- Coiled Spring Capital Macro Report

- Posts

- Coiled Spring Capital MW 12/10/25

Coiled Spring Capital MW 12/10/25

The Bull Market is Back!

Introduction

The Bull Market is Back! Not that it ever really left.

Powell opened the liquidity spigot once again—delivering not only the widely expected rate cut but also unveiling a form of stealth QE through $40B in Treasury purchases. Call it what you want, but markets speak one language: liquidity. What weighed on equities in October and November has now been flipped into reverse, and the major indexes are pressing back toward all-time highs.

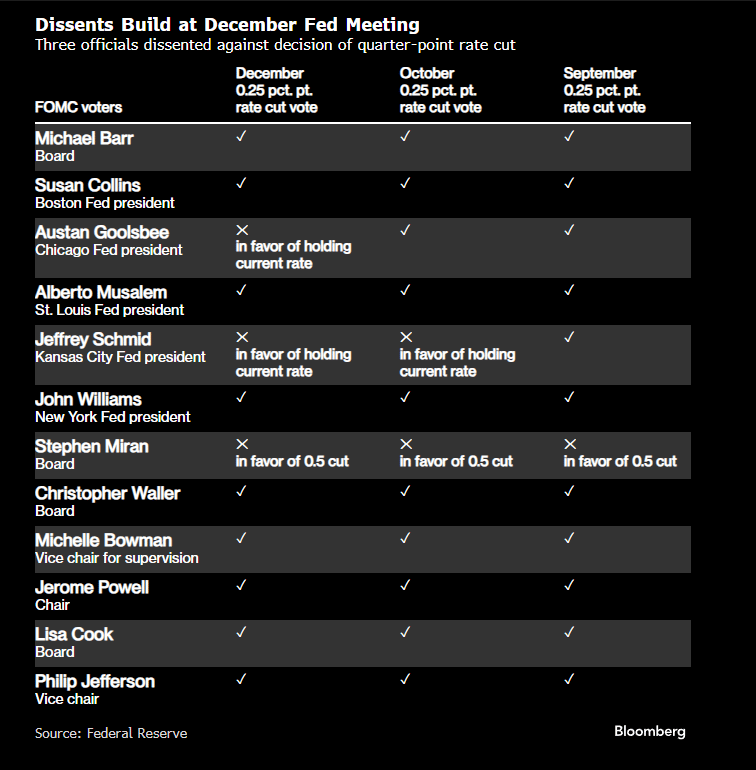

Powell effectively steamrolled the narrative that he would deliver a “hawkish cut.” Yes, the meeting featured the most dissents since 2019, but even that was a mixed bag—Fed Governor Miran actually voted for a supersized cut. There was something for everyone, but the message the market heard was simple: the easing cycle is alive and well.

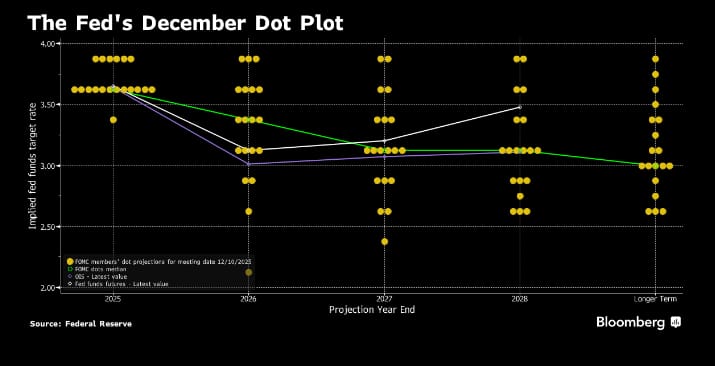

The Fed has now cut rates at three consecutive meetings while maintaining its one-cut outlook for 2026. The pathway for future cuts remains foggy, but directionally nothing has changed. Policy is shifting looser, the tweaks were modestly dovish, and risk assets responded accordingly—stocks went home happy.

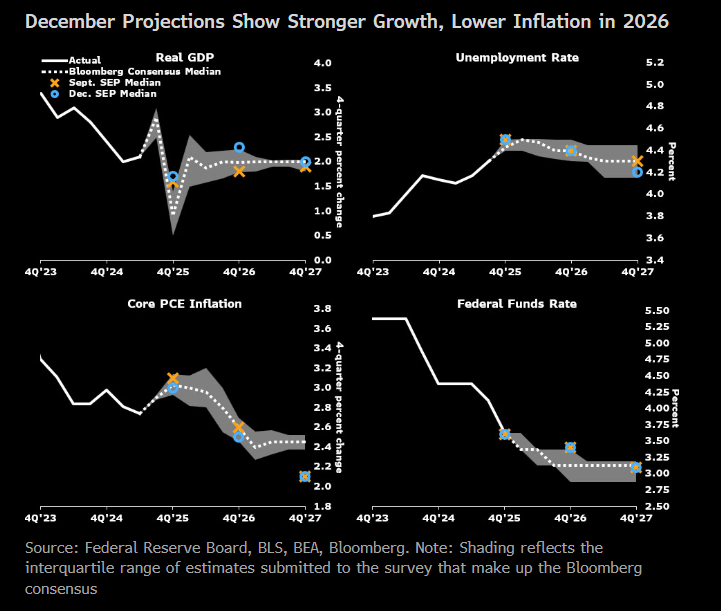

The FOMC also sharply revised up its economic growth trajectory while simultaneously lowering its inflation outlook—a rare combination that reinforces the soft-landing narrative the market has been betting on.

The Fed also kept the dot plot unchanged, even as the bond market continues to price in two cuts for 2026.

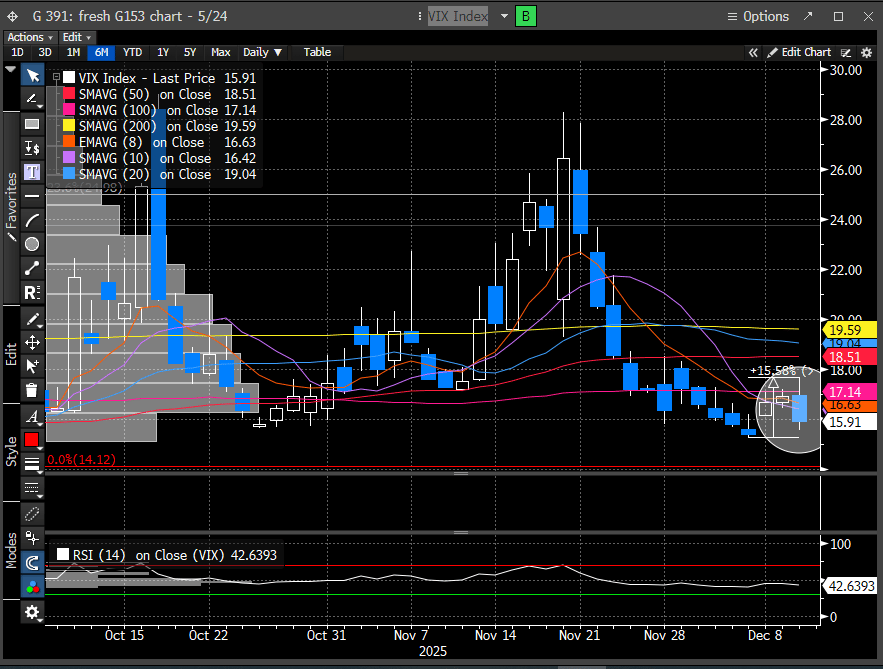

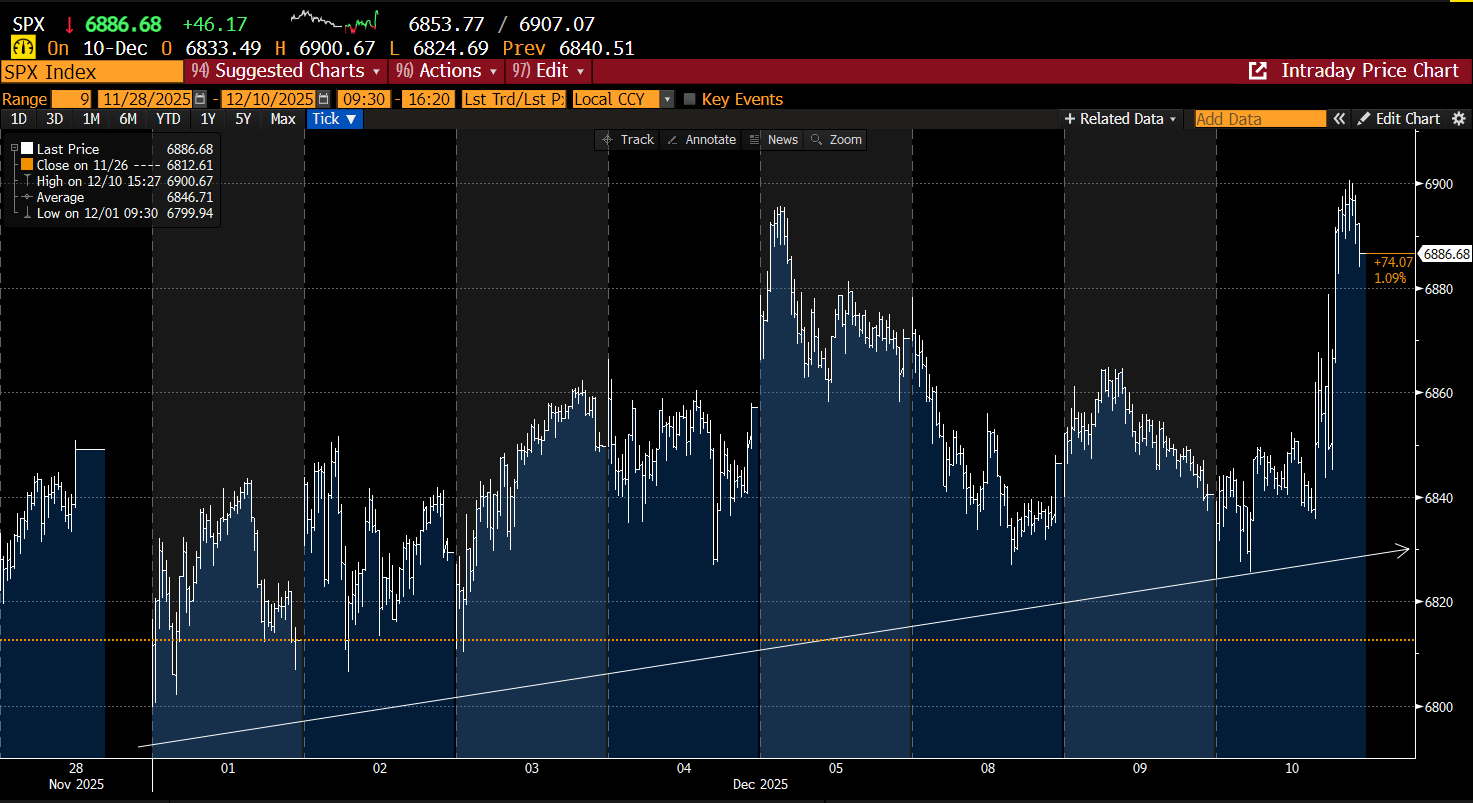

The stock market reacted immediately and favorably, with the SPX coming within inches of a new all-time high and the VIX sliding back toward last week’s lows. We had anticipated a possible VIX spike into the FOMC, but noted it would likely be short-lived. While we had no advance read on just how dovish Powell would be in order to trigger the reversal, the VIX did deliver a +15% pop before rolling over. The bearish outside day that followed now suggests additional volatility episodes may be in the rear-view mirror—for the moment.

Our stance this week was to approach the FOMC with caution and focus on adding long exposure only on weakness. So far, that has proven to be the right call, with every micro-dip since the weekend getting scooped up almost immediately. In fact, this has been the playbook since our 11/29 report—buying the dip has worked, and the market continues to reward that strategy.

Now that the event risk has passed, the more important question becomes the ultimate reaction. Fed-day moves are often noisy, full of misdirection as hedges get unwound and flows whip around. For us, the real signal comes from how the week closes, not the immediate post-press-conference volatility.

That said, we’ve been advocating grossing back into longs since the Thanksgiving break, and today’s continuation rally was a welcome development for anyone positioned for upside. The natural question now: can the market wrap up the year with a bow and squeeze out a bit more?

Let’s turn to the charts and find out.