Introduction

There’s nothing easy about navigating the markets—it’s a tough place to do business. Millions of participants compete daily in what amounts to a steel-cage match for capital supremacy, with unquantifiable sums on the line. Professional sports are difficult, but at least athletes know their opponents. In markets, your competition is an anonymous crowd trying to take your money. Like any great athlete, preparation is key—understanding risk and managing it with every dollar you deploy. Most participants fail here because they let their opinions guide their decisions instead of evidence.

This is where we differ. We use a weight-of-the-evidence approach to shape our views, not justify them. Our analysis centers on the study of price—letting price guide our opinion, not the other way around.

Back in October, we noted that the market was becoming too easy to make money—a signal in itself. When investors start fixating on daily gains, it usually marks the end of a favorable regime. Markets ebb and flow: sometimes they’re easy, sometimes uninvestable, but most of the time—they’re just plain hard.

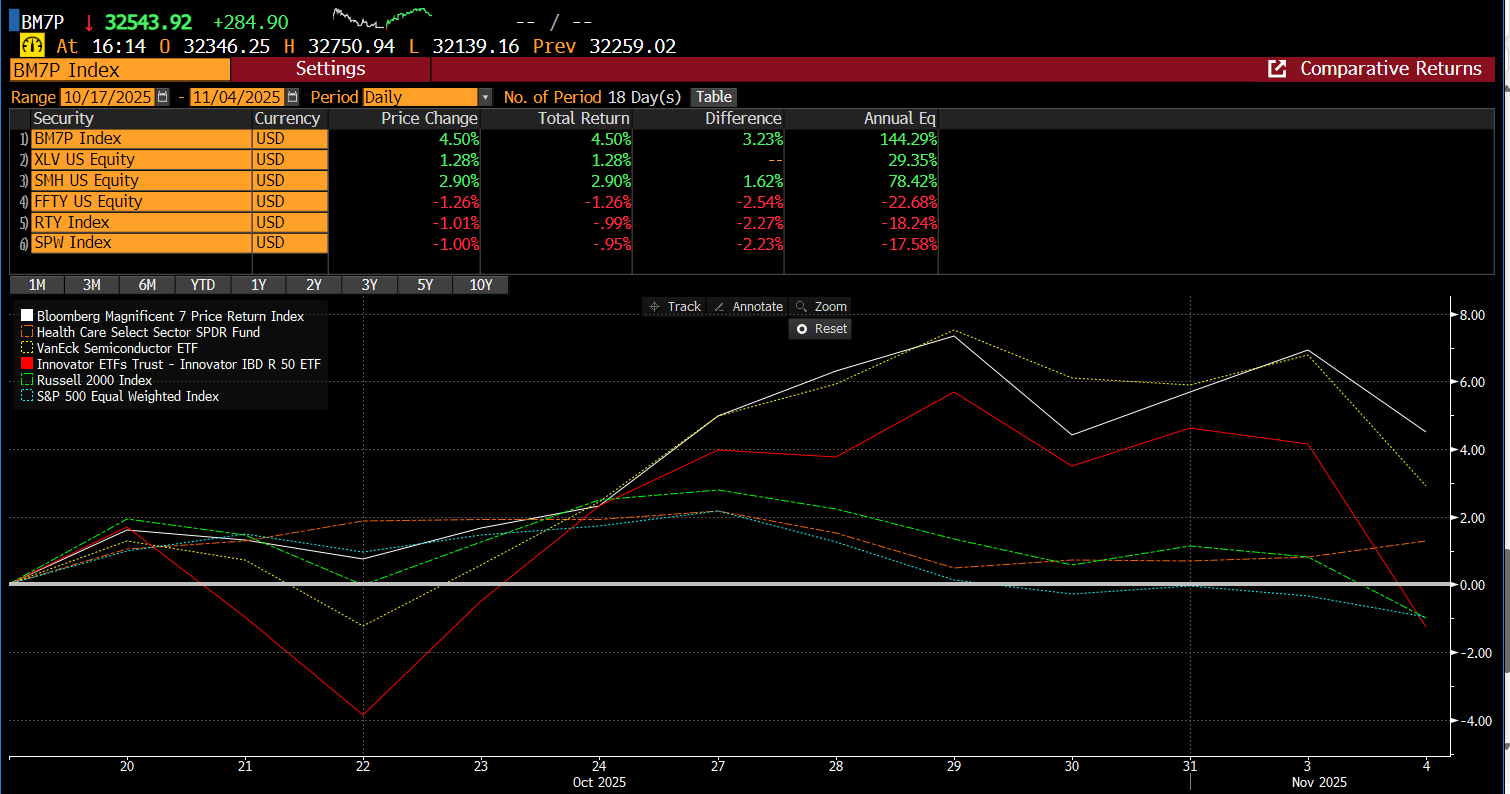

The market has gotten hard again. Momentum and crypto were the first to flash warning signs, a shift we’ve discussed repeatedly as a reason to stay guarded with capital allocation. We advised sticking with leadership—namely the Mag 7, semiconductors, and other large caps—while adding an uncorrelated sector like healthcare for balance. Since October 17th, when most stocks began to languish, those leading sectors have significantly outperformed the average stock.

Bitcoin’s breakdown on October 10th was the first real tell that risk appetite was changing—a subtle warning that the easy phase of the market was ending.

Speculative corners of the market followed shortly after. Space stocks (UFO) peaked on October 15th and have since fallen roughly 13.5%—another sign that risk appetite was retreating from the more speculative ends of the spectrum.

Nuclear stocks (NLR) topped out the same day, dropping roughly 19% into their recent lows—further evidence that speculative momentum was unwinding across multiple high-beta pockets of the market.

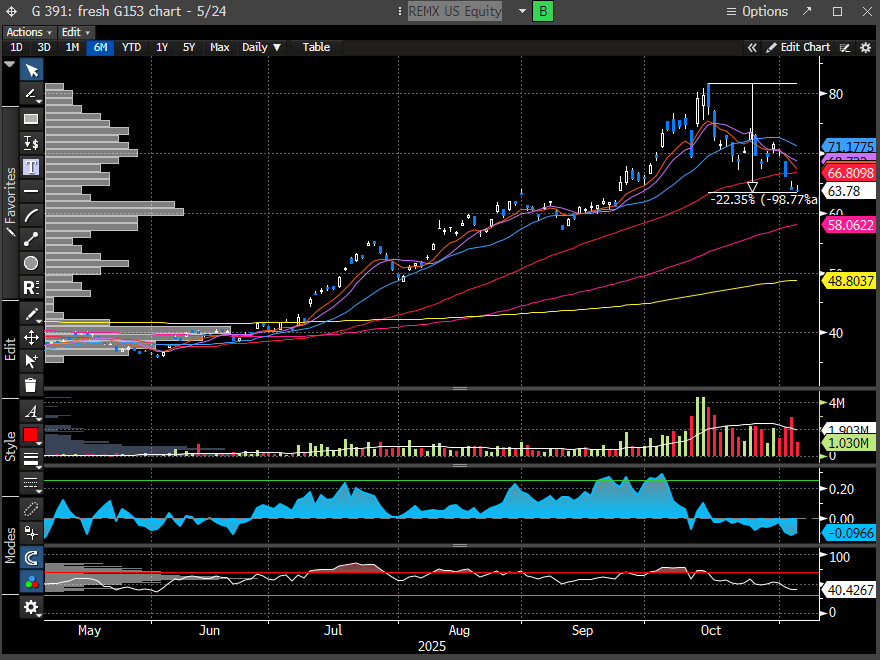

Rare Earth stocks (REMX) also peaked on October 15th and have since lost about 22% of their value—adding to the growing list of speculative groups that have rolled over in unison.

We’re not here to tell you these stocks weren’t overvalued—they were, and likely still are. But when the air starts coming out of speculative names, it usually doesn’t stay confined. It spreads—slowly at first, and then all at once.

Over the weekend, most of the commentary we read leaned heavily on November seasonality to “save” the market. And maybe it still will. But as we wrote clearly in our 11/2 report, the picture had already turned murky: “It may be prudent to remain patient before adding new long exposure.”

We noted that “the NAAIM exposure index reading has climbed above 100,” a level that typically signals stretched optimism and argues for caution, not aggression. We also observed that “the market is at a crossroads” and that the “setup for a near-term reversion is visible.” None of this implied we were bearish—it simply meant we were being disciplined. We’ve been notably less aggressive with capital deployment, respecting the growing number of signals pointing to a choppier market.

Our framework doesn’t react to narratives—it follows evidence. Seasonality alone isn’t a reason to add risk. That’s how investors lose money quickly, and our goal remains simple: limit losses and preserve flexibility.

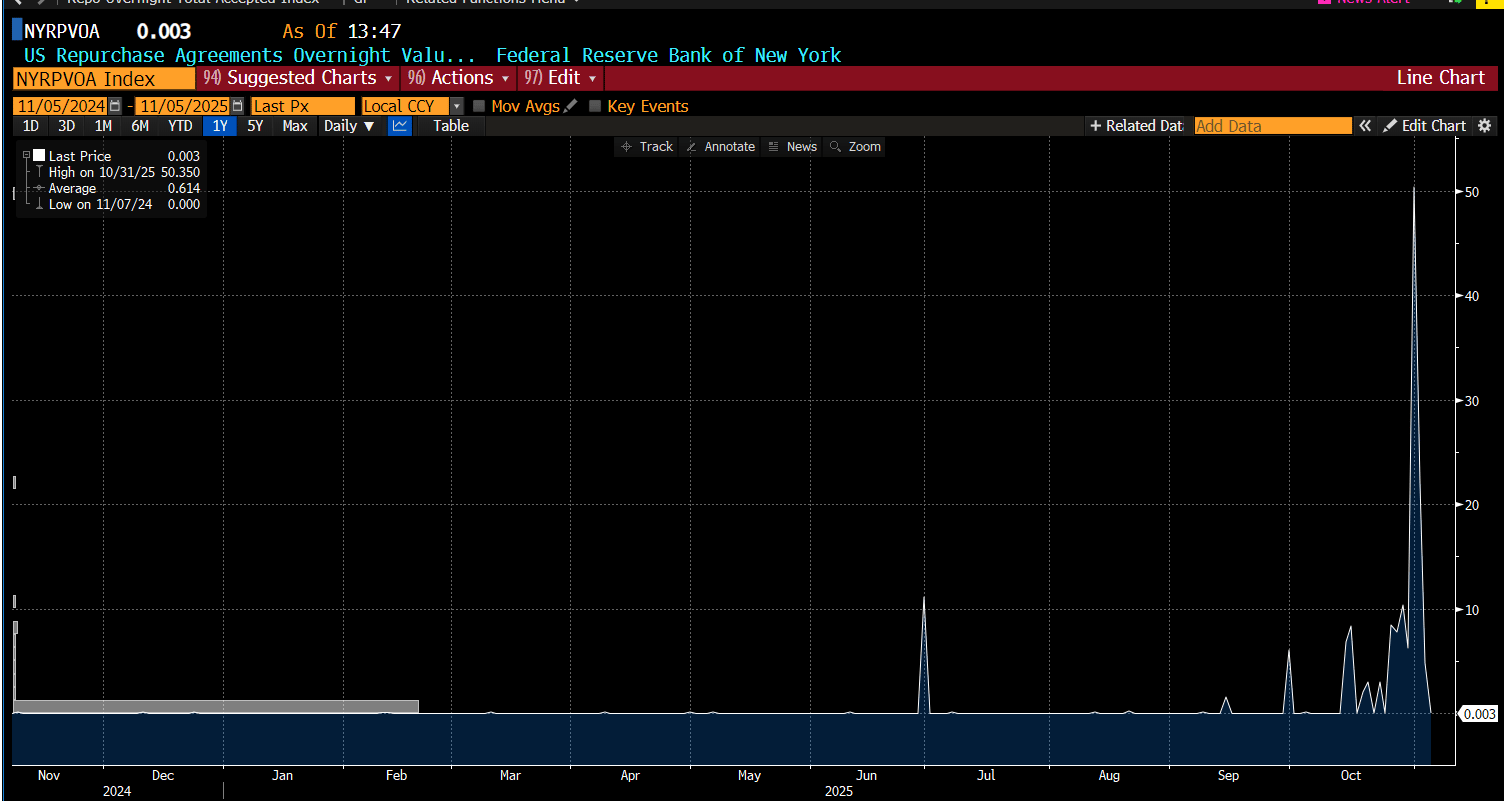

As for what triggered the October unwind in speculative froth—it’s difficult to assign a single cause, but it almost always ties back to liquidity. There’s been a noticeable capital drain at the bank level, reflected in the U.S. Reverse Repo data reported by the NY Fed. When reverse repo balances spike, it suggests cash is leaving the banking system and parking overnight at the Fed instead of circulating through the economy or markets. In short: it’s a liquidity drain.

All the erratic Reverse Repo spikes have occurred since mid-October—the same period speculative assets began to crack. Coincidence? We’d venture to say no.

As for why this is happening, one plausible thesis is that the U.S. government is drawing liquidity from the banking system to fund its operations. That’s a bit outside our lane, so we won’t overanalyze it here. What matters is the outcome: liquidity drives markets, and when it starts to retreat, casualties tend to follow.

Despite the steep index losses since the weekend, the market managed to claw back some of the drawdown on Wednesday following stronger-than-expected ADP employment and ISM services data—and on speculation that the Supreme Court may overturn Trump-era tariffs. In our last report, we highlighted the deterioration in consumer-sector earnings, and a reversal of those tariffs would certainly help ease cost pressures for both retailers and consumers.

There’s no shortage of curveballs to dodge in this market—and, as always, it’s the ones you don’t see coming that tend to do the most damage.

So yes… The Market is Hard.

Now, let’s check the charts.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade