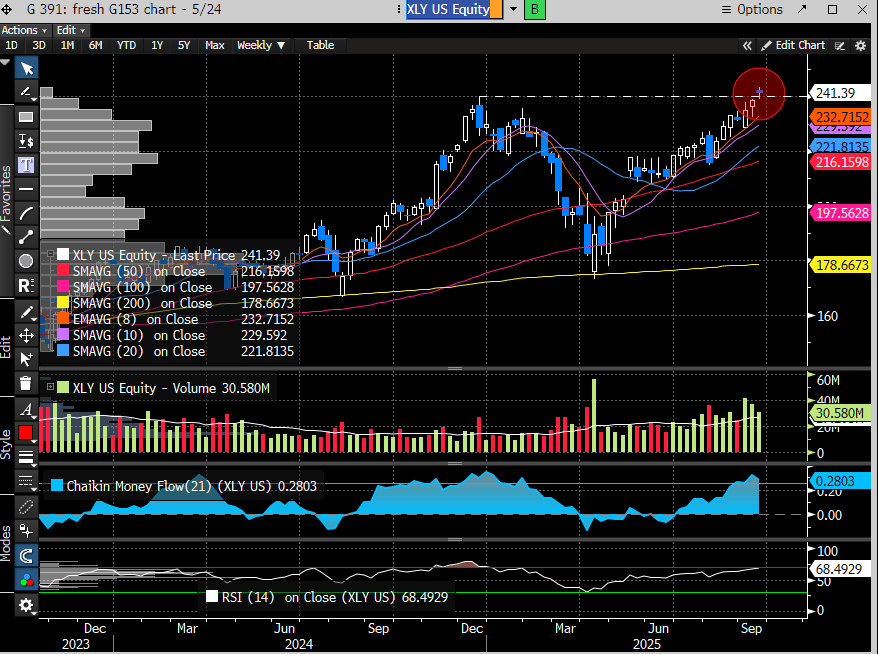

As technicians, we always confirm market strength by looking under the hood. It’s no surprise that Technology (XLK) and Communications (XLC) pushed to fresh highs again last week—they’ve been leading for weeks. What stands out is Consumer Discretionary. After lagging all year, the sector finally broke out and joined the leadership ranks. That rotation adds another layer of confirmation to the bull case.

This matters because Consumer Discretionary is the most economically sensitive sector—after all, consumption drives roughly 70% of U.S. GDP. If that sector just hit a new ATH for the first time since December ’24, the message is clear: why fight it? We’d argue you shouldn’t—though some folks seem to enjoy the pain.

Not us. We trade with the trend and will keep doing so until the evidence says otherwise. Until then, party on.

That said, stocks never move in a straight line, and this week could throw a few curveballs.

Let’s dig into the charts.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade