The Future of the Content Economy

beehiiv started with newsletters. Now, they’re reimagining the entire content economy.

On November 13, beehiiv’s biggest updates ever are dropping at the Winter Release Event.

For the people shaping the next generation of content, community, and media, this is an event you won’t want to miss.

Introduction

We love the doom-and-gloom crowd — the talking heads on TV, the perennial bear newsletter writers, and the self-proclaimed “experts” on social media calling for another Black Monday crash. None of their predictions ever come true, yet people keep listening. There has to be a better way to live than constantly expecting disaster. How is that any way to exist? Imagine being bearish on a market that appreciates nearly 70% of the time — that’s like telling a blackjack player to shove all their chips in on a hard 12. Would you?

Sure, the bears will eventually have their day in the sun. But who wants to spend two-thirds of their time harping on the negative? It sounds exhausting—and isolating. And honestly, are any of these perma-bears actually positioned short all the time? We doubt it. If they were, they’d have gone broke years ago.

So why bring this up? Because there’s a better way to approach the market. Being agnostic and listening to the rhythm of price is far more effective than fighting it. Are we in a bubble? Maybe. Is the market expensive? Absolutely. But does it matter right now? Not really. The capital pouring into AI is astronomical and unprecedented. It might not end well eventually, but it’s not ending anytime soon.

We could list countless reasons why the market should correct, but in the words of Linkin Park, “In the end, it doesn’t really matter.” In this cycle, discretionary investors are the minority—machines dominate the tape, and they’re programmed to buy momentum. When the macro backdrop is supportive, momentum strategies remain the primary source of alpha, even as the Mag 7 consolidate for a month. Their pause isn’t a warning—it’s confirmation that momentum remains king.

Meanwhile, space stocks (UFO) are breaking out to new highs almost daily, gaining nearly 18% over the past month, while the once-untouchable Mag 7 remain stuck in the mud. It’s a reminder that momentum hasn’t disappeared—it’s just migrated to new frontiers.

Nuclear stocks (NLR) are now all the rage, outpacing UFO by over 1,000 basis points. In a market where capital relentlessly chases what’s working, momentum has clearly found a new orbit—and it’s not in the familiar names everyone’s watching.

Will this all end poorly? Most definitely. Is that happening tomorrow? Probably not.

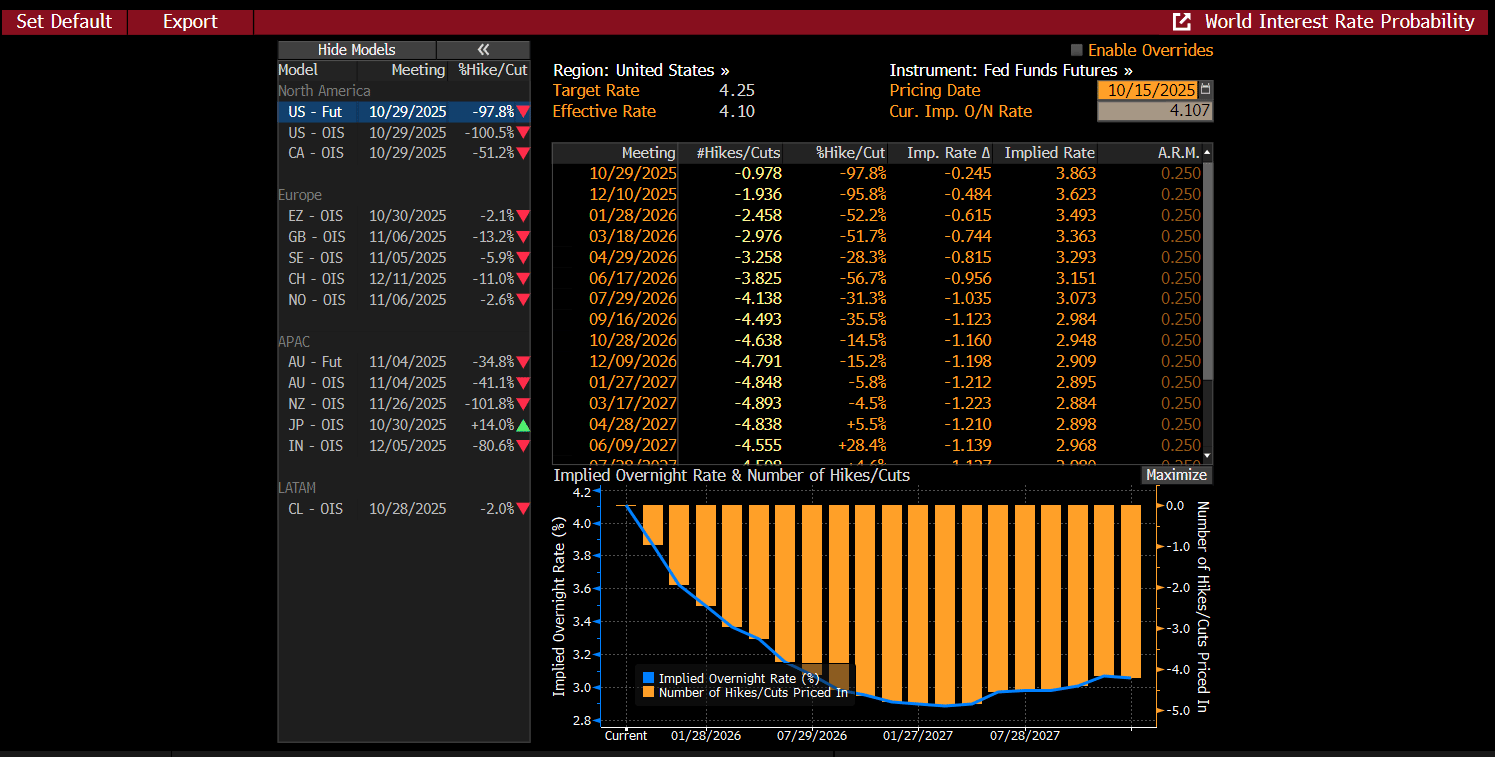

J Powell just reaffirmed his commitment to maintaining the rate-cut trajectory, and with a light macro calendar between now and the next meeting, there’s little reason to expect that stance to change. Fed Funds Futures are now pricing in a near 100% probability of two cuts by December, effectively giving the market a green light to keep the party going.

For the bubble to truly burst, that trajectory would need to be disrupted—and for now, there’s no evidence of that.

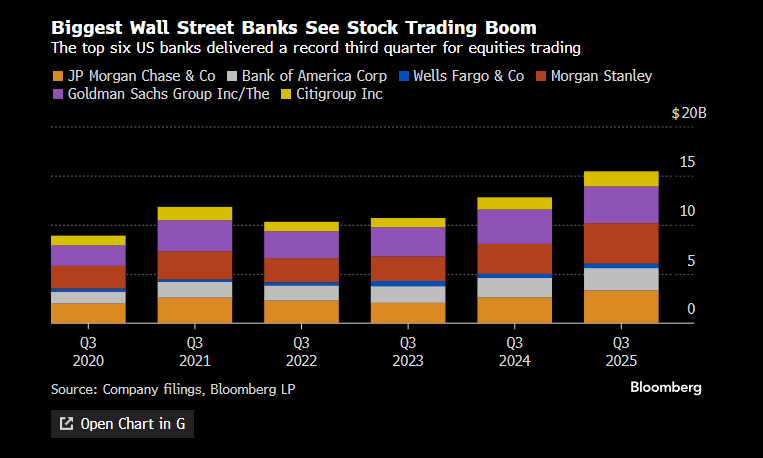

The next major catalyst for the market is earnings season, which just kicked off with the large money-center banks. So far, results have been robust, highlighted by record trading revenue and financing. We expect this strength to carry through the broader market, with most companies likely to deliver solid earnings and constructive outlooks that reinforce the current momentum narrative.

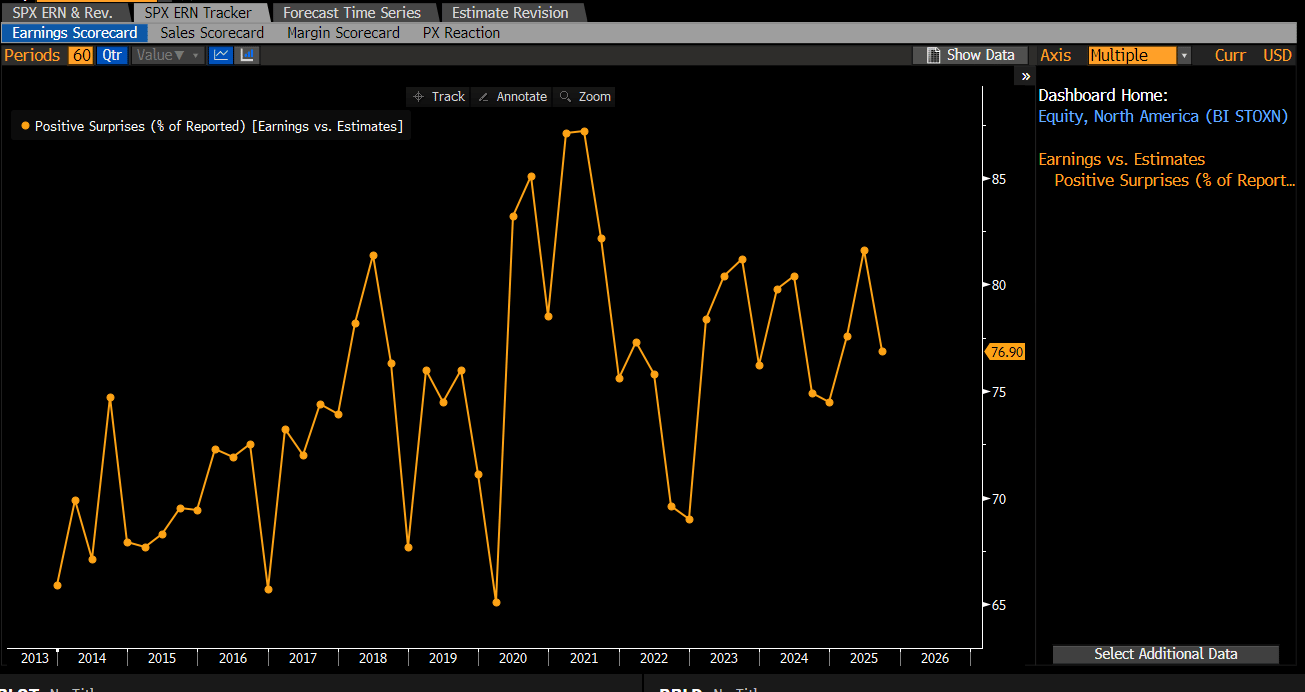

While it’s still early in the season, roughly 77% of companies that have reported so far have beaten estimates, reinforcing the view that corporate fundamentals remain resilient despite the macro noise.

And, in typical Wall Street fashion, earnings estimates have been drifting lower all quarter, effectively setting the bar low enough for most management teams to clear with ease. It’s a familiar game—soft expectations meet resilient results, and the market breathes a sigh of relief.

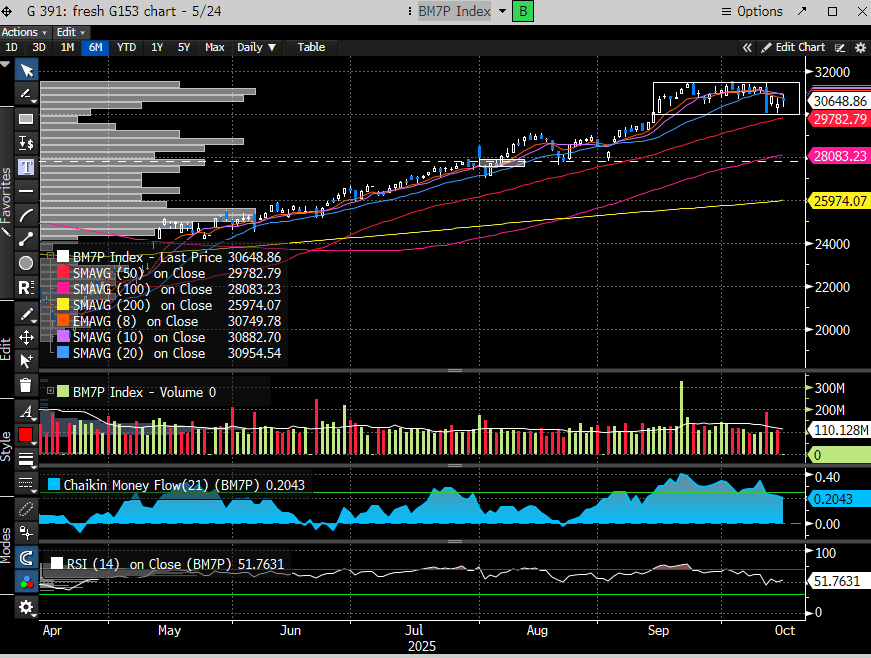

So that begs the question after Friday’s ugly reversal — are we bullish or bearish?

Let’s dig into the charts and find out.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade