Introduction

The eponymous Santa Claus rally failed to deliver for the third consecutive year, finishing marginally negative (-0.11%). That has never occurred before. While this does not automatically imply a negative year ahead, it does suggest that expectations should be tempered relative to the past two years. When Santa shows up with coal instead of gifts, forward returns have historically been meaningfully weaker.

According to the Leuthold Group, years following a failed Santa Claus rally have produced roughly half the average annual return versus the long-term norm. That outcome aligns closely with our broader view: this is likely to be a choppier, less directional market, characterized by shorter-duration trends and more frequent regime shifts. In that environment, passive positioning becomes less effective, while actively trading around core positions and remaining tactically flexible becomes far more important.

In other words, coal for Christmas doesn’t mean the party is over—but it does mean the playbook needs to change.

That said, not all early-year tendencies are flashing caution. The first five trading days of the new year have historically shown meaningful predictive power. A positive start matters—and it matters even more when the S&P 500 is up more than 1%.

As of today, the SPX has closed its fourth trading day of the year up 1.1%. If the index can hold together tomorrow and remain green, history becomes notably constructive. In years where the first five days are positive, the full-year market return averages 14.2%, with gains occurring roughly 82% of the time. When the index is up more than 1% over that window, the statistics improve further: average annual returns rise to 15.7%, with the market finishing higher nearly 87% of the time, according to a study from Carson Research.

While these tendencies are not deterministic, they offer an important counterweight to the Santa Claus anomaly—and suggest that, despite potential cross-currents, the broader backdrop may still be more supportive than headline narratives imply.

While we welcome it when historical studies stack in our favor, they are never the primary driver of our directional bias. Our conviction comes from the underlying market structure, positioning, and forward-looking macro signals—not calendar effects. In our 1/4 report, we were unequivocally bullish on the 2026 setup, with a clear emphasis on a small-cap resurgence.

Thus far, that call is playing out as expected. Our SMID-cap proxy (R2K / $RTY) has roughly doubled the performance of the major indexes, reinforcing our view that leadership is broadening beneath the surface—even as headline benchmarks mask the rotation underway.

This is precisely the type of environment where disciplined positioning and relative-strength analysis matter more than chasing index-level narratives.

Yes, we get it—it’s only four trading days, and a lot can change. If anyone understands that reality, it’s us. Trading and investing are exercises in probabilities, not certainties. Our job is to stack as many odds as possible in our favor while remaining intellectually honest and flexible. When the facts change, we change. The best traders and investors adapt quickly—and, just as importantly, cut losses decisively when the foundation of a thesis is compromised.

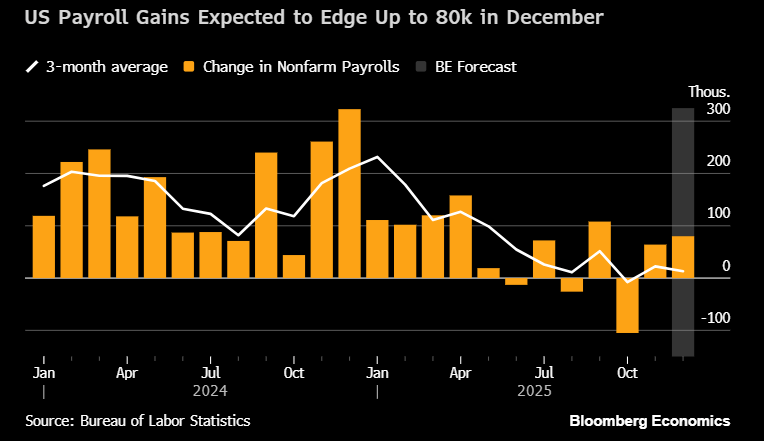

That brings us to this week’s payroll report, which has the potential to disrupt an otherwise constructive setup. Today’s private-sector employment data from ADP came in weaker than expected, increasing the risk of a broader disappointment. Consensus expectations sit near ~60K, while the Bloomberg estimate is closer to 80K, implying a materially stronger print and an improvement over November’s 64K.

A meaningful miss would challenge near-term momentum and could inject volatility back into markets. As always, we’ll let the data dictate—not the narrative—and adjust positioning accordingly.

Regardless, neither outcome is likely to materially alter the Federal Reserve’s projected two rate cuts in 2026, which continues to support our broader thesis of SMID-cap outperformance. If anything, growth that cools without collapsing remains an ideal backdrop for that segment of the market.

Moreover, should next week’s inflation report surprise to the downside—as we expect—the SMID-cap trade could become meaningfully supercharged, as rate expectations compress and financial conditions ease further beneath the surface.

With that macro context in mind, let’s turn to what ultimately matters most: the charts.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade