What Will Your Retirement Look Like?

Planning for retirement raises many questions. Have you considered how much it will cost, and how you’ll generate the income you’ll need to pay for it? For many, these questions can feel overwhelming, but answering them is a crucial step forward for a comfortable future.

Start by understanding your goals, estimating your expenses and identifying potential income streams. The Definitive Guide to Retirement Income can help you navigate these essential questions. If you have $1,000,000 or more saved for retirement, download your free guide today to learn how to build a clear and effective retirement income plan. Discover ways to align your portfolio with your long-term goals, so you can reach the future you deserve.

Introduction

With only two days having passed since our comprehensive 2/16 weekend report, there isn’t a great deal to materially update. Price action remains largely rangebound, continuing to oscillate between the support and resistance zones we previously outlined.

The major indexes are still finding buyers near referenced support levels, even as marginal lower lows continue to develop. Encouragingly, there has been some early stabilization across several lagging sectors, which is helping support the tape at the margin.

The release of the Fed Minutes introduced a modest shift in tone. Policymakers pushed back on the more dovish interpretations that had begun to creep into the narrative, with “several” officials highlighting renewed concerns around persistent inflation and the potential need for further tightening if progress stalls. In response, the 2-year Treasury yield — a key proxy for policy expectations — moved back above our referenced support pivot after coming within roughly 1 basis point of the 3.37 downside target highlighted in the 2/16 report.

Bank of America clients turned notable sellers of U.S. equities last week, with single-stock outflows totaling $8.3 billion — the third largest weekly drawdown since records began in 2008. The selling was broad-based, spanning nine of eleven sectors, with financials and consumer staples leading the move. Industrials, technology, and consumer discretionary also saw sizable outflows.

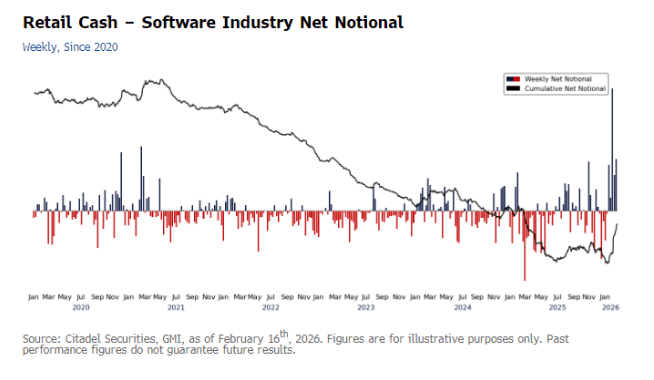

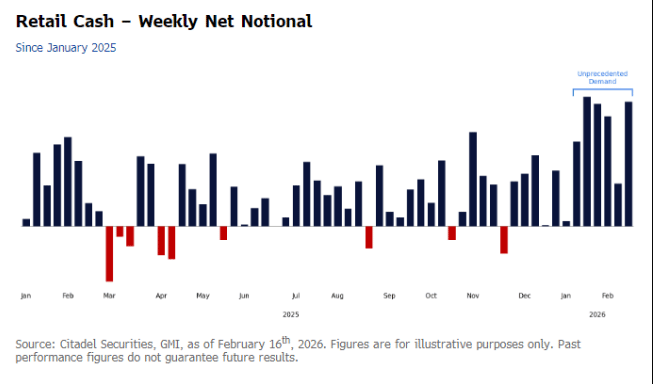

Interestingly, retail traders have been aggressively rotating into software. Scott Rubner, head of equity and equity derivatives strategy at Citadel Securities, noted that net retail buying on the firm’s platform has reached record levels since tracking began in 2017.

“Net notional on our platform has reached levels we have never observed before,” Rubner wrote in a client note. “The magnitude, persistence, and breadth of buying activity have materially exceeded prior peaks, underscoring retail’s role as a primary source of incremental demand in early 2026.”

Retail has been stepping in to absorb recent market weakness even as institutional selling persists. The tug-of-war for the so-called “smart money” mantle continues.

Let’s turn to the charts.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade