- Coiled Spring Capital Macro Report

- Posts

- Coiled Spring Capital MW 11/12/25

Coiled Spring Capital MW 11/12/25

Traveling today - quick market update

We’re traveling over the next two days and will be largely out of pocket, so today’s note will be a brief update.

The good news is that most of what we discussed in Monday’s video continues to play out, so there isn’t much in the way of material changes to report.

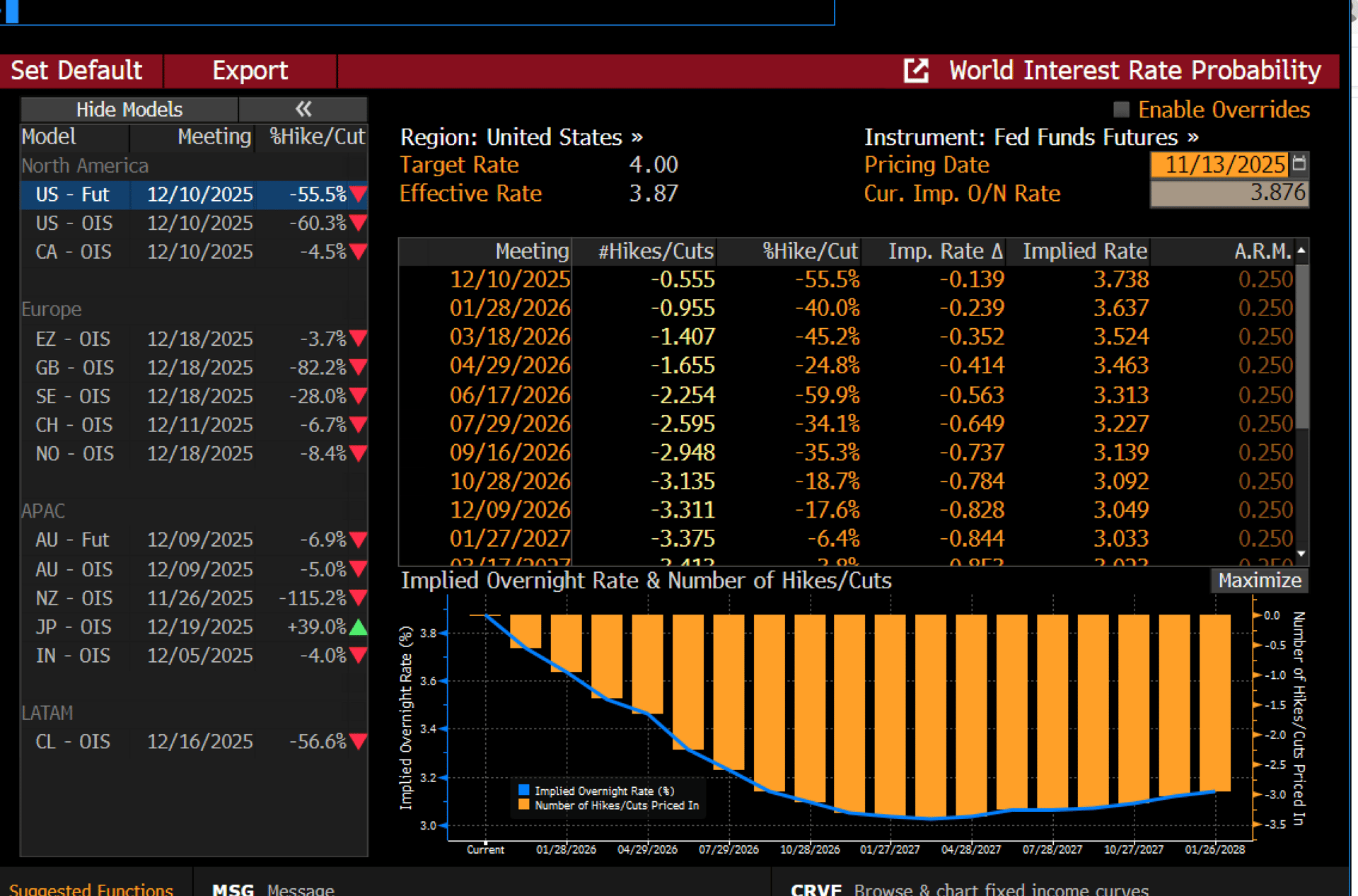

The biggest headwind we see for the market right now remains the Fed Fund Futures curve, which is pricing only a 55% probability of a December rate cut. That’s a problem for speculative growth stocks and other liquidity-sensitive assets such as crypto.

Until the rate-cut probabilities improve, we do not expect those segments of the market to stage any meaningful or sustainable reversion.

Unfortunately, we learned today that despite the government shutdown ending, the major macro releases—CPI, employment, and related datasets—will not be tabulated. This leaves the Fed flying partially blind, with a dearth of critical information to justify a December rate cut. In practical terms, this may push cuts further out, potentially into the next meeting.

The market appears to be telegraphing this risk, which is why so many stocks continue to grind lower beneath the surface. Without a meaningful stimulus impulse, it’s entirely possible the economy is slipping more than expected, with the shutdown likely exacerbating the slowdown. Whether reopening the government will be enough to soften the blow remains an open question.

Meanwhile, the major indexes have not fully reflected this reality, thanks to heavy sector rotation keeping the headline levels afloat. The problem is that technology continues to lag—and without tech’s participation, the broader market’s stability becomes far more tenuous.

With that, let’s turn to the charts.