7 Ways to Take Control of Your Legacy

Planning your estate might not sound like the most exciting thing on your to-do list, but trust us, it’s worth it. And with The Investor’s Guide to Estate Planning, preparing isn’t as daunting as it may seem.

Inside, you’ll find {straightforward advice} on tackling key documents to clearly spell out your wishes.

Plus, there’s help for having those all-important family conversations about your financial legacy to make sure everyone’s on the same page (and avoid negative future surprises).

Why leave things to chance when you can take control? Explore ways to start, review or refine your estate plan today with The Investor’s Guide to Estate Planning.

Table of Contents

Introduction

The upcoming CPI feels like a Dirty Harry moment for markets. Clint Eastwood’s iconic challenge still resonates: “You’ve got to ask yourself one question: ‘Do I feel lucky?’ Well, do ya, punk?”

That’s precisely where traders stand — one data point away from either having their day made with a cooler inflation print that powers the risk-on rally forward, or watching it all implode if CPI runs hot and forces a reset of Fed expectations.

We’ve been warning for weeks that September would test the market’s resolve — either appeasing the bulls and reinforcing expectations for further upside, or unraveling the rate-cut thesis and sending stocks spiraling lower. Three major macro events dominate the month, and the first hit last Friday with a weaker-than-expected payrolls report.

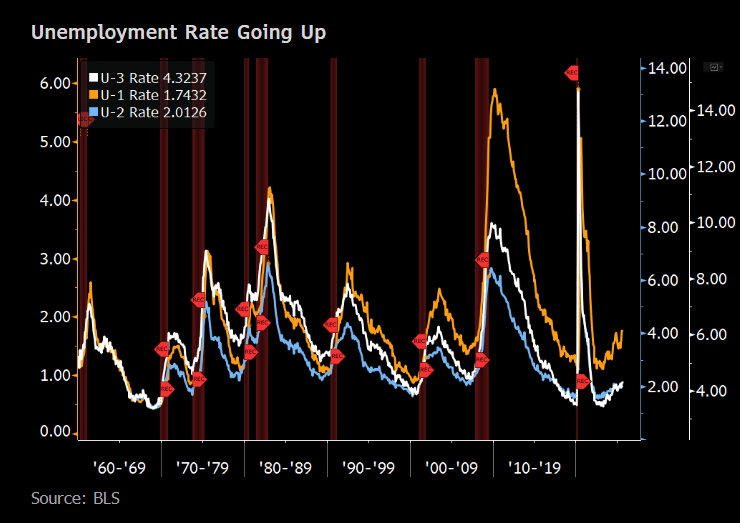

While the miss cemented expectations for a September rate cut, the only true certainty from the data was that the economy is slowing — and slowing fast. August’s nonfarm payrolls came in at just +22k, with downward revisions turning June negative. Weakness was broad-based across sectors, and even if August is revised higher (as it often is), the rise in unemployment makes it clear: labor supply is outpacing demand, and momentum in the economy is fading.

Fed Fund Futures are now pricing in a 108% chance of a September cut, with two more by January. That shouldn’t come as a surprise after Powell effectively shifted the Fed’s dual mandate toward prioritizing the deteriorating job market. Barring an “insanely hot” inflation print, a September cut looks all but locked in. What’s far less certain — and far more important for markets — is the trajectory beyond that.

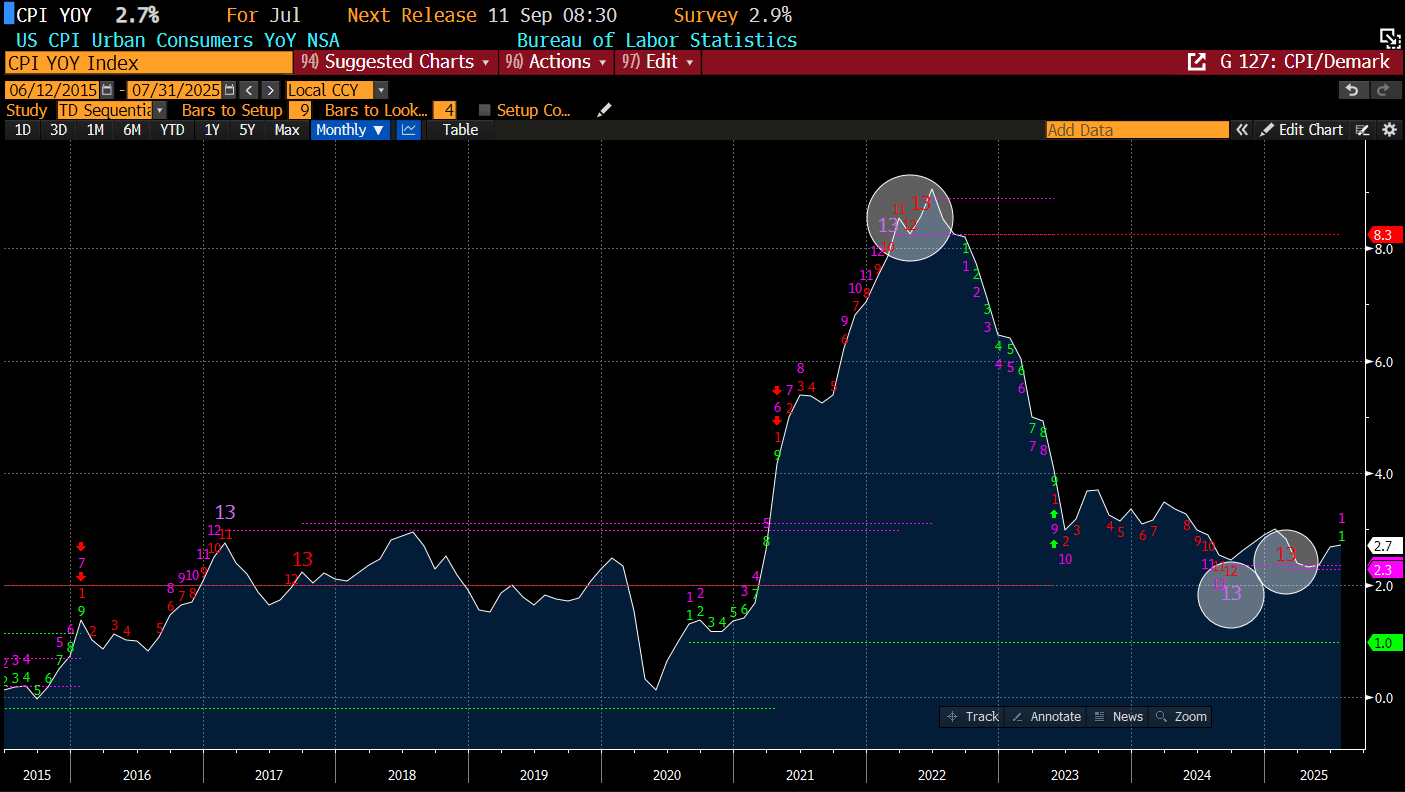

If CPI were to reaccelerate, the rate-cut path could quickly shift back to a “one-and-done” scenario. That would almost certainly inject fresh volatility into markets — and it’s where we’re leaning heading into this week’s report. The forecast calls for one of the hottest CPI readings since January, translating to nearly 3% year-over-year inflation — a level that could shake the market’s confidence in the rate-cut narrative.

Overlaying DeMark signals with CPI paints a clear picture: the recent 13-buy setup and the subsequent flip higher have correctly anticipated the reacceleration in inflation. The question now is whether these signals will once again nail the turn. From our perspective, the setup suggests they just might.

The bigger question is whether markets will care. On Friday, an early morning panic attack erased a gap higher and sent the SPX spiraling lower as investors confronted the reality of a rapidly deteriorating economy. By the close, the index had clawed back but still finished the week modestly in the red.

We find it hard to believe that equities will simply take a CPI reacceleration in stride. If inflation runs too hot, the implication is clear: the Fed will have less room to deliver the kind of stimulative cuts the market is counting on. Where that CPI pivot point lies is anyone’s guess.

What we do know is that volatility around macro events has been steadily intensifying. Over the past three months, the S&P 500’s average volatility on CPI releases, jobs reports, and Fed decisions has run nearly 50% higher than on all other sessions, according to Asym 500.

This is all happening with the VIX sitting near year-to-date lows — implying that 30-day SPX volatility may be priced too cheaply. What makes this even more interesting is the contrast with bonds: the MOVE Index has been steadily climbing. Historically, equity and bond volatility tend to move in tandem, but according to a Bloomberg analysis, that relationship has started to break down.

What does this divergence mean? Simply put, bond investors are far more nervous about the upcoming releases than equity investors. And last time we checked, it’s the bond market that wags the tail — not the other way around.

So how do we navigate this much uncertainty when increased turbulence feels inevitable? The answer is straightforward: precious metals. We’ve been recommending this trade since early August as a way to generate alpha through uncorrelated returns. That call is paying off — gold broke out to a new all-time high last week, while silver surged to its highest level in 14 years.

The Precious Metals Index (XAU) is now up roughly 28% since the start of August — nearly 15x the return of the major equity indexes over the same period. That’s not just a hedge; that’s serious alpha.

Or as we like to say: “Fire up the Harley, honey — cause we goin’ ridin’.”

That last line was just our poor attempt at humor — no Harley in this garage. But before we get carried away, it’s time to check the charts. After all, with CPI looming, the market’s about to face its Dirty Harry moment once again. Do you feel lucky?

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade