Introduction

Let’s not beat around the bush — the market is under real stress. As we outlined in this weekend’s report, we shifted from a tactically agnostic posture to aggressively cautious. That shift wasn’t based on narratives, opinions, or what anyone thinks the market should do. It was based on data — and the data continues to deteriorate.

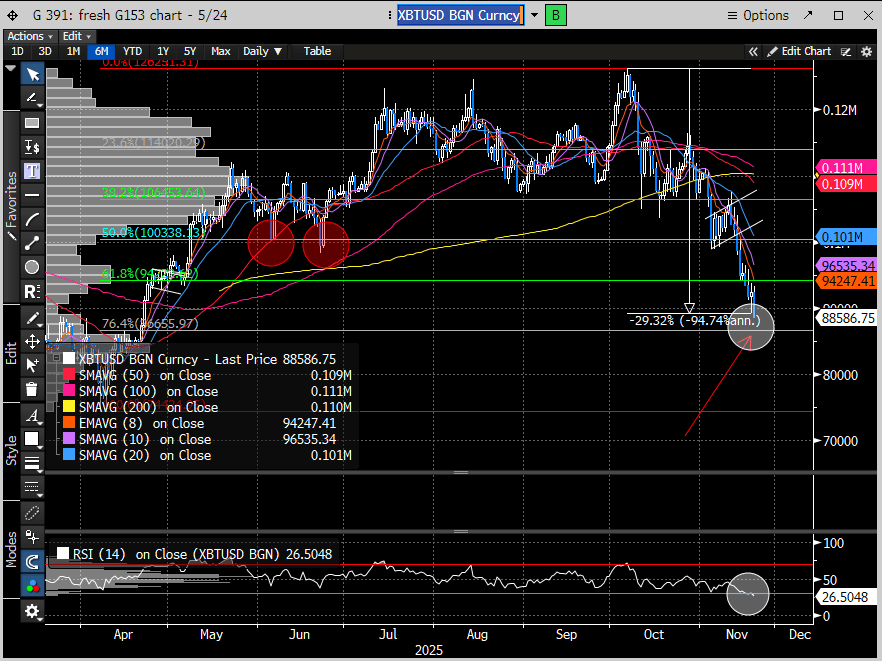

None of this means the bull market is officially over, but it is undeniably experiencing a bout of violent indigestion. Speculative corners of the market have already seen 30–70% drawdowns since the summer. Whether justified or not, that kind of risk decompression is contagious and eventually bleeds into broader equities.

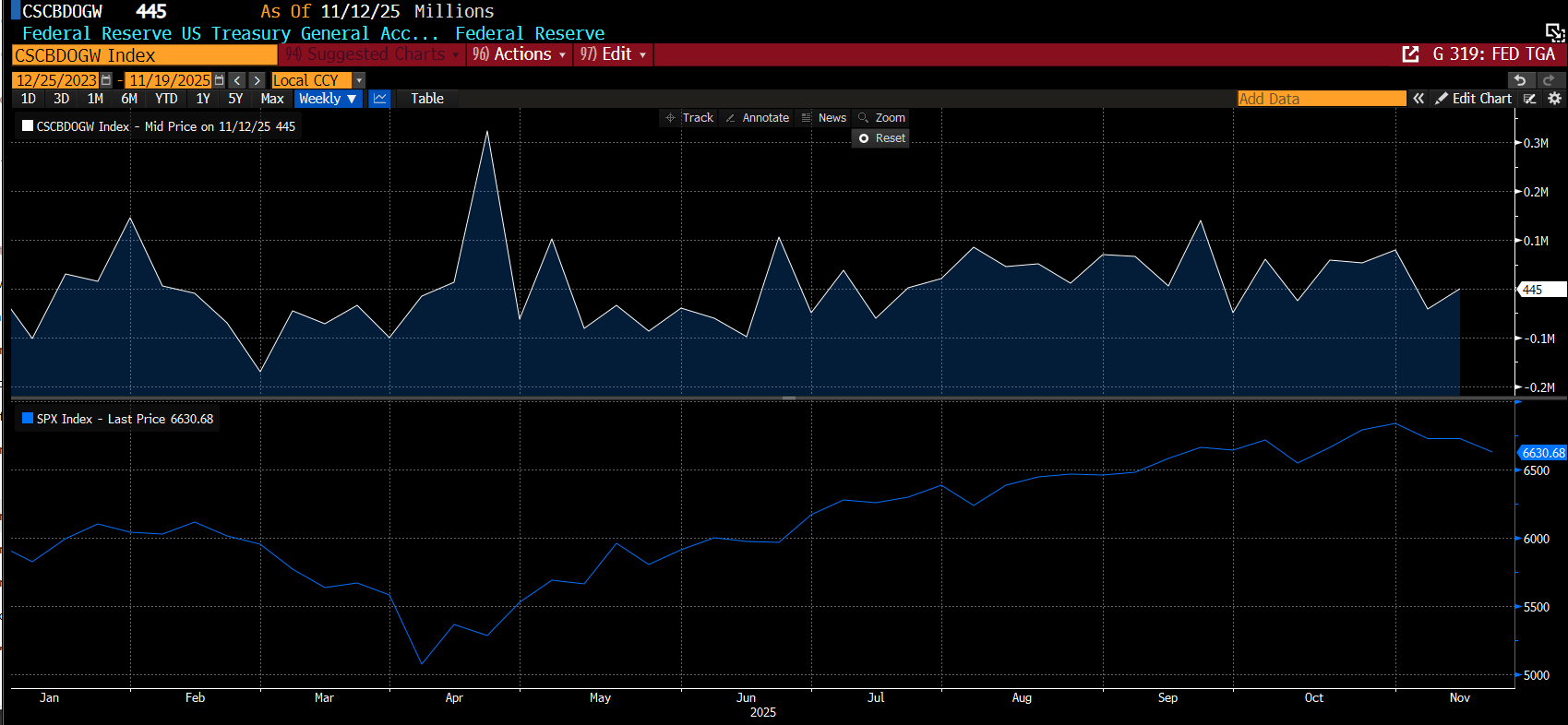

The liquidity backdrop we’ve been flagging for a month is still a major headwind. Repo stress continues to intensify, with rates now running ~5 bps above the Fed Funds target range (3.75–4.00). That is not a sign of a well-functioning funding market — and it is adding incremental pressure to risk assets across the board.

This becomes even more problematic when the Treasury General Account (TGA) is depleted, as it effectively raises the cost of borrowing in the repo market. The recent government shutdown likely contributed to this dynamic.

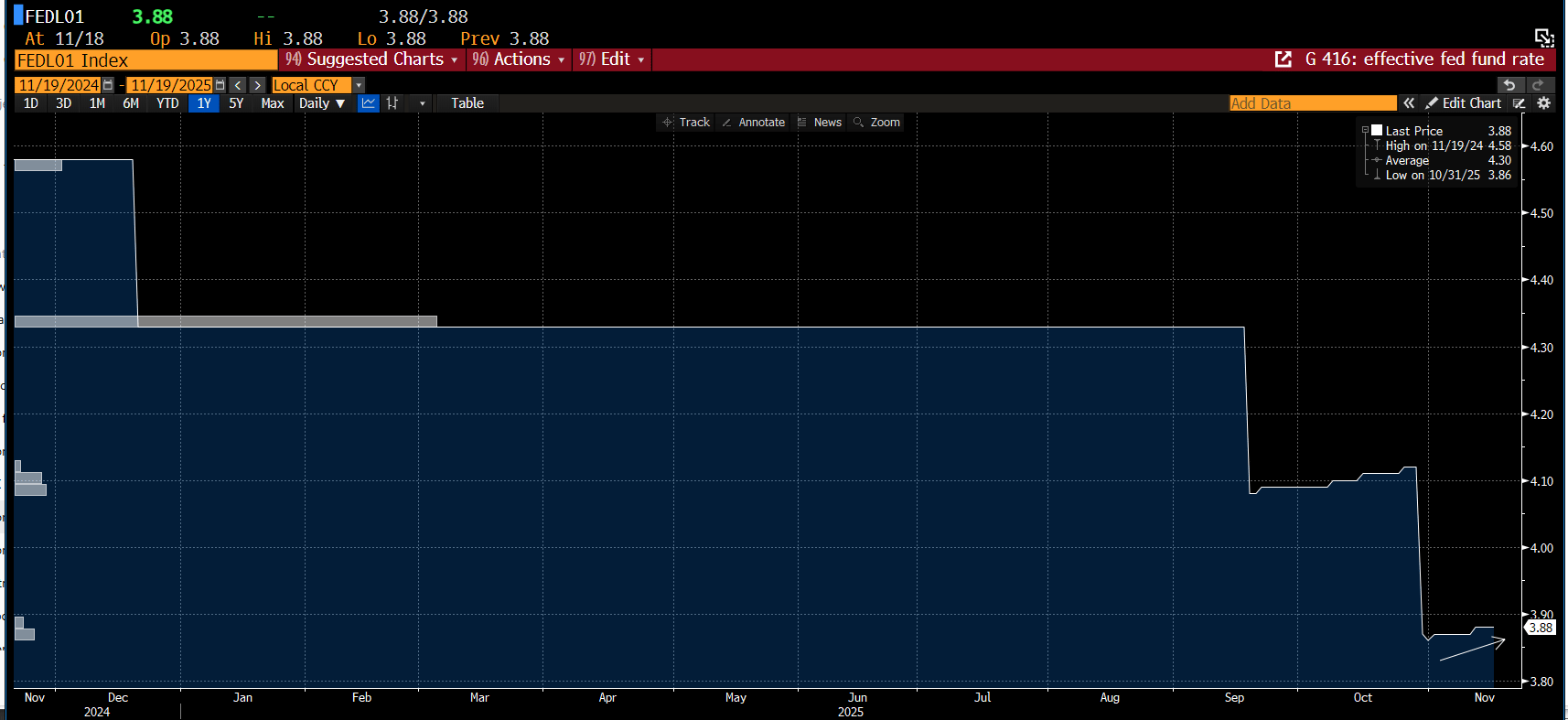

The clearest sign of stress is the recent rise in the effective fed funds rate (EFFR), the rate banks charge one another for overnight loans to meet reserve requirements. The move higher is almost certainly being dragged up by the elevated repo rates — a classic signal that funding pressures are building beneath the surface.

Tightening liquidity has a way of dislocating markets, and it’s the most plausible explanation for the unwinding we’re seeing in leveraged corners of the risk complex, especially crypto. You don’t need to be a specialist in government financing to see that something is off. Bitcoin — our preferred proxy for liquidity — is down nearly 30% in five weeks and is now approaching its next Fibonacci target near $86K.

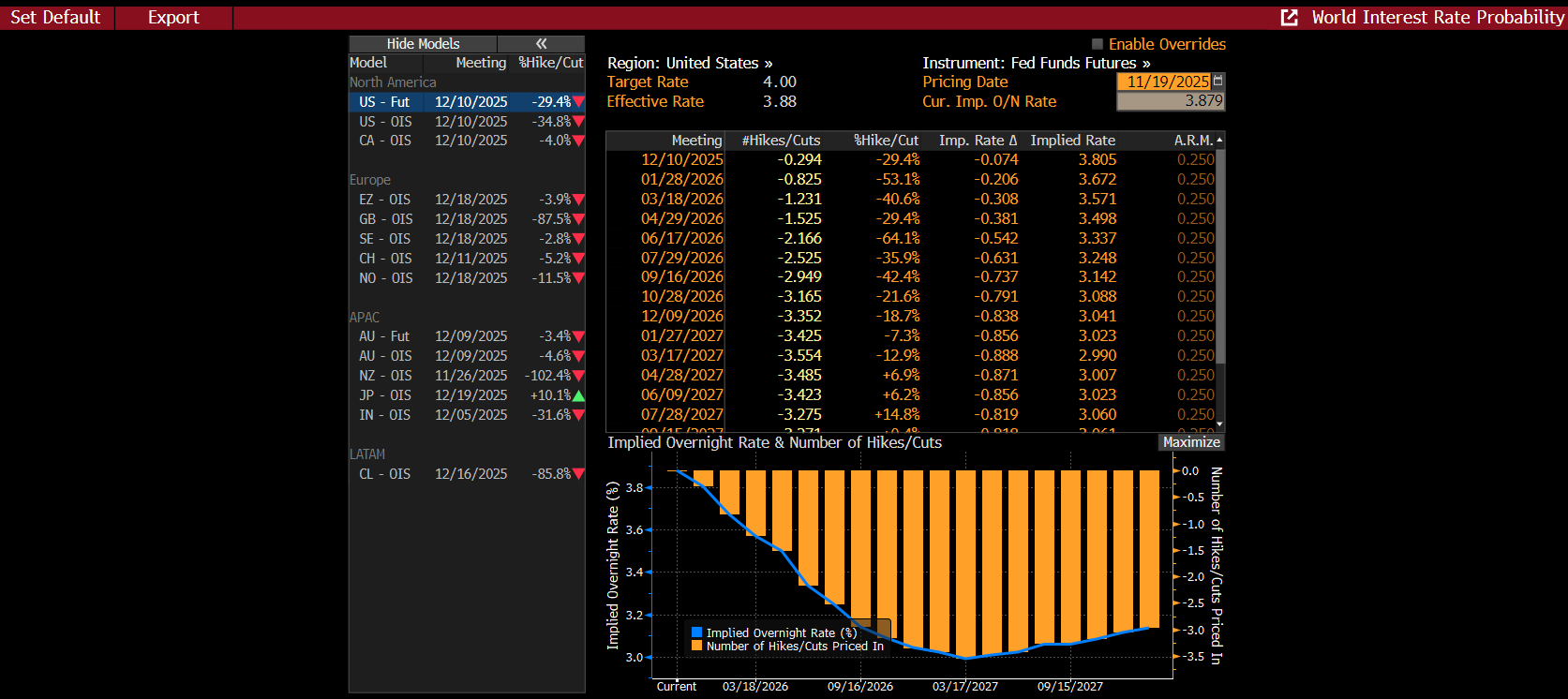

The Fed Fund Futures market is adding to the tightening-liquidity backdrop, now pricing in less than a 30% chance of a December rate cut. This shift reflects growing skepticism that the Fed will step in to counter the slowdown, and it reinforces the pressure already building across risk assets.

Rate cuts have steadily been priced out as the year has progressed.

WWe can debate valuations and froth all day, but markets ultimately run on leverage and liquidity. When the cost of capital rises, things break — and that’s exactly what we’re seeing. Something will need to shift to arrest the recent slide and restore confidence. Whether that catalyst comes from a Trump pivot on tariffs or from the Federal Reserve remains unclear.

Citadel’s Scott Rubner offered a potential roadmap, noting that pressures could ease once QT wraps up: “End of November, bills supply will ease somewhat, TGA will be spent down toward target balance, and QT will pause. Taken together, this should start to ease pressure in funding markets and provide support to more liquidity-sensitive risk assets.”

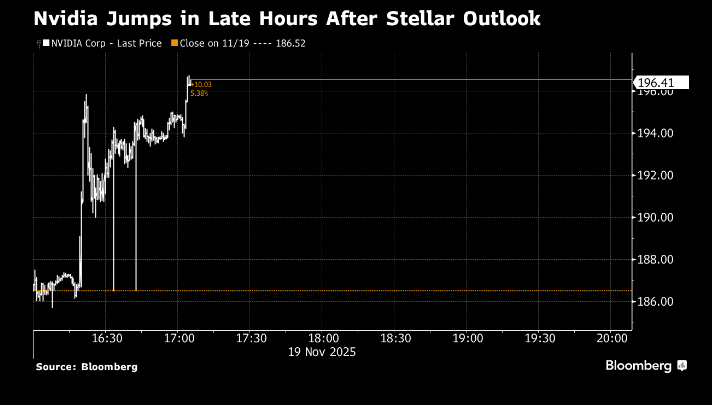

If he’s right, the market may begin discounting that improvement soon. Perhaps that process begins with NVDA. The company delivered another robust earnings report, and as of this writing, the stock is pushing toward $200. Recent narratives questioning the sustainability and ROI of AI infrastructure spending contributed to sharp drawdowns in leveraged AI names, but NVDA’s outlook undercuts that skepticism.

As Jensen Huang put it: “AI is going everywhere, doing everything, all at once.”

But as technicians, we’re less focused on the numbers than on the reaction. Tomorrow will be critical — either Santa shows up early and we get some holiday cheer… or we all end up with a sack of coal.

Get your eggnog ready.

Now let’s check the charts.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade