Introduction

Well… that was underwhelming.

It’s hard to recall an FOMC press conference with less new information than the one we just sat through. The decision itself was widely expected, but Chair Powell’s deliberate avoidance of the political noise now surrounding monetary policy made for a notably uneventful presser. The takeaway was simple and unchanged: the Fed remains on hold and firmly data dependent.

Powell made it clear that policy will not shift until the economic data justifies it — a stance that keeps the Fed in wait-and-see mode despite mounting political pressure. That restraint is unlikely to sit well with President Trump, who has been vocal about his preference for materially lower rates. The political commentary will likely grow louder, but for now, the Fed is staying in its lane.

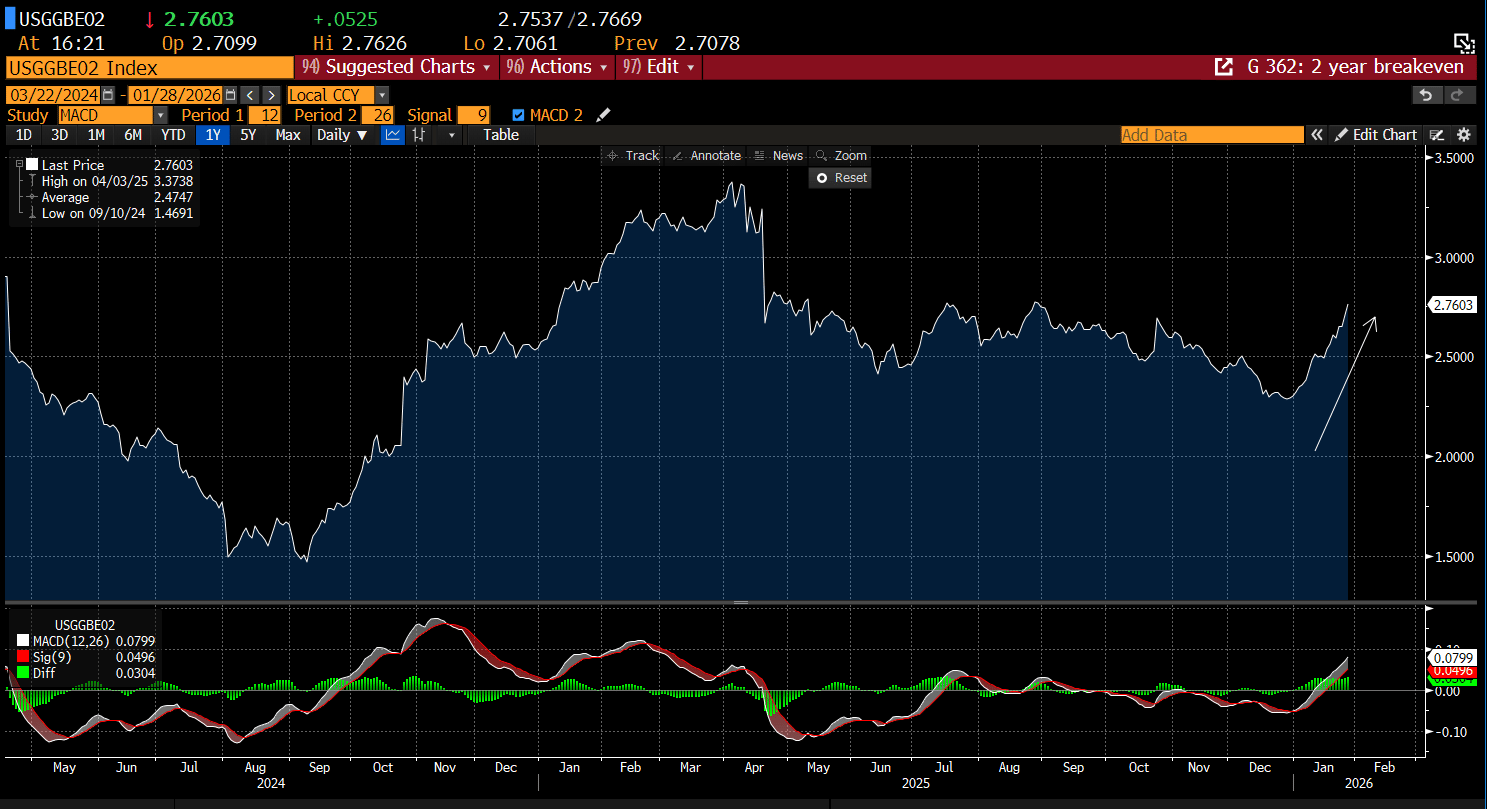

The challenge for the “cut now” narrative is that the bond market isn’t cooperating. Both the 2-year and 5-year breakeven inflation rates continue to trend higher, signaling that inflation expectations are firming, not fading. That dynamic makes it harder to justify preemptive easing and reinforces the Fed’s cautious stance.

Powell reiterated that inflation expectations remain well anchored and suggested that, absent tariff effects, inflation would likely be running cooler. Still, rhetoric doesn’t drive policy — the data does. For the Fed to move before Powell’s term ends, inflation likely needs to show clearer progress, especially now that officials view the labor market as broadly stable.

Of course, markets may be looking past Powell altogether, with equities appearing to price in the possibility that the next Fed Chair could take a more accommodative stance.

Bond yields reflected the lack of urgency. The 2-year Treasury yield barely reacted and continues to hold above its recent breakout level, underscoring that rate-cut expectations remain restrained for now.

In our weekend report, we highlighted the potential for yields to revert following the DeMark Sequential 13 sell, and so far that’s playing out. Yields appear to have peaked alongside the signal and have since begun to roll over (price flip with green 1, 2, and 3 beneath the bars).

The slow stochastic has also crossed bearishly, pointing to fading short-term momentum. A more subdued yield backdrop should provide near-term support for risk assets — at least for now.

Fed Funds futures have barely moved following the FOMC press conference and continue to price in roughly two rate cuts by year-end.

Moving on.

While Powell may have induced an afternoon lull, the real action came after the close as the Mag 7 earnings parade began. META delivered a particularly strong report and outlook, even while raising capex guidance. Investors looked through the spending increase and focused on accelerating ad growth, sending the stock up roughly 10% post-earnings.

MSFT, on the other hand, failed to provide enough upside surprise to offset its own capex ramp, noting that AI investments will take more time to translate into meaningful returns. TSLA also surprised to the upside after a string of weaker reports. Two out of three delivered, and importantly for the broader AI theme, capex intentions continue to trend higher — a tailwind for the semiconductor complex.

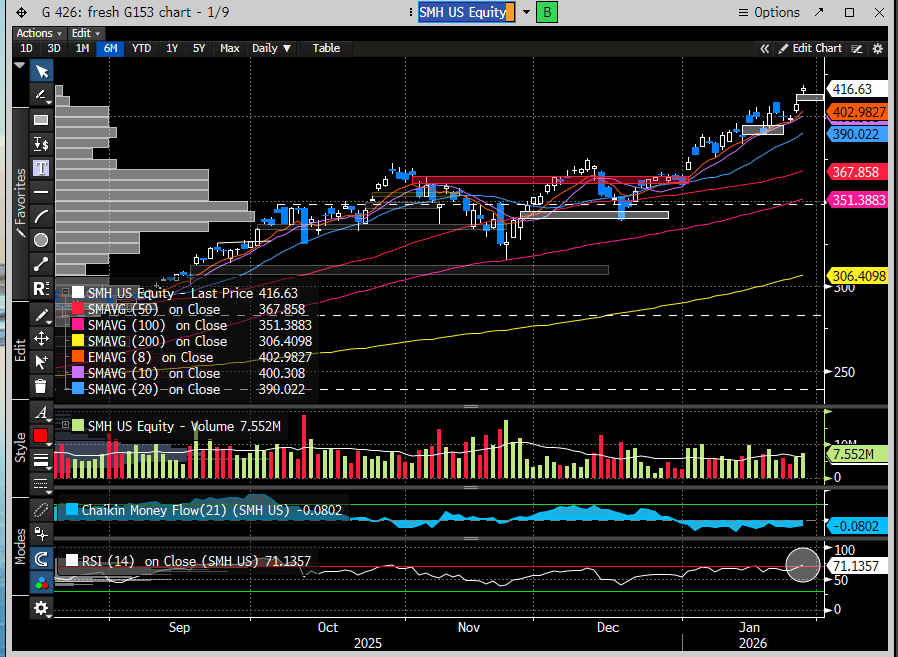

That strength showed up clearly in Semiconductors (SMH), which closed at a fresh all-time high after gapping higher. We’ve said repeatedly that it’s difficult to maintain a bearish stance on the broader market while semis continue to lead. For now, the trend remains bullish — though increasingly overbought.

The geopolitical and macro landscape continues to test investors’ resolve. While it’s understandable to feel tempted to sell into such a volatile backdrop, we remain focused on how markets are pricing risk, not just the headlines themselves.

We’ve consistently advised against overreacting to weekend noise, instead emphasizing how indexes behave at key support levels and, most importantly, how the week closes. That discipline has kept our clients on the right side of the tape, with the SPX printing a new intraday all-time high today.

All-time highs are bullish — last we checked.

But there are cracks forming.

Let’s review the charts.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade