- Coiled Spring Capital Macro Report

- Posts

- Coiled Spring Capital MW 12/3/2025

Coiled Spring Capital MW 12/3/2025

Stay Thirsty

Introduction

Our last report, Don’t Overthink It, couldn’t have been clearer: as long as the trajectory for rate cuts remained intact, the market would stay bid and likely push higher. That playbook has held. Early-week weakness was bought almost immediately, and the choppiness we anticipated has been more of an opportunity than a threat—precisely why we advised being selective and opportunistic rather than reactive.

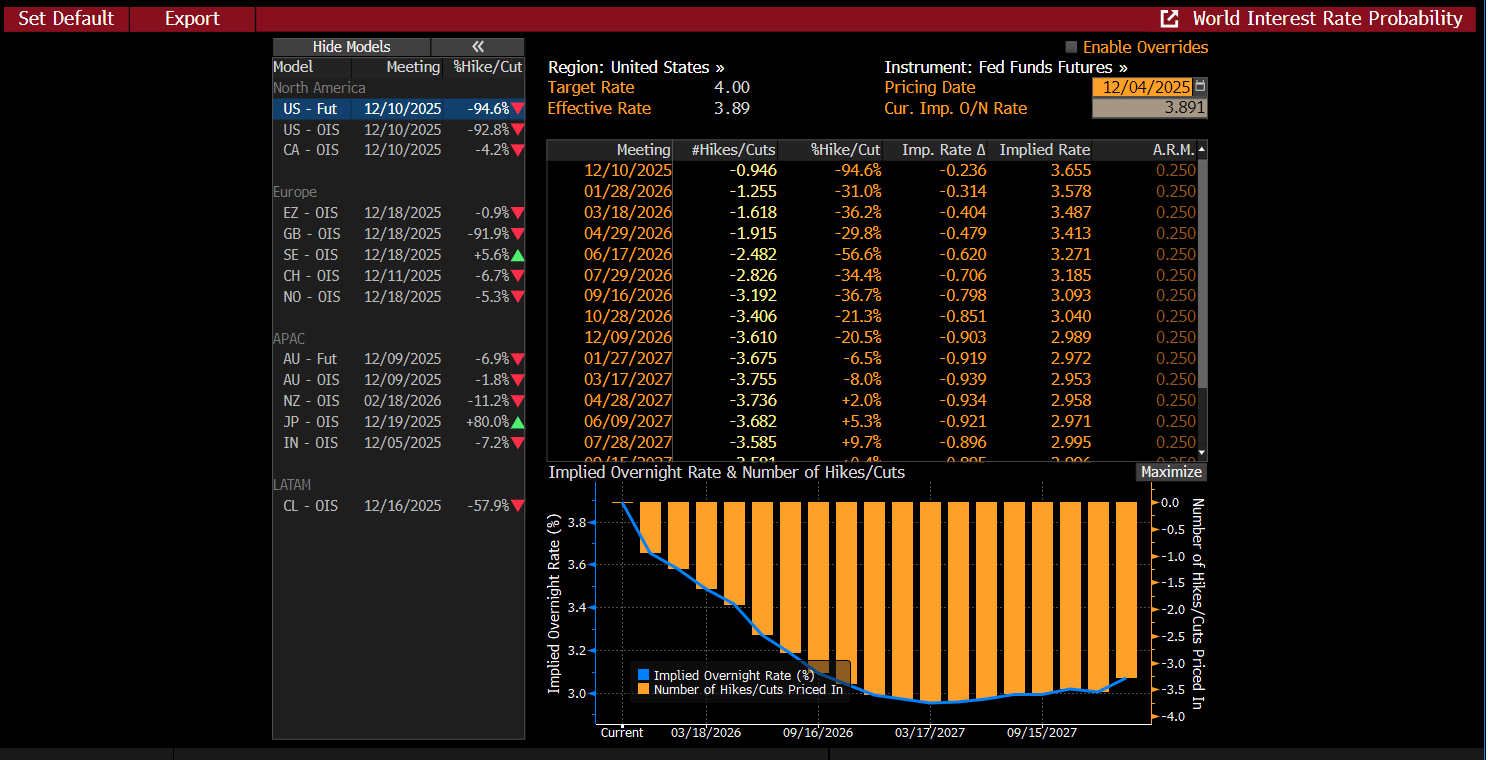

The macro backdrop has only grown more supportive. Fed Fund Futures now assign a 94% probability to a cut next week—up from less than 30% heading into Thanksgiving. That isn’t a subtle repricing; it’s a conviction shift. Whether or not one agrees with the Fed’s intent is irrelevant—the market has made up its mind, and positioning continues to adjust accordingly.

In fact, most of the sectors we highlighted over the weekend have already taken out their pivots. If leadership is rediscovering its footing, shouldn’t the market follow? We think so—and we’ve been re-leveraging our exposure accordingly. Yes, the Fed could still spoil the party by undershooting rate-cut expectations next week, which would almost certainly flush some of the recent enthusiasm. But at this point, that feels like a low-probability outcome.

Even a “hawkish cut” shouldn’t derail the broader move. Policy tone matters, but so does trajectory, and the trajectory has shifted. Add to that the political backdrop—there are credible indications that Kevin Hassett may be in line for the Fed Chair role—and it’s hard to imagine a materially restrictive policy regime emerging from that setup. Whether or not you like the optics is irrelevant; markets care about liquidity, and the expectation is for more of it. If that plays out, investors should assume a supportive policy environment into 2026.

Here are some of the standouts so far:

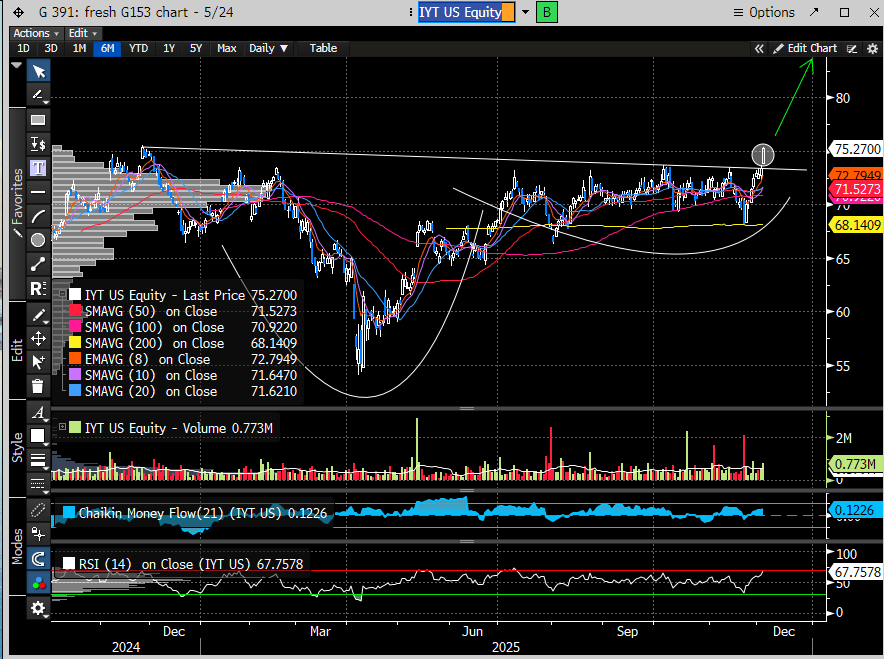

Transports (IYT)

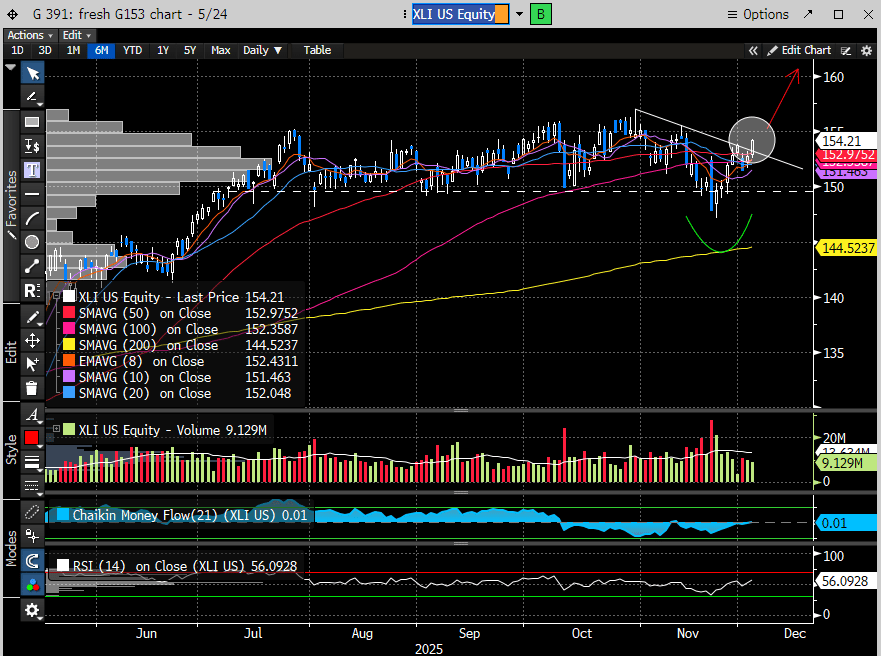

Industrials (XLI)

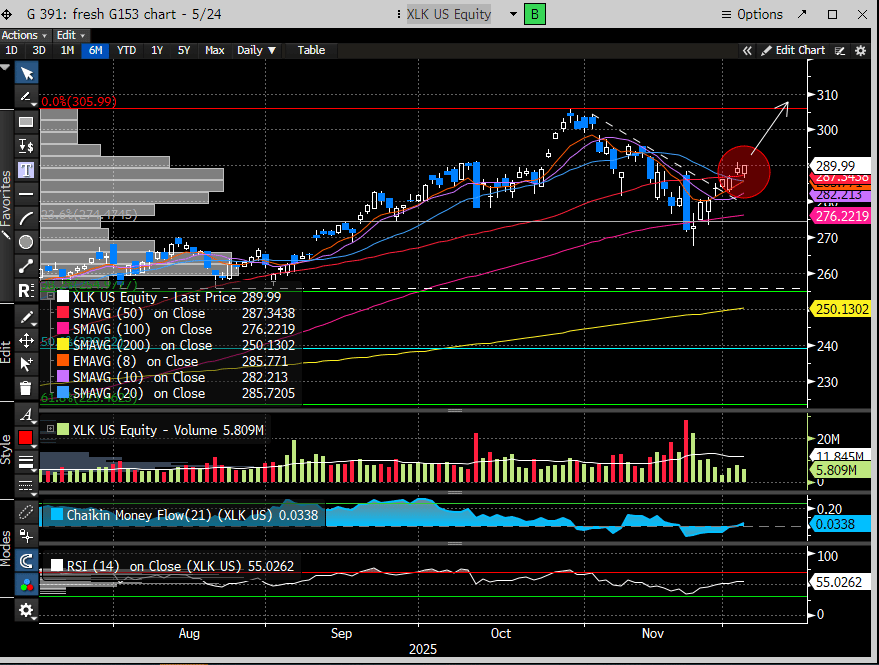

Technology (XLK)

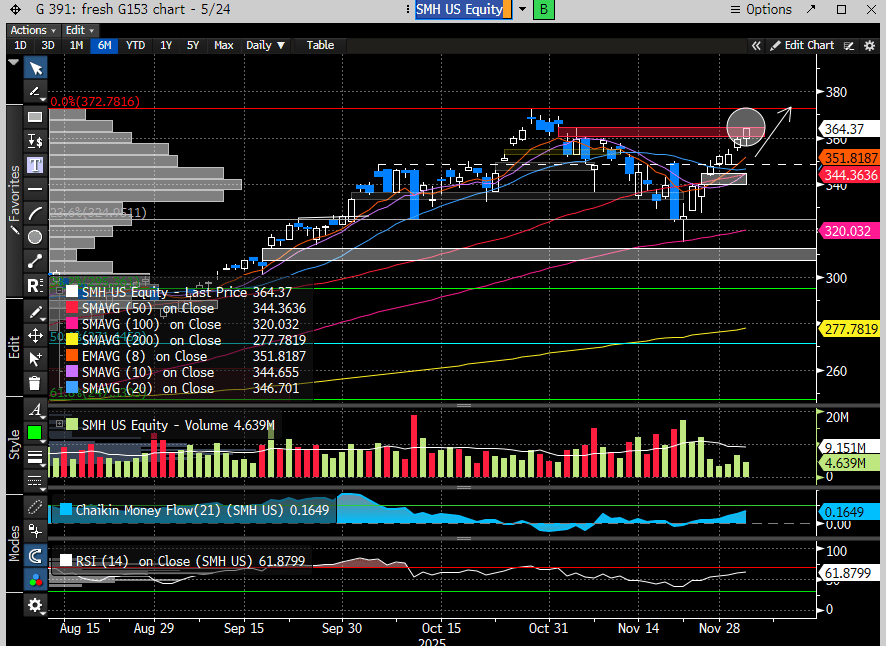

Semiconductors (SMH)

You don’t need a microscope to see what’s happening—breakouts are everywhere. If you step back and think even briefly about the trajectory, the message is clear: the market is gearing up for a constructive December. Price isn’t arguing; it’s confirming.

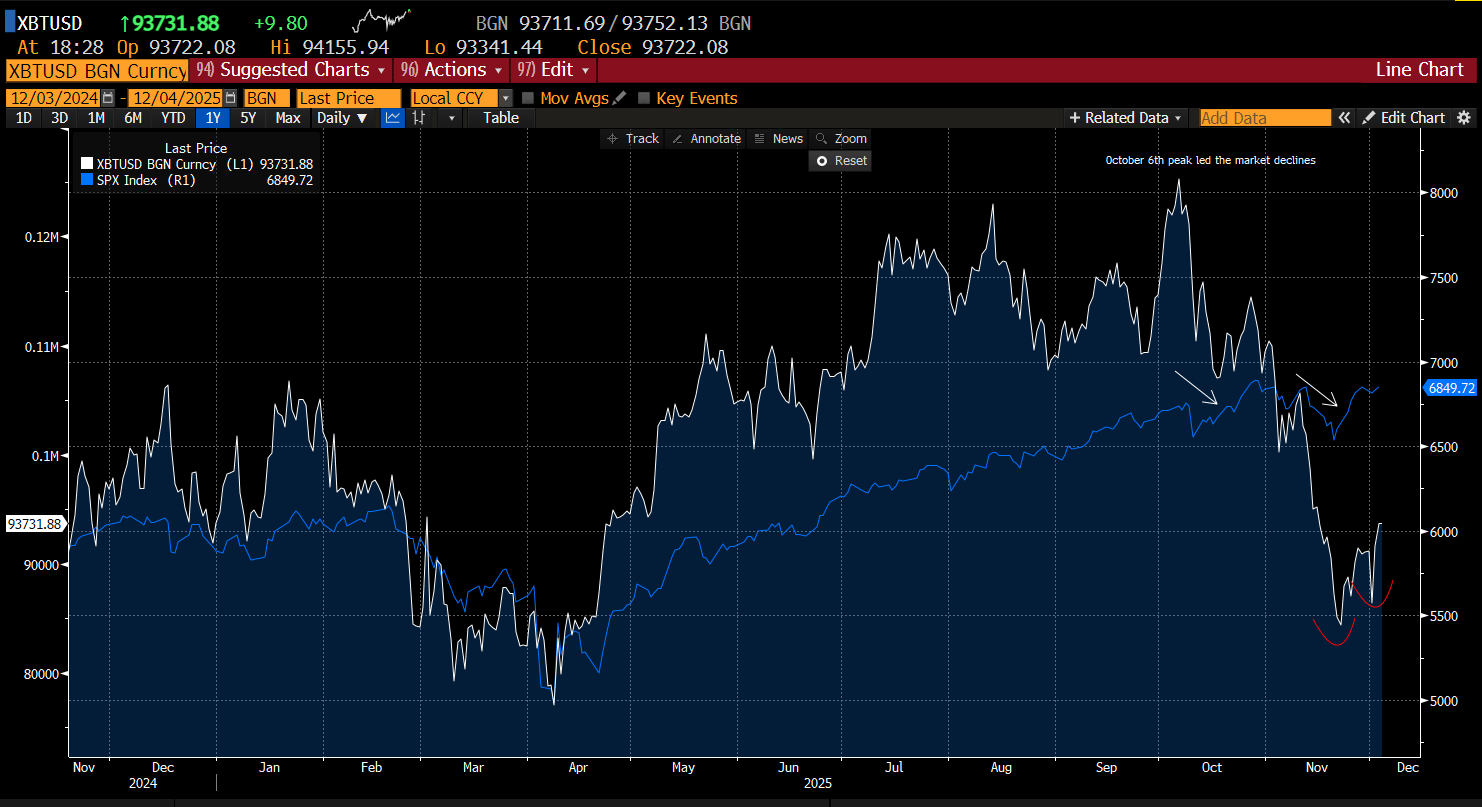

Bitcoin, our preferred proxy for liquidity, has now carved out a decisive higher low after a 30% drawdown. Recall that Bitcoin led the October unwind before risk assets cracked—so why wouldn’t it lead the recovery? If liquidity is the driver, Bitcoin is the tell. We think it’s already speaking.

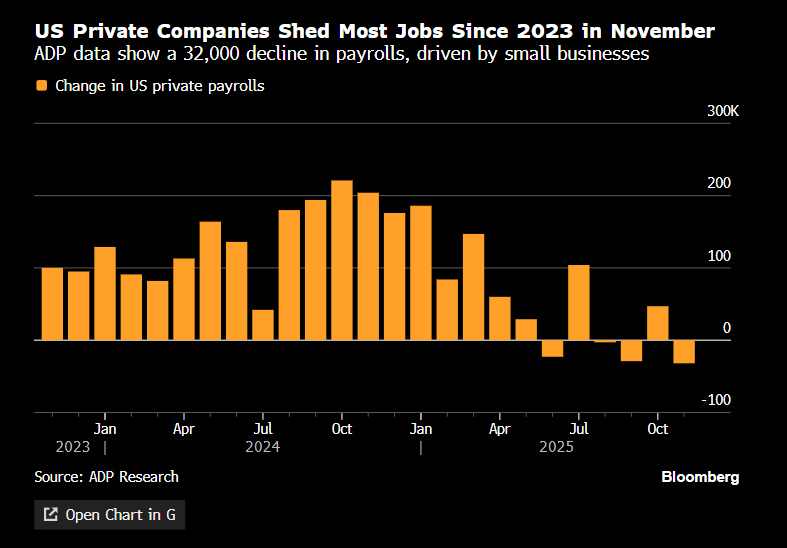

On Wednesday, the rates market reacted to the private payroll data, which showed the sharpest job losses since 2023. In an environment absent a few meaningful government macro releases, this print effectively gives the Fed all the cover it needs to cut rates next week. And, as the action in the bond market has already signaled, investors appear to agree.

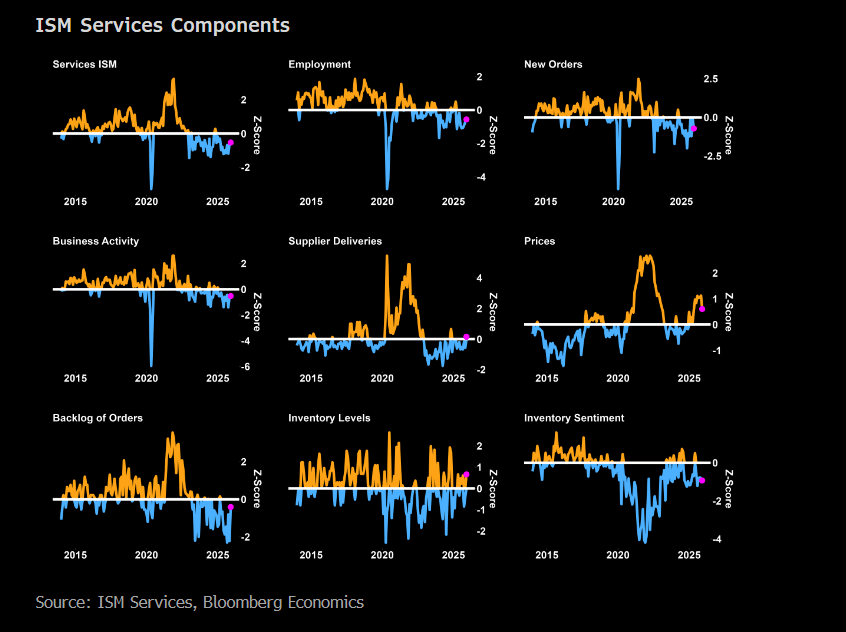

Today’s ISM report came in stronger following the government’s reopening, but the employment index remained in contractionary territory. More importantly, the prices-paid component — which spiked to 70.0 in October, its highest level since 2022 — eased to 65.4 in November. That signals pricing pressure is slowing, not accelerating. It’s another data point that should ease inflation concerns heading into next week’s FOMC. Friday’s PCE print will likely dictate the final tone, but the runway for a cut is widening, not narrowing.

Given the backdrop, the stage appears set for a clean run into year-end. But as we’ve said countless times, markets don’t move in straight lines, and this one won’t either.

Let’s see what the charts have to say.