- Coiled Spring Capital Macro Report

- Posts

- Coiled Spring Capital MW 10/29/25

Coiled Spring Capital MW 10/29/25

It's Powell's Punchbowl

Introduction

Just when investors thought the path toward rate cuts was a foregone conclusion, Powell reminded everyone that it’s his punchbowl — and we’re merely guests trying to sneak a drink.

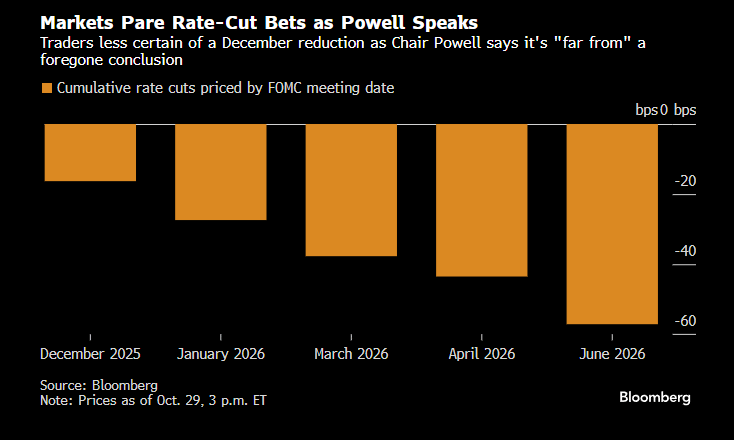

In a surprisingly hawkish press conference, Powell downplayed the odds of a December cut, jolting markets that had priced in near certainty only a week ago. Fed Fund Futures dropped from a 99% probability to just over 70%. Is this a derailment of the easing cycle? Probably not — the broader rate-cut trajectory remains intact — but it’s a sharp reminder that monetary policy still dances to Powell’s rhythm.

Complicating matters, the ongoing government shutdown (now entering week four) has choked off macro data releases, leaving markets flying partly blind. Powell acknowledged that inflation is hitting lower-income households hardest, with higher earners sustaining demand — signaling the Fed’s growing focus on the employment ecosystem rather than headline inflation alone. That’s a delicate stance in a world where AI adoption and automation are already displacing workers — a slow-burn risk that could eventually widen structural cracks beneath the surface.

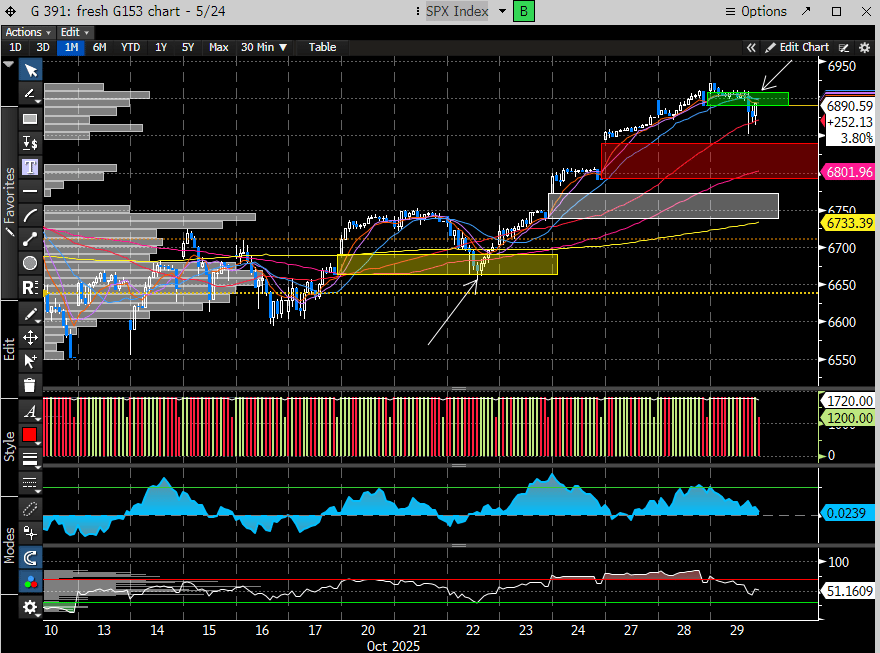

Equities, for now, have taken Powell’s remarks in stride. Often, the real move happens the day after a Fed event, once hedges come off — which is why we prefer to see where the market closes before drawing firm conclusions. A pause or mild giveback would be natural here, but positioning tells another story: according to Fundstrat, 22% of professional managers are underperforming the index, setting the stage for a year-end performance chase where every dip could be bought.

Meanwhile, treasuries sold off sharply — their worst drop in five months — as December cuts were priced out. The December FOMC now becomes a live meeting, and if the government ever reopens, the resumption of macro data releases will only add fuel to an already volatile setup.

While most professionals were caught off guard by Powell’s hawkish tone, Tom DeMark’s signal once again proved prescient. The DeMark 9 buy we highlighted last week marked the exact bottom in yields. A timely reminder that good technicals often outshine economists’ forecasts — in this case, by a wide margin.

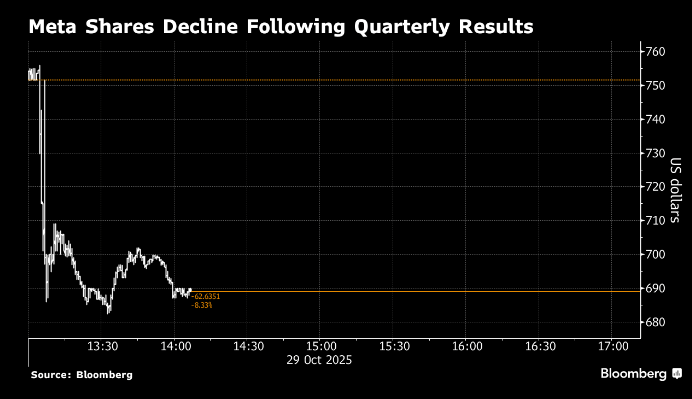

Not only must investors navigate shifting rate-cut expectations, but the Mag 7 earnings on Wednesday night added fresh uncertainty. GOOGL delivered solid results, but MSFT fell short of lofty expectations, and META is under heavy pressure following a substantial increase in capital expenditures. While higher capex should ultimately benefit AI infrastructure names, the short-term reaction could trigger broad large-cap selling that could easily spill over into the wider market.

Lastly, Trump’s meeting with President Xi tomorrow could determine whether markets correct or extend the rally. A contentious outcome could quickly unwind the optimism that had been priced into what many expected to be a catalyst-rich week. The S&P 500’s four gap openings in the past eight sessions already hint at exhaustion, and today’s failed gap may have reinforced that message.

Heavy catalyst weeks are always tricky to navigate, which is why we prefer a wait-and-see approach to let the market reveal its hand. What matters most isn’t the intraday noise — it’s how we close the week that carries real signal.

With that, let’s turn to the charts.